Trading in the financial markets can be a daunting task, but with the right tools, you can improve your chances of success.

One such tool is the Williams Alligator Indicator, a popular technical analysis tool used by traders to identify trends and make informed decisions.

In this article, we’ll explore what the Williams Alligator Indicator is and how to effectively use it in your trading strategies.

Understanding the Williams Alligator Indicator

The Williams Alligator Indicator, created by the renowned trader Bill Williams, is a powerful tool for traders that falls under the category of technical analysis.

It serves a crucial role in helping traders identify trends and make informed decisions when participating in financial markets.

To gain a deeper comprehension of this indicator, let’s break it down into a few key components.

What is the Williams Alligator Indicator?

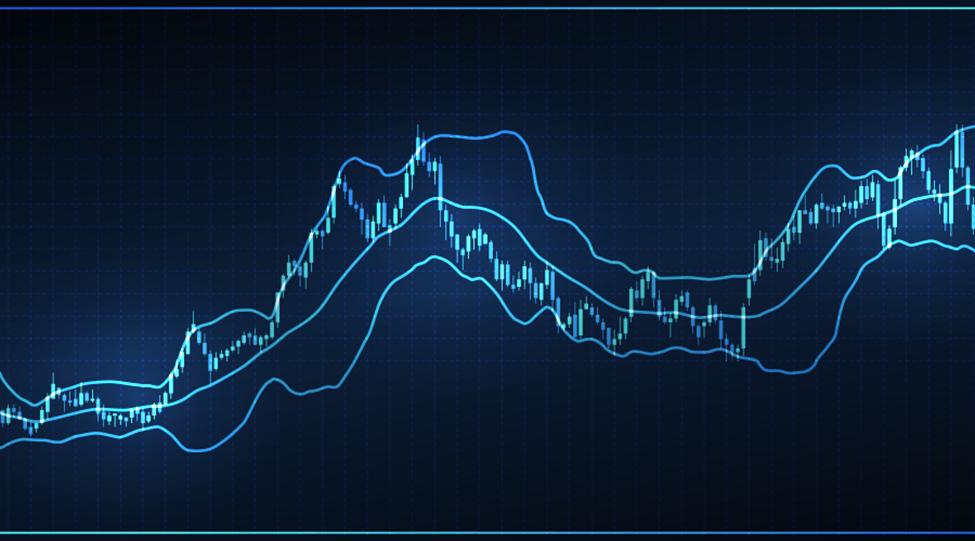

The Williams Alligator Indicator is essentially a momentum indicator, meaning it helps traders gauge the strength and direction of a prevailing trend in the market. It consists of three lines, each with its specific color and name:

- The Alligator’s Jaw (displayed as a blue line).

- The Alligator’s Teeth (depicted in red).

- The Alligator’s Lips (represented in green).

These lines are designed to work together cohesively and are based on smoothed moving averages of the price. Now, let’s delve deeper into how it functions.

How does it work?

The Alligator Indicator’s lines aren’t just colorful decorations on a chart; they have specific purposes:

- Alligator’s Jaw (Blue Line): This line represents a 13-period smoothed moving average that is offset by 8 bars into the future. It’s crucial for recognizing the “asleep” phase of the market.

- Alligator’s Teeth (Red Line): The red line signifies an 8-period smoothed moving average offset by 5 bars into the future. It plays a pivotal role in determining the “awakening” phase of the market.

- Alligator’s Lips (Green Line): The green line is a 5-period smoothed moving average that is offset by 3 bars into the future, indicating the “eating” phase of the market.

- To utilize the Alligator indicator in trading, traders should focus on three essential pieces of information. These can be incorporated into their trading strategy. Let’s examine them:

Sleeping Alligator

When the green, red, and blue lines are closely situated or intertwined, it suggests a lack of trend in the market.

Awakening Alligator

In this case, the red and blue moving averages are moving in the same direction, with the green moving average passing through them. Eventually, all three indicators move in the same direction, indicating an imminent trend formation.

Hungry Alligator

When the green line is positioned above the red line, and the red line is positioned above the blue line, this indicates an uptrend. Conversely, when the order is reversed (blue line on top, red line in the middle, green line at the bottom), it signifies a downtrend. An expansion of these lines confirms the direction of the trend.

Using the Williams Alligator Indicator

Using the Williams Alligator Indicator effectively in your trading strategies can be a valuable asset. Now that we understand what this indicator is and how it works, let’s explore how to use it in real-world trading scenarios:

Swing Trading:

Swing traders are those who aim to capture short to medium-term price movements in the market. The Williams Alligator Indicator can be a powerful tool for swing trading. Here’s how to use it:

- Identify Trend Reversals: Pay attention to the Alligator’s lines. When the Alligator’s Lips (green) crosses above the Alligator’s Teeth (red) and both lines cross above the Alligator’s Jaw (blue), it’s a strong signal of an uptrend.

Conversely, when the Lips crosses below the Teeth and both lines cross below the Jaw, it’s a sign of a downtrend. Swing traders can enter positions during these crossovers as they often indicate the beginning of a trend.

- Set Stop-Loss and Take-Profit Levels: Once you enter a trade based on the Alligator’s signals, set appropriate stop-loss and take-profit levels. These levels will help you manage risk and lock in profits as the trend develops.

- Monitor for Reversals: Continuously monitor the Alligator’s lines for signs of reversals. If the lines start converging, it might be a signal that the trend is losing momentum, and it may be a good time to exit your position to secure profits.

Day Trading:

Day traders focus on making quick, short-term trades within a single trading day. The Alligator Indicator can be particularly useful for day trading. Here’s how to apply it:

- Select Short Timeframes: Day traders often work with very short timeframes, such as 1-minute or 5-minute charts. The Alligator Indicator can provide quick signals in these timeframes.

- Execute Rapid Trades: Day traders may use Alligator signals for rapid buy and sell decisions, looking to capitalize on intraday price movements.

- Use in Conjunction with Other Indicators: Since day trading can be fast-paced and challenging, it’s common for day traders to use the Alligator Indicator in combination with other technical indicators and analysis techniques to confirm their trading decisions.

Long-Term Investing:

While the Alligator Indicator is typically associated with short and medium-term trading, it can also be used by long-term investors in the following ways:

- Market Entry: Long-term investors can use the Alligator Indicator to determine optimal entry points for their investments. They may wait for signals indicating the beginning of a new uptrend before entering a long-term position.

- Risk Management: Even long-term investors can benefit from monitoring the Alligator’s lines to spot potential trend reversals. This can help them make timely adjustments to their portfolios or implement hedging strategies to protect their investments.

Alligator Indicator Formula and Calculation

To calculate the lines of the Alligator Indicator, you’ll need to use a specific formula for each line. Here are the calculations for each of the Alligator’s lines:

- Alligator’s Jaw (Blue Line):

- Calculation: Smoothed Moving Average (SMA) over 13 periods, offset by 8 bars into the future.

- Formula: JAW = SMMA(Median price), offset by 8 bars.

- Alligator’s Teeth (Red Line):

- Calculation: Smoothed Moving Average (SMA) over 8 periods, offset by 5 bars into the future.

- Formula: TEETH = SMMA(Median price), offset by 5 bars.

- Alligator’s Lips (Green Line):

- Calculation: Smoothed Moving Average (SMA) over 5 periods, offset by 3 bars into the future.

- Formula: LIPS = SMMA(Median price), offset by 3 bars.

In these formulas, “Median price” refers to the highest and lowest prices of the bar. SMMA stands for Smoothed Moving Average, and the values are smoothed to provide a more stable representation of price movements.

The offset values (e.g., offset by 8 bars) determine the positioning of the lines into the future on the price chart, allowing traders to see potential trend changes.

What are some popular Alligator indicator strategies?

The Williams Alligator Indicator offers traders a range of strategies for identifying trends and potential entry and exit points in the financial markets. Here are some popular strategies that traders often use with the Alligator Indicator:

- Trend Following Strategy:

- This is the most common strategy with the Alligator Indicator. Traders look for strong trends by waiting for the Alligator’s lines to align in the direction of the trend (e.g., Lips above Teeth and Teeth above Jaw for an uptrend).

- Entry: Traders enter a trade in the direction of the trend when the Alligator’s lines confirm the trend.

- Exit: They exit when the lines start to diverge or when there are signs of a trend reversal.

- Breakout Strategy:

- Traders use this strategy to identify potential breakouts from consolidation or sideways patterns.

- Entry: They wait for the Alligator’s lines to converge, suggesting a period of consolidation. When the lines start to diverge again, it may indicate a potential breakout. Traders enter the trade in the direction of the breakout.

- Exit: Exit the trade when the lines start to converge again or when a reversal signal is detected.

- Scalping Strategy:

- Scalpers seek to profit from small price movements over short timeframes.

- Entry: Traders use very short timeframes and enter positions based on quick Alligator signals. This may involve a series of rapid trades within a single trading session.

- Exit: Scalpers often use tight stop-loss and take-profit levels and may exit a trade as soon as they achieve a small profit.

- Crossover Strategy:

- This strategy focuses on the crossovers of the Alligator’s lines.

- Entry: Traders look for crossovers (e.g., Lips crossing above Teeth and Teeth crossing above Jaw) as potential signals of a trend change.

- Exit: Exit when there’s a crossover in the opposite direction or when other confirming signals suggest a trend reversal.

- Multiple Timeframe Analysis:

- Traders may use the Alligator Indicator on multiple timeframes to confirm trends. For example, they might use a longer timeframe for trend identification and a shorter one for entry and exit signals.

- Combining with Other Indicators:

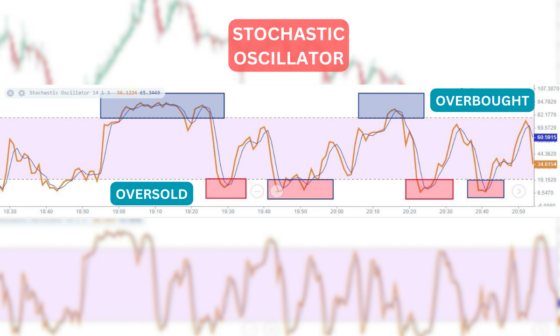

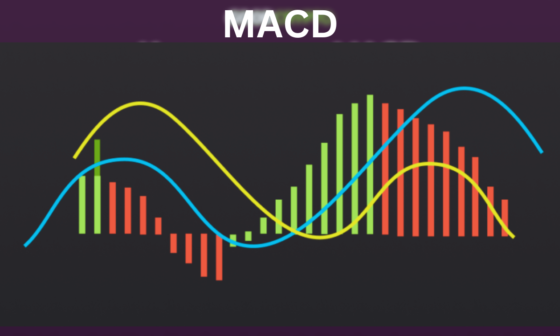

- Many traders combine the Alligator Indicator with other technical indicators, such as the Relative Strength Index (RSI), Moving Averages, or the Stochastic Oscillator, to improve the accuracy of their trading decisions.

- Long-Term Investment Strategy:

- Some investors use the Alligator Indicator to make long-term investment decisions, entering positions in assets like stocks or cryptocurrencies when the indicator signals a strong trend.

It’s essential to remember that no single strategy is foolproof, and traders must adapt their approach to different market conditions.

Additionally, using proper risk management techniques, such as setting stop-loss and take-profit levels, is crucial when implementing any Alligator Indicator strategy to minimize potential losses and maximize profits.

Test the Bill Williams Alligator in Action

The below chart is BTCUSD, 1D time frame.

Here, first, we see a downtrend, and then we see a small pullback. And again after a crossover, the downtrend continues resulting in a rest and further downtrend as mouth open.

And after a long consolidation that is rest. We finally can see the bull trend as the mouth opens. In this way, we can use William’s indicator for long-term trading.

Example of alligator strategy in forex market

This indicator works the same in any financial market. We will see GBP/USD in a smaller time frame.

Dropping down to a lower time frame of 15 min. Seeing the indicator works well in Forex trading, as well as in any time frame.

Using alligator with other indicators

Combining the Alligator Indicator with other technical indicators is a common practice among traders to enhance the accuracy of their trading decisions and to confirm potential trade signals.

By using multiple indicators, traders can gain a more comprehensive view of market conditions. Here are some ways to effectively use the Alligator Indicator in conjunction with other indicators:

Moving Averages:

- Combine the Alligator Indicator with other moving averages, such as the Exponential Moving Average (EMA) or Simple Moving Average (SMA). When the Alligator lines cross and align with the direction of a moving average, it can provide stronger confirmation of a trend.

Relative Strength Index (RSI):

- The RSI is a momentum oscillator that measures the speed and change of price movements. Combining it with the Alligator Indicator can help traders gauge overbought or oversold conditions.

Fibonacci Retracement Levels:

- Fibonacci retracement levels are used to identify potential support and resistance levels. Combining them with the Alligator Indicator can help identify entry and exit points.

- Traders may look for Alligator signals in the vicinity of key Fibonacci levels (e.g., 38.2%, 50%, or 61.8%) to strengthen their trading decisions.

Benefits and Limitations:

Before relying solely on the Alligator Indicator, it’s essential to consider its benefits and limitations:

Benefits:

- The Alligator Indicator is relatively simple to use and provides clear signals for identifying trends.

- It can be used in conjunction with other technical analysis tools and indicators to enhance trading strategies in any financial market.

Limitations:

- Like all technical indicators, the Alligator Indicator is not foolproof and may give false signals, especially in choppy or sideways markets.

- It’s crucial to use the indicator in combination with other confirming signals and thorough market analysis for more reliable results.

Conclusion

In conclusion, the Williams Alligator Indicator is a valuable asset for traders in the complex world of financial markets. This indicator, created by Bill Williams, serves as a guidepost for identifying trends and making well-informed trading decisions.

By understanding the distinct roles of the Alligator’s three lines and how they interact, traders can navigate the often turbulent waters of trading with greater confidence.

Frequently Asked Questions

1. Is the Williams Alligator Indicator suitable for beginners?

- Yes, the indicator is relatively easy to understand and can be used by traders of all levels.

2. Can I rely solely on the Alligator Indicator for trading decisions?

- While it’s a valuable tool, it’s recommended to use it in conjunction with other indicators and analysis methods.

3. Are there any specific timeframes the indicator works best with?

- The indicator can be used with various timeframes, but its effectiveness may vary.

4. How can I avoid false signals from the Alligator Indicator?

- It’s important to use the indicator in conjunction with other confirming signals and analysis.

5. Can the Williams Alligator Indicator be used in cryptocurrency trading?

- Yes, it can be applied to cryptocurrency markets like traditional financial markets. However, it’s important to adapt your strategy to the crypto market’s unique characteristics.