In the ever-changing and volatile ecosystem of cryptocurrencies it is important to formulate a trading strategy that would have higher chances of success. Having said that, it is to be noted that crypto day trading is a high-risk, high reward activity so one needs to be well-prepared and must have a sound strategy in place to protect their capital.

What is Day trading crypto?

Day traders take advantage of volatile market and use different techniques to book daily profits without holding crypto assets for more than a couple of hours.

Here is a list of 10 proven strategies for crypto day trading.

Crypto Trading Strategies

-

Range Trading

Range trading strategy is arguably one of the safest crypto trading strategies as it does not rely on market sentiments and news. It uses candle stick charts and identifies support and resistance levels. It is to be noted that support is the stable price below the current price, whereas resistance is the stable price above the current price.

Using range trading for booking daily profits

The range trading strategy allows day traders to take advantage of market volatility of the assets whilst ensuring profits because of the frequent crypto price movements. This particular crypto trading strategy is relatively simple as the day traders can buy at the support level and book their profits at the resistance level.

Moreover, this does involve slight bit of technical analysis, however it is an ideal crypto trading strategy for beginners. Traders can also deploy trading bots to take trades on pre-defined support and resistance levels.

Trading cryptocurrencies can be risky hence it is important to take into account the daily volumes, as this aids traders in identifying the right support and resistance levels in the candle stick charts. Once the cryptocurrency asset price reaches the resistance and stabilizes, then that resistance starts acting as a support.

-

Scalping

Scalping is arguably one of the favorite crypto trading strategies of crypto traders owing to its low risk high reward outcome. Trading digital assets involves a certain amount of risk and hence traders ideally go for a cryptocurrency trading strategy that promises good profits, and scalping is one of those rare trading strategy that ensures healthy profits with low risk.

Pros and cons of Scalping

Scalping is ideal for crypto day trading as traders instead of going for big wins settle for large number of small wins. This allows them not only to grow their crypto portfolio but also make handsome amounts on daily basis.

Scalping usually takes place on assets with high trading volume, and hence a small fluctuation in price action can result in a win. Support and resistance usually act as entry and exit points for scalp trades. Moreover, experienced traders prefer small market caps compared to large ones because of their increased volatility. Having said that, caution must be practiced in case of small cap assets.

However, the downside of scalping strategy is that if the market moves against your bet, you are more likely to lose a trade within seconds, henceforth it is important to put a stop loss.

-

News and sentiment Analysis

As evident from the name itself this particular crypto trading strategy feeds off human sentiments and emotions on a certain news or incident. Since crypto asset’s price movements are prone to market risk, hence keeping an eye on global events can reap huge boons for day traders.

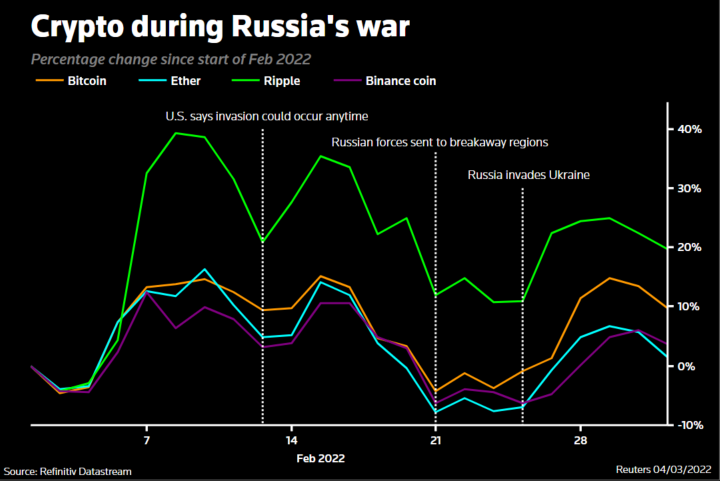

Russia Ukraine War Example

Russia Ukraine war of 2022 is a recent example of how global affairs impact the cryptocurrency markets. The beginning of the war shook the crypto market and the market cap went down below $1 Trillion and this was just beginning of what turned out to be a disastrous year for cryptocurrencies.

Therefore it is important to keep an eye on events like these as day traders can benefit to a great extent just by keeping a close eye on the news. Crypto market is more volatile than the traditional market and news like these have a brisk and drastic impact on the price action of cryptocurrencies.

The turnaround

However, interestingly crypto market was the first to rebound after the war, and the reason presented was that Russian billionaires owing to international sanctions are putting their money in the cryptocurrency market.

Henceforth, Bitcoin witnessed a 20% increase within 48 hours. Crypto investors and day traders largely benefitted from this business development and made huge gains.

Although the technical indicators could not predict such volatility but having an eye on global news is surely one of the reward reaping crypto trading strategies that helps day traders.

-

Playing with RSI

It is one of the handy indicators and is perhaps one of the most widely used indicators for technical analysis. It performs equally well on shorter time frames and hence is also frequently used by crypto day traders.

If you are looking to day trade crypto then you’ve got to befriend RSI indicator, it would help you book good profits on daily basis. All cryptocurrency exchanges offer it for free. Moreover, the best part is that using RSI indicator is relatively simple and easy.

How it works

Once the relative strength index is below 30 it means that the crypto asset price will potentially move up as it is oversold. Hence, this is the time for buying, as crypto prices are likely to rebound from here.

On the contrary, if the indicator shows the value above 70, this is taken as a sign to exit the market, as the crypto asset is overbought and the price is likely to see some sort of correction. Dollar cost averaging could also help in this case as it would reduce the risk.

Trading crypto is risky and it increases in day trading, henceforth traders who have a small risk appetite must try to go for long term holds of cryptocurrencies, as it is a safer option.

Moreover, any market fluctuation retail traders are the ones who take the first hit, therefore coupling two strategies could also help retail investors.

-

High-frequency trading strategy

High frequency trading is often deployed in crypto day trading as it allows the retailers to book profits frequently. This trading strategy takes advantage of high volumes, however it is not possible to keep track of hundreds of trades being executed every second across multiple cryptocurrency exchanges and hence it involves the use of trading bots.

High frequency trading is one of the most frequently deployed cryptocurrency trading strategies, it uses trading volume as its primary parameter and allows retail investors to take advantage of bitcoin volatility.

Why use trading bot?

Trading bot is used for high frequency trading by the advanced traders, as it helps them to execute numerous trades in a small time frame. The sell price of a cryptocurrency is determined beforehand which reduces the risk of asset liquidity to a great extent.

Trading bot monitors the market, looks for trading opportunities, and formulates a trading strategy based on current market conditions and then continues to execute trades at a lighting speed.

Market Volatility

It is worth noting that HFT is a great strategy for short period as multiple trades are taken every second. Moreover, HFT is extremely useful for assets that have high volume as it accounts to more volatility, which means more trades can be won.

Day trading cryptocurrency is a risky business, however the use of right trading strategy alongside DCA strategy allows retailers to book good profits on daily basis.

-

Playing Bitcoin volatility

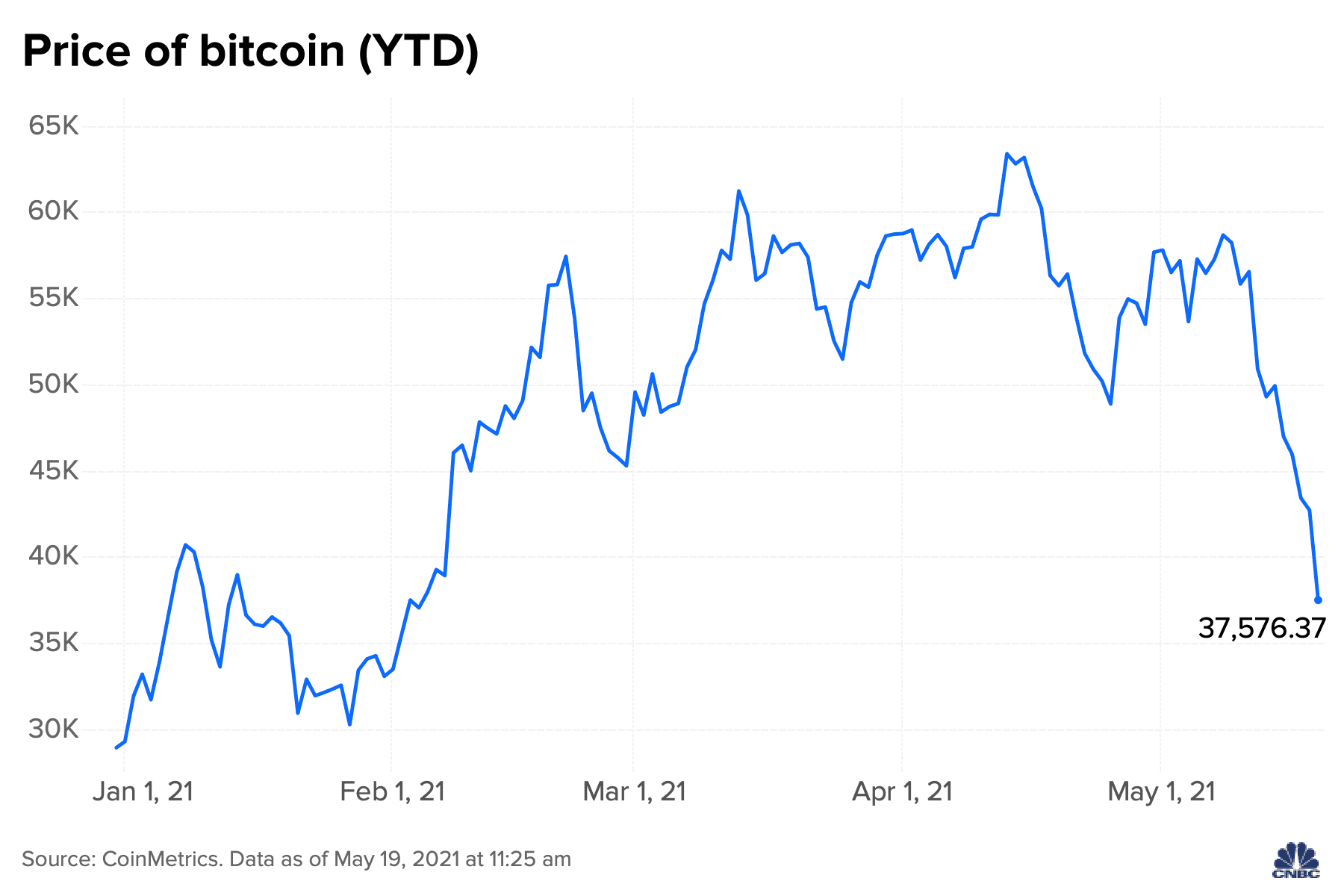

When it comes to volatility crypto investments are at least five times riskier than the traditional assets. However, retailers thrive on this uncertainty which is almost non-existent in traditional financial markets.

Most day traders buy and sell assets daily and this is how they make big gains in the market that is marred with volatility. If you are looking to day trade crypto then you can take benefit of this crypto volatility.

How do I profit from uncertainty

In order to make profit you need to place your strike price at the next resistance or support. However, in case of extreme volatility such as in case of a black swan event, it would be wise to sell assets quickly in order to save your capital.

However, in such extreme uncertainties money can still be made through dollar cost averaging dca. Remember that there is no right cryptocurrency trading strategy that would guarantee win every time, hence you need to play it smart and should combine a couple of strategies.

Play it safe

Moreover, do not stick to a single strategy as that would only lead to more loss. In special cases remember the old military statement ‘do not reinforce failure.’ If your technical analysis for cryptocurrency trading is not working then instead of applying it repeatedly and expecting different results it would be rather wise to change your strategy.

Bitcoin and other crypto assets are volatile assets and hence special care must be taken while day trading crypto as you might lose your hard earned capital and ALWAYS BOOK PROFITS.

-

Trend is your best friend

Trend trading is one of the most effective day trading technique, as it ensures huge boons for the traders. It is perhaps the easiest trading strategies but at the same time, it could horribly go wrong also, therefore precaution is advised.

Identifying trend

Trading crypto daily is a livelihood for many people across the globe, and hence this interest in digital assets brings trading volume, however in the case of crypto day trading it is important to identify trends.

Sometimes, a certain sector such as metaverse, gaming or Web3 would be trending and all cryptocurrencies hailing from that sector would be trending, hence it would be the right time to bet on such assets.

A Trading platform offers a list of trending cryptocurrencies and you can choose a trending asset from there. However, try to choose a crypto that has low asset liquidity. Moreover, once you see the initial signs of trend reversal, sell crypto and get out of the market.

If you are day trading cryptocurrencies, then you must settle for small wins and small losses, once you see that the trend is not on your side, you need to get out of the trade as soon as possible by selling the asset as else you will continue to lose money.

Crypto assets have lost as much as 10x of their value within 24 hours, so in case of cryptocurrency day trading, keep your emotions on the side and trade with a strategy.

-

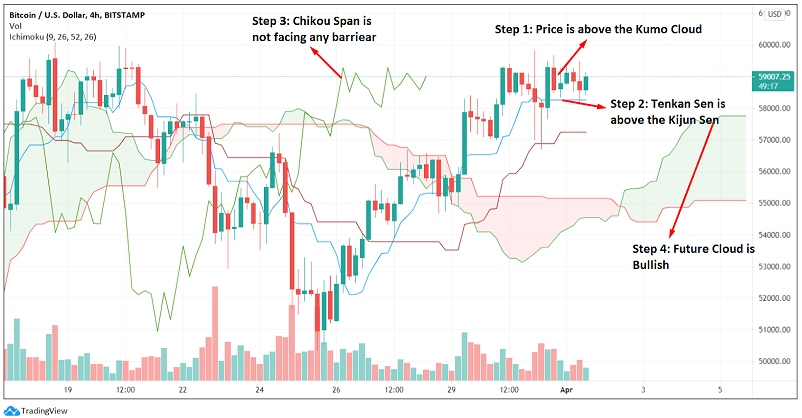

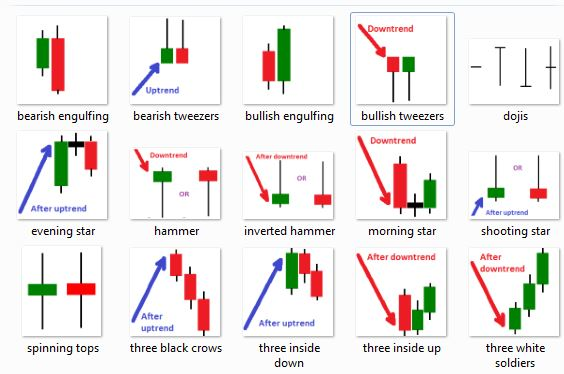

Technical analysis

No matter what crypto exchange you use, or you happen to have a degree in mathematics and computer science, you cannot day trade crypto without technical analysis.

All quant traders are adept in technical analysis and especially the ones who are involved in day trading. As when it comes to cryptocurrency market the volatility catapults the importance of technical analysis.

Importance of technical analysis

Technical analysis involves the use of various indicators such as relative strength index, MACD and moving averages. These indicators are available on all trading platforms and hence as a day trader you must have good understanding of them.

Technical analysis is one of the most important crypto day trading strategies, it allows the trader to predict future price movements based on past data. It is one of the key cryptocurrency trading strategies which must be mastered by all retail traders.

Technical analysis is a pretty useful tool in day trading as according to Mark Twain’s saying ‘history never repeat itself, but it does often rhyme.’

For instance a hammer candle usually predicts an upward trend, on the contrary an inverted hammer is usually taken as the beginning of a downward trend.

Remember that each day trader must be able to read charts and conduct technical analysis, as without it he/she would be completely lost.

Dollar cost averaging

If you are able to couple technical analysis with dollar cost averaging dca while trading cryptocurrencies, then you’ve truly earned your wings as a day trader.

-

Arbitrage

Although this one is only for experienced players out there, but sometimes owing to the increased uncertainty in the market, even the rookie day traders can benefit from it.

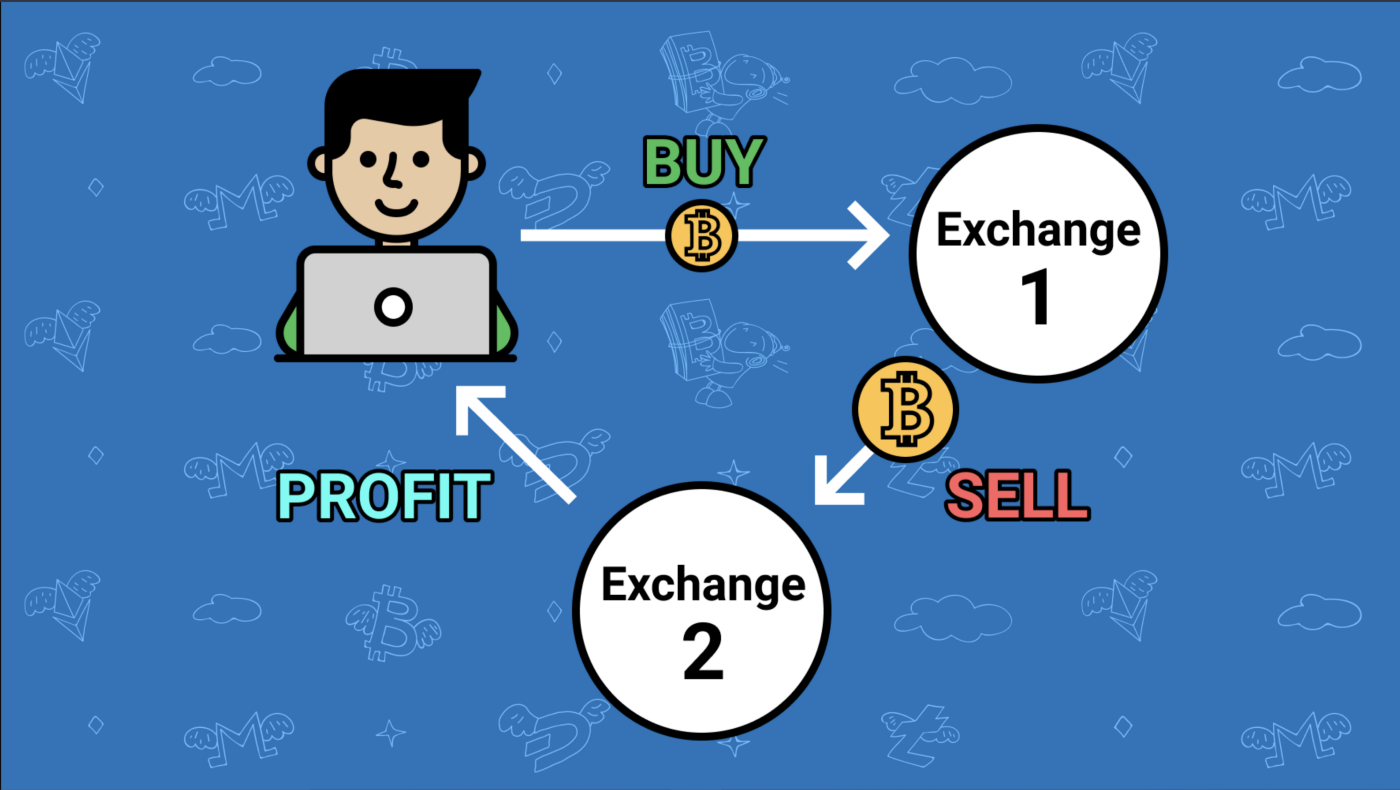

What is Arbitrage

It is one of the popular cryptocurrency trading strategies, it simply means buying an asset at a lower price from one trading platform and selling it on another where the price is higher.

Hence, you ought to have more than one exchange account, moreover the arbitrage opportunities are more when market is having a bad day, increased panic usually leads to more difference and hence creates more opportunities for crypto day trading.

However, at the same time it is worth mentioning that investing in financial instruments is subject to risk and all investors must be aware of it.

Why each exchange offers a different price?

Since, crypto market is not yet regulated, and anyone can open and operate an exchange, hence this is the reason why you see difference in prices, and smart traders benefit from it on a daily basis.

However, one thing which must be taken into account while formulating an arbitrage strategy is that each exchange has trading fees and hence a trade would only be considered profitable if the sell price is higher than the prospective investment.

Trading cryptocurrency is a risky business and especially in case of arbitrage trading traders need to be vigilant, as sometimes the price difference of a crypto asset might be as high as 10% on two different exchanges and this is the time when money is made through arbitrage.

-

Understanding moving averages

Though there are numerous cryptocurrency trading strategies but only few of them are as reliable as moving averages. Although seasoned traders would argue that moving averages do not perform well on shorter time frames. However, interestingly day traders have used them on shorter time frames and made good gains, especially in case of assets that have high incoming volume.

The beauty of moving averages is that it allows you to make educated guesses, there are multiple types of moving averages most common ones are 50-day, 100-day and 200-day. However, there are also others available on smaller time frames.

Usually the intersection of moving averages is a strong indicator of a trend change, hence before the expiration date of your trade you could benefit from moving averages and make good gains from the market.

Conclusion

Although crypto day trading might sound like a lucrative opportunity, however it is considered one of the most-risky ways to interact with crypto assets. It is advised that you do not day trade with more than 1% of your total capital, as you might end up losing all of it on a single trade.

Moreover, instead of relying on a single strategy, try to use multiple strategies as that would catapult your chances of winning a trade.

Lastly, try to go for small wins and small losses, if you try to play big you’ll end up playing rashly and that would cost you.