Many individuals see stocks as a means of generating income, and stock trading has undoubtedly grown in popularity since the Covid-19 outbreak and the advent of meme stocks. Before that, commission-free stock trading services like Robinhood increased the lure to retail investors.

Stock trading is one of the most prevalent means of investing in the stock market. However, the thought of making such a significant decision can intimidate novice investors who might want to dive in and start trading.

A well-built stock portfolio is the way to go for any investor’s success. Investors can build portfolios aligned with stock trading strategies by following a systematic approach.

Below we shall learn how to build a winning portfolio. But before that let’s understand the basics of stock trading and the importance of having a strategy before trading stocks.

What is Stock Trading?

Stocks are akin to fractional ownership in your organization. When you buy stocks, you are investing in a portion of your financial future; if the company is successful, the value of your stocks will rise.

The process in which stock traders buy and sell stocks in order to earn from daily stock price variations is known as stock trading. Investing in stocks can yield profits within minutes, hours, days or months. In contrast, you could also lose capital if the stock price decreases owing to market instability. Ideally, you should have a plan before you invest in or trade stocks.

So, a stock trading strategy is a set of actions used in stock trades to execute a trade. And a profitable stock trading strategy is one that helps traders gain while lowering the danger of loss.

Types of Stock Trading

Stock trading has two types – active trading and day trading.

Active trading is when an investor trades per month. Active traders usually place 10 or more trades in a month. Their trade heavily relies on a day trading strategy which in turn is dependent upon market timing and seeks to profit from short-term events (in the market or company) in an attempt for quick profits.

Day trading entails buying and selling the same stock in a single trading day. A day trader has little interest in the internal working of the companies. Their primary goal is to make the most profit possible in the ensuing minutes, hours, or days.

Why do we need a Winning Stock Portfolio?

The behavior of a stock market constantly changes, and stock market investments are always exposed to market risks. A well-constructed stock portfolio will probably beat alternative investments over the long term.

Besides, developing a successful stock trading strategy is a terrific method to increase your income. There are numerous investment strategies that can be used to increase your money, but they all share one feature. Each one of them employs a plan to assist you in picking the ideal stock to purchase.

You must know how to select an asset allocation as an individual investor in order to meet your specific investing goals and risk tolerance. In other words, your equity portfolio provides security while meeting your future money needs.

Planning for a Winning Portfolio

Creating a winning stock portfolio may seem daunting at first, but it is more straightforward than it appears.

Focus on identifying your investment goals, assessing your risk tolerance, and diversification, and choosing short-term or long-term investments according to your objectives.

Here’s more detailed information regarding these steps:

Choose investments that are appropriate for your age & goals

If you’re in your 20s or 30s, you’re still young enough to invest primarily in equities and take on greater risk. When making investments, you have time on your side to recover from any potential short-term losses that can happen.

But let’s say you’re getting close to retirement age or you want to safeguard your retirement income reserves. In that situation, it’s critical to invest in a variety of equities and bonds, which will offer stability and slow long-term development.

It’s crucial to understand your reasons for investing. What monetary objectives are you attempting to meet? Common investment objectives include purchasing a home, funding a child’s education, and preparing for a retirement account.

Choose a suitable investment strategy, even if you are young, in order to accomplish any one of these objectives in a given amount of time.

You can regularly revise your goals to take into account changes in your plans, circumstances, or income.

Prioritize risk tolerance and asset allocation

The process of allocating your investing funds among various asset classes is known as asset allocation. Securities like stocks, bonds, ETFs, mutual funds, cash, etc. are all examples of an asset class.

It’s essential to building a portfolio because it aids in risk management while you work to attain your desired return.

Allocating assets can be done in a variety of ways. For instance, you may choose a straightforward 60/40 stock-to-bond split for your asset allocation.

But as you improve, you might think about including more asset types like real estate or commodities.

Whatever strategy you choose, it’s critical that your portfolio represents your level of risk tolerance and investment philosophy.

That implies your portfolio should reflect your risk tolerance by having a bigger proportion of low-risk assets if you aren’t comfortable taking on many risks to earn potentially better returns.

Let’s say, though, that you’re willing to accept greater risk in exchange for the possibility of greater benefits. In that instance, you can lean more heavily toward equities and other higher-risk investments in your portfolio.

The key is finding an ideal balance between anticipated rewards and a manageable level of risk.

Diversify your investments

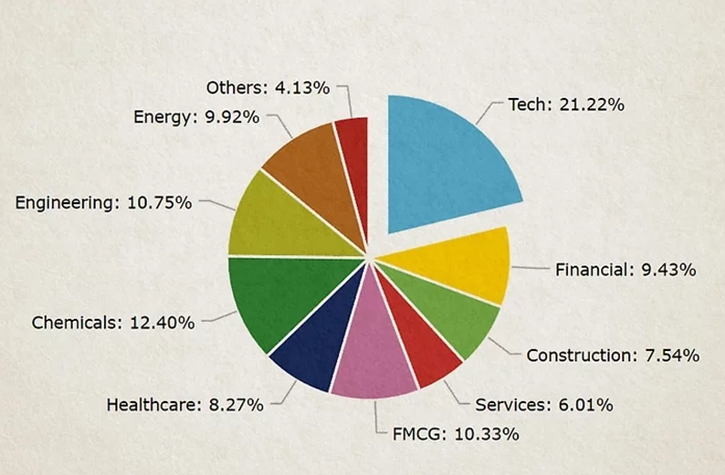

Stock diversification is a stock investment technique that involves buying a variety of stocks to lower the volatility of a portfolio. Traders can diversify by purchasing various companies from different industries or by purchasing various stock types, such as growth and value stocks.

A well-diversified portfolio is a wise decision regardless of your age. You should have assets in a variety of industries and regions in your well-diversified portfolio. By distributing your investment capital among many stocks, you can reduce the risk associated with stock market investing.

You lower the possibility of one sizeable loss impacting your entire portfolio by spreading your capital across several different investments.

Long-term investment VS Short term investment

Don’t be averse to taking chances when it comes to long-term investing. You can possibly increase your investment over a lengthy period by taking sensible risks with some of your money. Understanding when and how much risk to take is crucial.

You can decide how much risk you should take by considering your time horizon. How long are you going to keep the investment? Longer time horizons allow you more room for riskier investments.

Your personal risk tolerance is another factor to take into account. While some people don’t mind taking chances, others don’t like the prospect of losing money.

Being young, though, gives you time to recoup from losses, so when it comes to long-term investments, don’t be hesitant to take on risks. Some examples of long-term investments are real estate, mutual funds, individual stock investing, individual or employer-sponsored retirement accounts, and target date funds.

On the other hand, it is preferable to stay away from high-risk investments that could result in a loss of wealth if you are investing for the short term. Holding onto the money you know you’ll need in a few years requires short-term investments.

A savings bank account, government bonds, cash, and cash equivalents are a few examples of short-term investments.

Finding something that delivers a safe rate of return is essential when selecting short-term investments.

Stock investing is generally not considered a risk-averse activity, particularly if you plan to hold the investment for a short time.

Review your stock portfolio (occasionally, though)

Recognize that the market will change. If you monitor your stocks daily, you can start to worry about the worth of your investments as they rise or fall in value. On the other hand, you should periodically review your investments.

- It’s a good idea to review your portfolio a minimum of once or twice a year, but stock research has indicated that rebalancing modifications (selling revenue from profitable holdings and buying shares of those that have declined in value) more frequently than twice a year do not provide any advantage.

- Some industry masters advise examining a company’s quarterly financial reports to see if your projections for it are coming true. Make adjustments if required but don’t abandon ship every time a share’s value shows a slight decline.

- Tax ramifications of selling are another important factor to consider. If you invested after-tax money into this account (a non-IRA or similar type of brokerage account), try to hold off on selling anything for at least a year in order to get long-term capital gains tax treatment rather than ordinary income tax treatment on the proceeds. The capital gains rate is generally preferable to the income tax rate for most investors.

Conclusion

Traders can choose from a plethora of strategies. A well-built equity portfolio is the way to go for both novice and experienced stock traders. Besides identifying your investment goals, assessing your risk tolerance, and choosing short-term or long-term investments according to your objectives, you must prioritize keeping your diversification throughout the entire process of building your portfolio. You must diversify within each asset class in addition to owning securities from each one. Make sure your investments in a particular asset class are dispersed throughout an array of subclasses and industry regions.