There are quite a few technical indicators and trading strategies that help forex investors to speculate about market trends. Some are intended to identify the right entry and exit points while others intend to pick the right stocks at the right time.

When it comes to Andrews Pitchfork, it’s designed to explain the market reversal points and the trend trading strategies. The Pitchfork indicator has a command on identifying stop-loss occasions by predicting protracted market swings. To get into more details, read ahead:

Andrews Pitchfork Explained

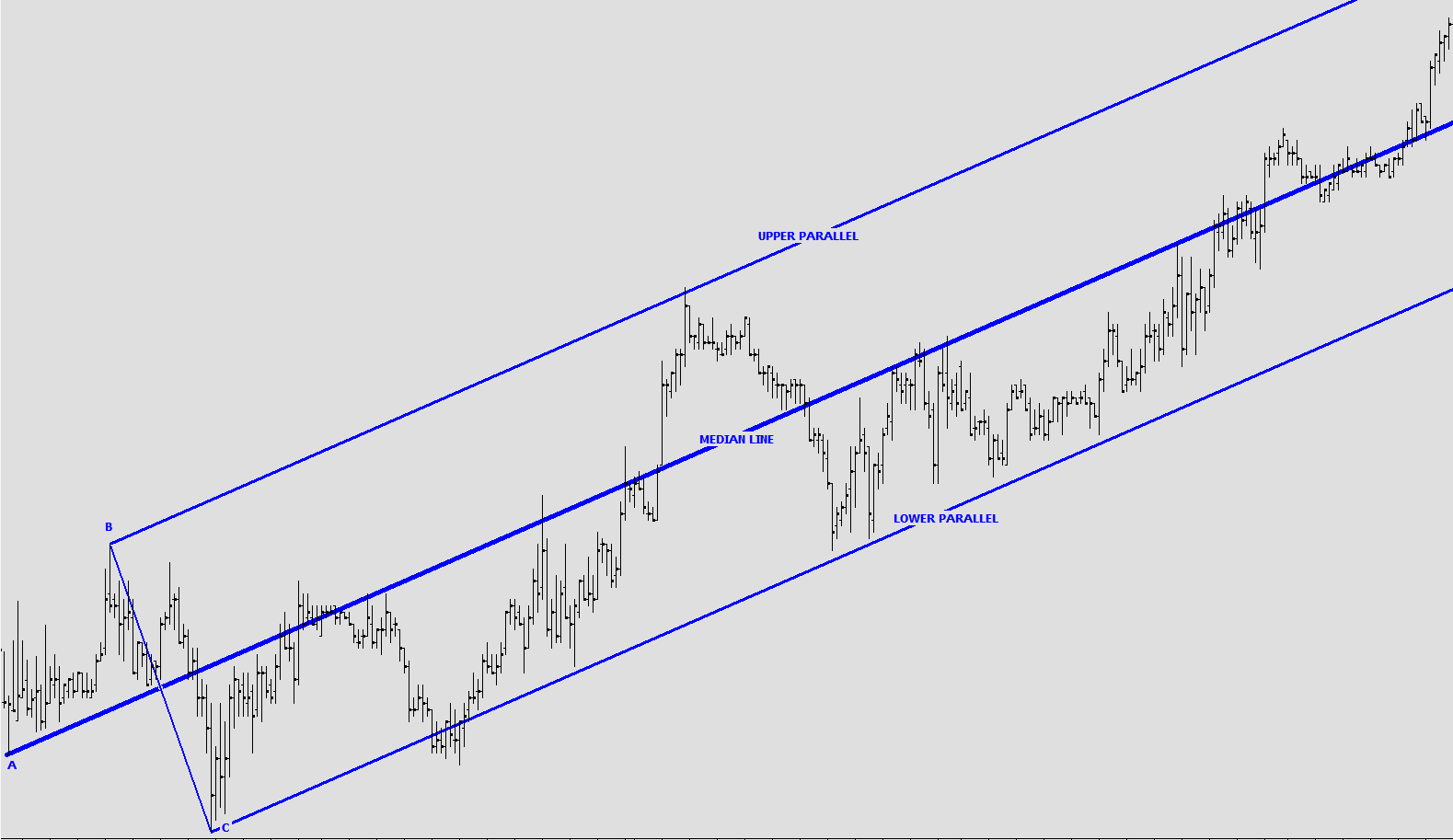

Designed by Alan Andrews, this indicator works on trendlines that are made with combinations of 3 points at the beginning of trends i.e. lower or higher. The three parallel trend lines are created after placing the 3 points consecutively as troughs and peaks followed by passing a ‘median line’ from the first point to the middle point. The lower and upper trend lines are then created parallel to that median line.

How to Calculate Andrews Pitchfork?

Andrews Pitchfork also deploys trigger lines or parallel trend lines that start from the median line (the inception price) and pass through other points.

The lower trigger line joins 1 and 2 points with a downward slope, showing a falling Andrew’s Pitchfork trend. Trend signals so created against these trigger lines work well after the price breaks/intersects the Andrews Pitchfork’s lower or upper trend line.

As a result, breakouts happen that behave differently on different occasions. Breakouts, occurring above the upper trigger line, demonstrate an upside situation or vice versa.

In summation, Andrews Pitchfork can be explained as follows:

-

Higher trend lines show the increasing price of a stock in the market

-

Lower trend lines show the supporting price of a stock in the market

-

As the security price decreases and reaches the lowest spot on the trend line, an investor can go into an extended position to reduce loss.

-

As the security price increases and reaches the highest spot on the trend line, an investor can go into a short position to earn maximum profit.

Methods of Trading with Andrews Pitchfork

Trading Within the Lines

As soon as the stock’s price begins to increase and moves towards the upper trigger line or beyond the original trendline, there is no more rising-buying movement on the price chart. There will be a Doji candlestick formation to confirm the downtrend.

Here, traders have to decide the entry point from the three parallel lines as soon as the price decreases, which means the point should be below the third trend line. Afterward, when the downtrend occurs, the entry order comes into action and causes the price to move toward the median line.

As a result, investors can rest assured of earning profits thanks to Andrews Pitchfork’s trading within-the-line strategy.

Step-By-Step Method Guide

-

Start by identifying the price action occurring through the middle line that moves towards its upper part.

-

Check the resistance point at the uppermost end and figure out if any candlestick pattern occurs.

-

Use the candlestick pattern to confirm the price decline.

-

Place a new market entry position right below the end of the final candlestick pattern/trendline.

-

Last but not least, put a stop loss point above the entry-level, that too at least 50 pips or more.

Trading Outside the Lines

Another way of using Andrews Pitchfork’s strategy is by trading outside the parallel trend lines.

While this method is not as commonly used as trading within the trend lines, it still has the potential to earn incredible profits in the financial market.

Investors usually assume to see stock prices going back to their median line, without even considering that the possibility to shift the direction is also there. This may result in causing significant losses that would be a bit hard to deal with.

Therefore, to avoid such circumstances, traders are recommended to focus on market retracements as well as support and resistance levels. They must keep an eye on adverse price movements and end the trade a bit before the time so that everything remains in their favor.

Step-By-Step Method Guide

-

Pay close attention to price movements and pick the one going towards the median line.

-

Choose falling prices that have the potential to move back towards the upper trendline.

-

Always highlight the support and resistance points in the price chart.

-

The entry order must be placed after 30 pips (at least) from the support level to secure profits.

-

Use a price oscillator to confirm the position.

-

Go with the flow.

What Does Andrews Pitchfork Explain?

Precisely, Andrews Pitchfork works by guiding traders about when to buy or sell stocks/securities.

Buying happens when the stock’s price closes near the support of the lower trend line or the median line. On the other hand, selling happens when the price approaches the resistance of the upper trendline or the median line.

While the median line helps to identify favorable spots for support and resistance, it doesn’t tend to be as efficient as the lower trigger line and upper trend line. This is where this technical indicator comes to action as it helps to identify ideal spots for stop-loss orders.

Support and Resistance

Entering a long position in Andrews Pitchfork refers to a situation when the asset’s price touches the lower trend line. On the other hand, a short position could be considered when the price touches the upper trend line.

Investors can think of claiming all or partial profit when the security price moves to the opposite side of Andrews Pitchfork.

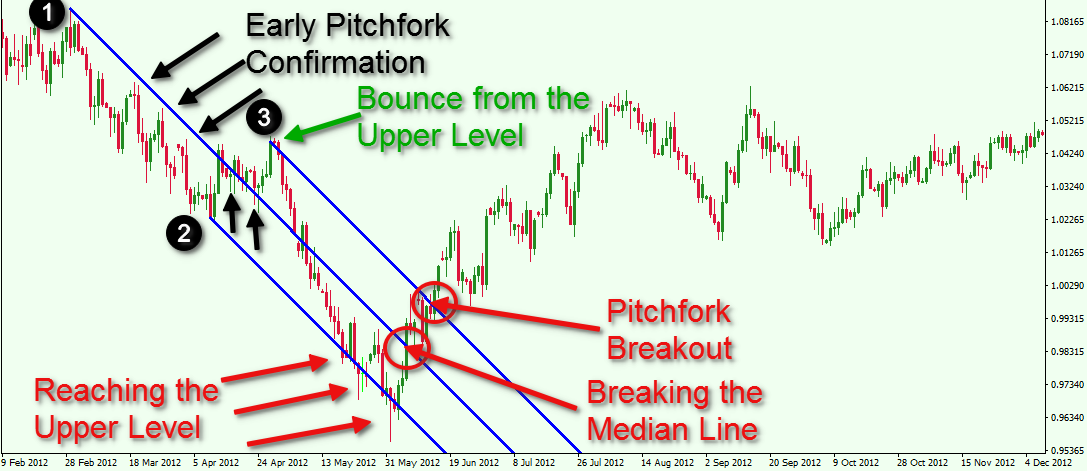

Trending Markets- Breakdowns and Breakouts

Traders can use Andrews Pitchfork to trade breakdowns and breakouts below the lower line and above the upper line respectively.

Investors must pay attention to the results of this bilateral strategy and combine them with other indicators to evaluate the weakness or strength of the breakdown or breakout.

Methods to Use the Andrews Pitchfork

Andrews Pitchfork has identified favorable levels that eventually help to anticipate the next steps. Once it’s added to the price chart, traders can use it for the following purposes:

Levels As Entry Points

Here the four lines on the price chart are considered as entry points. If the price falls below the median line, it directs traders to make selling decisions i.e. refers to a major selling point. On the contrary, if the price rises above the median line, it becomes a major buying point.

Trend Confirmation

Secondly, Andrews Pitchfork can be used as a trend confirmation assistant where traders can identify the support levels as per their movement. If the price flows above the median line, it sends bullish signals. Here, traders have to keep an eye on the median line- if it falls above the price, it’s crucial to keep an eye on the 1st resistance level and so on.

Shorting

In case a trader wants to shorten an asset at the 2nd resistance, the Andrews Pitchfork may be a useful method as it highlights the 1st resistance as the profit target. Later on, they can check the median line and other elements.

In Combination with Fibonacci Retracement

Probably, the best method to use Andrews Pitchfork is to combine it with other technical indicators.

One such tool is the Fibonacci Retracement which masters in identifying potential reversals. With that being said, drawing both tools on the price chart can simplify the task of finding potential buying and selling positions.

Other Than the Fibonacci Retracement

Traders can also employ the Andrews Pitchfork with technical analysis indicators like the RSI and moving averages (MAs).

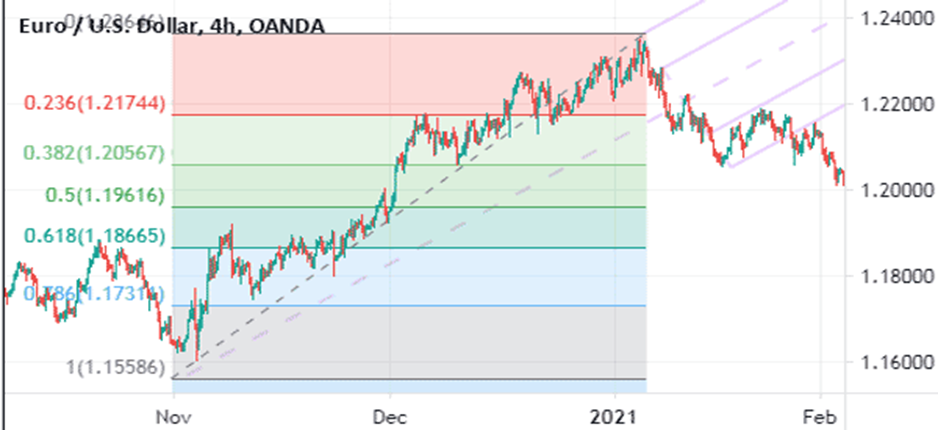

The following price chart shows combined results from the Fibonacci, 25-day exponential MA, and the Andrews Pitchfork. The currency pair will show a bullish trend until it’s above the MA. There will be an exit signal as soon as the trend falls below the moving average.

Pending Orders

Last but not least, the Andrews Pitchfork can be used efficiently with pending orders. Considering the above chart, traders may create a buy-stop pattern over the 1st support and a stop-loss order at the median line. In that case, there will be a stop trade when the price falls over the support level and will stop as soon as it touches the median spot.

Conclusion

All in all, it can be said that Andrews Pitchfork has emerged as a reliable source to identify profitable opportunities for currency traders.

Whether in the intermediate or longer term, the Pitchfork indicator can help investors claim more profits than they did without using any other technical indicator.

When combined with authentic technical analysis and specified money management strategies, Andrews Pitchfork can let the investors isolate setups while controlling price action in the financial market.

By identifying support and resistance levels, Andrews Pitchfork can help investors know when is the right time to play or enter the trade and when they shouldn’t invest in any asset. This way, the trade can promise more profitability, considering that all the above-mentioned criteria are met.