The feeling of getting emotionally attached to the items you own is common. But at times, this can result in major problems (and expensive consequences).

You’ve probably engaged in negotiations with the seller if you’ve ever sold a house. They won’t pay what you’re asking since it’s too expensive. You want to get the most money out of the deal. Who does not like the extra money?

However, it goes beyond that. Since it is yours, the house has a deeper value to you than it does to the seller. You’ve resided there. It was painted by you. You have fixed it. It holds memories for you. The seller has not.

Because you own it, you overvalue the property.

This sort of situation happens frequently:

- A corporation resists closing a branch that isn’t operating well, even though management would never spend money to open the same branch if the company didn’t already have one.

- Even if you could buy three additional lottery tickets for $5.18 and treble your chances of winning, people who purchase lottery tickets for $1.28 won’t sell them for less than $5.18.

- Once they had it, sportsmen who would only spend $31 on a hunting license wouldn’t resell it for less than $138.

Selling a property, shutting down a company branch, purchasing a lottery ticket, or purchasing a hunting license are all examples where the item’s objective value does not change. Only its ownership changes i.e. you or them. And if it belongs to you, it is worth more purely because it is yours.

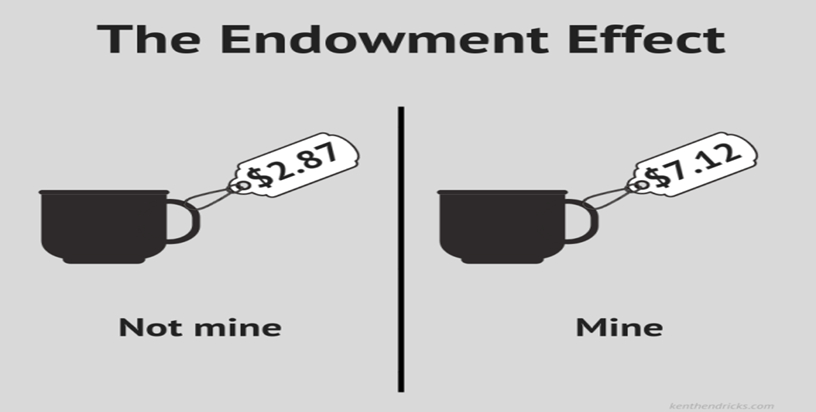

The endowment effect is responsible for the disparity in value.

What is the endowment effect?

According to behavioral economics, the endowment effect refers to the propensity of people to regard things they own more highly than they would regard the same object if they didn’t own it. They frequently overestimate the fair market value of an item they hold. This kind of behavior is usually triggered by things that have a symbolic, monetary, or emotional significance to the person. But it can also occur just because the person possesses the item in question.

Another name for the endowment effect is psychological ownership. It is a cognitive bias tracked by trading psychologists.

In the classic “mug experiment,” which was used to confirm the endowment effect, participants were handed mugs and asked to trade them in for Swiss sweets that had a more retail value. Despite this, 80% of the participants were hesitant to initiate the exchange.

People commonly presume that loss-aversion psychology, which holds that people place a greater value on losing something than obtaining something, is the root of the endowment effect. In one endowment effect research, employees worked harder to maintain their eligibility for a bonus that had already been given to them than they did to earn a greater bonus that might be given to them in the future.

Endowment Effect Explained

The term ‘endowment effect’ was introduced by Richard Thaler, a Nobel Prize-winning economist, in 1980.

Besides loss aversion, numerous other psychological theories have been put forth to explain this emotional bias.

According to the psychological inertia theory, unless given a strong incentive to do otherwise, people are more likely to choose a condition of “no change”—including holding onto the possessions they presently own.

According to theories based on attachment or connections, once someone owns something, it takes on emotional significance beyond its monetary value and becomes a part of their identity. Therefore, selling the thing and subsequently losing becomes a challenge for the individual’s sense of self.

Additionally, it’s common for people to hold onto their status quo bias. It can be explained by a variety of variables, such as emotional attachment and loss aversion, why people opt to remain in their current situation.

Experts also explain the emotional significance of the endowment effect through theories like motivated taste change and reference price theory. The motivated taste change theory postulates that once an item is owned, its usefulness increases in the owner’s eyes, which influences their decisions when they decide to purchase it again. According to the reference price theory, each trading party has a different set of references that informs their choices. For instance, a customer expects the price to reflect the value of the goods, but the seller won’t prefer to price a product below market value.

The Endowment Effect & Investing

The endowment effect has been observed numerous times in the realm of investing. Investors have consistently demonstrated a reluctance to sell underperforming stocks and a reduced propensity to trade them for ownership of a stock that is comparable but performing better. This sort of behavior would support attachment theories that were proposed to explain the endowment effect.

The Endowment Effect & Marketing

Businesses have tried several approaches to incorporate the endowment effect into their sales strategies because it has significant implications for marketing items.

The free trial is a perfect endowment effect example to boost sales of an item. A potential buyer can frequently test drive an automobile they are thinking about buying for two or three days at no cost by taking it home from the car dealership. It is blatantly intended to foster a sense of attachment and ownership that will increase the likelihood of someone buying the car.

Other goods are available for free 30-day trials for customers. Again, it’s a ruse to give the impression that the customer already owns the goods and make them unhappy about having to return them after the trial period.

Other organizations have utilized sales techniques that don’t entail holding goods in your hands but aim to give a potential buyer a sense of ownership. Converse is a good example of a company that uses computer graphics to allow customers to pick the color or design of a pair of shoes. Consumers have demonstrated to be more likely to purchase when they customize their purchase.

To foster a sense of attachment, Apple stores permit customers to freely hold things as much as they’d like. When businesses employ the second-person form of addressing to describe their products, such as “You’re (product ‘x’) will make your daily schedule simpler and more pleasant,” they are making a more subtle attempt to take advantage of this emotional bias.

Tips for Avoiding the Endowment Effect for Trading Success

Biases such as the endowment bias are tricky because they have developed over millions of years. It is impossible to run from natural behavioral tendencies. However, you can take measures to put the subjective value of your possessions into closer line with its genuine, objective market value by being conscious and by being smarter than those attempting to influence you.

Here are some tips for avoiding it to achieve more tremendous trading success.

Avoiding the Endowment Bias as a Seller

Opportunity cost poses a serious risk to sellers. Here is how to prevent it:

- According to studies, you ought to conduct market research. Whether it’s a car, used books, or clothes, you’re not the only one selling this product. This object is frequently sold for a variety of prices. Aim to stay nearer the midpoint of that range.

- Consider how much you would be ready to spend if another person offered you a comparable product.

- How many offers have you turned down so far? If you receive offers from lots of potential customers at lesser prices, it might not be them. You could be passing up valuable deals here.

Avoiding the Endowment Bias as a Buyer

Here is what to check while purchasing a product in a market:

1. Free trials and try-on should be avoided. Be cautious whenever a firm offers you the chance to test out their items or is quite specific about how they’ll let you do so for a few days or several months free of cost.

Again, it is always advisable to try items before buying. Just keep in mind that sellers deliberately work to create a sense of ownership among potential customers.

2. Sellers want you to vividly picture a situation. They depict incredibly relatable scenarios that you can readily relate to regarding any issues you could be dealing with. For instance, a business selling pillows can portray you as getting the best sleep of your life and inquire as to when was the last time that you experienced that. Many years ago? Think about how it would feel to rest that way each night. The next section talks about how fantastic their pillows are. And there the psychological ownership gets to work.

Avoiding Endowment Bias for Investors

- Make a plan for your investments and follow it. Investors may perform best if they have a straightforward, easy-to-follow investment approach that eliminates emotional considerations. This could include an explicit exit plan for price targets for each stock in a portfolio and for times when a stock is not performing as anticipated or when important evaluation criteria have changed. A clearly defined process compels investors to consider all the information and do an unbiased stock analysis.

- Be objective and take into account any potential drawbacks. The endowment effect generates a tendency to overlook any unfavorable changes in profits forecast, revenue growth, or the strength of the stock within its industry group in favor of the good aspects of the business and its products.

- Be receptive to new stock-related information. Endowments demonstrate a high propensity to obstinately adhere to the original investment strategy even with fresh and better knowledge.

Conclusion

The endowment effect is a concept used to describe how people place a higher value on particular things, frequently items they own, than things they don’t own. According to this cognitive bias, once a person owns an item, the perception of its usefulness will escalate. People exhibiting the endowment effect are frequently willing to buy at lower prices and sell at higher prices for things of similar worth. Investors or traders can avoid it by having an explicit investment plan that includes an exit strategy and broad portfolio aim.