Automated trading, also known as automated trading systems or algorithmic trading, is a tool that can help traders to increase the speed, efficiency, and accuracy of their trades. It eliminates human intervention and can be executed automatically using computer software.

However, they should be supervised by human monitors to evaluate their performance before using it in live trading.

The automated trading system generates most trades nowadays and is used by notable investment houses, hedge funds, brokerages, and other investment managers.

Before choosing one, investors need to know how automated trading systems work and some of the best-automated trading platforms. All of this will be covered in detail below.

History of Automated Trading

When it comes to how automated trading systems started and went on to become something so helpful for traders, we have to see their journey one by one from the beginning:

- Richard Donchian was the first to introduce the idea of the automated trading system. He used a set of rules to buy and sell the assets of financial markets.

- In the 1980s and 1990s, the use of automated trading systems began to gain traction in the financial industry. The development of faster and more powerful computers, along with the increased availability of market data and information, made it possible for traders to develop more complex and sophisticated trading algorithms.

- The mid-1990 and the beginning of 2000 saw a significant increase in the utilization of automated trading in the foreign exchange (forex) market, as well as the rise of high-frequency trading (HFT) firms. HFT firms deployed powerful computers and sophisticated algorithms to execute trades at high speeds, taking advantage of small price movements in the market.

- In the 2010s, automated trading continued to grow, with an increasing number of retail traders and investors using automated trading platforms and systems to execute trades. Additionally, the development of machine learning and artificial intelligence led to the creation of more advanced and sophisticated trading algorithms that could adapt and improve over time.

- Today, automated trading accounts form a significant portion of the trading volume in financial markets worldwide. It is used in a variety of markets, including equities, derivatives, forex, and commodities.

What is Automated Trading & How Does it Work?

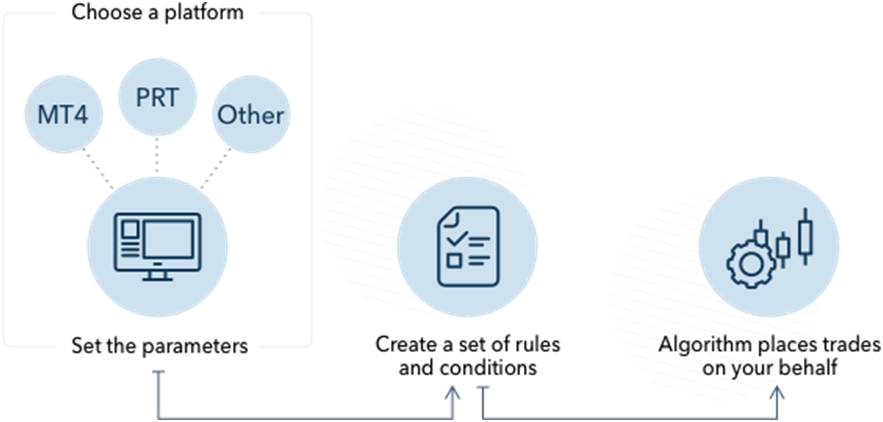

Automated trading is the use of computer programs and algorithms to execute trades automatically based on pre-determined rules and conditions. These rules and conditions can be based on various factors such as technical indicators, market data, and other input variables. They are connected to price movements as well. For instance, the rule can specify buying a particular number of shares at a time when the price goes below a particular level and selling when the price goes above that level.

In addition to that, auto trading allows traders to execute trades automatically without the need for manual intervention. This is useful for traders who want to take advantage of market opportunities in real time or for those who want to implement complex trading strategies that would be difficult or time-consuming to execute manually.

Once the auto trading system is completed and rules are established, traders can ease a little as the computer will execute the majority of the task. The computer can oversee the financial markets to find sell or buy opportunities based on the specifications of the trading system. Any orders for protective trailing stops, stop losses, and profit targets are automatically generated the moment a trade is entered.

The core of the auto trading system is the software, which buys and sells according to programmable rules. These are set by the investor that directs the software to enter the orders, exit the positions, and the amount of money to invest.

Moreover, the details of the rules may vary as infinitely as the individual investor’s preferences. Some depend on strategies like picking market tops, whereas others prefer following investing trends. Since rules can get triggered by prices, volumes, and other data on market activity, the automated trading system is restricted to the use of technical indicators. Information regarding fundamentals like mergers or dividend declaration isn’t considered.

Automated trading systems allow traders to try algorithms against previous market activity to help devise rules, which will generate profit in a procedure called backtesting. For instance, an automated investor would see how his set of rules-based investment decisions works out if they were implemented at some point in the past.

There are different types of automated trading systems, including those that are fully automated and those that are semi-automated. Fully automated systems execute trades automatically without any human intervention, while semi-automated systems allow some level of human input and oversight.

Automated Trading Pros And Cons

The list of advantages is very long when a computer oversees the financial markets for trading opportunities and executing trading trades.

One of the major advantages of using auto trading is that it eliminates emotion in the trading process. This helps the trader to avoid making irrational decisions and follow the strategy defined in the algorithm.

One unique aspect of automated trading is the ability to backtest the trading algorithm. Backtesting involves running the algorithm on historical market data to see how it would have performed in the past. This can help traders evaluate the performance of the algorithm and make adjustments as needed.

Another unique aspect of automated trading is the ability to execute trades at a much faster pace compared to manual trading. Automated trading systems can process large amounts of market data and execute trades in milliseconds, which can give them an advantage over manual traders, who may take longer to make decisions.

However, automated trading also has its downsides. One major concern is that the algorithms may not always be able to adapt to unexpected market conditions. Additionally, if a trading algorithm is not properly designed and tested, it may experience significant losses. Monitoring is still required to ensure that it is working correctly and to avoid unexpected failures.

Summary

In summary, automated trading is a unique way of trading which uses computer programs to execute trades on financial markets. It has the ability to backtest the trading algorithm, the ability to execute trades at a much faster pace than is possible with manual trading, but also has its downsides like the algorithms may not always be able to adapt to unexpected market conditions, and if a trading algorithm is not properly designed and tested, it may experience significant losses.

Components of Automated Trading Solution

An automated trading solution can include a variety of components, including:

-

Trading platforms

A software application, which allows traders to access financial markets, view real-time market data and execute trades.

-

Algorithms

These are a set of rules and conditions that determine when and how trades will be executed. These algorithms can be based on various types of analysis such as technical analysis, fundamental analysis, or machine learning.

-

Backtesting

As mentioned earlier, this component is the process of testing a trading strategy using historical market data to evaluate its performance and optimize its parameters.

-

Execution engine

This component interacts with the trading platform and executes trades according to the algorithms.

Best Trading Platform

Automated trading platforms lower the work of traders by analyzing assets autonomously. They also enable them to identify successful trading opportunities and the best entry and exit positions for these trades. There are several popular automated trading platforms available, including:

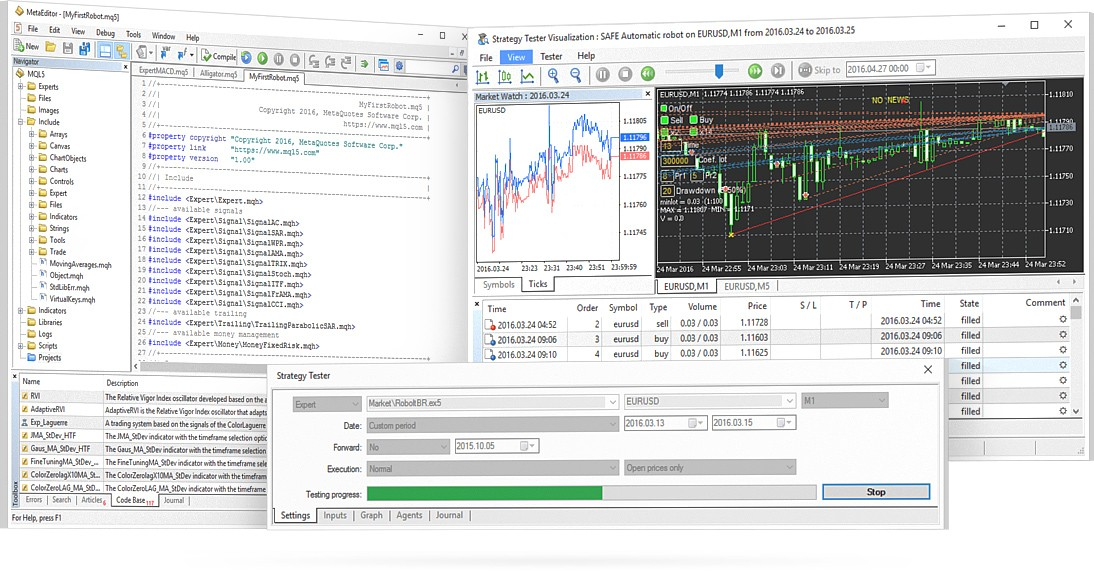

MetaTrader 4 and MetaTrader 5

These platforms, offered by MetaQuotes, are widely used by forex traders and support the development of custom indicators and automated trading strategies.

NinjaTrader

A platform that supports the development of custom indicators and automated trading strategies, along with advanced charting and market analysis.

TradeStation

The next platform offers advanced charting, market analysis, and the ability to develop and backtest automated trading strategies.

cTrader

This platform offers advanced charting and market analysis, as well as the ability to develop custom indicators and automated trading strategies.

Amibroker

A platform that specializes in technical analysis, and supports the development of custom indicators and automated trading strategies.

Etoro

eToro is an online trading and investment platform that offers a feature called “Copy Trading”. This feature allows users to copy the trades of other successful traders automatically on the platform.

Users can browse through a list of top-performing traders, known as “Popular Investors”, and select the ones whose trading strategies align with their own goals and risk tolerance. Once a user has selected a trader to copy, their trades will be automatically executed in the user’s account at the same time as the trader’s trades.

It is worth noting that the best trading platform for you will depend on your specific needs and requirements. It’s important to research and compare the features and capabilities of different platforms before making a decision.

Trading Rules

Automated trading rules are a set of pre-determined conditions and parameters that are programmed into automated trading software to guide the execution of trades. These rules can be based on various factors such as technical indicators, market conditions, or other data inputs. Examples of automated rules include:

-

Technical indicators

A rule may be set to buy a stock when its 50-day moving average crosses above its 200-day moving average.

-

Market conditions

A rule may be set to sell a stock when the market is showing signs of a trend reversal.

-

Time-based rules

A rule may be set to buy or sell a stock at a specific time of day or during a specific trading session.

-

Volatility rules

A rule may be set to buy or sell a stock based on its volatility.

-

Position sizing rules

A rule may be set to adjust the size of a position based on the level of risk or the account balance.

It is important to note that automated trading rules are not guaranteed to be profitable and can also result in losses if not implemented properly. It is recommended to have a good understanding of financial markets and a robust risk management strategy before implementing automated trading rules.

What is Trading Plan?

A trading plan’s a set of guidelines used by traders in decision-making and managing their trades. A trading plan should include goals and objectives, risk management strategies, entry and exit strategies, and performance metrics of a trader.

Some of the key elements of a trading plan include:

Goals and Objectives

Clearly define what you want to achieve from your trading, such as how much you want to make, the level of risk you are willing to take, and the time horizon for achieving your goals.

Risk Management

Establishing guidelines for how much you are willing to risk on each trade and how you will manage risk throughout your trading.

Entry and Exit strategies

Developing a plan for when to enter and exit trades based on technical analysis, fundamental analysis, or other factors.

Performance Metrics

Setting up a system to track your performance, such as profit/loss, win/loss ratio, and other key performance indicators.

Reviewing and Updating

Regularly review and update your trading plan based on your performance, changes in the market conditions, and other factors.

Having a well-defined trading plan can help traders stay disciplined and focused and can also help them manage their emotions and make more informed trading decisions.

Automated Trading Strategy Types

There’re several strategies that can be used for automated trading, including:

Trend Following

This strategy involves buying an asset that is rising in price and selling one that is falling.

Mean Reversion

This strategy involves buying an asset that is undervalued and selling one that is overvalued, based on historical prices.

Statistical Arbitrage

Statistical Arbitrage, also known as stat arb (StatArb), quantitative trading, or stat arb trading. is a strategy that involves using statistical methods to identify price discrepancies between financial instruments and taking advantage of those discrepancies to generate profits. It uses statistical models and algorithms to analyze large amounts of market data and identify patterns that indicate an opportunity for profitable trades.

StatArb is a form of quantitative trading that is based on mathematical models and statistical analysis rather than fundamental analysis. It often employs high-frequency trading techniques to quickly identify and exploit pricing inefficiencies.

This strategy is often used in the context of pairs trading, which involves buying and selling two highly correlated financial instruments simultaneously in order to profit from the relative price movements of the two assets.

Algorithm Execution

Algorithm execution refers to the process of carrying out or implementing an algorithm. This involves following the steps outlined in the algorithm in a logical order, starting at the first instruction and progressing through the remaining instructions until the task or problem is solved or the desired outcome is achieved. The execution of an algorithm can be done by a computer, a person, or a combination of the two.

Machine Learning

This strategy involves using machine learning algorithms to create a predictive model to forecast the market trend and make trading decisions.

Application of Automated Trading

Automated trading can be applied to various asset classes, including:

-

Stocks

Automated trading systems can be used to trade individual stocks or stock indices based on pre-determined rules and parameters, such as technical indicators or market conditions.

-

Forex

Automated trading can be used to trade currency pairs in the foreign exchange market, using strategies such as trend following, breakout trading, and scalping.

-

Futures

Automated trading systems can be used to trade futures contracts on commodities, currencies, and other financial instruments, based on pre-determined rules and parameters.

-

Options

Next, automated trading can be used to trade options contracts, which give traders the right to sell or buy an underlying asset at a specific price and time.

-

Cryptocurrency

Automated trading can be used to trade cryptocurrencies such as Bitcoin, Ethereum, and Litecoin, using strategies such as trend following, momentum trading, and mean-reversion.

-

Commodities

In addition to that, it can be used to trade commodities such as gold, oil, and copper, using strategies such as trend-following, mean-reversion, and statistical arbitrage.

Note

It is important to note that automated trading strategies should be specific to the asset class, as different assets have different characteristics and market behavior.

While automation can improve efficiency, it can also increase risk if not implemented and monitored properly. It is always recommended to backtest and forward-test the strategy before deploying it in live markets.