There can be several potentially lucrative trading opportunities, but how can you tell which ones will succeed and which will not? The truth is that you cannot because there is a certain amount of risk and reward associated with every trade or investment. All a trader can do is select positions where the potential reward outweighs the substantial dangers associated with trading. This is the point where the risk-reward ratio enters the picture.

A risk-to-reward ratio can be a crucial component of your trading strategy and help you avoid taking unnecessary financial risks. In this article, you will learn everything about it.

What is the Risk-Reward Ratio?

The risk-reward ratio is an important metric used by traders that demonstrates the potential return on investment for each dollar at risk. It’s determined by dividing the potential loss (risk) of a trade by the amount of potential gain (reward). For example, if you risk $100 to make $200, your risk-to-reward ratio will be simply one-to-two.

Risk management is essential in the financial markets, and understanding the risk-reward ratios is a key concept. It is frequently used to assess an investment’s expected return and the level of risk necessary to achieve that return. It is a critical tool for risk management since it provides an important evaluation of the risk and reward balance of potential investment.

If you have a higher risk-reward ratio, you’re at risk of losing more money than you could potentially gain. It is often preferred to have a lower ratio because it shows a lesser risk for a similar potential gain. Most traders use stop-loss and take-profit orders to set their risk-reward reward ratio. A stop loss is an order to close a trade when the price moves against you by a specific amount. A take profit is an order to close a trade when the price moves in your favor by a specific amount. These orders enable traders to limit their risk and determine their expected return even before they enter the trade.

Additionally, the risk-reward ratio is a key component of every effective trading strategy, and there is no profitable trader without an understanding of the reward-risk ratio.

How Does the Risk-Reward Ratio Work?

The risk-reward ratio assesses how much you would earn for every dollar you risked. The 1:3 R/R ratio is generally considered the best for most situations by analysts, traders, and investors. It shows that you can make three dollars for every dollar you risk.

You’ll receive more than a dollar for every dollar traded if your risk-reward ratio is less than 1.0 (the 1:3 risk-reward ratio is 0.33, so it’s less than 1.0). This means the reward is greater than the risk and is a good trading opportunity to take. If the ratio is greater than 1.0, the risk is higher than the reward, and it is not a good trading opportunity to take. Finding trades with a ratio of at least one to two or higher is ideal. This implies that you stand to gain at least $200 in profits for every $100 you invest.

As mentioned above, you should use a stop-loss order and take profit order to manage the risk-reward ratio better. This will ensure that you don’t take on more risk than you can afford to lose.

Importance of Risk-Reward Ratio

The risk-reward ratio is undoubtedly one of the most crucial tools you should utilize if you want to become a profitable trader. It makes it easier to calculate gains and losses and gives you an additional reason to think twice prior to opening a trade. It would be ideal if you didn’t base your trading choices on the standard R/R ratio. For every trade, you should decide how much money you can afford to lose on a particular trade and how much money you can lose before the trading day is over.

If a given investment looks promising due to price patterns, economy background, or your gut feeling, you may afford to take more risks and have a reward-risk ratio of 1:2, 1:1, or even 1:0.5. It is acceptable as long as you are aware of your motivations and maintain emotional restraint. Additionally, your odds of making money in the deal are reduced by your risk-reward ratios (1:3 isn’t too small, but 1:5 is small). It occurs as a result of market volatility, which might lead the chart to advance to your stop loss and then return to your targets. To succeed, it would be beneficial if you could strike a balance between the risk-to-reward ratio and the trade’s win rate.

Every market undertaking that involves a return requires a certain level of risk. Avoid making emotional decisions since they may force you to deviate from your preset investment goals and tempt you to place irrational stakes. You must always have a reward-to-risk ratio to take a calculated risk.

How to Calculate the Risk Reward Ratio?

Traders must calculate both the risk and the reward to determine the risk-to-reward ratio. In manual trading, both of these levels are set and analyzed by traders before opening a position.

Risk is the sum of money you are willing to lose in the trade. It is the price difference between the entry price and the stop-loss order. Do not arbitrarily place the stop-loss order on the chart just to maintain the reward-to-risk ratio. Stop loss and take profit levels are far more important than the risk-reward ratios in terms of determining whether a trade has a possibility of success or failure.

The reward is the potential profit when the trade hits the take profit level. It is determined by calculating the distance between the entry point and the profit target. To achieve a desired risk-reward ratio, avoid placing your take-profit levels at any point on the chart, just like with the risk. Sometimes having a higher win rate over a lower risk-reward ratio is preferable.

The risk-reward ratio is the quotient obtained by dividing the risk with the reward. It can be calculated using the following formula:

Risk Reward ratio = (Entry Price – Stop Loss) / (Take Profit – Entry Price)

There are three possible outcomes of the calculation, which are as follows:

- Risk < Reward

- Risk > Reward

- Risk = Reward

We know that when the ratio is less than 1, the risk involved in getting higher returns is lower. The objective in any of these three scenarios is to keep potential risk lower than the reward so that your loss is kept to a minimum every time the trade reaches the stop loss. The final goal is to minimize risk in every trade in order to maximize potential profit.

The following example describes a desirable reward-to-risk ratio.

The trade entry point, take profit, and stop loss are shown in the image above. Let us plot them to determine the risk-reward ratio using the formula.

Risk Reward Ratio = (44738 -43676) / (47591 – 44738) 1062 / 2853

The risk-to-reward ratio will be 1:2.68, which is less than 1.

What is a Good Risk-Reward Ratio?

Unfortunately, there is no simple answer to this question. The ideal reward-risk ratio will vary depending on the circumstance, your preferred trading approach (scalping, day trading, etc.), your risk tolerance, and other elements.

However, it’s wise to aim for a ratio of at least 2 to 1. Many investors may even aim for 3 to 1 or higher ratios. By doing this, you may make sure that you profit more from winning trades than you lose from losing trades. This is the secret to long-term market success.

Calculating both points separately and in accordance with your analysis, whether it be technical, fundamental, or both, is the best way to employ the reward-to-risk ratio.

The risk-reward ratio can then be used as a tool to fairly compare several prospective trades once it has been calculated. You can also make yourself a rule, for example, not engaging in trades with a risk-reward ratio of less than 1:2. This is an excellent way to begin your risk-reward analysis.

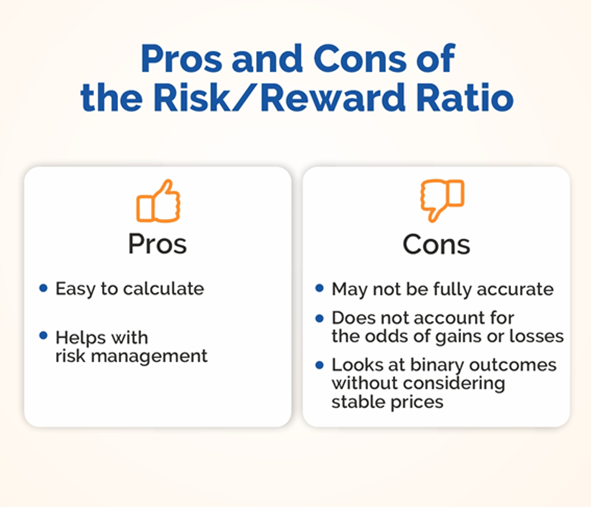

Pros and Cons of Risk-Reward Ratio

Pros

- Easy to calculate: The risk/reward ratio has a fairly simple formula, which allows investors to utilize it to make on-the-spot decisions.

- Assists in risk management: After the ratio describes the risk of an investment, the investor has more information to decide whether to make a trade.

Cons

- May not be entirely accurate: Risk/reward ratios are calculated using the investor’s stop-losses and potential profits, which may not be fully correct. An investor may not be able to sell a security at the intended price if its price rises or falls too quickly, therefore, the actual loss or gain may exceed the potential loss or gain.

- Ignores the probability of gains or losses: The risk-reward ratio solely considers the gains and losses that an investment might experience. The probability of either outcome cannot be taken into account in the calculation.

- Disregard stable prices in favor of binary outcomes: Securities’ prices might increase or decrease, but they can also stay constant. Risk/reward ratios do not account for this possibility.

Conclusion

The risk-to-reward ratio calculates the prospective reward and losses in investments and trades. The risk outweighs the trade profit if the ratio is larger than 1.0. The return exceeds the risk if the ratio is less than 1.0. While it is a powerful and simple tool for good risk management, it’s not the best indicator of your trading expertise. Traders must have sound trade management and techniques in place to make winning trades.