After a less-than-optimistic 2022, 2023 has been relatively beneficial for cryptocurrency ETFs. But which of these crypto ETFs is the best performing, and which will continue to thrive in 2024?

With the advent of spot bitcoin ETFs, there is a newly formed interest in bringing cryptocurrency into the mainstream. One of the ways for ordinary investors to invest in this new asset class is by a crypto ETF.

Cryptocurrency ETFs provide a one-of-a-kind value proposition that might lead to a large-scale capital influx that hasn’t been seen in the realm of digital currencies before. They come in a variety of flavors, ranging from funds that exclusively hold Bitcoin to funds that carry a diversified basket of blockchain and crypto-related stocks.

Cryptocurrency ETFs serve as a clever middle ground that allows institutional investors to dabble in cryptocurrency without having to check the price of Bitcoin (BTC) and its unpredictable market cap every few minutes.

This detailed article will highlight some of the top crypto ETFs available and explain why they may better suit your investment style.

What is a Crypto or Bitcoin ETF?

Cryptocurrency exchange-traded funds or crypto ETFs are investment funds and exchange-traded products that track the performance of underlying assets (including cryptocurrencies like Bitcoin and Ethereum). A Bitcoin ETF subsequently represents a fund that monitors the performance of Bitcoin. But here’s the catch: instead of purchasing these digital assets directly and needing to traverse the perplexing complexity of digital wallets and blockchain researchers, you acquire shares of the ETF.

Some cryptocurrency ETFs take it a step ahead. Instead of maintaining an indexed basket of high-liquidity cryptocurrencies, some cryptocurrency ETFs invest in blockchain companies, such as Coinbase Global (COIN), a Bitcoin mining company.

Moreover, cryptocurrency ETF shares indicate a proportional stake in the ETF’s cryptocurrency holdings. The ETF handles the heavy labor of acquiring and managing the cryptocurrencies while you, the investor, ride along, your investment growing and dropping in value with the fluctuation of the underlying crypto assets.

Unlike their underlying assets, a cryptocurrency ETF is traded on a standard stock exchange, allowing you to purchase and sell it just like shares of a tech firm or gold ETF units. Traditional investors see ETFs as a practical and accessible way to obtain exposure to the volatile crypto market without getting their hands dirty. ETF investment also helps build a diversified portfolio because most ETFs invest in a collection of stocks, bonds, and/or other assets – in this case, cryptocurrencies and the companies involved in their establishment.

As mentioned above. ETFs are of several types:

- Index ETFs

- Commodity ETFs

- Foreign market ETFs

- Industry or sector ETFs, and so on.

However, these ETFs invest in countless businesses. They are divided into the following general groups:

- Companies that own Bitcoin, including Tesla and MicroStrategy.

- Blockchain-based technology firms like Advanced Micro Devices, Galaxy Digital Holdings, and VMware.

- Crypto miners like Marathon Digital Holdings and cryptocurrency exchanges like Coinbase.

- Financial services enterprises like HSBC, BNP Paribas, and NVIDIA Corp.

But now the actual question is whether you should invest in ETFs and what are the best crypto ETFs to consider in 2024.

Is a Crypto or Bitcoin ETF Appropriate for Me?

If you’re tempted by the potential of cryptocurrencies but are wary of unpredictable pricing and never-ending scams, a Crypto or Bitcoin ETF may be the right choice.

Crypto ETFs provide a more conventional and regulated approach to investing in cryptocurrency. They are traded on reputable stock exchanges and handled by qualified fund managers, offering reassurance and stability, which direct cryptocurrency investments do not.

Furthermore, crypto ETFs are appropriate for traditional investors seeking a well-diversified portfolio. Many crypto ETFs track a variety of cryptocurrencies, not only the mainstays such as Bitcoin and Ether. This implies you may diversify your portfolio rather than relying solely on a single asset.

Furthermore, the US Securities and Exchange Commission will govern crypto ETFs with significantly more precision than it has for other digital assets, such as XRP.

Cryptocurrency ETFs are also ideal for people who prefer passive investment techniques. Once you purchase shares in the ETF, the fund manager handles the rest, watching the performance of the underlying crypto assets and modifying the portfolio as needed.

Before investing in ETFs, you need to be familiar with a few important terms. We describe a few of them in this post.

- Expense ratio: This is the expense of maintaining and operating the ETF presented as a percentage of total assets. Reduced expense ratios are usually preferable because they devour less of your returns.

- Assets Under Management: This is the entire market value of the assets, which an investment firm or financial institution manages for investors. Larger assets under management can imply that the ETF has a wider market presence and possibly higher liquidity.

- Liquidity: This relates to how simple it is to acquire and sell an ETF without affecting its price. ETFs that are regularly traded have more liquidity and are simpler to buy and sell.

- Trading Price vs. Net Asset Value: While equities trade at market prices, the net asset value of an ETF is calculated by dividing the fund’s total asset value by the number of shares. Variations between the trading price and the net asset value may develop, which implies buying an ETF at a discount or premium.

Best Crypto ETFs for Investing in 2024

Here is a list of the eight most prominent cryptocurrency ETFs you can consider in 2024.

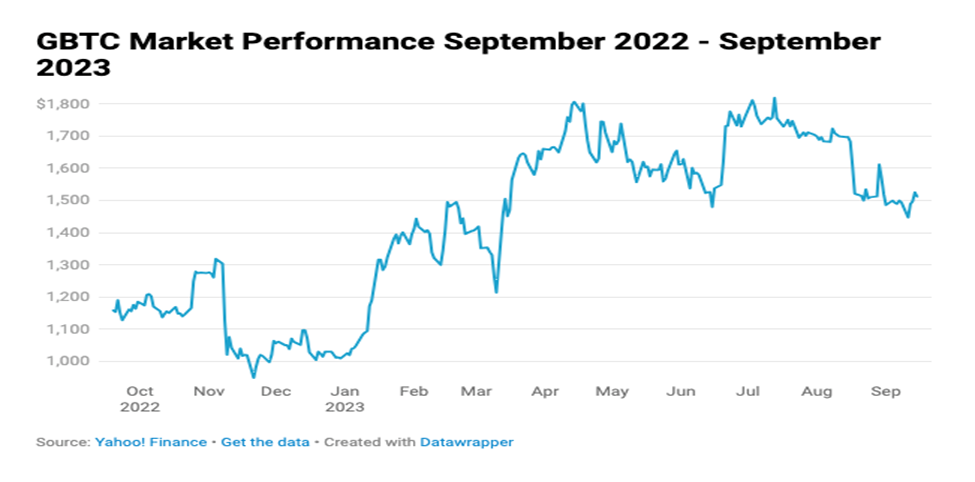

Grayscale Bitcoin Trust ETF (GBTC)

GBTC, an early mover in the crypto space, is an index fund that exposes investors to fluctuations in bitcoin prices without requiring them to purchase the digital currency.

The shares are exchanged on the over-the-counter market, and the price of each share is determined by the underlying Bitcoin’s value, as well as the supply and demand of the market. It’s worth noting that the price of GBTC shares frequently varies from the value of the underlying Bitcoin, resulting in the shares trading at a premium or discount.

GBTC may be a viable solution for investors who want Bitcoin exposure but prefer to invest through a standard investment product rather than purchasing and storing Bitcoin directly. Since its establishment in 2013, the Grayscale Bitcoin Trust has generated approximately 19,000% gains.

It is crucial to note that GBTC functions differently than the newly approved spot Bitcoin ETFs because it was not originally established as an ETF but has sought conversion to an ETF structure to offer better liquidity and tighter tracking to net asset value. Because of this, as well as its higher expense ratio (1.5% management charge), this trust had a major outflow of assets in early 2024.

- Assets under management: 24.47 billion USD

- Expense Ratio: 1.5%

- Returns since inception (2013): 8799.81%

- Investing Strategy: Bitcoin holdings

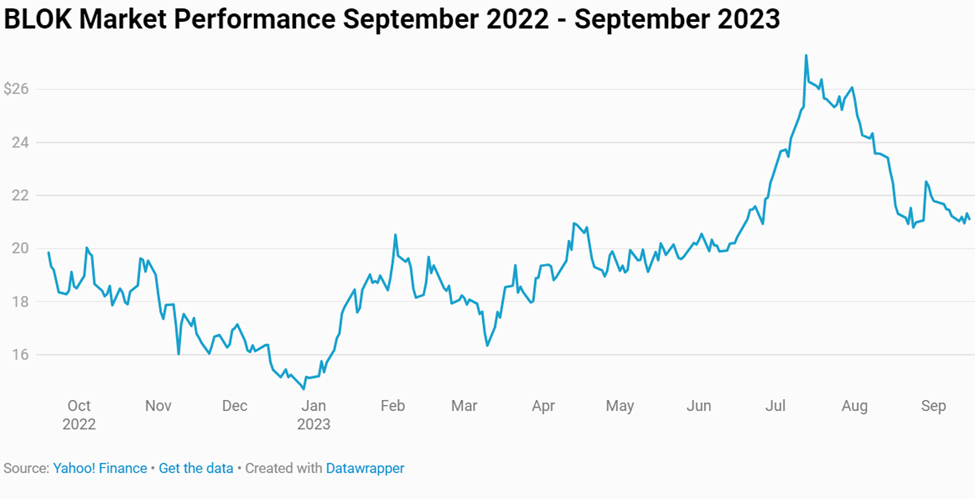

Amplify Transformational Data Sharing ETF (BLOK)

The Amplify Transformational Data Sharing ETF, which trades under the ticker BLOK, invests in a mix of value and growth equities with diverse market capitalizations using a blended strategy. It is a crypto pioneer that invests at least 80 percent of its net assets in stocks of companies developing blockchain technologies.

These fund holdings are spread across important cryptocurrency exchanges, bitcoin mining firms, IT firms, payment providers, and other financial service providers. This includes crypto industry behemoths like Coinbase Global, Overstock.com, Marathon Digital Holdings, and Michael Saylor’s MicroStrategy, the largest publicly traded company with Bitcoin holdings. It’s a good pick for investors wishing to diversify into the larger blockchain ecosystem beyond cryptocurrencies.

- Assets under management: 1.16 billion USD

- Expense Ratio: 0.71%

- Returns since inception (2018): 81.96%

- Investing Strategy: Blockchain-related company equities

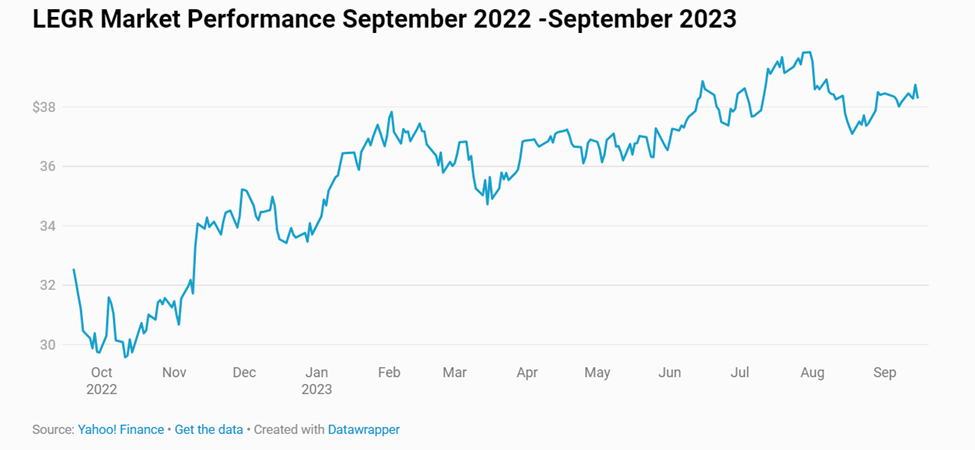

First Trust Indxx Innovative Transaction and Process ETF (LEGR)

First Trust Indxx Innovative Transaction and Process ETF (LEGR) aims to monitor the performance of businesses that utilize, invest in, produce, or sell products that will likely profit from blockchain technology. It also invests in companies that expect to benefit from the blockchain’s ability to enhance the efficiency of various business operations.

While the majority of the fund’s assets are in the United States (41%), it also has exposure to securities from China (10%), India (7.6%), France (7.4%), and Germany (4.8%).

LEGR’s top holdings till 2023 included NVIDIA Corp, Amazon, Accenture, Salesforce, Microsoft, Oracle, and Intel. These are spread across IT, finance, industrial, utilities, healthcare, consumer staples, and energy.

- Assets under management: 103 million USD

- Returns since inception (2018): 28.17%

- Expense Ratio: 0.65%

- Investing Strategy: Blockchain-related company equities

Bitwise Crypto Industry Innovators ETF (BITQ)

Bitwise Crypto Industry Innovators ETF was launched in the second quarter of 2021 and comprises 30 stocks. These stocks target early cryptocurrency innovators and adopters, with either 75% of their net holdings in Bitcoin or other crypto assets, or at least 75% of their revenue derived from cryptocurrencies.

While most of the ETFs on this list emphasize Bitcoin futures contracts, the Bitwise Crypto Industry Innovators ETF takes a slightly different approach. Instead, the BITQ ETF invests in cryptocurrency startups and equities, exposing investors to the blockchain industry without having to deal with digital assets directly.

The fund is a relative newcomer to the market with an expense ratio as low as 0.85%. The BITQ fund has proven popular on Wall Street, gaining a large number of investors as its holdings grew to a net worth of more than $140 million.

- Assets under management: 140 million USD

- Expense Ratio: 0.85%

- 2023 return: 97.64%

Proshares Bitcoin Strategy ETF (BITO)

Proshares Bitcoin Strategy ETF (BITO) debuted on October 19, 2021, as a game changer in the cryptocurrency ETF space. It was the first ETF in the US to receive SEC permission to trade on a major US exchange and is one of the best crypto ETFs to keep an eye on in 2024.

It is an actively managed fund. Besides Bitcoin futures contracts, it can hold cash and Treasury securities as well. The Commodity Futures Trading Commission oversees the future contracts owned by BITO. It can be purchased and sold using a brokerage account.

The BITO ETF is intended to offer investors a low-cost and convenient option to obtain exposure to cryptocurrency prices. It offers this exposure without purchasing, holding, or maintaining Bitcoin, freeing investors from the hassle of dealing with complex seed words for digital wallets.

The BITO fund is an extremely popular choice among investors eager to test the waters of the volatile cryptocurrency market. Besides, it has also proved appealing to seasoned investors. It was announced in December 2023 that Cathie Wood, chief executive officer of Ark Invest, had acquired a BITO allocation worth about $92 million at the time of acquisition.

- Assets under management: 1.356 billion USD

- Year to Date Daily Return: 112.22%

- Expense Ratio: 0.95%

- Investing Strategy: Bitcoin futures

Global X Blockchain ETF (BKCH)

The Global X Blockchain ETF (BKCH), a passively managed fund, claims that blockchain technology may be utilized for much more than cryptocurrency. It makes suitable investments in 25 technology and Bitcoin mining firms that benefit from the use of blockchain technology.

It is one of the finest crypto ETFs since it includes companies that develop new blockchain technologies, cryptocurrency exchanges (like Coinbase Global Inc.), and mining companies (like Marathon Digital).

- Assets under management: 64 million USD

- Expense Ratio: 0.50%

- 3-month average daily volume:179,196

Valkyrie Bitcoin Strategy ETF (BTF)

Valkyrie Bitcoin Strategy ETF debuted three days after BITO went public. BTF, like BITO, does not make direct investments in Bitcoin. Similarly, the Commodity Futures Trading Commission oversees transactions.

The Valkyrie Bitcoin Strategy ETF, which was launched in October 2021, has swiftly established itself as a leader in the crypto ETF industry. This actively managed fund intends to invest as close to 100% of its net assets as possible in Bitcoin futures contracts.

Beyond Bitcoin futures, the other assets are invested in US government securities, corporate bonds, and money market funds. BTF, like the majority of the funds on this list, seeks to invest mainly in Bitcoin futures, allowing investors to receive exposure to Bitcoin price changes without directly owning the cryptocurrency.

The Valkyrie Bitcoin Strategy ETF is best imagined as an elite squad of experienced traders swing trading Bitcoin’s peaks and troughs.

- Assets under management: 34.51 million USD

- Expense Ratio: 0.95%

- Returns (1 year): 102.42%

- Investing Strategy: Bitcoin futures

VanEck Bitcoin Strategy ETF (XBTF)

The VanEck Bitcoin Strategy ETF allows investors to obtain cryptocurrency exposure (Bitcoin) without actually owning or storing the digital asset, sparing them from the hassle of buying Bitcoin through a crypto exchange. XBTF invests primarily in Bitcoin futures contracts, hoping to closely monitor the performance of the world’s most popular cryptocurrency.

VanEck, a well-known asset management firm, manages the fund and has a track record of developing innovative investment solutions. XBTF is an excellent solution for investors who believe in Bitcoin and want to capitalize on its possible upside while profiting from the risk control and operational efficiency of an ETF structure.

- Assets under management: 64.8 million USD

- Expense Ratio: 0.65%

- Investing Strategy: Bitcoin futures

Outlook for Crypto ETFs in 2024

The picture for cryptocurrency in 2024 is mixed. Potential benefits include greater institutional adoption and regulatory improvements. For instance, hedge funds and pension funds have been growing their cryptocurrency investments, and this trend is expected to continue in 2024. Countries like El Salvador and Singapore are taking a more positive stance on cryptocurrency legislation. In addition, the US is considering approving a spot Bitcoin ETF.

These and other factors could strengthen the cryptocurrency market in 2024. Investors should be aware that while crypto ETFs offer high growth potential, they can also be risky and experience substantial short-term falls. For instance, the top-performing cryptocurrency ETFs of 2023 increased by about 100% or more, whereas some of the same ETFs fell by over 80% in 2022.