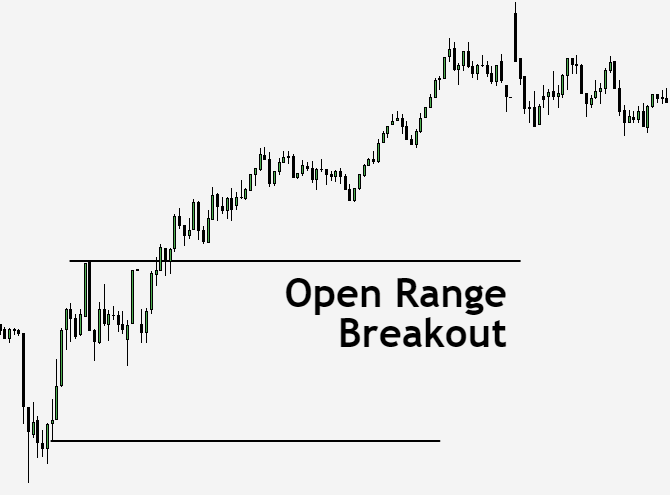

In the world of trading, having a reliable strategy is crucial for success. The Opening Range Breakout (ORB) strategy is a popular technique used by traders to take advantage of the early price movements that occur during the opening minutes of a trading session.

By focusing on breakouts above or below the established opening range, traders can identify potential trading opportunities and ride the momentum of the market.

In this article, we will delve into the principles and implementation of the ORB strategy, providing you with a valuable tool to enhance your trading endeavors.

Understanding the Opening Range Breakout Strategy

The Opening Range Breakout strategies are based on the concept that significant price moves often occur when the market breaks out of the established opening range. The opening range refers to the high and low prices that are established within a specific time window after the market opens, usually referred as early morning range breakout.

The opening hour of the market is associated with big trading volumes and volatility. This time of the trading session provides many trading opportunities.

Traders look for breakouts above the high or below the low of this range, considering them as potential entry points for trades. This strategy aims to capture the initial surge of momentum and take advantage of the subsequent price movements.

Benefits of the Opening Range Breakout Strategy

The ORB strategy offers several benefits that make it an attractive approach for traders:

- Simplicity

The ORB strategy is relatively simple to understand and implement, making it accessible to traders of all experience levels. It focuses on a specific time window and clear breakout levels, providing a straightforward approach to identifying potential trades.

- Timeliness

By concentrating on the opening range price, the ORB strategy allows traders to take advantage of the most volatile and potentially profitable periods in the market. This is when the market tends to experience heightened activity and significant price movements, offering lucrative trading opportunities.

- Clear Entry and Exit Points

The ORB strategy provides clear entry and exit points for traders. When a breakout occurs above the high or below the low of the opening range, it serves as a signal to enter a trade. Traders can set specific entry orders accordingly.

Similarly, stop-loss orders can be placed below the breakout level for long trades or above the breakout level for short trades, providing a predefined exit point if the trade doesn’t go as anticipated. This clarity helps traders manage their positions effectively.

Risk management is a crucial aspect of trading, and the ORB strategy allows traders to implement it effectively. By setting stop-loss orders, traders can limit their potential losses if the trade moves against them. The predefined exit points provide a structured approach to managing risk and protecting capital.

- Scalability

One of the advantages of the ORB strategy is its scalability. It can be applied to various markets, such as stocks, commodities, forex, and indices. Traders can choose the market that aligns with their trading preferences and exhibits sufficient liquidity and volatility during the opening minutes of the trading session.

Additionally, the strategy can be adapted to different timeframes, catering to the trading style and goals of individual traders.

Step-by-Step Guide to Implementing the Opening Range Breakout Strategy

To effectively implement the ORB strategy, follow these steps:

-

Selecting a Suitable Market and Timeframe

Start by selecting a market that aligns with your trading goals and preferences. The above chart has a bearish gap. Consider factors such as liquidity, volatility, and trading hours. Additionally, choose a timeframe for defining the opening range that suits your trading style. Commonly used timeframes are 5 minutes, 15 minutes, or 30 minutes.

-

Defining the Opening Range

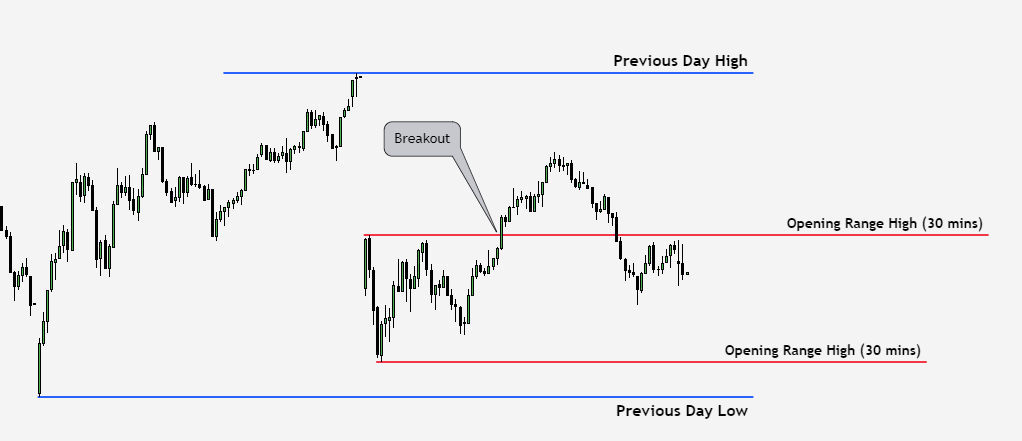

Once you have selected the market and timeframe, determine the duration of the opening range. For example- Mark the 15m or 30m first candle. And go on a lower time frame like 1m-3m-5m.

This is the time window within which you will identify the high and low prices. Typically, the opening range low and high is established within the first few minutes of the trading. Monitor the price action during this period and record the highest and lowest prices reached.

-

Identifying the Breakout Levels

With the opening range defined, you can now identify the breakout levels. If the price breaks above the high of the opening range, it indicates a potential bullish breakout. Conversely, if the price breaks below the low of the opening range, it signifies a potential bearish breakout. These breakout levels will serve as entry points for your trades.

-

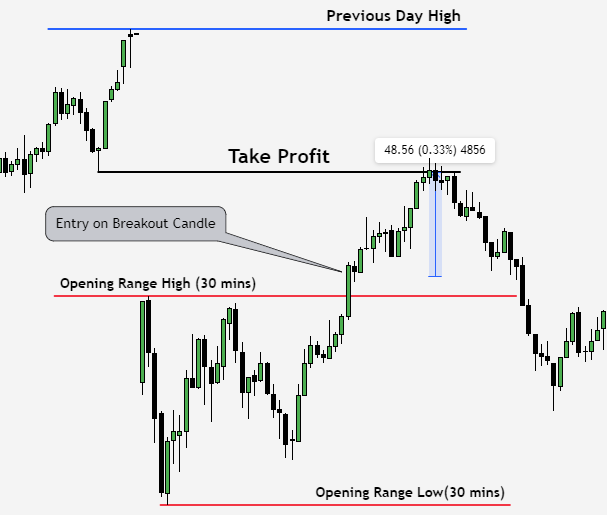

Placing Entry and Exit Orders

Once the breakout levels are identified, it’s time to place your entry and exit orders. For a long trade, you would place a buy order above the high of the opening range. For a short trade, you would place a sell order below the low of the opening range.

Set your stop-loss order below the breakout level for long trades or above the breakout level for short trades to manage risk. Additionally, consider setting a take-profit order to secure profits when the price reaches a favorable level like the closing gap and the previous day’s high and low.

Especially if the gap size is big or very close enough you can easily look closing gap reversal which also depends on where the breakout candle occurs.

-

Managing Risk and Reward

Effective risk management is essential in trading. Determine your risk tolerance and ensure that the potential reward justifies the risk taken for each trade. Set appropriate stop-loss levels to limit potential losses and protect your capital.

Consider using a favorable risk-to-reward ratio, aiming for a higher potential reward compared to the risk undertaken.

Best Practices for Successful Implementation

To enhance your success with the ORB strategy, consider the following best practices:

Patience and Discipline

Patience and discipline are crucial traits for successful trading. Stick to your predefined rules and wait for the breakout to occur within the opening range before entering a trade. Avoid impulsive decisions based on emotions or short-term price fluctuations. Exercise patience and let the market confirm the breakout before taking action.

Confirmation and Filters

While the strategy provides a straightforward approach, it can be enhanced by using confirmation indicators or filters. Consider incorporating technical indicators such as moving averages, trend lines, or volume analysis to confirm the breakout signals. These additional signals can increase the probability of a successful trade by providing additional validation.

Most beginners try to trade opening range breakouts, one should wait for 5-30 minutes of the trading range and wait for the breakout candle.

Adapting to Market Conditions

Market conditions are dynamic and can change rapidly. It’s crucial to adapt your trading strategy accordingly. Stay informed about the latest market developments, including news events, economic releases, and overall market sentiment.

Adjust your approach if necessary to align with the prevailing conditions. Flexibility and adaptability are key to long-term trading success.

Case Study: Applying the ORB Strategy to NASDAQ

To provide a practical example, let’s consider applying the ORB strategy to NASDAQ. After identifying the opening range and breakout levels, you execute a long trade when the price breaks above the high of the opening range in the lower time frame like 1m or 5m. You set a stop-loss order below the breakout level to manage risk. The picture above basically depicts the chart pattern gap pullback.

As the price continues to rise, you trail your stop-loss order to protect profits. Finally, when the price reaches your predetermined take-profit level, you exit the trade with a profit. Here we keep our Take Profit where the Volume Gap is filled.

This case study showcases how the ORB strategy can be applied in real-life trading scenarios.

Key Takeaways:

1. The Opening Range Breakout (ORB) strategy is a simple yet effective approach for trading the markets, especially during the early minutes of a trading session.

2. The strategy involves identifying the opening range, which is the high and low prices within a specific time window after the market opens, and then executing trades when the price breaks out above or below the opening range.

3. Patience and discipline are crucial when implementing the ORB strategy. Wait for a confirmed breakout and avoid impulsive decisions based on short-term price fluctuations and keep trailing your Stop loss.

4. Incorporating confirmation indicators or filters, such as moving averages or volume analysis, can enhance the ORB strategy by providing additional validation for breakout signals.

5. Adaptability to changing market conditions is essential. Stay informed about market developments, adjust your strategy if necessary, and align your trades with the prevailing market sentiment.

6. Most of the time, price breaks in the same direction of the gap it created in its first hour. Trading the opening range breakout strategy could be the best option.

Conclusion

The Opening Range Breakout (ORB) strategy is a simple yet powerful approach for traders to capitalize on the early momentum and breakouts that occur during the dynamic period of a trading session. By defining the opening range, identifying breakout levels, and implementing proper risk management techniques, traders can enhance their trading success.

Remember to exercise patience, discipline, and adaptability to market conditions for consistent results. The ORB strategy provides clear entry and exit points, allowing traders to effectively manage their positions. Combine this strategy with proper risk management and validation techniques for optimal results in your trading endeavors.

Frequently Asked Questions (FAQs)

-

What markets are suitable for the Opening Range Breakout strategy?

The ORB strategy can be applied to various markets, including stocks, commodities, forex, and indices. Choose markets that exhibit sufficient liquidity and volatility during the opening minutes of the trading session.

-

What is the recommended timeframe for the ORB strategy?

The timeframe for the ORB strategy depends on your trading style and preferences. Commonly used timeframes include 5 minutes, 15 minutes, or 30 minutes for defining the opening range. Choose a timeframe that aligns with your trading goals and provides sufficient price movement during the opening minutes of the session.

-

How can I manage risk when implementing the ORB strategy?

Risk management is crucial in trading. Set appropriate stop-loss orders to limit potential losses. These orders should be placed below the breakout level for long trades and above the breakout level for short trades. Additionally, consider your risk tolerance and ensure that the potential reward justifies the risk taken for each trade.

-

Can I combine the ORB strategy with other trading indicators?

Yes, you can combine the ORB strategy with other trading indicators to further enhance your trading decisions. Technical indicators such as moving averages, RSI (Relative Strength Index), MACD (Moving Average Convergence Divergence), or Bollinger Bands can provide additional insights and confirmation signals.

For example, you can use a moving average to determine the overall trend direction. If the price breaks out above the opening range and is also above a rising moving average, it could provide additional confirmation for a bullish trade. Similarly, if the price breaks below the opening range and is below a declining moving average, it could confirm a bearish trade setup.