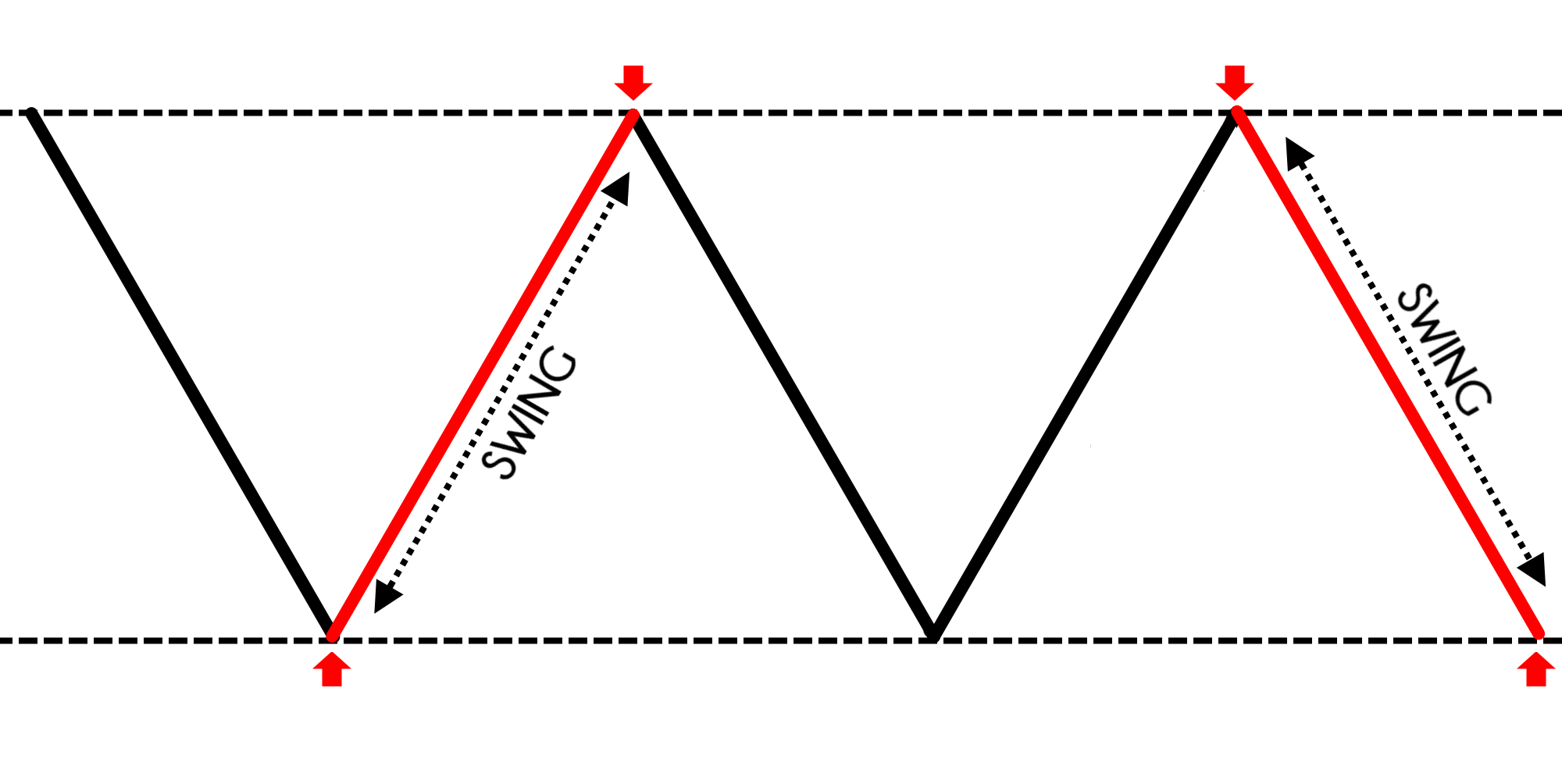

Swing trading strategy has become popular among intermediates, advanced, and even seasonal traders. Traders using swing trading strategies tend to identify the best entry position or exit point in trading.

Because swing trades combine fundamental and technical analysis, it becomes necessary that traders take critical advantage of historical price moves to make a profit. An example of swing trade is illustrated below using a stock chart:

.png)

Naturally, the swing trading strategy comes with its disadvantages. For optimal results traders should expect higher capital and more efficient execution of swing strategies. And expect commissions and volatility. Swing traders generally deal with lower price changes during long trends.

There are a plethora of swing trading techniques to choose from, but some perform better than others in the long run. Depending on your individual psychology, the outcome will vary. A sound financial plan should underpin all of your efforts.

You may use any of the above methods to begin swing trading stocks, options, FX, or cryptocurrency. You may utilize them in stock market to create your own swing trading strategy, or you can combine many swing trading methods into one potent instrument.

This article will provide many swing trading tactics that have been successful in the past and are still effective as of the writing of this post. For this reason, it is hard to predict how long a swing trading technique will be effective.

However, the swing trading methods we are about to discuss with you have a firm basis and function by taking advantage of market behavior in stock market that has lasted for a long time, which is also why we think these strategies have a strong possibility of succeeding in the future.

Keep in mind that even the most foolproof plans might be derailed by the occurrence of a “black swan event” or just plain poor luck.

Use a trading simulator to hone your skills before putting down real cash. With that in mind and following unconventional trading style, let’s take a look at the five swing trading methods that are often used by seasoned pros.

:max_bytes(150000):strip_icc()/dotdash_Final_Swing_Trading_Definition_and_Tactics_Sep_2020-01-4a6d22bec15342ed8ad60170afda74ca.jpg)

What are Swing Trading strategies

There is a wide variety of approaches of swing trading strategies one may take to making money in the financial markets. There is not only a wide range of trading tactics and trading style to choose from, but also a range of trading emphases.

The time range during which you trade is one of the primary ways in which traders’ approaches differ.

Some traders focus on the long term swing trading strategies, with a view to riding out trends that develop over many months or even years. The possibility for significant earnings is a major perk of long-term trading.

Like any sort of swing trading strategy, though, there is always the chance of losing money.

Moreover, long-term trading will often only need a little level of attention, beyond a daily check. Nonetheless, you’ll need greater patience since your trading prospects will be reduced.

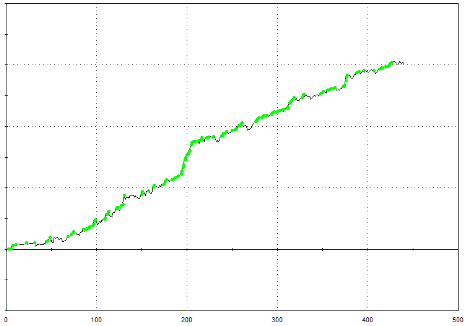

Conversely, scalpers are at the opposite extreme of the scale. The goal of the several deals that a scalper makes, each of which lasts just a few minutes, is to generate a modest profit. A sample stock chart is illustrated below:

Due to the brief duration of these transactions and popular swing trading indicators, your exposure to the market is greatly reduced. The fact that you need to track very minor price shifts means that trading possibilities abound. A few of scalping’s drawbacks are as follows:

- This requires a substantial commitment of time and energy.

- The need of highly organized and systematic departure planning and management

- As a result of the frequent deals, transaction fees might add up.

Day traders are the next tier up from scalpers, holding positions for a few hours but no more than a day to prevent being caught off guard by overnight news that might have a significant impact on the market.

swing trading strategies is a middle ground between day trading and long-term investing, with positions often held for few days to a few weeks.

Swing traders are interested in chart patterns that span many days so that they may profit from larger price fluctuations (swings) than would normally occur on a single trading day.

This approach appeals to many individuals because it strikes a good balance between the time commitment required to make trades and the time spent actually trading.

Advantages of Swing Trading strategies

We’ll examine some of the benefits of swing trading strategies below:

- Time: Transactions with a short time horizon need regular attention. Long-term transactions, on the other hand, involve a great deal of trading discipline and may not be exciting enough for certain investors. Because it takes place over a more manageable time range, a swing trading technique is a popular choice among novices.

- Longer Trends: Swing trading enables traders to take advantage of longer term trends, whereas scalping and day trading focus on short-term volatility. Contrary to short-term trading, which is more susceptible to noise and misleading signals, long-term analyses tend to be more reliable. Because prices are influenced by transactions following longer trends, this also implies that each trade has more time to turn a profit.

- Efficiency in Costs: The spread, or the difference between the purchase and sell prices of an item, is a major expense for traders. Although spreads are little, they are deducted from your earnings every time you make a transaction. Swing traders are less affected by the spread since they make fewer transactions and do so over longer time periods.

Market Swing Alerts

Time is money, and not every trader has the luxury to spend hours poring over charts and reading up on the latest market news and technical indicators. Time is needed for this procedure.

Many swing traders still have designs on crafting their own unique swing trading strategies. Time is required to develop a swing trading strategy, and here you will discover a compilation of the most effective swing trading systems utilized by investors today.

Entry point, profit objective, precise set of criteria and parameters for trade entry, and money management rules for where to put stops and how large to make a position are all essential components of any successful swing trading system.

What Elements Constitute an Effective Swing Trading Approach?

People often wrongly assume that a successful swing trading strategies requires complex reasoning and a wide variety of rules and circumstances. When it comes to trading, little is more.

Curve fitting, whereby your rules are adjusted to account for fluctuations in the market rather than actual market behavior, becomes more likely as the number of criteria increases.

There are as little as two requirements in some of our most successful swing trading techniques.

Look at this swing trading method as an example. It uses a time-based exit to close the deal and has no more than two criteria with easy-to-understand logic. Since they are based on a larger than/less than comparison, the entrance criteria cannot be optimized.

It’s likely you’ve had little luck swing trading the market based just on your gut instinct. Intuitively knowing what the market will do next is a skill few people have. Since so few people really have this skill, it may as well not be worth pursuing.

But it doesn’t imply all traders are condemned to lose money. Any trader may increase their odds of success in the market by using a technique that has been put through rigorous robustness testing and has been shown to work.

But first, we’ll explain the five primary types of swing trading methods before we show you the rest. We’ll even throw in some examples of tactics that we believe effectively illustrate the reasoning. Remember that these are simply samples, and they may not apply to your situation.

Trend Continuation Trading Strategy

You’ve certainly heard of gap trading before, but just to refresh your memory, this is when the opening price of a security or currency pair significantly rises or falls, reflecting an abrupt shift in investor opinion.

One of the most common strategies used by swing traders, who by definition are trend followers, is to take advantage of continuation gaps.

This is common after an earnings report that exceeds market forecasts. You should be entering the market or increasing your current position if you understand this and are currently in an uptrend. Keep in mind that this is the case only when we follow the general long-term trend.

Following the release of quarterly results, the stock price may gap up or else move dramatically higher at the market open.

Sometimes this occurs within the framework of an ongoing uptrend, and when it does, the break above the most recent highs often occurs around the time of an announcement or immediately thereafter.

It’s not uncommon for the market to respond with a little correction before continuing its ascent. This is the kind of continuation gap that long-term traders prefer to exploit since it essentially spells out the direction of the market.

Keep in mind that many traders will just use earnings reports while making transactions. The fundamental and institutional traders will generally take their positions here, influencing the market much more than you will. Therefore, it is often to one’s advantage to go along with the crowd.

Fibonacci Retracement Strategy

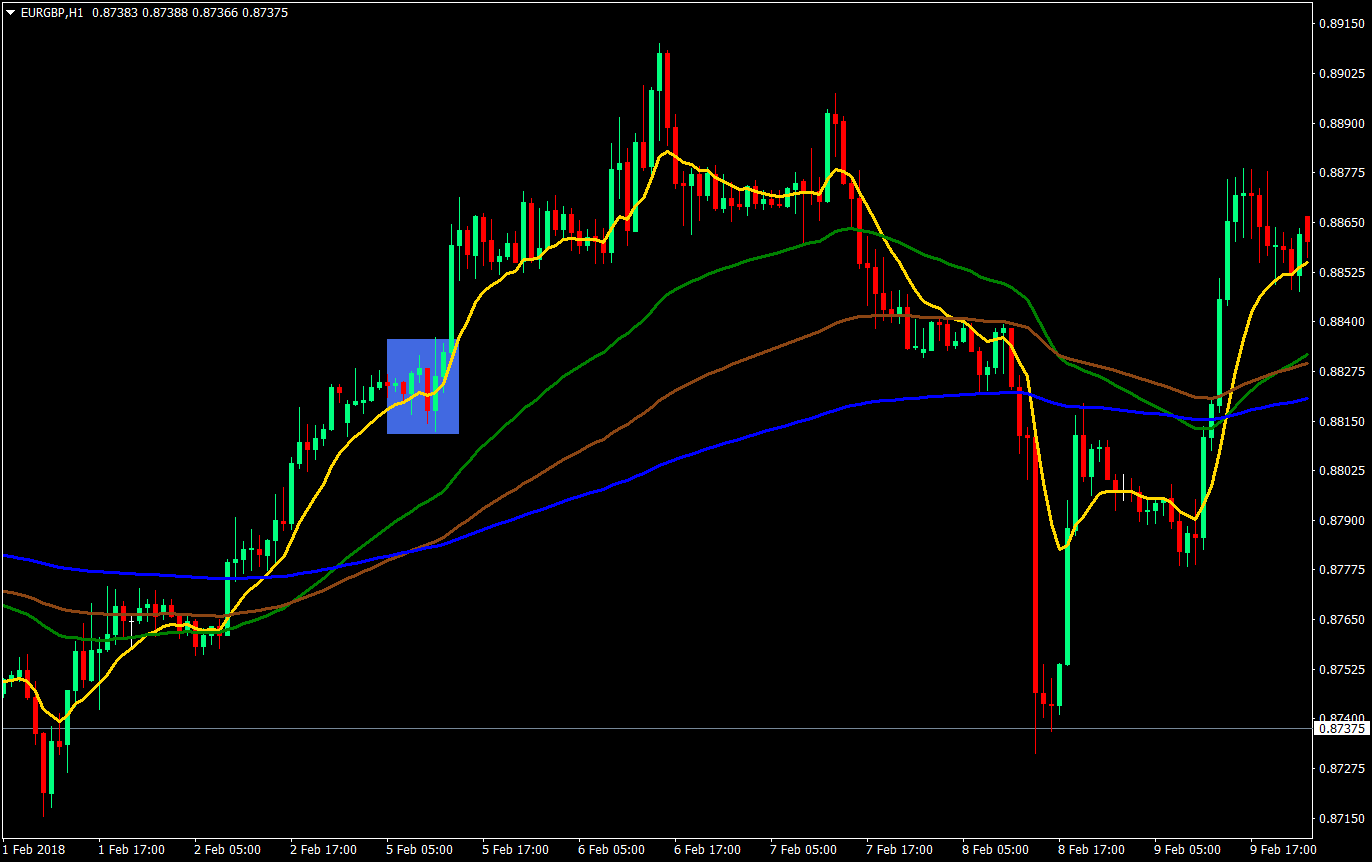

To choose an entry point, traders everywhere turn to Fibonacci retracement tools. The 38.2 percent, 50 percent, and 61.8 percent retracements are the most often used levels.

For this reason, many investors choose to take advantage of a well-known ratio by trading at certain levels based on their preferred candlestick pattern. Just remember that these comparisons are irrelevant. These are broad scopes.

This indicates that you are seeing a potential reversal candle play area. If you missed the initial advance in a stock and are looking for a place to get in, a bullish candlestick like a hammer near the 50% Fibonacci retracement level on the weekly chart is something to keep an eye on.

Once a bullish candlestick appears at the 50% retracement level (from swing low to swing high), the trend may change. The swing trader will begin buying there once the candlestick shows that support has been sustained.

Even if there was a 50% correction along the way, you can see that we often move higher thereafter.

:max_bytes(150000):strip_icc()/dotdash_INV-final-Strategies-for-Trading-Fibonacci-Retracements-June-2021-01-508c06e0d08c4e28a71e7778e0eae9ee.jpg)

Candlestick patterns like engulfing candles, shooting stars, and Doji candlesticks are just a few examples. It all boils down to the preferred trading configuration of the individual trader. All of them, however, can be traced back to the 0.618 level of the Fibonacci sequence.

Weekly Trend Line Break to Go Short

It is clear that there were several opportunities to buy a stock near support if the investor had just followed a trend line. What’s even more spectacular is when you break a key trendline to the negative.

A substantial breakdown of support signals a potential short swing trading opportunity in large-cap equities.

Breaks in major trendlines that have been in place for years are not common, but when they occur, you should take notice since they may frequently determine the success or failure of the whole year.

You can clearly identify your exposure to loss in the event of a reversal back above the prior trendline, which would indicate that selling was doomed to failure.

Because of this, it is evident that you have a beginning point, an ending point, and that the bottom of the trend line is often where you want to go for your objective. Most traders, however, will lower their stop-loss orders to account for the market’s recent decline from its swing highs on shorter time frames.

Patient trading is required here, but this one transaction had the potential to account for most of your year earnings and wipe out several unsuccessful trades.

Eventually, individuals will have to start selling their stock that is now losing money, which will accelerate the market in your favor again since you are on the right side of the market.

Gap and Go Swing Trading Strategy

Day traders sometimes use the gap and go technique, in which they buy or sell equities that have had large price swings on high relative volume. If the gap is the result of significant results or corporate news, then intraday volatility will be particularly strong.

Conversely, merger and acquisition news often causes gaps but not volatility after the open since the precise price per share for the M&A transaction was typically previously publicized.

Gap and Go Swing Trading Strategy: AN EXAMPLE

The setup is most effective for intraday trading, although it also has some success with swing trading. Large price increases after the release of good news are generally ignored by traders until the gap has been closed.

On the other hand, sometimes the news is so good that it completely alters the company’s perspective and no one can bear to quit purchasing. Because of this FOMO, the trading setup is effective when stock prices rise.

They start purchasing at a greater price, nevertheless. Establishing trading parameters, including take-profit and stop-loss levels, is crucial for this configuration.

It is also important to determine position size depending on the risk each transaction, and to risk the same amount of money on each trade.

If your trade risk is $50, then you would divide that amount by the hypothetical spread between your entry price and stop loss level to determine how many shares you would have to trade. In such swing trades, the stop loss level is often the bottom of the candle the day before the gap up.

Stock Split Power

Successive stock splits have a positive effect on the value of shares in almost every company. After recently processing a stock split, the price of shares in both Apple (AAPL) and Nvidia (NVDA) rose steadily.

Stock Split Power: AN example

Apple has undergone five stock splits. In 1987, the ratio was 2 to 1, in 2000 it was 2 to 1, in 2005 it was 2 to 1, in 2014 it was 7 to 1, and in 2020 it will be 4 to 1.

If you purchased 100 shares of Apple in 1987, you would then own 200 shares by the end of the year, 400 shares at the end of 2000, 800 shares by the end of 2005, 5,600 shares by the end of 2014, and 22,400 shares of Apple by the end of 2020.

Don’t you think that’s really insane? If you had purchased shares in 1987 at their original price of $0.25, you would have almost $150 in today’s dollars.

This investing approach is based on the premise that swing traders would perceive the price per share to be far lower than it really is.

Since the market value of a firm is just the price of its shares multiplied by the number of shares outstanding, the company’s value has not changed despite the increase in its share count.

However, it seems inexpensive, and price movements like that are often welcomed by investors. Taking a long position now might pay out handsomely in the near future if the current bullish trend holds.

These trades do not need the use of a technical indicator. Instead, it’s important to keep an eye on the business news and sift out any stock split announcements.

Be cautious, however. Similarly, penny stock businesses may use a reverse stop split in an effort to restore their stock’s appearance to that of a higher-valued company or maintain its index inclusion.

If a stock is now valued at $0.25 per share and undergoes a 1:4 stock split, the price per share will increase to $1 at the following open.

While maintaining the same market capitalization may be accomplished by issuing fewer shares at a greater price per share, doing so at a price of $1 per share has the dual benefit of being visually appealing and meeting Nasdaq’s minimal listing requirements.

Tips for Successful Swing Trading

You have learned the fundamentals of swing trading strategies and various swing trading methods; now, we’ll give you some of our best advice for making it as a swing trader.

Trade in accordance with the direction of the long-term trend: In addition to the time chart you’re now consulting, it might be useful to examine one from a much longer period of time in order to better understand the underlying long-term trend. Once you’ve done that, you may aim to avoid going against the market’s bigger trend. When doing swing trades, it’s far simpler to go with the trend than than against it. So before you start swing trading stocks, keep the direction in mind.

Utilize Time Series and Moving Averages: If you’re using a swing trading strategy, the MA indicator may assist you detect the trend by smoothing out short-term price changes. There is no any best swing trading strategy, but a combination of these tips add to your progress.

Leverage yourself a bit: Increase your potential earnings by using leverage to obtain a greater stake than your initial investment would normally permit (and losses). Effective use of leverage allows you to magnify the effects of profitable transactions. Still, it has to be taken with prudence.

Watch out for exchanges: Positions that are held overnight incur a swap, which is a kind of interest. You need to factor in the price of these exchanges into your budgeting decisions.

Can you still make money through swing trading?

There is still money to be made in swing trading strategies. However, successful swing trading necessitates a strong method with a significant trading advantage and efficient trading psychology. The aforementioned list of 10 swing trading tactics is an excellent place to begin.

Can you say that all swing traders make money?

Contrary to popular belief, a sizable portion of swing traders do achieve lasting success. That’s not because swing trading doesn’t work; it’s because novice traders often lack an advantage when they enter the market. That, or they just don’t care enough to play by the rules.

Conclusion

We have not only detailed the concepts of mean reversion, best trading strategies and trend following, but also provided you with five swing trading strategies that have historically produced profits and are expected to continue doing so in the future.

Remember that there is no way to predict the future, and that ultimately, every strategy will fail. Therefore, it is crucial to spread your bets around and use appropriate position sizes.