Developed by a scientific researcher John Kelly Jr. at Bell Labs in 1956, the Kelly criterion formula has long been established to provide a potent equation to calculate the optimum level of risk for placing a bet in a probabilistic types game like sports betting or blackjack.

Today the best prop trading firms use this formula to maximize the possible return of a given bet or investment. Besides its established application in sports betting, funded traders are known for using it in financial markets for a long time.

The Kelly formula mathematically answers the question, ‘Given the odds of the game, how much should I bet to increase my return?’

It has become well known amongst betters despite being a little complex and entailing a certain degree of risk.

This article outlines what the Kelly criterion formula is and how traders and investors use it to maximize their profit.

Kelly Criterion – Background

An AT&T’s Bell Lab scientist and researcher, John Larry Kelly Jr., discovered the Kelly criterion in 1956 in New Jersey. He was working on the Information theory by Claude Shanon when he came up with this powerful equation.

After getting published in 1956, the gambling community got wind of it and realized its prospects in the horse racing betting system.

It was believed earlier that winning a bet is dependent upon the situation and the odds. However, not much significance was given to the betting amount.

The Kelly betting was the first that brought the concept of scientific gambling to light. It practically demonstrated that an optimum amount of betting size is critical for boosting the winning probability ultimately.

Later, Kelly criterion found applications in stock market investment as well. The mathematical formula of Kelly strategy gave numerous traders the idea of proper diversification, scientific management of risk, and optimum investment size.

More recently, the Kelly strategy witnessed a renaissance when legendary investors like Bill Gross and Warren Buffet used a variant of the criterion. Moreover, several fund managers and big funding houses use the Kelly criterion formula to organize their investment size and as their general money management system.

The Kelly criterion assumes that the investor will reinvest profits and put them at risk for subsequent trades and is used by investors who wish to trade to increase capital. The formula’s objective is to establish the ideal investment amount for each trade.

Understanding the Kelly Criterion

The Kelly criterion, also called the Kelly formula, Kelly strategy, or Kelly bet, entails two basic components.

- Winning Probability (W) – the probability that a trade will return a positive amount.

- Win/loss ratio (R) – This ratio is the total positive trade amount divided by the total negative trade amount.

These two components are further put into an equation whose result informs investors about the percentage of their total capital that they must apply to each investment.

The formula is as follows:

Kelly % = W – (1-W) / R

Where

Kelly % or Kelly percentage is the percent of an investor’s capital to place in a single trade.

W= Winning probability of the trading system

R= Historical win/loss ratio of the trader

Kelly percentage has numerous real-world implementations. Although gamblers can employ it to help optimize their bet size, investors can deploy it to ascertain their portfolio amount that can be allocated to every investment.

While the Kelly Criterion can be helpful for some investors, it’s also necessary to take diversification into account. Even though the algorithm shows a high likelihood of success, many investors would be hesitant to invest all of their assets in one single asset.

Example for Calculating the Kelly Percentage

Calculating W

Let us assume that a trading system gives 60 losing trades and 40 winning trades.

W= total number of winning trades / total number of trades

W = 40/100

W= 0.4

Calculating R

Over time, using the technique, winning trades increased the trading account by 6000 dollars while losing trades resulted in a total loss of 2000 dollars.

Win/loss ratio = Positive trade amount / Negative trade amount

R= 6000/2000

R=3

Calculating Kelly Percentage

Kelly % = W – (1-W) / R

Kelly % = 0.4 – (1 – 0.4) / 3

Kelly % = 0.2 or 20%

The Kelly criterion shows that the optimal position size is 20% of a trader’s equity for a single investment. To maximize the return, the trader must bet this amount of the available capital on each trade.

Of course, if you are day trading or engaging in any type of short-term trading, this does not mean that you should blindly base 20 percent of your account on trade because a string of losses would completely wipe out your account. If you’re aiming for long-term trading or investment, diversifying your portfolio by allocating a portion of your trading equity to specific assets could be beneficial.

Analysis and Interpretation

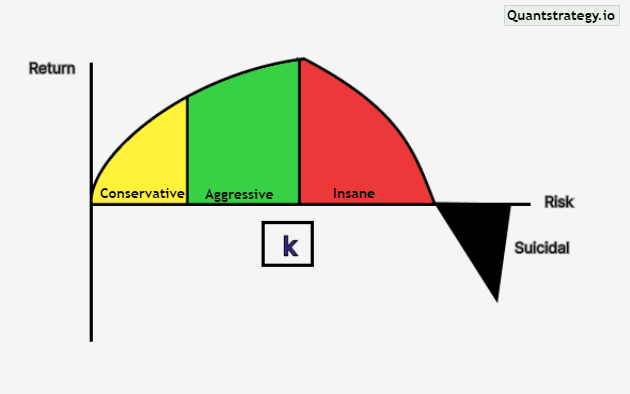

The Kelly criterion results in the K percentage, which represents the portfolio size to devote to each investment. In short, it provides information regarding how much a trader should diversify.

Regardless of what the Kelly criterion suggests, one shouldn’t invest more than 20-25 percent of their wealth in single equity, because diversification itself is crucial to avoiding a big loss in the event a stock fails. Besides, the Kelly criterion is not a perfect method. It is more practical when deployed in a longer time frame.

Due to their risk aversion, some investors prefer betting less than the Kelly %, which is fair given that it lessens the risk of potential overestimation and bankroll depletion. It’s referred to as Kelly Fraction.

The Kelly criterion, on the other hand, advises that one should walk away and not place any bets at all if the Kelly percentage yields a negative value because, based on mathematical formula and calculation, the odds do not appear to be in one’s favor.

The Kelly criterion is usually successful since it is based on a straightforward formula that uses only pure mathematics.

However, factors that can affect success are accurate inputs of the odds of winning and losing because an inaccurate percentage would be adverse.

Understanding how position sizing can change depending on a balance between risk and reward is one of the main benefits of adopting the Kelly criterion method. It’s one of the most difficult elements for gamblers and investors to understand and incorporate into their strategy.

Additionally, there can be unforeseen occurrences like stock market crashes, which can affect all equities whether the Kelly criterion was applied or not.

The formula cannot predict black swan events, which result in extreme stock market declines. This is why many gamblers, investors, and traders opt not to utilize full Kelly, preferring to employ a more conservative approach such as half Kelly, which involves using a smaller percentage of the optimal bet sizing strategy.

Regarding financial trading, it’s even more critical to be conservative since (unlike casino games) it isn’t simple to accurately estimate the expected return (payoff) or exact win rate. Hence it’s essential to employ conservative values in the formula as well.

When it’s about trading systems, there are some more significant implications.

Does the Kelly Criteria Work?

Pure mathematics is the foundation of this system. Some individuals might doubt the applicability of this maths, which was initially devised for telephones, in the stock market, or the gambling industry.

An equity chart can prove the system’s performance by simulating the growth of a specific account using only mathematical formulas. In other words, the investor must be expected to maintain such performance, and the two variables must be entered accurately.

Conclusion

The Kelly criterion is one well-known method that has been used for a long time in investments as well as gambling. It is useful in minimizing losses and focuses on attaining efficient returns through diversification.

It might not necessarily work for every trader or investor even though it did for gamblers. While it’s beneficial to employ a variety of money management formulas, one shouldn’t rely on just one kind to determine which investments are good and which are not.

The Kelly criterion can be a prudent choice to determine how a potential investment would fare for an entire portfolio. It can help you determine how much or how little one can invest in a specific investment.

All of the resources shouldn’t be allocated to a single trade. Even if the model predicts a high percentage, it’s a good idea to diversify investments and own various securities rather than just a handful.