The idea of investing in cryptocurrencies might sound good but, the decision brings in a lot of risks that no investor could ignore in any way. The biggest element is pricing which shows higher volatility and has always been an easy target. Scammers and hackers are always on the lookout for such security weaknesses that could allow them to invade and steal funds.

Being a crypto trader, people might face slippage at least once in their career where they are unable to figure out the next step and have to go with the flow. That’s where slippage occurs and causes trouble for the traders.

What is Crypto Slippage?

In the simplest form, slippage crypto refers to a situation where traders take buying or selling decisions at a minimum price or maximum price than the expected one.

Here, the term slippage explains the difference between an actual price and the expected price of a security.

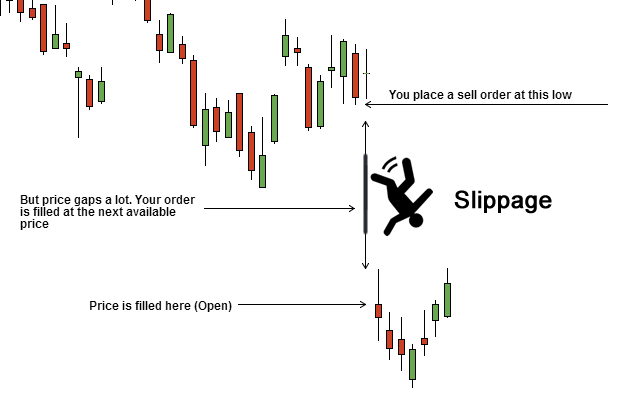

Since every crypto trader has an estimated budget to spend on a specific trade, it’s quite difficult to come up with somewhat similar pricing every now and then. Moreover, there are immediate price movements with respect to the crypto market conditions. Traders cannot expect a trade to complete at the actual price as they initiated an order on. Sometimes, prices may change right after a market order is created.

With that being said, traders might buy or sell at a lower/higher price than the favorable one. Slippage is the difference between what they have expected and the final execution price.

How Does Trade Slippage Work?

The first and foremost thing is to understand that slippage doesn’t only refer to only finding the difference between the market and the expected price. Rather, it also defines the positives and negatives of a trade that could eventually affect trading strategies and decision-making.

To make buying decisions, traders have to know the right time of trading and favorable price range i.e. when the market shows positive slippage. Practically, when a security is traded at a lesser price than the expected one, it means the trade is favoring investors. It shows better buying rates and lets traders enjoy better prices and returns. On the other hand, negative slippage occurs when the intended execution price lies above estimated and leads to unfavorable buying rates.

To make selling decisions, traders have to wait until slippage shows a positive trend. In positive slippage, the market price tends to be higher than estimated. It allows traders to claim more returns on a sale than they had expected. On the contrary, slippage becomes negative as soon as the crypto market price goes below expected, thereby letting investors face losses.

Slippage in the Crypto World

Crypto trading is not as easy as it seems. There are many things that crypto traders have to be concerned about. Not only do they have to keep an eye on the price movements, market trends, and external factors, but also have to take measures to keep slippage as low as possible.

Investors have to allocate a percentage from the transaction value of every order as an acceptable slippage for the trade. This percentage is known as slippage tolerance. Its responsibility is to control the trade or in other words, a trade will not happen if the transaction’s value falls above the slippage tolerance.

Factors Affecting Slippage in Crypto Trading

There are 2 major reasons behind slippage in digital currencies:

Low Liquidity on a Crypto Exchange:

If an investor chooses an exchange with a low liquidity percentage to place an order to, let’s say, 50 BTC @ $20,000/BTC, there would be some hurdles he/she has to pass. Due to low liquidity, the exchange might not fulfill the whole order at the asked price. Instead, some transactions have to cost more than $20,000 to ensure 100% execution.

To make this point clearer regarding slippage tolerance, here is the explanation:

-

50% of market orders are matched with the actual order value i.e. $20,000

-

25% of orders are processed at the selling price of $20,001

-

The remaining 25% BTC is matched at $20,002

After all calculations, the average sell price for BTC will be $20,000.75, which is more than $20,000 and creates a $75 negative slippage.

High Volatility

When the crypto is highly volatile, slippage may increase due to the price shift after order placement. When crypto market trends are volatile, it’s quite common to see frequent or immediate price fluctuations, where traders have to fill orders within seconds. Besides, the limit order may affect the trends by informing when high-frequency traders could take benefit from frontrunning.

For example, consider the same buying order of 50BTC @ $20,000/BTC.

At the time of order placement, BTC ask prices are: $19,990 or $20,000.

Due to the BTC market’s high volatility, high-frequency trades usually happen that cause quick price shifts and leave some orders unfilled. The remaining orders are then filled at new pricing i.e., $20,000.5 or $20,001, thereby adding $1 per BTC. This total difference sums to $50, which shows negative slippage on an order of 50BTC.

Tips to Minimize Slippage in Crypto Trading

Ignore Market Orders and Go for Limit Orders

While a market order is intended to trade crypto in the market, that too at the best available price, it’s still recommended to choose limit orders. The reason behind this is less or no guarantee to execute a trade on the mentioned price. Slippage may have significant effects on the intended execution price.

On the other hand, a limit order is always ready for execution at the requested price. It’s possible for crypto investors to trade their cryptocurrencies at their requested prices instead of what the market sets. However, be sure to see some unfilled orders at the requested price.

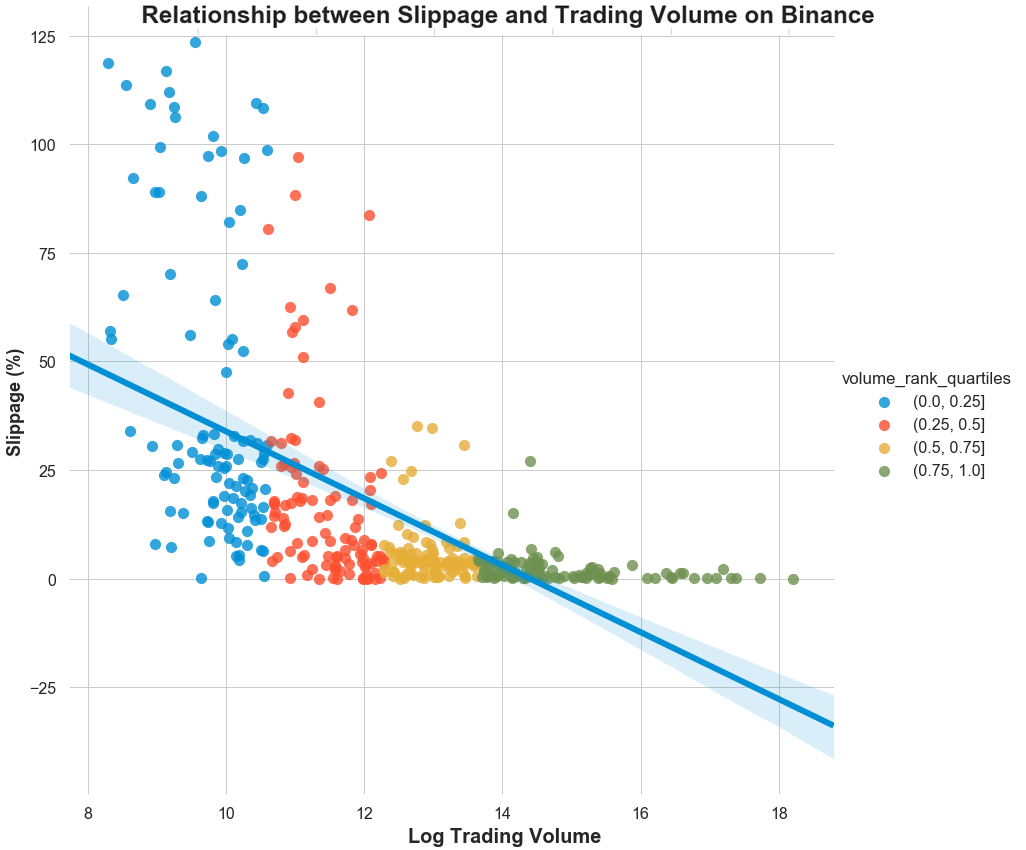

Trade with High Liquidity Exchanges During Low Volatile Trends

The rule of thumb is not to trade on low liquidity and high volatility exchanges because they are an easy target of slippage.

With that being said, investors should always find crypto trading platforms with high volume and better liquidity so that it’s possible to mitigate the risk as much as possible. This way, there will be lesser or no partially unfulfilled orders at the specified price.

Adjust Slippage Tolerance

As mentioned above, slippage tolerance is the percentage a crypto trader can bear in terms of order cancellation or incompletion. Many exchanges use it as a shield for traders to keep themselves safe from possible price changes while placing orders.

Slippage tolerance is ideal for decentralized exchanges like DEX because of its frequent occurrence. It gives detailed insight into current market conditions and depicts a final execution price that traders should proceed with.

Split Big Orders into Smaller Ones

Since trade volume is high for big orders, they are more likely to face slippage followed by latency in execution and the need for more liquidity.

Therefore, experts suggest not following this approach. Rather, traders should split such orders and divide their execution time to avoid slippage in trading. Here, they can apply multiple Algorithmic Trading Strategies or ATS such as TWAP and VP for efficient execution.

Conclusion

Crypto traders are well aware of the term ‘Slippage.’ They know why it happens and how they are supposed to react in such a situation.

Slippage in the crypto world refers to a situation when the intended price of a cryptocurrency doesn’t meet its market price. Even though it has a significant impact on the trading plan, it still doesn’t always yield bad results.

There are two conditions in slippage tolerance– it could either be positive or negative, meaning that it may give huge profits in some trades or vice versa.

Frequently Asked Questions (FAQs)

Why is slippage important in crypto trading?

Slippage means getting less or high out of any trade when executed. Its volume may be small for some while others might have to deal with huge losses from some trades. Therefore, it requires careful analysis and decision-making.

Is it possible to avoid slippage in crypto?

Yes, there are ways to do it- choose a centralized crypto exchange and go for limit orders. Or else, slippage tolerance, trading during low price volatility, and splitting big trades into smaller groups can do the job.

What’s the ideal slippage tolerance?

It entirely depends upon a trader’s preference and budget. However, for DEXs, the slippage percentage is likely to be 0.5% and may increase with the increase in trade frequency or vice versa.

Is it good to trade with high slippage tolerance?

If market slippage conditions are in favor, investors can expect higher slippage tolerance along with a greater number of cryptos than they actually thought. Likewise, they should not overlook the possibility to lose more money than expected against the slippage.

Does the price change with slippage?

There is no relationship between price and slippage. Rather, it only shows a change in prices. In fact, it demonstrates shifts in market conditions i.e. demand (bids) and supply (offers) at different cryptocurrency price points. In other words, there is no impact of price change on slippage. It only shows how far the price has changed over time.