Market psychology depicts the general sentiment that drives market movements and price action. Humans are heavily impacted by cognitive and emotional biases and are prone to the effect of herd instinct rather than being rational actors. All of these recommend that markets are not the effective agents of rationality that conventional economics assumes them to be.

Stock market and technical analysis are, in fact, driven by the principles of market psychology. Therefore, understanding crowd behavior is crucial to explain trends, which occur in the stock market when the biases or emotions of an investor affect their trading decisions.

In this article, we will explore the power of market psychology and how it is used by analysts and traders to their advantage.

What is Market Psychology?

Market psychology describes the typical behaviors and overall sentiment of market participants at any given period. Financial analysts and media frequently use this phrase to explain a market movement that may not be explicable by other indicators, such as fundamentals.

Behavioral economics studies both market and trading psychology and takes into account the constraints and emotional consequences that traders may encounter when trading stocks. Market psychology refers to the general online behavior of market players based on emotional and cognitive variables on the whole; trading psychology, on the other hand, refers to the same factors but looks at the investor on an individual level.

Market psychology is a powerful force that is applicable to all asset classes, including stocks, bonds, cryptocurrencies, interest rates, and forex.

In terms of measuring it, one can examine a number of market sentiment indicators, such as the VIX, which gauges the market’s implicit level of fear or greed. Technical analysis tools can also serve helpful in determining market sentiment based on previous price and volume movements.

Understanding Stock Market Psychology

Stock market psychology describes the ability to recognize and manage behaviors and emotions that may occur while trading. This form of psychology advises that factors, like biases or mood, can influence stock market transactions and affect how and when traders buy and sell stocks. For instance, the indexes which monitor the stock prices of the entire market will decline if investors abruptly lose faith in the state of the economy and decide to reduce their stock purchases. Regardless of how well the firms holding those stocks are doing financially, the prices of individual equities will drop along with them.

Factors that influence trading psychology, such as fear, greed, euphoria, expectation, as well as crowd psychology, all contribute to the stock market’s overall market psychology. It is generally known that these mental states can cause recurring “risk-on” and “risk-off” cycles or boom and bust cycles in the financial markets.

These changes in market behavior are frequently described as the emergence of animal spirits. John Maynard Keynes first used this phrase in the 1936 book “The General Theory of Employment, Interest, and Money.” Animal spirits, according to his writing from after the Great Depression, are a “spontaneous urge to action rather than inaction.”

The efficient market hypothesis (EMH), a pillar of conventional finance theory, is criticized for inadequately accounting for market psychology. It fails to consider the emotional component of the market and depicts a world in which all market participants act rationally. However, market psychology can result in surprising outcomes that cannot be foreseen by analyzing the fundamentals. Or, to put it another way, theories of market psychology conflict with the idea that markets are rational.

Predicting Market Psychology

Professional stock pickers often employ one of two dominant strategies, with only one giving significant weight to market psychology.

- The fundamental analysis aims to select winning stocks by examining a company’s finances in the context of its industry. There isn’t much room for market psychology in this number scoring.

- Technical analysis is concerned with the patterns, trends, and other factors that influence the price movement of a company’s stock. One of those forces is market psychology.

Hedge fund trend-following quantitative trading strategies are one example of an investment strategy that partially depends on taking advantage of changes in market psychology. Their objective is to find and profit from differences between an instrument’s fundamentals and how the market perceives it.

How Investors Use Market Psychology to Their Advantage?

Market psychology is a common tool used by experienced traders to determine when to enter and exit the market.

In essence, they take on the role of spectators who refrain from engaging in emotional trading but profit from the sentiments of less experienced investors and traders.

For example, an experienced trader may frequently identify a market stage where people are utterly hopeless, which leads to the capitulation of the market.

In this instance, even if the majority of trading professionals have already sold their assets, the trader who utilizes the market cycle’s psychological effects makes the most of this phase by purchasing assets at a discount.

But how can expert traders identify various phases?

Technical Analysis & Market Psychology

Supporters of technical analysis frequently read charts as if they were books, which contain all the information required to plan the next course of action.

Charts are the most effective means, according to market theories based on price analysis, of observing the state of the market as a whole.

An excellent example of this is the Wyckoff strategy, whose proponents can set their strategies by examining prices and volume following the guidelines proposed by well-known investors.

Over time, technical analysis and indicators became simpler to apply, in part because of the development of digitization.

For example, if the Bollinger Bands indicator is properly configured, it can help you recognize when an asset is overbought or oversold. This permits you to connect prices to particular emotional phases of the market.

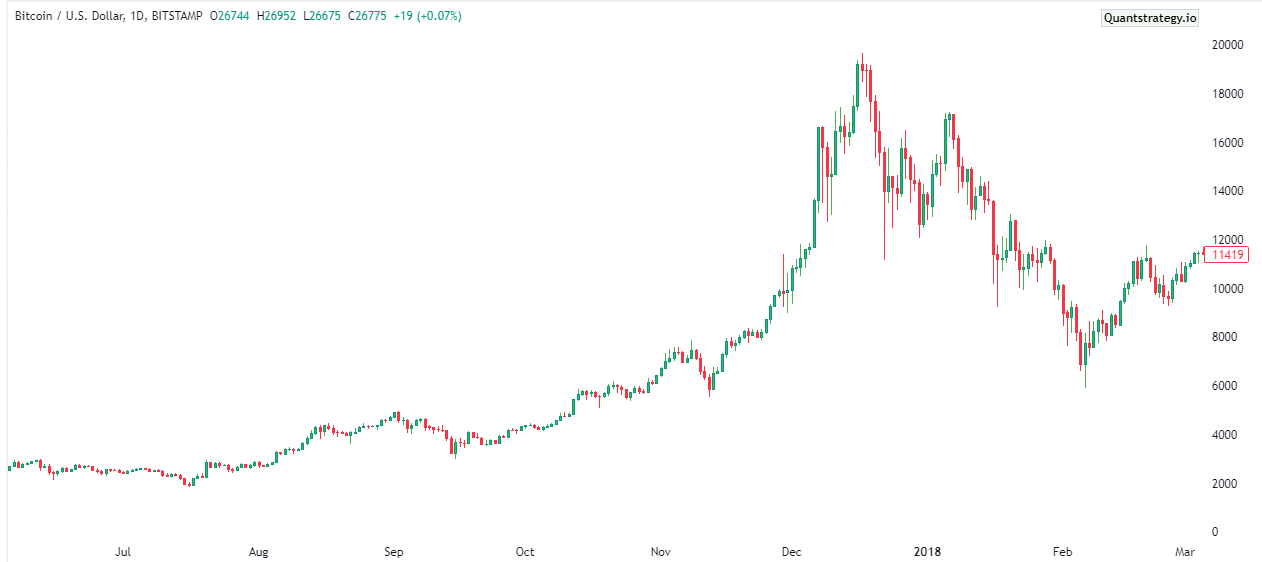

The above BTC/USD price chart demonstrates the use of Bollinger Bands. You might be able to determine if an asset is oversold by looking at the candlestick, which breaks the lower band.

Bitcoin & Market Psychology

Let’s use Bitcoin to illustrate practically how technical analysis and market psychology provide you with the most pertinent trading knowledge.

Even though there are numerous factors contributing to this cryptocurrency’s high value, it is also influenced by the emotions of trading professionals, and its astonishing volatility, particularly during specific times, enables us to comprehend why psychology is so crucial.

All traders and investors ought to study the fluctuation of Bitcoin between 2017 and 2018.

The price of Bitcoin began increasing impressively amid greed and uncontrolled optimism, as well as “Lambos” and tales of people who became wealthy overnight. However, there are two things to be noticed:

- The price was increasing at a rather low volume;

- The buying volume surges weren’t aligned with the bodies of the matching candlesticks – just to paraphrase Wyckoff.

Everything indicated that the price was being driven by emotions: the price decline caused many investors to lose their money, and fear and panic caused a terrible capitulation. The below BTC/USD price chart for 2017/2018 illustrates it.

Cognitive Biases

The Bitcoin example demonstrates explicitly how various cognitive biases might affect less experienced traders or traders who simply surrender to emotional trading.

To name just a few that are popular (and nicely fit our Bitcoin example):

- Confirmation bias is the propensity to believe news and information that supports our opinions only, entirely discounting anything that suggests we may be mistaken. It is arguably the most basic fault observed in behavioral finance.

- The endowment bias is the propensity to overvalue our assets while undervaluing all other assets and possibly even giving ours an unjustified value. This could lead to passing up excellent opportunities and hoarding worthless digital assets.

Smart investors aggressively resist these kinds of biases by seeking opposing counsel and critically evaluating all available data.

Another way of to benefit from the effects of crowd psychology is using a reversal or contrarian strategy where investors can profit from trend reversal in the financial markets. For instance, buying dropping stocks and selling winning stocks in anticipation of a change in performance. This tactic takes use of the unifying bias in investment psychology that contends that when glamorous stocks perform well, people may react overly and overinvest.

Besides, by buying equities that appear to be trading for less than their value, investors might profit from the overreaction of market participants. For instance, the stock price may decline in response to negative news, even if the downward trend fails to accurately represent the company’s long-term fundamental facts. This method allows trading professionals to succeed by buying equities at absurdly low stock prices and holding them until their market value rises to an acceptable level.

Additionally, the volatility index can be used by momentum traders to buy rising stocks and then sell them when they look to have reached their highest point. Investors can then apply this profit to continue the process, acquiring the following group of trending stocks as they reach their peak value and repeating the process. This trading approach is based on the idea that trends come and go and that you may make money by following a trend all the way to the end.

Conclusion

Market psychology is a conviction that every movement in any kind of market is an outcome of the participant’s emotion. It is regarded as a potent force that may or may not be supported by specific fundamentals or circumstances.

By recognizing psychological factors, using technical analysis tools, and doing research, investors can identify how emotions affect markets. Savvy investors can use several strategies to capitalize on the effects of behavioral finance and crowd psychology, and make sound investment decisions.