Ed Seykota is a legendary figure in the world of trading and is known as one of the market wizards. His life and trading strategies have not only left an indelible mark on the financial industry but have also inspired countless traders and investors.

Let’s delve into the life of Ed Seykota and explore his pioneering trend-following trading strategies.

The Life of Ed Seykota

Born in 1946, Ed Seykota grew up to become a prominent figure in the field of commodities trading. He is best known for his trend-following approach, which involves identifying and capitalizing on market trends.

Seykota’s journey into trading began in the 1970s when he worked at a traditional major brokerage firm. However, his thirst for knowledge and innovative thinking led him to develop his own trading system.

Ed Seykota’s academic journey led him to study electrical engineering and management. These disciplines provided him with a strong foundation in mathematical concepts and analytical thinking. Little did he know that these skills would later play a crucial role in his remarkable career in the world of trading.

His early exposure to computer programming further sharpened his analytical abilities. As he honed his skills in this domain, he developed a keen interest in using technology and quantitative methods to solve complex problems. This early experience with computers would be a significant advantage in his future career as a trader.

These formative years of education and skill development set the stage for Ed Seykota’s journey into the world of finance and trading. His combination of mathematical acumen, management knowledge, and proficiency in computer programming would prove to be invaluable assets as he embarked on a path that would eventually lead him to become a trading legend.

This innovative approach allowed him to analyze vast amounts of historical data and develop trading systems based on quantitative analysis. He had his own trading style.

Ed Seykota’s trading rules

Ed Seykota, a prominent figure in the world of trading known for his trend-following strategies, has outlined several trading rules that have guided his approach to the markets. These rules emphasize risk management, discipline, and systematic trading. Here are some of Ed Seykota’s trading rules:

-

Cut Losses Short, Let Profits Run: This rule encapsulates Seykota’s trend-following philosophy. He suggests swiftly exiting losing trades to limit potential losses and allowing profitable trades to continue as long as the trend remains intact growing their trading account.

-

Use Stops: Seykota emphasizes setting stop-loss orders to protect trading capital. Stops are predetermined price levels at which a position is automatically exited if the market moves against the trade.

-

Risk a Consistent Percentage: Seykota advises risking a consistent percentage of capital on each trade. This helps maintain a balance between risk and potential return. This is a crucial role of becoming a winning trader from a losing trader while mastering risk control.

-

Diversify: Seykota suggests diversifying a trading portfolio to spread risk. Trading in various markets, for example, futures markets or asset classes can reduce the impact of a single asset’s poor performance.

-

Quantitative Analysis: Seykota is a proponent of quantitative analysis. He recommends using data and historical price information to develop trading systems and make informed decisions, while you can use speculative accounts.

-

Psychological Discipline: Maintaining emotional discipline is crucial in trading. Seykota advises traders to adhere to their trading systems and avoid making impulsive decisions driven by fear or greed.

-

Review and Learn: Regularly review and analyze your trades. Seykota encourages traders to keep a trading journal to learn from both successful and unsuccessful trades.

-

Adapt to Changing Markets: Markets can evolve, and what works in one period may not work in another. Be prepared to adapt your strategies to changing market conditions.

-

Trend Identification: Develop a systematic approach to identifying trends. Whether through technical or quantitative analysis, Seykota suggests having clear criteria for recognizing trends and potential trend reversals.

These trading rules reflect Ed Seykota’s systematic and disciplined approach to trading. They highlight the importance of risk management, emotional discipline, and quantitative analysis in achieving success in the financial markets. Traders often draw inspiration from Seykota’s rules as they seek to master the art of trading.

Ed Seykota’s Trading Strategies

Market Wizard Ed Seykota is renowned for his trend-following trading strategy, which he developed throughout his successful trading career. This strategy is based on the principle of identifying and capitalizing on market trends. Here’s an overview of Ed Seykota’s trading strategy:

1. Trend Identification:

-

Seykota’s approach begins with identifying trends in the market. These trends can be either upward (bullish) or downward (bearish). He believes that markets move in discernible trends that can be profitable if identified correctly. After every crash there comes an inevitable bull market.

2. Ride the Trend:

-

Once a trend is identified, Seykota’s strategy involves “riding the trend.” This means that when a trader places a trend in a particular asset, they should maintain a position as long as that trend remains intact. The goal is to capture the maximum profit as the trend progresses.

3. Cut Losses Short:

-

In contrast to letting winning trades run, Seykota emphasizes cutting losses short. If a trade moves against the trader, he suggests swiftly exiting the position to limit potential losses. This rule is essential for effective risk management.

4. Quantitative Analysis:

-

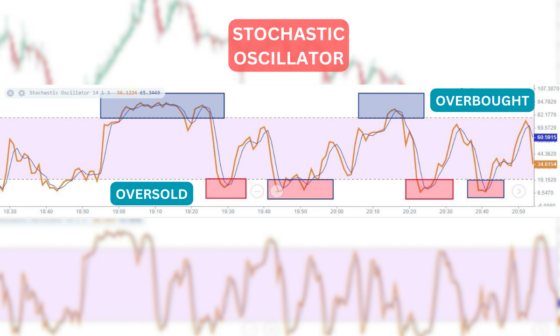

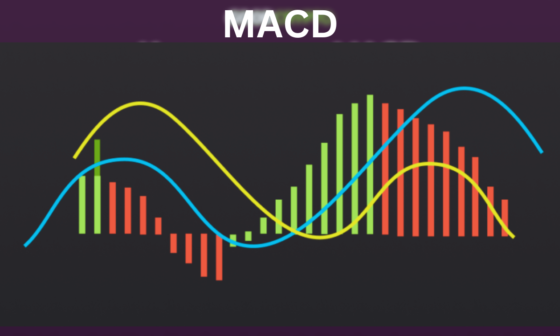

Seykota employs quantitative analysis, which involves using historical market data and technical indicators to make trading decisions. This data-driven approach helps in determining entry and exit points for trades.

5. Risk Management:

-

Effective risk management is a critical component of Seykota’s strategy. He suggests risking a consistent percentage of capital on each trade, which helps control risk and prevents significant drawdowns.

6. Diversification:

-

Seykota diversifies his trading portfolio, spreading risk across various markets or asset classes. Diversification ensures that poor performance in one asset doesn’t have a catastrophic impact on the overall portfolio.

7. Emotional Discipline:

-

Emotional discipline is fundamental in Seykota’s strategy. He advises traders to stick to their trading systems and avoid impulsive decisions driven by fear or greed. This discipline helps traders make rational decisions based on their predefined rules.

8. Adaptation to Changing Markets:

-

Seykota acknowledges that markets can change, and a strategy that works in one period may become less effective in another. He encourages traders to adapt their strategies to evolving market conditions.

9. Position Sizing:

-

Determining the appropriate position size for each trade is crucial. Seykota suggests that position size should be based on risk tolerance, market conditions, and the potential for profit.

Ed Seykota’s trading strategy is known for its systematic and disciplined approach. By following these principles, traders can aim to capture significant profits during strong trends while limiting losses during unfavorable market conditions.

A trader may have months of losing streak and losing money that may also lead them to think stop trading. Market wizards like Ed seykota and many other traders are inspiration for such youth. Implementing all this rules in their trading career can result them into being a consistently profitable trader. Many students of seykota’s are trend followers, long term trend follower, etc. One should implement this rules and have strict trading rules.

His quantitative approach and emphasis on risk management and emotional discipline have made him a respected figure in the trading community, inspiring many to adopt similar strategies.

What market did Ed Seykota trade?

Ed Seykota traded a variety of financial markets during his trading career. His approach to trading was diversified and adaptive, allowing him to trade in multiple markets and asset classes. While he was known for his trend-following strategies, his trading activities included:

-

Commodity Futures: Seykota actively traded commodity futures contracts, including those for agricultural products like grains and soft commodities, energy commodities, and metals.

-

Stock Market: He also traded in the stock market, participating in equities trading. This involved buying and selling shares of publicly traded companies.

-

Currency Markets (Forex): Seykota traded in the foreign exchange (Forex) market, which involves the exchange of one currency for another. Forex trading allows traders to speculate on the value of different currencies.

-

Fixed Income: Additionally, he traded in fixed income markets, including government bonds and other debt securities.

His ability to adapt his trading strategies to various markets and asset classes contributed to his success as a trader. This diversification allowed him to reduce risk and seize opportunities in different financial instruments. His trend-following philosophy remained a constant in these markets, as he focused on identifying and capitalizing on market trends, whether they were bullish or bearish.

Lessons from Ed Seykota

Ed Seykota’s life and career offer a wealth of insights and lessons for traders, both novice and experienced. Here are some key takeaways:

-

Trend Following Philosophy: Seykota’s fundamental principle was trend following. He believed that the best way to trade was to identify existing trends and ride them. This approach emphasizes the importance of analyzing historical price data to make informed trading decisions.

-

Discipline is Key: Seykota’s disciplined approach to trading was a defining characteristic of his success. He adhered to his trading system and did not let emotions interfere with his decisions. This highlights the significance of maintaining discipline and sticking to a well-defined trading plan.

-

Systematic Approach: Ed Seykota was known for his systematic approach to trading. He developed a comprehensive trading system that allowed him to filter out market noise and focus on high-probability trades. Traders can learn from his commitment to systematic and structured trading.

-

Emotional Control: The ability to manage emotions in trading is a skill that Seykota mastered. Emotions can cloud judgment and lead to impulsive decisions. Ed Seykota’s calm and emotionally intelligent approach serves as a valuable lesson for traders seeking to maintain a level head during market volatility.

-

Continuous Learning: Seykota was a lifelong learner. He never stopped improving his trading skills and adapting to changing market conditions. Traders can benefit from his commitment to staying informed and evolving with the markets.

-

Long-Term Perspective: Ed Seykota’s success was not built on quick, speculative gains. He demonstrated the value of taking a long-term perspective in trading. This means focusing on consistent, sustainable profits rather than chasing short-term trends.

-

Risk-Reward Ratio: Understanding the risk-reward ratio was essential to Seykota’s strategy. He assessed potential risks and rewards before entering any trade. Traders can learn to calculate and consider risk-reward ratios in their trading decisions.

-

Technical Analysis: Ed Seykota heavily relied on technical analysis. Learning how to interpret charts and indicators can be a valuable skill for traders looking to emulate his approach.

In conclusion, Ed Seykota’s life and trading strategies offer a treasure trove of lessons for traders. Whether it’s embracing trend following, maintaining discipline, or managing risk, his principles can guide traders on the path to success in the dynamic world of financial markets.

Frequently Asked Questions

Who is Ed Seykota?

Ed Seykota is a renowned trader known for his trend-following strategies and contributions to the field of finance.

What are the key principles of trend following?

Trend following involves identifying and riding major market trends by analyzing historical price data.

What is Ed Seykota’s famous trading mantra?

Seykota’s famous saying is “ride your winners and cut your losses,” highlighting the importance of effective risk management.

What is the legacy of Ed Seykota in the trading world?

Ed Seykota’s legacy includes inspiring traders to adopt disciplined, systematic, and emotionally intelligent approaches to trading.

What tools and resources are available to modern traders for trend following?

Modern traders have access to online platforms, technical analysis software, and educational resources to aid in trend following.

Conclusion

Ed Seykota’s life and trend following systems & trading strategies have left an indelible mark on the world of finance. His disciplined, systematic, and emotionally intelligent approach to trading serves as an inspiration to traders of all levels.

One of the most valuable lessons from Ed Seykota is the significance of discipline and systematic trading. His ability to adhere to a well-defined trading system, manage risk effectively, and control emotions served as a blueprint for trading success. The principles he advocated, such as “ride your winners and cut your losses,” have become fundamental tenets of risk management in trading.

Moreover, Seykota’s emotionally intelligent approach to trading is a reminder of the importance of maintaining composure during market volatility, making rational decisions, and avoiding emotional biases.

His enduring influence continues to guide traders of all levels, from novices to seasoned professionals. The legacy of Ed Seykota is a testament to the power of disciplined, systematic, and emotionally intelligent trading approaches to follow rules, which have stood the test of time in the dynamic world of financial markets.

As traders embark on their own journeys, the wisdom and principles of Ed Seykota serve as a source of inspiration and guidance, reminding them that with dedication and the right mindset, they too can achieve success in the world of trading.