In the fast-paced world of financial markets, mastering breakout trading is essential for traders seeking consistent success. Breakout trading is a strategy that capitalizes on the moments when the price of an asset breaks through a significant support or resistance level, signaling potential price movement in the direction of the breakout.

In this comprehensive guide, we will delve into the key techniques that can help you excel in breakout trading and outperform other traders in the market.

Understanding Breakouts

Before diving into the techniques, let’s have a solid understanding of what breakout trading entails. Active investors or breakout traders look for such breakout stocks in the market.

Breakouts occur when the price of a financial instrument surpasses a predetermined level of support or resistance. Price breaks such level of support and resistance to move in the breakout direction. This event often signifies a shift in market sentiment i.e. new trend and can lead to substantial price chart movements.

Identifying High-Probability Breakouts

Analyzing Historical Data

One of the most critical aspects of mastering breakout trading is conducting thorough historical data analysis. By examining past price movements and identifying recurring patterns, you can develop a keen eye for potential breakouts.

This data-driven approach enables you to make well-informed decisions based on probabilities and reduce reliance on gut feelings.

Technical Indicators

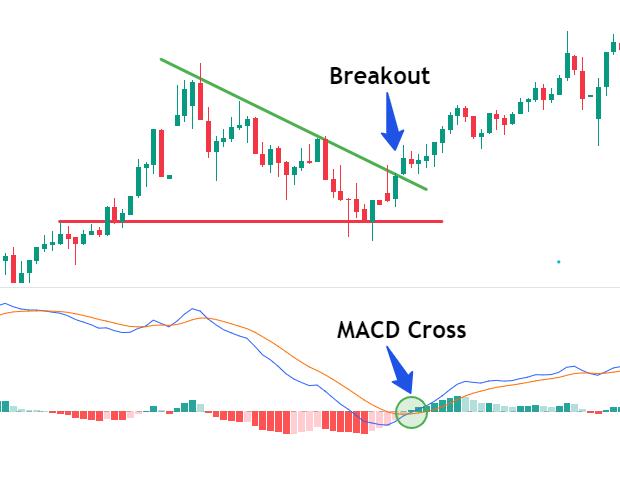

Utilizing various technical indicators is paramount to spotting high-probability breakout opportunities. Indicators like Moving Averages, Bollinger Bands, and Relative Strength Index (RSI) can provide valuable insights into price trends, volatility, and momentum. The stock market offers breakout stocks on a daily basis. Such stock breakouts occur from smaller time frame to timeframes like 1 day or 1 week.

Combining multiple indicators can enhance your accuracy in predicting breakouts.

How to Trade Breakouts: A Step-by-Step Guide

Trading breakouts can be a lucrative strategy when executed with precision and discipline. Follow these step-by-step guidelines to effectively trade breakouts:

1. Identify Key Support and Resistance Levels

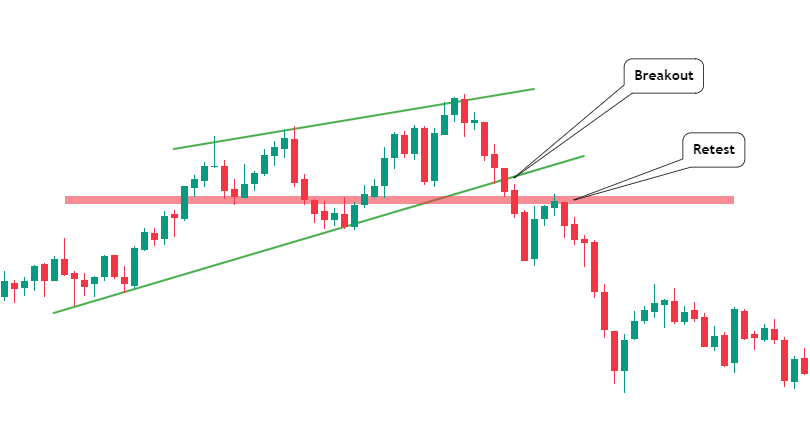

The first step in breakout trading is identifying significant support and resistance levels on the price chart. These levels represent zones where the price has historically stalled or reversed. Use technical analysis tools, such as horizontal lines and trendlines, to mark these critical levels on your chart. As in the above chart, the downside breakout is about to take place.

2. Monitor Price Action

Keep a close eye on the price action around the identified support and resistance levels. Look for signs of accumulation or distribution, such as tightening price ranges or decreasing trading volume. These indications may suggest an imminent breakout. Wait for the trade breakout at the support level.

3. Wait for Breakout Confirmation

Exercise patience and wait for a clear breakout confirmation. A valid breakout occurs when the price convincingly moves beyond a support or resistance level, accompanied by a surge in trading volume. This volume surge signifies market conviction in the breakout direction. Here, the price chart breaks the support and resistance levels, and price moves to the resistance levels to retest. Here, traders can look for short positions with limited downside risk as the price falls.

4. Set Entry and Stop-Loss Orders

Once a breakout is confirmed, set your entry order just above the breakout level for bullish breakouts or just below the breakout level for bearish breakouts at the retest on a smaller time frame. Additionally, place a stop-loss order below the breakout level for bullish breakouts or above the breakout level for bearish breakouts. This risk management technique helps limit potential losses if the breakout turns out to be false.

Fake Breakouts: Identifying and Avoiding False Signals

In the world of breakout trading, fake breakouts, also known as false breakouts, are common occurrences that can lead to losses if not identified and managed properly. Some stock breaks can result in losing trade as well.

A fake breakout happens when the price appears to break above a resistance level or below a support level but quickly reverses, trapping traders who entered positions based on the initial breakout signal. Failed breakouts are nothing but just a part of the game.

Here are some essential tips for recognizing and avoiding fake breakouts:

1. Volume Analysis

Pay close attention to the trading volume during the breakout. A genuine breakout should be accompanied by a surge in volume, indicating strong market participation and confirming the move. However, in the case of a fake breakout, the volume might be relatively low, signaling a lack of conviction from market participants.

2. Price Confirmation

Instead of rushing to enter a trade immediately after a breakout signal in price patterns, consider waiting for price confirmation. Look for follow-through in the direction of the breakout. If the price continues to move decisively beyond the breakout level, it strengthens the validity of the breakout signal.

3. Candlestick Patterns

Candlestick patterns can provide valuable insights into market sentiment during a subsequent breakout. Engulfing patterns, doji candles, or long wicks could indicate indecision and the potential for a fake breakout. Pay attention to the candlestick patterns surrounding the breakout level to assess the reliability of the breakout signal.

4. Support and Resistance Zones

Rather than relying solely on single support or resistance levels, consider using defined support and resistance zones. These zones provide a broader perspective of potential breakout levels and can help filter out false signals. A breakout that occurs above or below a well-defined zone is generally more reliable.

5. Wait for Confirmation Close

Avoid entering a trade during the initial moments of a breakout point. Instead, wait for the price to close above the breakout level (for bullish breakouts) or below the breakout level (for bearish breakouts). A closing price above or below the level strengthens the credibility of the breakout and reduces the risk of a fake signal.

6. Use Multiple Timeframes

Analyzing multiple timeframes can provide a comprehensive view of the breakout. A breakout that appears valid on a shorter timeframe might turn out to be a fake breakout when viewed on a higher timeframe. Consider using higher timeframes to confirm the strength of the breakout signal.

9. Monitor Market Sentiment

Keeping a close eye on market sentiment can be instrumental in detecting potential fake breakouts. Market sentiment refers to the overall attitude and feelings of traders towards a particular asset or market. Social media platforms, financial news, and market analysis can provide insights into prevailing sentiment. If there is a significant discrepancy between the breakout signal and market sentiment, it might indicate a higher probability of a fake breakout.

11. Pay Attention to Market News

Breaking news or unexpected events can disrupt technical patterns and lead to fake breakouts. Keep an eye on economic releases, geopolitical developments, and company-specific announcements that might impact the asset you are trading. Being aware of potential news-driven market movements can help you avoid falling into false breakout traps.

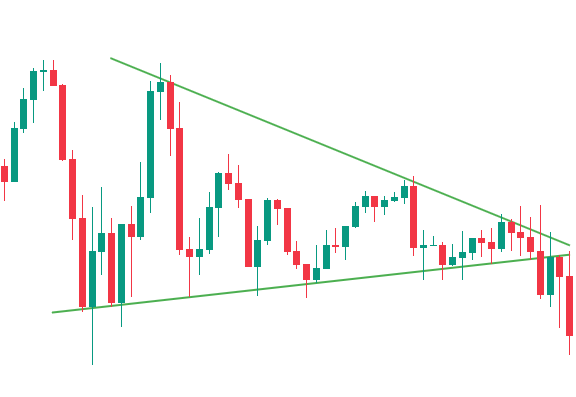

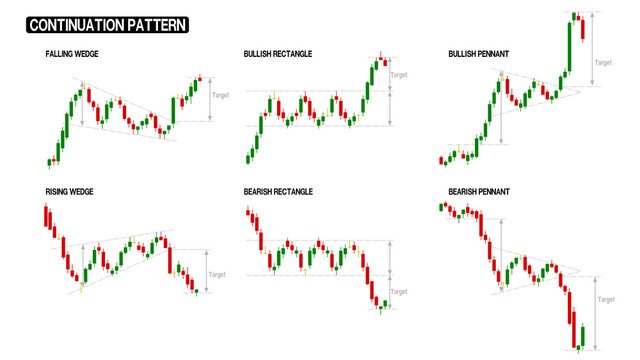

12. Continuation Patterns

In breakout trading, continuation patterns can be more reliable than traditional breakout patterns. Continuation patterns, such as flags, pennants, and triangles, suggest that the market is taking a brief pause before continuing in the direction of the prevailing trend. These patterns can be less susceptible to fake breakouts since they validate the underlying trend.

13. Avoid Overtrading

Overtrading is a common mistake that many traders make, especially when they fear missing out on potential opportunities. However, overtrading can lead to emotional decision-making and increase the likelihood of falling for fake breakouts. Stick to your trading plan and only enter trades that meet your well-defined criteria.

The Art of Timing

Timing is everything in breakout trading. To achieve success, you must master the art of entering and exiting positions at the right time.

Patience is Key

While it may be tempting to jump into a trade at the first sign of a potential breakout, exercising patience is vital. Waiting for a confirmed breakout and validating it with a surge in trading volume can significantly improve your success rate.

Managing Risk

Breakout trading, like any trading strategy, involves inherent risks. Implementing appropriate risk management techniques, such as setting stop-loss orders and position sizing, ensures that a single unfavorable trade doesn’t wipe out your trading capital.

Trading breakout stocks can be an exhilarating and potentially profitable venture for traders. The breakout trading strategy revolves around identifying key support and resistance levels where stock prices have historically stalled or reversed.

When the price breaks above a significant resistance or below a critical support level, a breakout is confirmed, signaling potential price movement in the breakout direction. Implementing a well-defined breakout strategy involves setting entry and stop-loss orders, carefully assessing target profit levels, and being prepared for the possibility of fake breakouts.

With discipline and a keen eye on price movements, traders can capitalize on breakout stocks and navigate the dynamic world of financial markets to achieve successful outcomes.

Stay Informed and Adaptive

In the dynamic world of financial markets, staying informed and adaptive is crucial for breakout traders.

News and Events

Keep an eye on economic announcements, corporate earnings reports, and geopolitical events. Such events can trigger breakouts or reversals and impact the overall market sentiment.

Embracing Change

Markets are ever-evolving, and successful breakout traders are not afraid to adapt their strategies. Continuously evaluate your trading approach and be open to refining it based on changing market conditions.

Backtesting and Forward Testing

Practice makes perfect in breakout trading, and one of the best ways to do this is through backtesting and forward testing.

Backtesting

Backtesting involves applying your trading strategy to historical market data to evaluate its effectiveness. This process helps you identify strengths and weaknesses in your approach and fine-tune it accordingly.

Forward Testing

Forward testing involves implementing your strategy in real-time market conditions but with reduced risk. This live simulation allows you to gauge its performance and build confidence in your trading plan.

Conclusion

Mastering breakout trading requires a combination of technical expertise, market awareness, and psychological discipline. By understanding the nuances of breakouts, identifying high-probability setups, and analyzing confirmation patterns, you can enhance your trading edge significantly. Furthermore, always be mindful of risk management and maintain a favorable risk-reward ratio.

Remember, breakout trading is not about taking reckless risks for quick gains, but rather about executing well-thought-out strategies that stand the test of time.