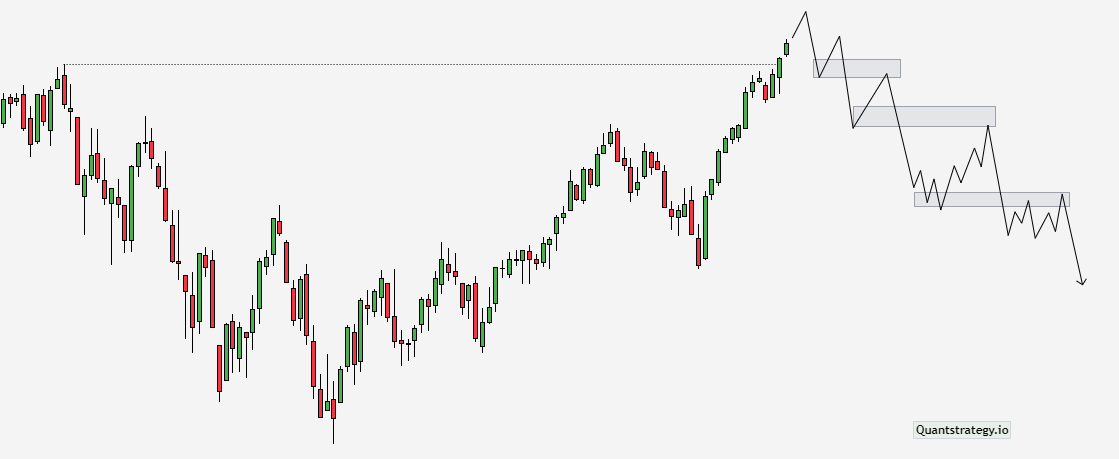

Generally, traders who want to test a trading notion in a live market make the error of depending solely on backtesting data to assess whether the approach will be lucrative. While backtesting can provide significant information to traders, it is frequently deceptive and is only one component of the evaluation procedure.

Forward testing provides further confirmation about the effectiveness of the system and can reveal its true colors before real money is at stake. In fact, it is a crucial step between backtesting and consistently profitable financial trading.

In this article, we shall discuss why forward testing is important and how to conduct it effectively.

What is Forward Testing in Trading?

Forward testing is a way of evaluating the efficacy of trading strategies by applying them to real-time market data and understanding how they perform in real-time on data that the strategies have never seen before. Unlike backtesting, which entails applying strategies to historical data and analyzing how they would have performed in the past, this is not the case with forward testing.

Forward testing requires traders to rigorously adhere to the trading method that has been evaluated in backtesting. It is also commonly referred to as “paper trading”.

The primary goal of forward testing is to establish a trading strategy’s effectiveness and resilience in real-world market circumstances. It enables traders to evaluate the strategy’s potential to respond to shifting market circumstances as well as its future profitability potential. Forward testing can also be used to detect potential flaws or shortcomings in a strategy that was not apparent during backtesting.

The Significance of Forward Testing

While backtesting is useful for determining the potential of a trading strategy, it cannot entirely recreate the intricacies of real-world trading situations.

Forward testing overcomes this gap by taking into consideration the psychological reactions, technical intricacies, and unanticipated market movements. It enables traders to assess how their strategies work under real-time pressure and modify as needed.

Furthermore, forward testing is crucial because it eliminates historical bias and concentrates on what is currently taking place and what will occur in the future.

Investment offers are typically accompanied by a disclaimer that “historical returns cannot predict future results.” Similarly, backtesting cannot serve as the end-all and be-all for developing a profitable trading strategy. We must also test the plan in scenarios that are as similar to real-world market conditions as possible.

If your forward testing hinges on demo trading, for example, you will be completely engaged in the market. As a result, you will incorporate the current environment, such as the most recent news and economic developments, into your testing process.

How to Forward Test a Trading Strategy

A forward test is carried out in the same way as ordinary trading. The main thing in this procedure is to execute trade according to the rules defined by your trading system. This technique fosters discipline, which is essential for successful trading.

Forward testing requires multiple steps. While the first three steps can be conducted once, the others may be carried out in a loop until the desired results are obtained. Let us explain these steps in detail.

Step 1: Understanding Why You Need the Forward Testing

Backtesting is useful, but forward testing is also required.

Backtesting reveals aspects that cannot be anticipated in live trading settings. These are examples:

- You may be sleeping when the most favorable setups occur.

- There may be discrepancies between your backtesting charts and live charts.

- The swap and spread may be different enough to affect your profitability.

- You may trade differently when real money is at stake.

For all of these reasons (and a few more that we have mentioned above), you should test your trading system in as near to real-world trading situations as possible.

Step 2: Trading System

You can’t just dive right into forward testing. There are two crucial things that are required first.

- A trading system that has been tested by proper backtesting is the first requirement. This system should encompass at least entry and exit points, including, profit targets, criteria for abandoning unprofitable trades, and stop loss. For example, if you wish to trade it on the EURUSD daily chart, make sure you’ve backtested it at least three times.

- If the backtest was lucrative during the whole backtesting time and you were pleased with the results, you are ready to go on to forward testing.

Do not continue until you have both of these items. Once you’ve obtained them, proceed to step 3.

Step 3: Set up a Demo or Live Account

After fulfilling the requirement of choosing a properly backtested trading system, the trader should set up a demo account using virtual funds or a live account using a modest amount of initial balance.

Beginners can start with a demo account to understand the market dynamics. However, traders who want to enhance their expertise would benefit more from forward testing in a live account while practicing their money management skills. A cent or micro account would be adequate because it is not designed to produce profits but rather to test the new trading strategy.

Step 4: Create a Trading Strategy

The next step is to make a trading strategy. There are a variety of approaches to this. First, if you are skilled in programming, you may build a trading bot to automate your trading.

You can build such a bot by leveraging your technical analytical expertise. You may, for example, develop a basic bot, which opens a bullish trade when the 25-period and 50-period moving averages cross.

Alternatively, you can employ consolidated tactics like trend following, technical indicators, or chart patterns.

Step 5: Backtesting the Trading Strategy

After developing a trading strategy, the next step is backtesting it. This is when you use historical data to apply it to the market.

The goal is to see if it works using previous data. Even if your ultimate aim is to forward-test the indicator or bot, this is a crucial step to take.

This stage is critical since it helps us to fine-tune our strategy if our initial idea was incorrect. However, as previously stated, this alone is insufficient.

Step 5: Maintaining a Trading Journal

Another important step in forward testing is maintaining a trading journal, either manually written or obtained from account history that details each trade’s reasoning, parameters, and outcomes. This data helps in assessing performance and improving the strategy.

Step 6: Track Your Results and Improve

The next step involves tracking and improving the results of forward testing. For example, you should prioritize resolving the issues if the outcomes are disappointing.

You may accomplish this by making a few changes. For example, if you’re testing deploying the moving average, you can change the period from 20 to 25 to observe what happens.

One of the easiest methods to complete this task is to keep a trading journal, noting what we utilized in our tests and why.

Step 7: Start Trading

Once you set up everything, the next is where the work really happens.

Trade your technique and adhere to the rules, just the way you did while backtesting.

It is recommended to perform (at least) 100 trades in the forward test before starting to evaluate and fine-tune your trading system. However, you can change that amount as you see appropriate.

Limit your risk per trade to 0.5-2% of your equity. This reduces the possibility of losses and ensures that you can evaluate the method over a sufficient number of trades.

If your trading system employs longer time frames, it may not be realistic. Forward testing on several currency pairs may take 1 or 2 months if your trading system uses a timeframe higher than Daily. So, use your discretion to stop testing and begin reviewing your results. If any question develops during the procedure, perform more trade while the process is ongoing.

Step 8: Review Your Results

Once you have performed around 100 trades, it is time to look at your forward test results and see if they match with the previously obtained backtesting results.

If you did the trades correctly, they shouldn’t vary too much, with a maximum margin of error of less than 5%.

However, if the results differ drastically, then you have to understand what went wrong and address them to improve the strategy.

There can be several reasons for your results to be different. Some of them include:

- You are unavailable during the moments when your best trades are set up.

- You only backtested at a time when your system was doing really well.

- You did not backtest for an extended enough length of time.

- Something in the current market situation has altered.

- You did not follow the same rules during forward testing, that you employed in backtesting.

- You are employing a different level of risk.

- Improper forward tests, backtests, or both.

These aren’t the only reasons, but you get the picture. It is up to you to study the results and determine if they are credible or not.

Moreover, it is important to highlight that forward testing might be influenced by the survivorship bias, which implies that the strategy performance can be influenced by the fact that only the performing strategies are tested.

Advantages and Drawbacks of Forward Testing

Advantages

The advantages of forward testing are enormous. Some of them are:

- Forward testing allows you to trade utilizing real-time market data. In contrast, backtesting involves the use of historical data.

- It offers realistic expectations regarding what to anticipate.

- It permits you to discover and correct weaknesses in your trading strategy.

- It aids in the development of trust in the financial market.

Drawbacks

Despite being an excellent tool, this method has some major drawbacks:

- The first is that it demands time. If you develop anything today, it will be a long time before you are able to trade it live.

- Sometimes the outcomes of forward testing can vary from what is observed in the actual market.

- It can deter a trader from engaging in trading.

Conclusion

Forward testing is a valuable tool for traders to test the effectiveness of their trading strategies. It evaluates the efficacy of a trading strategy by applying it to real-time market data and assessing how it would have fared if utilized during the time period represented by the data.

The role of forward testing is critical in bridging the gap between theoretical techniques and real-world trading. It exposes traders to the technical and psychological obstacles of live trading, helping them to fine-tune their methods for maximum results.

Traders can reduce the risk of losses and improve their chances of success in the volatile world of financial markets by integrating the knowledge garnered through back-testing and forward-testing. Remember that perfection is impossible to achieve, but constant progress encouraged by rigorous testing can lead to long-term success.