Risk management is one of, if not the most, crucial subjects when it comes to trading. On the one hand, traders aim to minimize any possible losses, but on the other hand, they also want to maximize any potential profits from each deal.

All kinds of trading, including stocks, commodities, forex, and shares, carry a certain element of risk. No trader has not or will not face a loss at some stage. Losses cannot be prevented, but they can be managed so that the trader’s entire account is not destroyed with careful planning.

Proper risk management is an absolute necessity for becoming a successful trader. Without one, there’s a good chance that a trader could lose all of their trading capital even if they possess the best trading strategy.

We’ll cover all you need to know about risk management in this post, along with some of the top risk management suggestions to help you trade less stressfully.

What is Risk Management?

Every trader assumes some level of risk in exchange for every cent of return. Risk management is how a trader manages that risk and makes money on a number of trades. Risk management is essential for both novice and experienced traders.

Risk management strategies involve limiting your positions so that in the event of a significant market shift or series of consecutive losses, your loss, on the whole, will be something that you can easily afford. Furthermore, it seeks to preserve a sufficient amount of your trading capital so that you may quickly and profitably trade your way back to a profit.

Trading risk management is the process of weighing the extent of your possible losses against the initial profit potential on each new position within the financial markets in order to be a successful trader. It’s easy for people to fall into the trap of holding losing positions for an extended period without having a disciplined mindset toward risk and reward. If your initial goal was to make a tiny profit over a few hours, it makes little sense to hold out in the hope that things may improve before, eventually closing out for a significant loss.

Long-term trading success can be defined as the successful fusion of:

-

The ratio of winning trades to losing deals

-

The average profit made on each trade in relation to the average loss made on each trade

It’s crucial to consider both these ratios and the connection between risk and reward. For instance, many successful traders actually have a higher percentage of losing trades than winning deals, but they still generate profits since the average magnitude of each loss is significantly lower than their average profit. Others have an above-average profit value relative to losses but a relatively high proportion of winning situations.

Common Risks

Whether you’re interested in managing risk with energy trading, commodity, futures, or stock trading, the fundamentals of risk management are fairly similar when trading with all financial instruments.

These risks could include:

-

Market Risk: The most frequent risk in trading is known as market risk. This risk may affect certain equities, industries, or the entire market. It reflects the possibility that market performance will differ from what you anticipate. For instance, if you decide to buy the EURUSD currency pair because you think the US dollar will strengthen versus the Euro, but it declines instead, you will lose money.

-

Leverage Risk: Using leverage, many traders can open transactions that are significantly greater than the initial deposit they have made in their trading account. In some circumstances, this can result in losing more money than was first submitted to the account.

-

Interest Rate Risk: Because an economy’s interest rate can affect the value of its currency, traders may be exposed to sudden changes in interest rates.

-

Liquidity Risk: Different currencies and trade instruments have different levels of liquidity. When a currency pair has high liquidity, there is greater supply and demand for it, which allows for speedy trade execution. When trading currencies with lower demand, there may be a lag between when you open or close a position in your trading platform and when it is actually completed. This could imply that the trade isn’t executed at the anticipated price and that you end up making less money—or even losing money—as a result.

-

Risk of Ruin: This refers to the possibility that you won’t have enough money to make deals. Imagine for a moment that you have a long-term plan for how you believe the value of security will change, but it goes the other way. Until the market moves in the direction you want, you need to have enough money in your account to survive that price movement. If you don’t have enough money, your trade may be automatically canceled, and you could lose all you invested, even if the security later advances in the direction you anticipated.

Why is Trading Risk Management Important?

Trading is frequently viewed by traders as a means of generating income, but they often overlook the potential for loss. By implementing a risk management strategy, a trader can lessen the adverse consequences of losing trades when the market moves oppositely.

Losses are reduced by risk management. Additionally, it can protect traders from losing all their money. Trading losses increase the risk exposure of the investors. If traders can manage their risk, they can increase their chances of becoming successful in the market.

A trader will be able to profit from upward movement while reducing downside risk if risk management is incorporated into the trading strategy. This is accomplished by trading with a diversified portfolio and using risk management tools such as stops and limits.

Trading stops can help traders avoid holding onto positions for too long in the expectation that the market will turn around. This is the most common mistake that traders make and can be avoided by incorporating the characteristics of successful traders into all trades.

What can be done to Reduce Trading Risks?

You can avoid risks by following some general rules listed below.

-

Don’t take any huge risks. Due to their excessive use of leverage, some traders have committed trading suicide by taking unnecessary and preventable risks.

-

Never be extremely self-assured, unduly sensitive, or overly stubborn. Always assume that you will lose and prepare yourself to handle the setback.

-

Make a risk management plan and follow it. Determine the purchase and sale prices that you can afford. Do not proceed if the trade does not fit your pre-established criteria.

Managing Risk in Trading – Top Tips & Strategies

By now, you must’ve understood that risk management is an extremely important prerequisite to successful day trading. After all, without a sound risk management plan, a trader who has made substantial profits could face huge losses in just one or two disastrous trades. So how do you plan ahead to reduce market risks?

Here are some risk management strategies that traders of all levels must follow while trading.

-

Follow the one percent rule.

-

Use stop losses to limit losses.

-

Diversify your risks.

-

Maintain a favorable risk-to-reward ratio.

-

Use a take profit to protect your profits

-

Manage your emotions and keep your risk constant

The One Percent Rule

Every trade carries some level of risk, thus, it’s extremely important to assess your risk prior to entering the trade. A general rule will be to never risk more than 1% of your entire capital in a single trade and to never risk more than 5% of your total account equity on one open position.

For instance, if the 1% rule were implemented to a $10,000 account, it would suggest that no more than $100 should be staked on a single position. The transaction amount will then need to be determined based on how close the stop is in order to risk no more than $100.

The advantage of this strategy is that it aids in maintaining account equity following a string of unsuccessful deals. A further advantage of this strategy is that traders have a greater likelihood of a free margin to take advantage of new trading opportunities in the market. This prevents having to pass up such opportunities due to the margin being locked up in active trades.

Use Stop Losses to Limit Losses

The Placement of stop losses is an important aspect of risk management practices. It is mandatory to place a stop loss whenever you place a trade. A stop-loss order determines how much loss you can bear ahead of time. Sell the stock when it reaches your cut-off point and accept the loss. Bury your head in the sand and let the emotion take over while telling yourself it will pass. Be sure to plan out how much the stock needs to increase before you can profitably sell it. Do not convince yourself that the value will keep increasing by becoming overconfident. Therefore, whenever your stop-loss is reached, you should always accept it without any emotional resistance.

For instance, if you purchased an asset for $200 and want to restrict your loss on this trade to $10, your stop loss point would be at $190. If the asset price, unfortunately, dropped and went below $190, your deal would instantly be closed off, resulting in a loss of $10.

Setting an exit stop-loss before you begin a trade helps you stay on track with your strategy. It is also crucial for determining your risk/reward ratio, which we shall discuss below and is an important component of any risk management strategy.

Diversification of Risks

Diversifying trading risk is a crucial component of any risk management approach. Portfolio diversification is a crucial tactic for lowering risk without compromising an expected return. American economist Harry Markowitz initially introduced the idea of modern portfolio theory in his 1952 work “Portfolio Selection”, which was subsequently adopted globally.

The goal of portfolio diversification is to disperse your wealth throughout a variety of asset classes, thereby reducing the high risk associated with trading or investing. It is anticipated that an area of a portfolio that performs well would outperform an area that performs poorly. When you spread your investments among several commodities, at least one of them will be able to make up for the losses from the others.

Thus, the idea behind diversification is that by trading or investing in many assets, you may lessen the influence that any one trade or investment will have on your overall portfolio. Although it is not a surefire technique to make money, portfolio diversification can help to lower the overall risk of your trading or investment strategy.

Maintaining a favorable Risk-to-Reward Ratio

It is critical to maintain a favorable risk/reward ratio in order to manage risk over time. Early losses are possible, but your trading account will be much more consistent if you keep a positive risk/reward ratio and stick to the one percent rule on each trade.

The risk/reward ratio determines the level of risk that a trader is willing to take in order to achieve the desired rewards. It is the ratio between the potential profit and the potential loss.

A 1:2 risk-to-reward ratio suggests that the trader in average will lose one dollar and gain two if the transaction is successful.

Use Take Profit to Protect Your Profit

A take profit is a technique that is quite similar to a stop loss, but, as the name implies, it serves the opposite function. While a stop loss closes a trade automatically to stop future losses, a take profit cancels a trade automatically once they reach a specific profit level.

Clear expectations help you decide what level of risk is reasonable for each transaction. This enables you to set a profit target and, consequently, a take profit. Most traders would strive for a reward-to-risk ratio of at least 2:1, where the potential reward is twice as great as the risk they are ready to accept in a trade.

As a result, if you placed your take profit at 40 pip above your entry price, your stop loss would be at 20 pip, meaning halfway down.

In other words, consider the levels you want to reach on the upside and the minimum loss you can bear on the downside. Doing so will assist you in maintaining your discipline while achieving your trading goals. Additionally, it will inspire you to think in terms of risk versus reward.

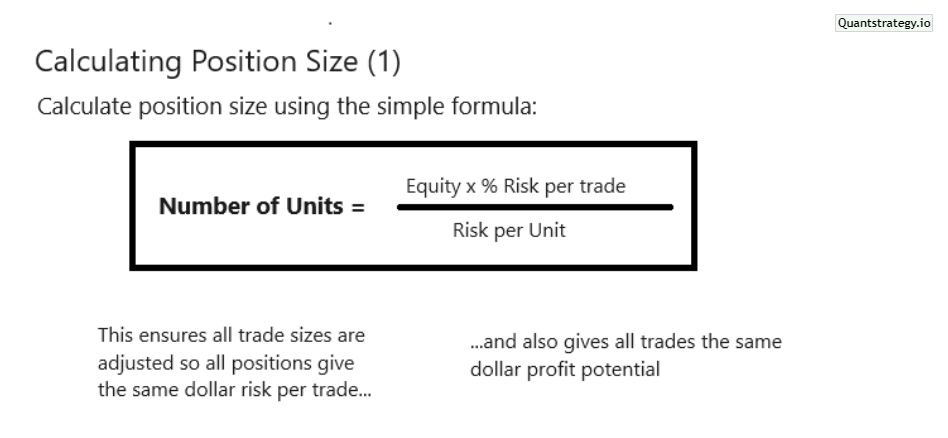

Position Sizing

Position sizing is one of the important aspects of risk management strategies. Risk is directly impacted by the size of your trade. The number of shares or contracts you want to trade constitutes your position size. The amount of stop loss and the quantity of capital you desire to risk in a specific transaction are the sole determinants of position sizing.

Position sizing is calculated as risk per trade (amount) divided by the value of stop loss. Consider that your risk per trade is $2000, and your stop loss is $10 for each share. In that case, we get 200 shares by dividing 2000 by 10. Therefore, you are not allowed to trade more than 200 shares in this instance. This is the way to calculate position size in order to consistently manage your risk.

One of the factors to consider when determining your position size is how much of your trading money you would be willing to lose during a particularly long run of losses. If you were to use 1%, you would lose 13.1% of your capital after 14 losses in a row. If you were to use 2%, you would lose 24.6% of your capital if you experienced 14 straight losses.

Manage your Emotions and Keep your Risk Constant

Greed can easily set in after traders place a few profitable transactions, leading them to increase their trading sizes. This is the simplest way to lose money and jeopardize the trading account. For more experienced traders, it is OK to increase their winning positions, but the general rule should be to keep a consistent risk framework.

Conclusion

Risk management, trading psychology, and technical analysis are three important parts of profitable trading. Effective risk management entails planning ahead of time and minimizing losses as soon as risky scenarios are identified.

You may have good trading strategies, but if you do not have sound risk management in trading, you’ll inevitably end up facing excessive losses than wins. Day traders need to build an appropriate trading risk management system to protect their capital, avoid losses, and maximize profits.

Risk per trade, risk-to-reward ratio, position sizing, and other risk management criteria need to be checked before making any trades so that there is no uncertainty or concern after making the trade. Risk management eliminates trade anxiety by predicting losses. When you lose your fear, you can work at full capacity. By incorporating risk management strategies, you can improve the overall profitability of your trade and the likelihood of long-term success.