Backtesting is one of the essential processes in creating a trading strategy. It helps traders to optimize and improve their trading strategies and build confidence in their plan, before using it in real market scenarios.

In this blog post, we will describe 3 main methods for backtesting a trading strategy.

What Is Backtesting?

To determine how a trading strategy would have fared statistically in the past, backtesting is the practice of examining historical data.

By determining how a trading strategy or pricing model would have performed retrospectively using previous data, backtesting evaluates a strategy’s viability.

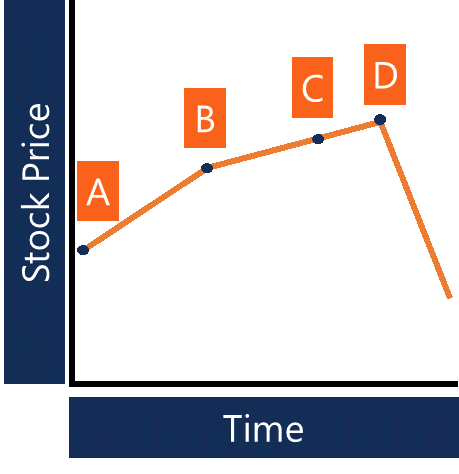

According to the underlying idea, any approach that did well in the past is likely to do so in the future. In contrast, any method that performed poorly in the past is likely to perform poorly going forward.

It is advantageous to set aside a period of historical data for testing while analyzing historical data to evaluate an idea. If it is successful, evaluating it using data from unrelated samples or alternative periods can help to establish its viability. Backtesting on unseen historical data after strategy parameters are optimized is called forward testing or validation.

A trading strategy can be backtested in three different ways.

Manual Backtesting

In order to perform manual backtesting, you just go over your historical charts candle by candle. Manual backtesting has some significant advantages over the alternatives, which we will explain shortly.

Replay Backtesting

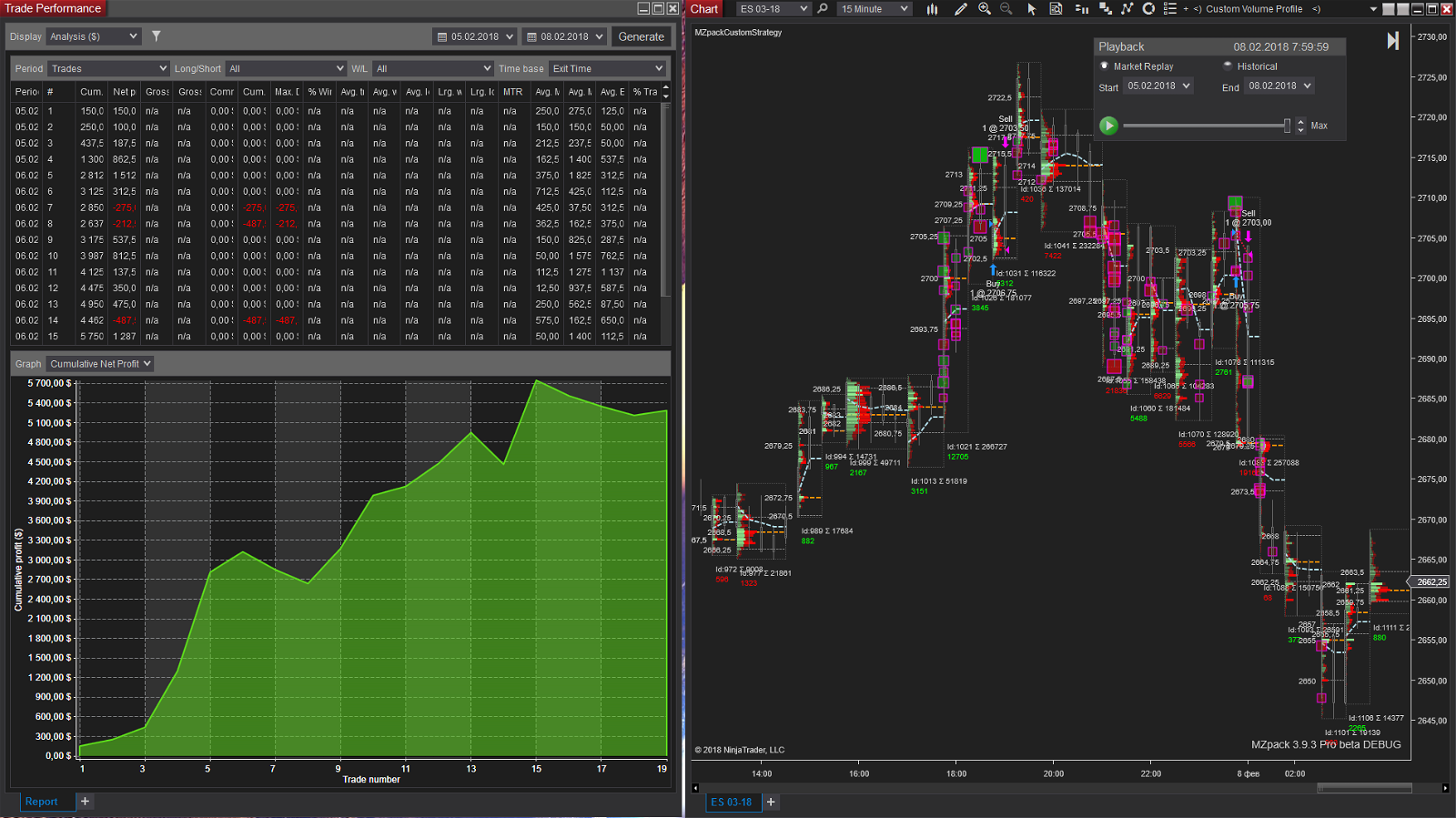

Replay is a feature that is available on most charting platforms, allowing you to mimic a live market situation using historical trading data. The replay program will often compile statistics on the trades you made.

Automated Backtesting

Algorithmic traders backtest their coding strategies by running simulations.

Historical data from stocks, bonds, and other financial instruments are used in the simulation. The person conducting the backtest will evaluate the model’s returns across several datasets.

How is backtesting utilized in professional money management?

Backtesting is a well-known technique used by traders to evaluate their methods and raise returns. Backtesting is a technique that is useful in areas of finance other than speculating, though. These fields consist of forensic accounting, risk management, and the creation of investment strategies.

Portfolio managers, for instance, employ backtesting to identify appropriate allocations and enhance rebalancing tactics. Longer time horizons and less active investment strategies are frequent candidates for this kind of backtesting.

Backtesting is crucial to the regulation of financial institutions. This procedure offers supervisory authorities, including the Basel Committee and bank regulators, a key evaluation technique to assess the suitability of internal VaR models used by subject banks and to spot banks using models that may understate risk.

Using Backtesting to Improve Your Strategy

One of the biggest reasons rookie traders fail is because they don’t learn how to backtest their methods.

You need a clearly defined trading strategy and faultless execution to succeed in this industry. Backtesting is useful for both.

You can better establish a strategy by understanding its strengths, limitations, and characteristics by manually backtesting it.

Additionally, after you’ve thoroughly backtested a strategy and shown it has the potential to be profitable, it will make you feel more confident about sticking to your rules.

The ability to lose money is a necessary skill for success. Finally, it will help you understand the downsides of the method. With ALL trading techniques and traders, drawdowns will happen.

You’ll start to understand that a downturn is just a result of trades being distributed randomly. Instead of focusing on each transaction individually, you will begin to consider the performance over a number of trades.

Backtesting Platforms

As was already noted, you can manually test a strategy with your charting software, conduct a simulation using an algorithm, or use replay tools to backtest it.

Let’s have a look at several software providers who can support each style.

Trading View

Trading View is a well-known web-based charting program that includes a rewind feature.

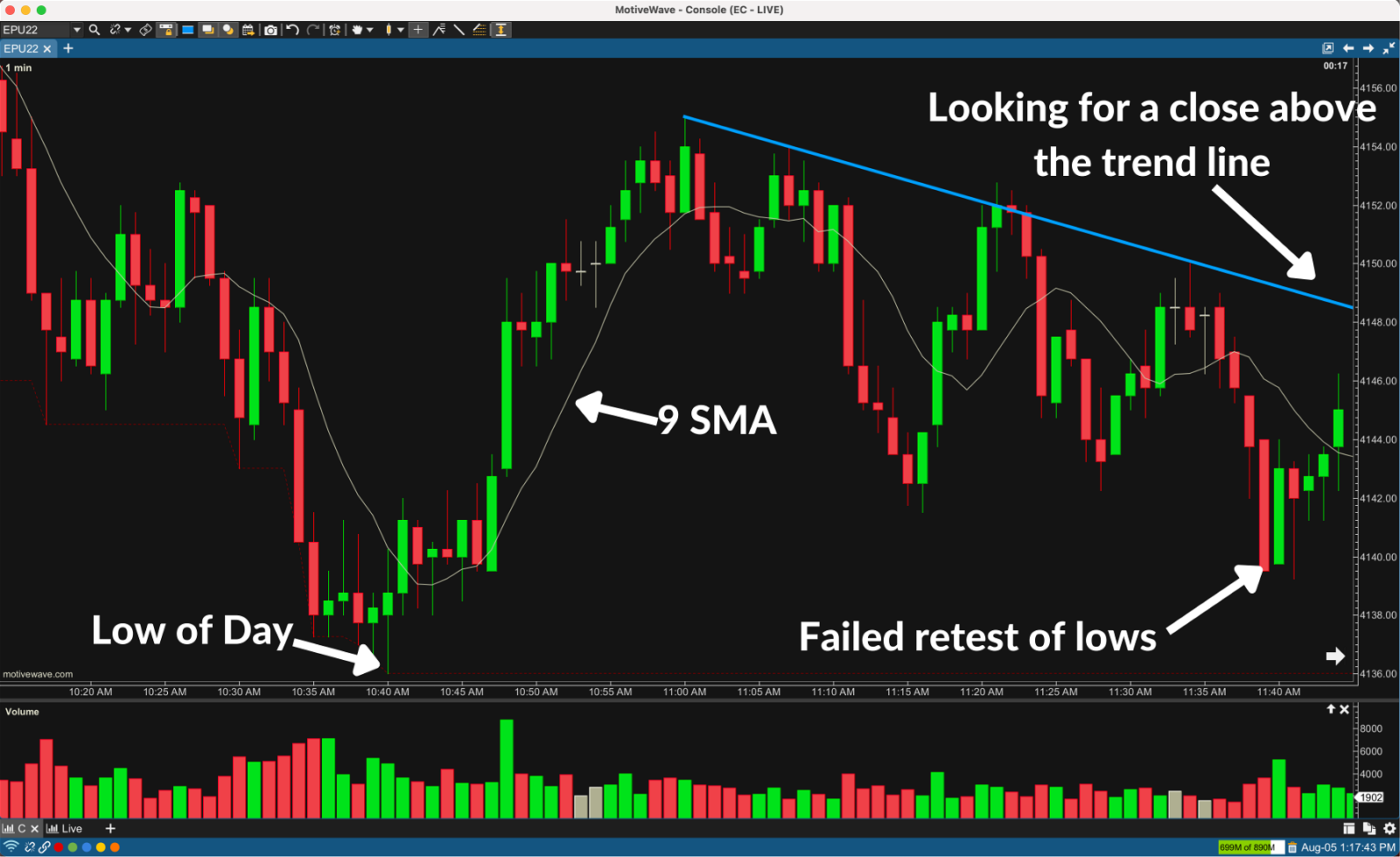

MotiveWave

MotiveWave is a trading platform with tons of features, excellent usability, and stunning charting. It also uses the most sophisticated Elliott Wave analysis programmed out there.

With support for Windows, macOS, and Linux, Motive Wave is a broker- and data-feed-neutral.

Trade Station

In terms of automated trading, Trade Station has always been a pioneer. Easy Language, a proprietary programming language developed by Trade Station, enables you to create specialized trading strategies and indicators using English-like phrases.

Meta Trader 4 (MT4)

Among Forex traders, MT4 is well-liked. For the expert advisor you code, MT4 offers a strategy tester. The principles of the well-known C++ programming language are the foundation of Meta Quotes.

The Ninja Trader (NT)

Algorithmic traders who trade futures frequently use Ninja Trader NT. Based on the C# programming language is NT8.

Tips for Backtesting

When backtesting a trading strategy, many mistakes are frequently made. Make use of the following advice to assist you.

Objectivity

Your backtesting objectivity will decide the accuracy of your results.

For this reason, when backtesting, I strongly advise that you look at the charts candle by candle rather than simply zooming out and examining a broader period to look for setups.

It’s common for your mind to fool you. The successful setups will be simpler to identify, and you’ll typically ignore some of the losers that are corrupting your data.

Dimensions of the Data Set

Naturally, every strategy is different. In some cases, strategies might only offer one set up each day, in which case you would need to look at a larger data set.

start analyzing the data to determine the strategy’s viability after 50 trades. If it does, continue with the plan as is while gathering more data. prefer to get about 200 trades on average.

Start optimizing the strategy by experimenting with various trade and risk management strategies once you’ve completed 200 deals. You will have a strategy of between 300 and 500 backtested trades before going live.

Trends & Volatility

Due to the market setting you are testing the strategy in, some methods may appear fantastic at first.

Make careful to test your technique at times of high and low volatility as well as in markets that are moving as opposed to range-bound.

Under some market circumstances, your technique might perform better or worse. You can only determine that by backtesting under various circumstances.

By examining a daily or weekly chart of the instrument you’re testing, you can see different periods of volatility and trending vs. range-bound behavior, which can help you determine where you should draw your data sets from.

Commissions and Slippage

Far too often, traders fail to account for slippage and commissions in their calculations. Commission and slippage can significantly lower profit margins.

Depending on the type of strategy you’re trying, commissions and slippage will affect your approach in different ways.

For instance, slippage and costs will have a greater impact on a scalping strategy for the eMini S&P500 that has an average profit of 6 ticks than a strategy with a 10-point take profit.

Forward testing

Forward testing refers to testing on historical data after strategy parameters have been refined to ensure that it works on an unknown data sample. It is prior to implementing a new strategy, it is advised to use SIM trade for at least 30 days. It will take some practice to learn to recognize reliable setups as they develop before the live market while trading a new approach.

Backtesting Techniques (Example)

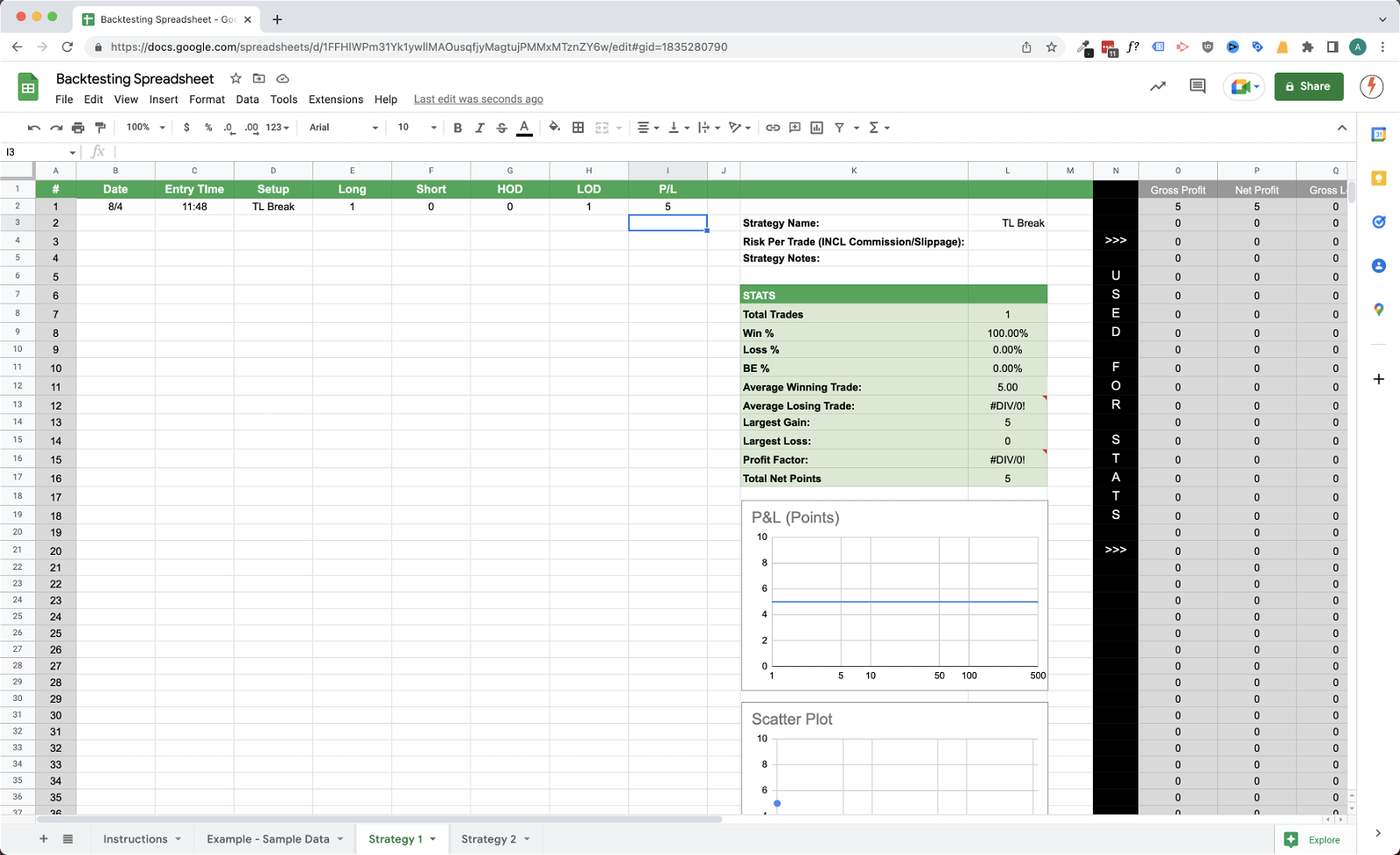

Before you can begin backtesting, there are a few procedures you must do. A trading strategy and a playbook must already be in place. Your trading strategy and playbook ought to specify:

Entry: Clearly describe the setup, including the trigger, pattern, signal, etc.

Context: Specify the conditions under which you must trade the strategy.

Trade management: Establish your stop loss and take profit objectives.

Risk management: What is your anticipated level of risk in this transaction?

We’re going to utilize this as our example.

Title: Trend Line Break

Context: Trading tactics used following a failed retest of the day’s high or low.

Trade Management: Stop behind the prior candle of the signal bar when managing your trades.

Risk reduction: 1% for each transaction

Navigate to the initial date of your data collection, then begin scrolling across your chart, one bar at a time. Decide whether or not you have a viable setup at the end of each bar, and why.

You can observe how the price started to match the criteria for our strategy in the aforementioned case.

Price made an attempt to retest the day’s lows but failed, and a rebound started instead. If we get a candle that closes above it, we will use the excellent trend line that has formed overhead as our entry point.

Until a signal appears, keep moving your charts one bar at a time (the candle closes above the trend line).

You can see that as we move forward, we would have had an entrance at 4,149.25. Our approach dictates that we hold the trade until a candle falls below the 9 SMA, closing the position at 4,154.25 in that case.

Simply enter the trade in your spreadsheet right now.

Up until you have enough information to begin the analysis, repeat this approach.

Conclusion

Backtesting is one of the most important processes in developing a trading strategy. It can help traders optimize and improve their strategies, spot any technical or theoretical flaws, and build confidence in their plan before putting it to use in actual market situations if it is properly constructed and reviewed.