In the fast-paced world of financial markets, traders are continually seeking profitable strategies. One such strategy that has gained popularity is the momentum trading strategy. Momentum trading is based on the principle that stocks that have performed well in the recent past will continue to do so shortly.

This works in any market whether it’s the stock market or forex market or any other financial market referring to past performance.

This article will explore the ins and outs of momentum trading, offering insights into its strategies, risk management techniques, and tips for success.

Understanding Momentum Trading

Momentum trading is founded on the belief that strong-performing stocks will continue their upward trajectory, attracting more investors and leading to further price increases. Traders capitalize on this momentum by identifying stocks that have shown significant price movements recently. These stocks often exhibit positive market sentiment, creating a potential opportunity for short-term gains.

How Momentum Trading Works

Identifying High Momentum Stocks

The first step in momentum trading is identifying high-momentum stocks. Traders look for stocks that have recently experienced substantial price increases or have reached new highs. To determine the strength of a stock’s momentum, traders often use technical indicators such as the Relative Strength Index (RSI) and Moving Averages.

Entry and Exit Points

Timing is crucial in momentum trading. Traders aim to enter positions at the right time to maximize profits. They typically look for entry signals, such as a breakout from a resistance level or a moving average crossover.

Additionally, they set exit points, either using predetermined target prices or trailing stop-loss orders to protect their gains.

Momentum Trading Strategies

Breakout Strategy

The breakout strategy involves identifying key price levels, such as support and resistance, and waiting for the stock price to break through these levels. Traders enter long positions when the price breaks above resistance or short positions when it breaks below support. The breakout strategy aims to capture significant price movements that occur after a period of consolidation.

Pullback Strategy

The pullback strategy focuses on identifying temporary price reversals within a larger trend. After a stock has experienced a significant uptrend, it may undergo brief price declines before continuing its upward movement. Traders employing this strategy wait for the pullback to enter positions with the expectation that the stock’s trend will resume.

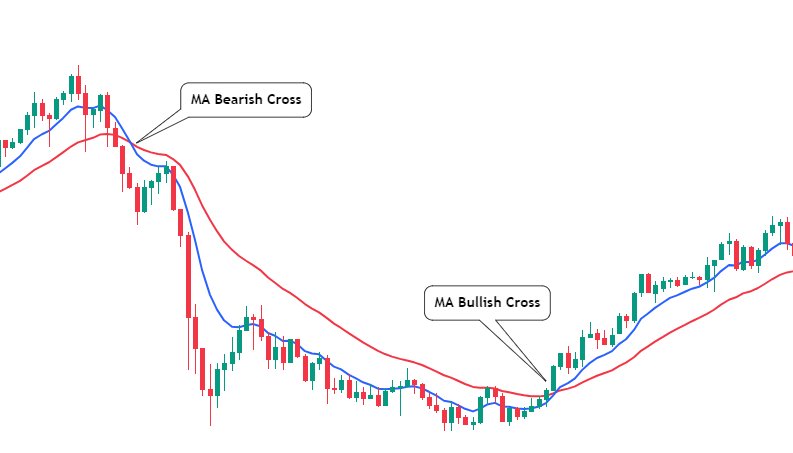

Moving Average Crossover Strategy

The moving average crossover strategy utilizes two moving averages: one short-term and one long-term. When the short-term moving average crosses above the long-term moving average, it generates a buy signal. Conversely, when the short-term moving average crosses below the long-term moving average, it generates a sell signal.

This strategy aims to capture changes in trend direction. Make sure you keep an eye on price trends and the market’s volatility

Momentum Indicators

Momentum indicators are a crucial part of technical analysis used by traders to assess the strength and speed of price movements in financial markets. These indicators help traders identify potential trend reversals, confirm market trends, and spot overbought or oversold conditions. Here are some popular momentum indicators:

1. Relative Strength Index (RSI):

The RSI is one of the most widely used momentum indicators. It measures the speed and change of price movements and provides readings between 0 and 100. An RSI value above 70 is considered overbought, indicating a potential downward correction, while an RSI below 30 is considered oversold, signaling a possible upward correction.

2. Moving Average Convergence Divergence (MACD):

The MACD is a versatile momentum indicator that shows the relationship between two moving averages of a security’s price. It consists of two lines – the MACD line and the signal line. Crossovers of these lines indicate changes in momentum and potential buy or sell signals.

3. Stochastic Oscillator:

The stochastic oscillator compares a security’s closing price to its price range over a specific period. It provides readings between 0 and 100, where values above 80 indicate overbought conditions and values below 20 indicate oversold conditions.

4. Momentum:

The momentum indicator simply calculates the difference between the current closing price and the closing price a specific number of periods ago. Positive momentum values indicate upward price trends, while negative values indicate downward trends.

In summary, momentum is a leading indicator that provides valuable insights into the strength and speed of price movements in financial markets. It aids traders in making informed decisions and assessing the potential for continued trends or trend reversals.

5. Rate of Change (ROC):

The rate of change (ROC) technical indicator is a tool used by traders and analysts to measure the speed at which a security’s price is changing over a given period. It provides valuable insights into the momentum or strength of a trend.

The ROC is calculated by taking the current price of a security and comparing it to a previous price, then expressing the difference as a percentage.

A positive ROC suggests that prices are increasing, indicating an upward trend, while a negative ROC implies a decline in prices, indicating a downward trend. Traders use the ROC to identify potential trend reversals or confirm the strength of an existing trend. By monitoring changes in the ROC, traders can make informed decisions about buying or selling securities, aiding in their overall trading strategies.

6. Commodity Channel Index (CCI):

The CCI measures the deviation of a security’s price from its statistical average. It oscillates around zero, and values above +100 suggest overbought conditions, while values below -100 suggest oversold conditions.

Momentum trading in the Stock market

Momentum trading is a popular and dynamic strategy used in the stock market by traders seeking to capitalize on short-term price movements and trends as it is volatile market. By momentum trading, you can directly enter emerging trends or spot emerging trends already occurred in the financial market.

The above strategies mentioned can be included in Momentum Day trading strategies.

It is based on the principle that stocks that have performed well in the recent past are likely to continue their upward trajectory, while poorly performing stocks may continue to decline. Momentum trading strategies include swing trading, day trading, and position trading.

How Momentum Trading Works in the Stock Market

Momentum traders focus on identifying stocks with strong positive price momentum, which indicates positive market sentiment and growing interest from investors. These stocks are often referred to as “hot” or “high-flying” stocks and momentum traders seek to ride the wave of their upward momentum for potential profits.

When applying momentum trading in the stock market, traders use various technical indicators and tools to identify stocks with strong momentum. Some common indicators include the Relative Strength Index (RSI), Moving Averages, and Bollinger Bands, among others. These indicators help traders gauge the strength of a stock’s price movement and identify potential entry and exit points.

Risk Management in Momentum Trading

Setting Stop-Loss Orders

In the volatile world of momentum trading, setting stop-loss orders is crucial to protecting capital from significant losses. A stop-loss order is a predetermined price level at which a trader’s position will be automatically sold, limiting potential losses in case the trade goes against them.

Position Sizing

Prudent traders allocate only a small percentage of their capital to each trade. By doing so, they effectively manage risk and prevent substantial losses from affecting their overall portfolio. Proper position sizing allows traders to stay in the game even if some individual trades result in losses.

Tips for Successful Momentum Trading

Stay Informed with News and Market Trends

To make informed decisions, successful momentum traders stay abreast of financial news and market trends. They understand that significant events and announcements can impact stock prices and use this information to their advantage.

Avoid Overtrading

Overtrading can be detrimental to a trader’s success. Engaging in excessive trades driven by impulse or emotions can lead to poor decision-making and higher transaction costs. Successful momentum traders exercise discipline and execute only those trades that align with their strategy and analysis.

Stick to Your Strategy

Momentum trading requires discipline and sticking to a well-defined strategy. Traders should not let emotions sway them from their plan, as impulsiveness can lead to losses. A consistent approach to trading increases the likelihood of achieving profitable results.

Keep Emotions in Check

Emotions can cloud judgment and lead to irrational decisions. Successful momentum traders maintain emotional control, relying on analysis and data to guide their actions instead of being swayed by fear or greed.

Regularly Review and Adapt

Markets are dynamic, and what works today may not work tomorrow. Momentum traders regularly review their performance, adapt to changing market conditions, and refine their strategies accordingly. Continuous learning and adjustment are essential for long-term success.

Common Mistakes to Avoid

Chasing the Hype

Jumping into trades based solely on hype or rumors is a common mistake in momentum trading. Relying on data and thorough analysis is crucial to making sound investment decisions. Like the historical performance of market moves occurred in any of the financial instruments

Ignoring Fundamental Analysis

While momentum trading primarily relies on technical analysis, ignoring fundamental factors can be detrimental. Understanding the underlying financial health and prospects of a company is vital for making informed trades.

Not Having an Exit Plan

Entering a trade is only part of the equation; knowing when to exit is equally important. Traders must have a clear exit strategy to secure profits or cut losses before they escalate.

Pros of Momentum Trading

- Potential for High Returns: Momentum trading seeks to capitalize on short-term price movements, which can lead to quick and substantial profits if the trader enters and exits positions at the right time.

- Quick Profit Opportunities: Momentum traders are often looking for rapid price movements, allowing them to identify and take advantage of profitable opportunities in a relatively short period.

- Clear Entry and Exit Signals: Momentum trading relies heavily on technical indicators, providing traders with clear entry and exit signals. This clarity can aid in making decisive trading decisions.

- Market Trend Alignment: By trading in the direction of market trends, momentum traders align themselves with prevailing market sentiment, increasing the likelihood of profitable trades.

- Emotion Management: Momentum trading’s reliance on technical analysis can help traders avoid emotional decision-making, as trades are based on objective criteria rather than subjective feelings.

Cons of Momentum Trading

- Market Volatility: Momentum trading can be more susceptible to market volatility, as it aims to profit from short-term price swings. Sudden market fluctuations can lead to unexpected losses.

- False Breakouts: Momentum traders face the risk of false breakouts, where a stock briefly breaks above a resistance level or below a support level, only to reverse its course. False breakouts can result in losing trades.

- Overtrading and Transaction Costs: The fast-paced nature of momentum trading may tempt traders to overtrade, increasing transaction costs and potentially eroding profits.

- Limited Holding Periods: Momentum trades are typically short-term, which means traders may miss out on long-term gains if the stock continues to perform well beyond their holding period.

- Information Overload: Traders need to process significant amounts of data and stay up-to-date with market news to identify strong momentum opportunities, which can be overwhelming for some.

- Risk of Chasing Trends: Momentum traders may be prone to chasing trends and entering positions at the peak of a stock’s momentum, leading to losses if the trend quickly reverses.

Conclusion

Momentum trading offers traders the potential for attractive returns in a relatively short timeframe. By leveraging technical indicators and analyzing recent price movements, momentum traders aim to ride the wave of positive market sentiment for profitable results.

However, it is essential to be aware of the risks involved, such as market volatility and false breakouts, which can lead to losses if not managed properly. Most momentum traders look for buy and sell signals in the same direction in stock trading in any particular stock. Such momentum trading attempts are made.

As with any trading strategy, successful momentum trading requires discipline, risk management, and a clear understanding of market trends. Traders should continuously review and adapt their approach, keeping emotions in check and making well-informed decisions based on solid analysis.

With proper planning and execution, momentum trading can be a valuable tool in a trader’s arsenal, potentially leading to consistent profits and success in the dynamic world of financial markets.

FAQs

-

Can momentum trading be applied to different financial markets?

- Yes, momentum trading can be applied to various financial markets, including stocks, crypto, commodities, forex markets, and indices. The underlying principle of identifying strong-performing assets and capitalizing on their momentum can be adapted to different market environments.

-

How do I know if a stock has strong momentum?

- Identifying strong momentum in a stock involves analyzing various factors. Traders often look for rapid price movements, increasing trading volume, and technical indicators like RSI (Relative Strength Index) showing overbought conditions. Additionally, a stock making new highs or breaking out from key resistance levels can signal strong momentum.

-

Is momentum trading suitable for beginners?

- Momentum trading work can be challenging for beginners due to its fast-paced nature and reliance on technical analysis. It requires a solid understanding of trends and risk management. While beginners can explore momentum trading, it is crucial to start with a well-defined strategy and practice with smaller positions.