In the world of finance and investment, the term “trading range” refers to the price range within which a particular financial asset or security is traded over a given period. It is essentially the difference between the highest and lowest prices that security reaches during a specific timeframe, such as a day, week, month, or year.

Understanding trading ranges and learning how to utilize them effectively in trading strategies can significantly enhance an investor’s decision-making process and overall success in the financial markets.

Understanding Trading Range

The trading range is a crucial concept in technical analysis, a method used by traders and investors to forecast future price movements based on historical market data. It provides valuable insights into the behavior of security, indicating the levels at which it is likely to find support and resistance in a particular trade range bar chart.

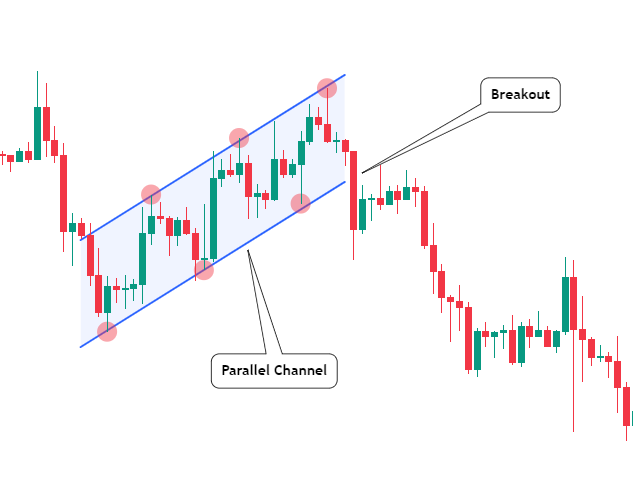

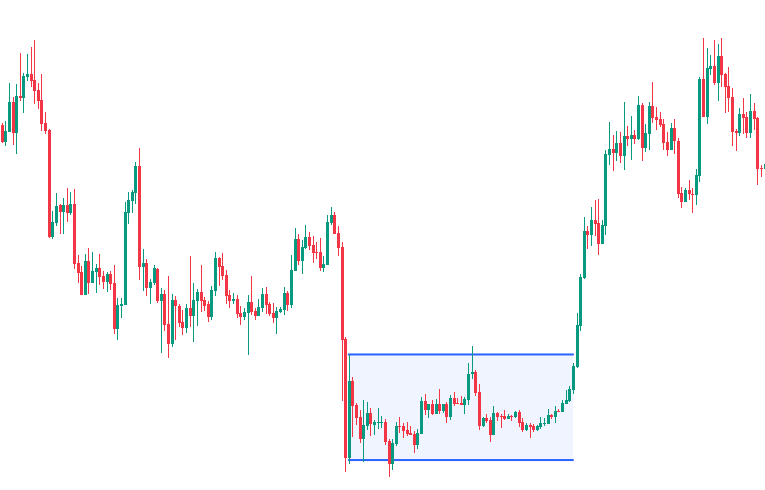

In simple terms, a trading range is like setting boundaries for a security’s price fluctuations, helping traders identify potential entry and exit points. Note the price breakout occurs on a long consolidation in a ranging market. Short-term traders find this as trading opportunities in non trending markets.

Importance of Trading Range

Trading ranges are significant for multiple reasons. They offer valuable information about the supply and demand dynamics of security, indicating the equilibrium between buyers and sellers, this is how a trading range occurs. This understanding can help traders make informed decisions and avoid impulsive actions based on short-term fluctuations.

Moreover, trading ranges are instrumental in determining potential profit targets and stop-loss levels, thereby assisting traders in managing risks effectively.

Identifying Trading Range

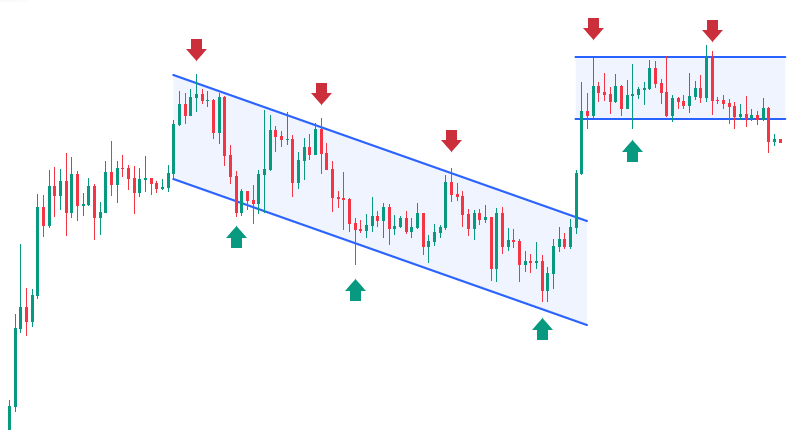

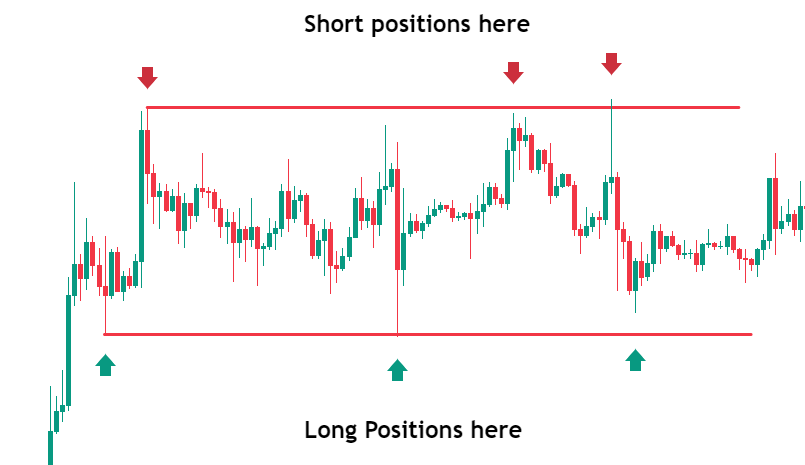

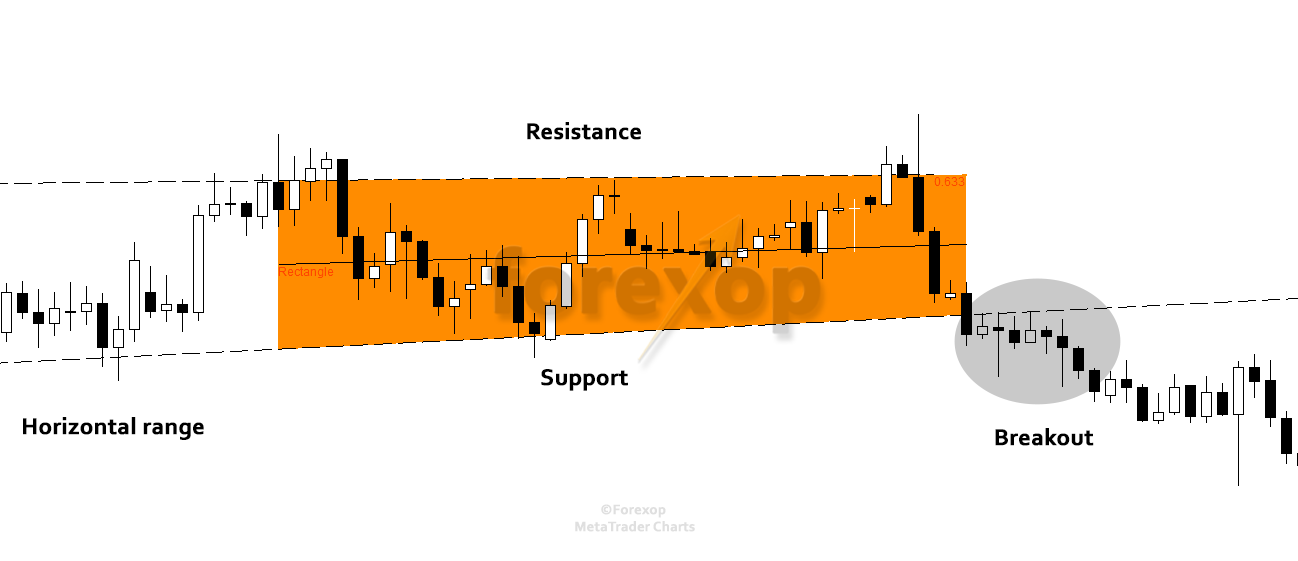

Identifying a trading range involves analyzing price charts and looking for patterns that indicate relatively stable price movements. One common pattern is the horizontal price channel, where the highs and lows of the security’s price form parallel lines.

Traders can look for long and short positions as the price taps high and low prices respectively in a ranging market. Such price channels can be spotted in ranging markets which is basically a sideways market.

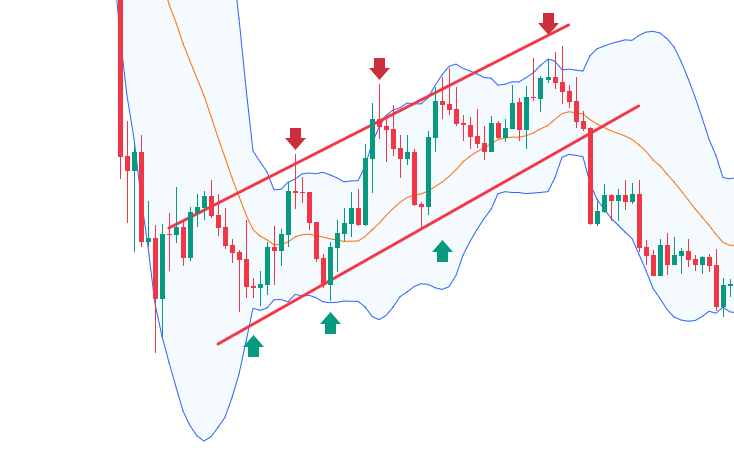

Additionally, traders often use technical indicators like Moving Averages, Bollinger Bands, and the Average True Range (ATR) to identify periods of low volatility and define the trading range more precisely.

How to Use Trading Range in Strategies

Traders employ various strategies based on trading ranges to capitalize on market conditions. Here are some popular approaches:

Trend-Following Strategies

Trend-following strategies involve idenfying the prevailing trend of a security within the trading range and trading in the direction of that trend. Traders may buy when the price is trending upwards or sell short when it’s trending downwards. This strategy aims to ride the momentum of the price movement until the trend reverses.

Range-Bound Strategies

Range-bound strategies are employed when a security is moving between established support and resistance levels within the range bound market. Traders buy at the lower boundary and sell at the upper boundary, taking advantage of the predictable price movements within the range which is also called as range bound trading.

Breakoutrategies

Breakout strategies come into play when the price breaks out of its trading range, either above the resistance level or below the support level. Traders may take positions in the direction of the breakout, expecting a significant price movement in that direction.

Reversal Strategies

Reversal strategies focus on identifying potential turning points within the trading range. Traders aim to enter the market at the early stages of a trend reversal, anticipating a change in the security’s price direction.

The Role of Volume in Trading Ranges

Volume is crucial in understanding trading ranges. Higher volume during breakouts confirms strong market conviction provides us with range trading sand trategies. Decreased volume near range boundaries suggests potential reversals or continuations. Volume analysis helps differentiate genuine breakouts from fakeouts. Traders should consider volume along with price movements for more informed decisions within trading ranges.

The Role of Technical Indicators in Trading Ranges

Technical indicators are vital tools for traders in trading ranges. Moving averages identify trends, while the RSI and Commodity Channel Index(CCI) detect potential reversals. Bollinger Bands show volatility and breakout opportunities, especially when the it’s a narrow range in a treg market.

By using these indicators, traders can make informed decisions and capitalize on price movements within the established boundaries of a trading range, this is one of the best range trading strategies.

Benefits of Incorporating Trading Range

Incorporating trading ranges into trading strategies can offer several benefits:

Minimizing Risks

By understanding the trading range, traders can set appropriate stop-loss orders and avoid placing trades during volatile market conditions. This helps minimize potential losses and protects their capital.

Maximizing Profits

Trading ranges enable traders to identify favorable entry and exit points, allowing them to capture more significant portions of price movements within the range, thereby maximizing potential profits.

Improved Decision Making

With a clear understanding of trading ranges, traders can make more informed and rational decisions based on data and analysis rather than emotions and guesswork.

Tips for Successful Use of Trading Range

To make the most of trading ranges, consider the following tips:

Research and Analysis – Perform thorough research and technical analysis to identify trading ranges accurately. Use multiple indicators and chart patterns to confirm the presence of a trading range.

Risk Management – Always apply proper risk management techniques, such as setting stop-loss orders and position sizing, to protect your capital from substantial losses.

Patience and Discipline – Stay patient and disciplined in executing your trading strategies. Avoid acting impulsively based on short-term market movements and stick to your predefined plan.

Common Mistakes to Avoid

To ensure success when using trading ranges, steer clear of these common mistakes:

Ignoring Market Trends

One of the most significant mistakes traders make is disregarding broader market trends when trading within a trading range. While the price may move within the established boundaries, it is still influenced by the overall market direction.

Ignoring the prevailing trend can lead to trading against the momentum, resulting in unnecessary losses. Always consider the larger market context and align your trades with the prevailing trend to increase your chances of success.

Chasing the Market

Chasing the market refers to entering a trade after a significant price movement has already occurred. In the context of trading ranges, this means buying near the upper boundary or selling near the lower boundary after the price has already made a substantial move in that direction.

Such impulsive actions can lead to buying at a high or selling at a low, making it challenging to achieve profitable outcomes. Instead, be patient and wait for price pullbacks or confirmations before entering a trade.

Overlooking Fundamentals

While technical analysis plays a vital role in trading ranges, overlooking fundamental factors can be a costly mistake. Fundamental factors, such as economic indicators, company earnings, geopolitical events, and market sentiment, can significantly impact a security’s price movement.

Combining technical and fundamental analysis can provide a more comprehensive understanding of the market and improve the quality of your trading decisions.

Neglecting Stop-Loss Orders

Risk management is a crucial aspect of trading, and neglecting to use stop-loss orders can expose you to significant losses. In a trading range, prices can experience sudden and unpredictable movements.

Without appropriate stop-loss levels, your losses can quickly escalate, leading to a substantial drawdown of your trading capital. Always set stop-loss orders to limit potential losses and protect your trading account from excessive risk.

The Pitfalls of Trading Range Bias

Trading range bias may lead to short-term gains, but it can have severe consequences for overall trading performance. As sideways markets are prone to unpredictable price movements, failing to adapt to changing conditions can result in missed profit opportunities and being caught on the wrong side of sudden breakouts.

By recognizing and addressing this bias, traders can safeguard their long-term success and make more informed decisions within trading ranges. Staying adaptable and objective is crucial to thriving in dynamic market environments.

Conclusion

Trading ranges play a vital role in the world of trading and investing. Understanding and effectively using trading ranges can significantly enhance a trader’s success by providing valuable insights into market dynamics. By incorporating various strategies and following essential tips, traders can make well-informed decisions, manage risks, and capitalize on price movements within these ranges.

FAQs

-

How can traders improve their use of trading ranges?

Traders can improve their use of trading ranges by conducting thorough research, utilizing technical indicators, and staying disciplined in their approach.

-

Can trading ranges be applied to all types of financial assets?

Yes, trading ranges can be applied to various financial assets, including stocks, commodities, currencies, and cryptocurrencies.

-

Are trading ranges more prevalent in certain market conditions?

Yes, trading ranges are more common during periods of low market volatility and when there is an equilibrium between buyers and sellers.

-

Can trading ranges help predict future price movements?

While trading ranges provide valuable information about support and resistance levels, they do not predict future price movements with certainty. Traders should use trading ranges in conjunction with other technical and fundamental analysis tools.