There are many technical indicators to choose from to understand patterns in the market. Many traders usually combine the power of two indicators to improve their ability to spot trading opportunities. This is quite common in trading because traders who are adaptable to various tools and indicators get an edge over others as they can adjust their trading strategy depending on market conditions. Bollinger Bands RSI strategy comprises two of the most well-known indicators. When used properly, they form a formidable pair that can significantly boost any trader’s account balance.

Keep reading to learn more about this potent combo of indicators.

What is the Need to Combine Bollinger Bands and RSI?

You might be curious how Bollinger Bands and RSI relate to one another and why we should combine them. Firstly, it’s important to note that this pair is already well-known among traders, indicating that it is compatible and capable of providing relatively dependable signals. However, the fact that Bollinger Band is a lagging indicator and RSI is a leading one makes these two indicators work perfectly together.

The purpose of leading indicators is to predict prospective price movements. As a result, it provides a signal before something takes place. The disadvantage is that they are frequently not as reliable because there is a possibility that they will send out false signals.

In contrast, lagging indicators use historical prices and provide the signal after an event has occurred. Lagging indicators are, therefore, frequently more dependable, but the downside is that you are prone to join the game late.

Now, doesn’t it make sense to combine them so they can complement one another’s shortcomings?

Relative Strength Index (RSI)

The Relative Strength Index (RSI) is a frequently used momentum oscillator in technical analysis that gauges the rapidity and variance of price movements over a specific period. J. Welles Wilder Jr., a former mechanical engineer who became a trader and technical analyst, invented the RSI indicator. He initially published the concept in his 1978 book New Concepts in Technical Trading Systems.

Like the majority of indicators, RSI is frequently displayed below a price chart. Any candlestick or bar chart time frame, including minutes, hours, days, and weeks, can be used with it.

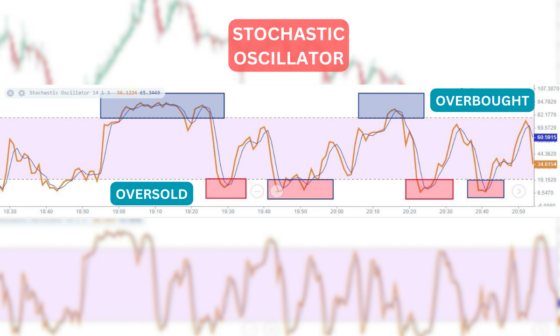

The RSI indicator is commonly used to provide traders with a way to recognize overbought or oversold conditions in a market. It can be used as support and resistance levels as well.

Interpreting the Signals

The Relative Strength Index measures the number of days over time that a security closes up against days where it closes down over the same period. These values are then plotted on a scale from 0 to 100, where they reflect the weakness or strength of an asset’s price momentum.

The asset is usually considered overbought when the RSI value rises above 70, indicating the asset may be overpriced and a price correction may be on the horizon (a sell signal).

The asset is usually considered oversold when the RSI value drops below 30, signaling that the asset may be underpriced and a price comeback may be imminent (a buy signal).

The Relative Strength Index is frequently deployed by traders to recognize possible entry and exit positions depending on these overbought and oversold levels.

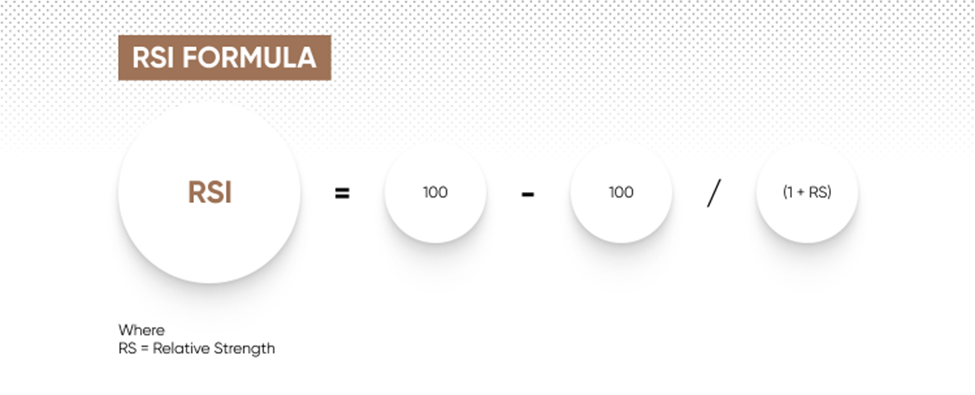

Calculation of RSI

The Relative Strength Index can be calculated by the following formula:

Relative Strength or RS is computed as the average gain divided by the average loss during a specified period, usually 14 days (as suggested by Welles Wilder). The range of the RSI is 0 to 100. Higher stock price values imply stronger upward movement, while lower values signify stronger downward motion.

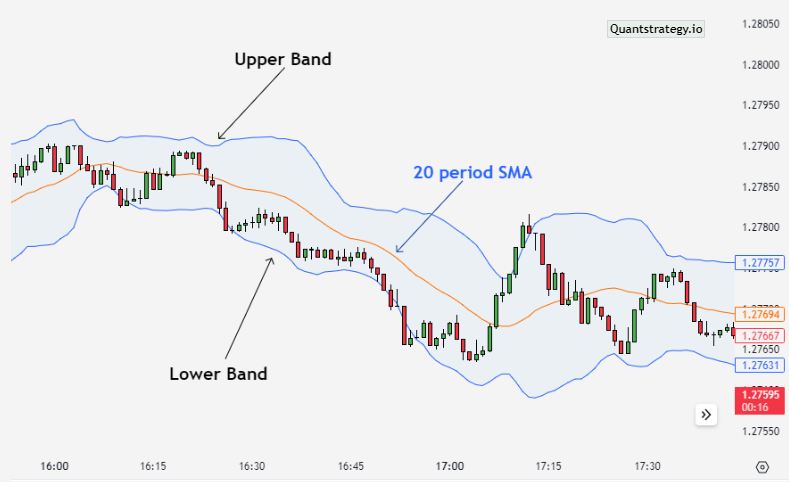

Bollinger Bands

Bollinger Bands are one of the most frequently utilized volatility indicators in technical stock market analysis. They were introduced in the 1980s by a famous American trader John Bollinger.

The Bollinger Bands indicator consists of a set of three separate lines and the band lines are placed above and below a moving average. These bands capture nearly all price movement and can be employed to spot possible market reversals and price breakouts.

Calculation of Bollinger Bands

The Bollinger Bands plot three lines on a price chart.

- Middle Band: It is a simple moving average, usually over 20 periods.

- Upper Band: Two standard deviations of the price plus the middle band.

- Lower Band: The middle band minus two standard deviations of the price.

Interpreting the Signals

The bands narrow when the market is calm, signifying little volatility. In contrast, the bands widen when the market is busy, suggesting strong volatility.

The bands’ behavior and price action can be deployed by traders to recognize possible breakouts, reversals, or trends. Moreover, Bollinger Band can be a very adaptable and versatile technical analysis indicator because the standard deviation may widen or narrow dynamically depending on the trading range of the asset.

Bollinger Bands RSI Combined Trading Strategy

Traders can choose to combine the benefits of the Relative Strength Index and Bollinger Bands for better market analysis and a more thorough understanding of price fluctuations. Below we will understand how Bollinger Bands can complement an RSI trading strategy.

How to use Relative Strength Index with Bollinger Bands

Traders should first watch for instances where the asset price breaks the upper or lower Bollinger Bands before using the RSI with the Bollinger Band. A possible overbought condition appears when the price cross over the upper band, and the RSI reads 70 +. This suggests that a price correction or trend reversal may be on the horizon. They can then sell the asset.

On the contrary, when the price falls below the lower band and the RSI is below 30, it denotes an oversold situation and predicts a future price rise. This may serve as a possible buying opportunity.

Traders can also keep an eye on how wide the Bollinger Bands are around the middle line. Wide bands denote high volatility, whereas narrow bands denote low volatility. Traders can spot market consolidation phases as well as potential breakouts or trend reversals by studying the bands’ behavior.

Some suggestions for integrating RSI and Bollinger Band into your Trading Approach

- Use Bollinger Bands and RSI combo strategy along with other indicators to verify possible trade signals.

- Determine proper stop-loss and take-profit levels to control risk and safeguard your trading funds.

- Before implementing the indicator into your real-time trading strategy, test it on historical data to make sure it works as intended.

- Keep your composure and wait for the Bollinger Bands and Relative Strength index pair to deliver clear signals before you place any trades.

- Make sure the Relative Strength Index reaches its extremes during the initial pullback.

Pros & Cons of Bollinger Bands and RSI Combo Strategy

Pros

- Combines two well-known and trustworthy indicators to produce a more precise analysis.

- Effective across a variety of financial instruments and markets, including commodities, cryptocurrencies, forex, and stocks.

- Assists in spotting probable market volatility and trend reversals.

- Traders can improve their knowledge of the present state of the market and make better investment decisions by combining RSI and Bollinger Band.

Cons

• Requires a solid grasp of both the RSI and Bollinger Band indicators.

• Shorter timeframes may produce false signals, which may diminish accuracy.

• Unsuitable for scalping or other short-term trading techniques.

Conclusion

Bollinger Bands and Relative Strength Index are already well-known technical analysis tools, however, combining their strengths provide traders with a strong means of spotting potential market extremes. You may better grasp the current market situation and make more educated decisions by including this combination in your trading strategy. But to attain long-term trading success, it’s important to use the RSI and Bollinger Band strategy, along with other technical analysis tools, and keep a strict risk management strategy in place.