Scalping trading is a popular and dynamic trading strategy in the financial markets. It involves making rapid trades with the intention of profiting from small price movements.

Unlike other trading styles, where positions are held for more extended periods, scalpers aim to capitalize on short-term price fluctuations.

This article will explore the essential aspects of scalping trading and provide valuable strategies to achieve success in this fast-paced environment.

What is Scalping?

Scalping, in the context of trading, refers to the practice of opening and closing positions within a brief time frame, often within seconds or minutes.

Scalping traders aim to make small profits on each trade, which can add up significantly over numerous trades throughout a trading session. This strategy requires a trader to be highly attentive to the market, as they seek to identify quick opportunities for profit.

Benefits of Scalping Trading

Scalping offers several advantages for traders, including the potential for frequent profits. Since scalpers execute numerous trades daily, they can accumulate profits even from minor price movements.

Additionally, scalping can be less exposed to market risks compared to longer-term strategies, as positions are typically not held overnight. This approach can also provide a steady stream of trading opportunities in various market conditions.

Key Principles of Scalping Trading

Timeframes in Scalping

In scalping trading, timeframes play a crucial role. Traders usually focus on short-term charts, such as 1m or 5m intervals. These shorter timeframes offer a closer view of market movements, allowing scalp trading to spot potential entry and exit points more effectively.

Choosing the Right Instruments

Not all financial instruments are suitable for scalping trading. Scalpers often prefer highly liquid assets with tight bid-ask spreads to minimize costs and ensure swift execution. Major currency pairs, stocks of large companies, and popular indices are commonly chosen by scalpers.

Importance of Volatility and Liquidity

Volatility is essential in scalping trading since it determines the potential price movements in a short period. Highly volatile assets provide more frequent opportunities for quick profits.

Liquidity is equally crucial as it ensures that a trader can enter and exit positions seamlessly without significant price slippage.

Building a Scalping Trading Plan

Setting Clear Objectives

Before embarking on scalping trading, it’s crucial to define clear objectives. Traders must establish their daily or weekly profit targets, as well as the maximum acceptable loss. Sticking to these targets can help maintain discipline and prevent emotional decision-making.

Risk Management Strategies

Due to the rapid nature of scalping, risk management is paramount. Scalpers often use tight stop-loss orders to protect their capital from substantial losses. Additionally, risking only a small percentage of their trading capital on each trade helps preserve their overall account balance.

Developing a Trading Strategy

Having a well-defined trading strategy is essential for scalpers. This includes identifying entry and exit signals based on technical indicators, price patterns, or a combination of both. A robust strategy also considers market conditions and trends.

Best Scalping Trading Strategies and Techniques

Price Action Strategies

Price action scalping involves analyzing the raw price movements of an asset without relying on indicators. Traders look for patterns and candlestick formations to make trading decisions. This strategy requires a deep understanding of price action and market behavior, allowing traders to respond quickly to changing market conditions.

Bollinger Bands Scalping

Bollinger Bands consist of three lines: a central moving average line and two outer bands that represent standard deviations from the average. Scalpers use these bands to gauge price volatility and identify potential breakouts.

When the price moves close to the outer bands, it may indicate overbought or oversold conditions, offering potential trading opportunities.

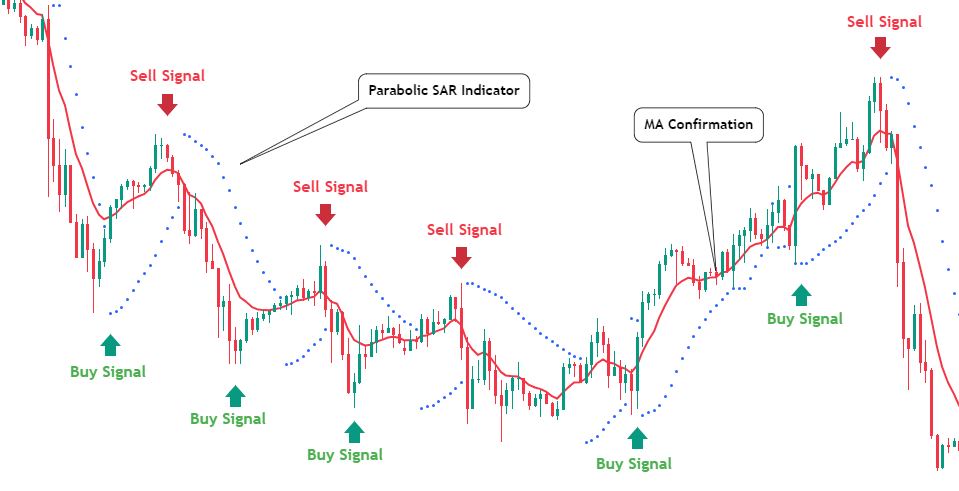

Using Parabolic SAR for Scalping

Scalpers often combine the Parabolic SAR with other technical indicators and price action analysis to refine their trading decisions. For example, they may use moving averages to confirm the trend direction before executing a trade signaled by the Parabolic SAR.

Additionally, scalpers may incorporate tight stop-loss orders to protect their positions from sudden price reversals.

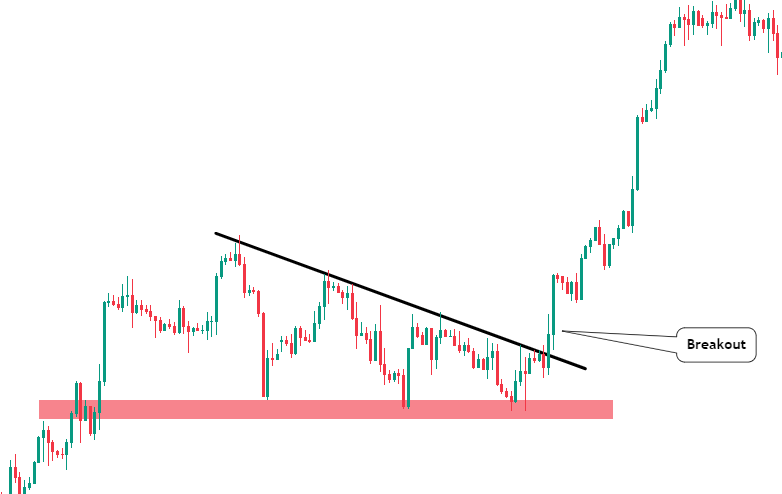

Scalping Breakouts

Scalpers look for breakout opportunities when the price breaks through significant support or resistance levels. Trading breakouts involves entering trades as soon as the breakout occurs and placing tight stop-loss orders to manage risk effectively.

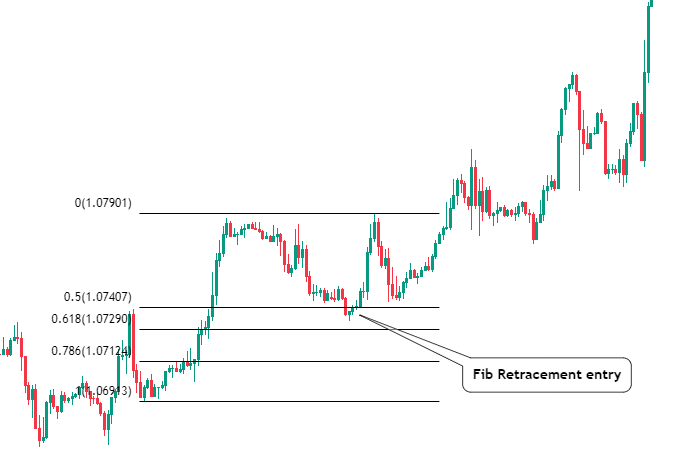

Scalping with Fibonacci Retracements

Fibonacci retracements are used to identify potential support and resistance levels based on the Fibonacci sequence. Scalpers may use these levels to enter or exit trades, especially during price corrections within a larger trend.

By combining Fibonacci retracements with other technical tools, traders can enhance the accuracy of their trading signals.

Market Making: Enhancing Liquidity and Profits

Market making involves providing continuous buy and sell quotes for financial instruments, enhancing market liquidity. Market makers profit from bid-ask spreads and stabilize prices. They play a crucial role in efficient trading operations, benefiting investors and the overall market.

Bid price is the highest price a buyer will pay for an asset. Ask price is the lowest price for which a seller will sell the security. The bid price will almost always be less than the ask or offer price. The difference between the two prices is called the spread.

Picking any two trading strategies above can make you a profitable trader in the market, whether it’s scalping stocks or trading cfds.

Common Mistakes in Scalping Trading

Ignoring the Trend

Failing to consider the overall market trend can be a costly mistake in scalping trading. Trading against the trend increases the risk of losses as it goes against the prevailing market sentiment. It is essential to align scalping trades with the direction of the broader trend price movement whenever possible. Stick to one trading system.

Not Using Stop-Loss Orders

Without stop-loss orders, scalpers expose themselves to significant losses in case of adverse price movements. Utilizing stop-loss orders is crucial to protect capital and manage risk effectively. Traders should always be ready to exit a trade when it is not moving as anticipated.

Chasing Losses

After experiencing a loss, scalpers may feel tempted to immediately take another trade to recoup the losses. This emotional reaction can lead to impulsive decision-making and further losses. It is essential to stick to the trading plan and avoid chasing losses.

Best Practices for Scalping Trading

Keep Updated with News and Events

Staying informed about economic and geopolitical events can help scalpers anticipate potential market movements. This information can influence trading decisions and risk management strategies. Being aware of events that may cause significant volatility is particularly important.

Backtesting and Analyzing Strategies

Before implementing a scalping strategy in live trading, it is crucial to backtest it on historical data to assess its performance. Backtesting allows traders to evaluate the effectiveness of the strategy under different market conditions in any currency pair. Regularly analyzing trading results can provide valuable insights for optimization and improvement.

Continuous Learning and Adaptation

The financial markets are ever-changing, and successful scalpers continuously adapt to new conditions and refine their strategies. Learning from both successes and failures is crucial for long-term success in scalping trading. Staying open to new ideas and market developments can lead to improved trading performance.

Write down your scalp trades in your journal using above mentioned strategy effectively. Even experienced traders write down their wins and losses. A few successful trades can make you over-confident in your trading journey. Pick your trading style, refine it and stick to it.

Scalp Trading vs. Day Trading: A Brief Comparison

Scalp Trading:

Scalp trading is an intraday trading strategy focused on making quick trades to profit from small price movements.

Traders aim to hold positions for a very short time, often seconds to minutes.

Forex scalpers heavily rely on technical analysis, using various indicators and chart patterns to identify entry and exit points.

The strategy requires fast decision-making and precise risk management to cut losses quickly and lock in small profits.

Scalp trading is suitable for traders who can maintain intense focus, handle the rapid pace, and manage stress effectively.

Day Trading:

Day trading involves holding positions within a single trading day, seeking to capitalize on intraday trends and price fluctuations.

Day traders typically hold positions for a few minutes to a few hours.

Analyzing intraday trends, support and resistance levels, and market sentiment are crucial aspects of day trading.

Day traders may execute fewer trades compared to scalpers but aim for larger profit targets on each trade.

This style demands a broader market perspective and a deeper understanding of the factors influencing price movements.

Pros and Cons of Scalping:

Pros:

- Quick Profits: Scalping aims to capitalize on small price movements, generating quick profits on numerous trades within a single trading session.

- Reduced Exposure: Scalpers hold positions for brief periods, minimizing exposure to overnight market risks and potential unexpected events.

- Enhanced Liquidity: Scalping contributes to market liquidity as traders frequently enter and exit positions, facilitating smoother price discovery.

- Lower Market Exposure: Scalpers are less exposed to overall market trends and economic events since their trades are based on short-term price fluctuations.

- Frequent Trading Opportunities: The fast-paced nature of scalping provides traders with multiple trades throughout the day.

- Focus on Technical Analysis: Scalpers heavily rely on technical analysis, allowing them to exploit chart patterns and indicators effectively.

Cons:

- Transaction Costs: The high frequency of trades in scalping incurs greater transaction costs, which can erode profits if not managed effectively.

- Execution Risk: Rapid trade execution is crucial in scalping, and delays can result in missed opportunities or undesirable entry and exit points.

- Stress and Pressure: Scalping demands intense focus and discipline, leading to higher stress levels compared to other trading styles.

- Time-Consuming: Scalping requires constant monitoring of the markets, limiting the trader’s ability to participate in other activities.

- Emotional Challenges: The fast-paced nature of scalping may lead to emotional decision-making and impulsiveness, which can negatively impact trading results.

- Less Room for Error: With small profit targets, scalpers have less margin for error, necessitating high accuracy in their trading decisions. With making big profits in small time one can also start losing money rapidly in a very short period.

Find a Reliable platform

Finding a reliable platform for scalping is crucial for executing fast and accurate trades. Here are some key features to look for when choosing a platform:

- Low Latency: A platform with low latency ensures that trade orders are executed quickly and efficiently, minimizing delays and slippage.

- Advanced Charting Tools: Look for a platform that offers comprehensive charting tools, indicators, and technical analysis features to aid in identifying profitable scalp trading opportunities.

- Real-time Data: Scalping requires up-to-date market information. Choose a platform that provides real-time data for accurate decision-making.

- Customizable Interface: A platform with a customizable interface allows traders to tailor the layout to their preferences, ensuring ease of use during fast-paced trading.

- Stability and Reliability: Reliability is paramount in scalping. The platform should have a stable infrastructure to prevent downtime and technical glitches.

- Fast Order Execution: Ensure the platform provides short order execution with minimal slippage to maximize profits in volatile market conditions.

- Tight Spreads: Look for a broker associated with the platform that offers competitive spreads, as tighter spreads reduce trading costs and enhance profitability.

- Risk Management Features: A reliable platform should have robust risk management features, including stop-loss and take-profit orders, to protect against adverse price movements.

- Mobile Compatibility: Having a mobile app version of the platform allows traders to scalp on the go, offering flexibility and accessibility.

- Regulation and Security: Choose a platform that operates under reputable regulatory authorities and prioritizes data security to safeguard your funds and personal information.

Before committing to a platform, consider testing it with a demo account to assess its performance and compatibility with your trading style. Additionally, read reviews and seek recommendations from experienced traders to ensure you choose a platform that meets your scalping needs effectively.

Conclusion

In conclusion, scalping strategies offer a dynamic and potentially lucrative approach for traders willing to embrace its challenges. By understanding the key principles, employing effective strategies, and maintaining discipline, investment advice traders can increase their chances of success in this fast-paced trading style. Scalping requires continuous learning, adapting to market conditions, and staying informed about economic events. Make sure you pick a better trading platform with keeping spread in mind.

If you’re considering exploring scalping as a trading strategy, it is essential to start with a well-thought-out plan and practice on a demo account before transitioning to live trading. Scalping demands a high level of skill and experience, but with dedication and a sound approach, traders can navigate the financial markets with confidence and achieve consistent profits.

Remember, successful scalping trading is about being proactive, disciplined, and adaptable. Embrace the learning process, and avoid common mistakes. With persistence and a commitment to improvement, you can become a proficient scalping trader and achieve your financial goals.

FAQs (Frequently Asked Questions)

-

Is scalping suitable for all traders?

Scalping trading demands a high level of skill, experience, and discipline. While it can be rewarding, it may not be suitable for novice traders due to its fast-paced nature and potential risks.

-

What timeframes are commonly used in scalping?

Scalpers often focus on short-term time frames, such as one-minute or five-minute charts, to identify quick trading opportunities. One can look for setups in a 15m timeframe, and look for entries on even shorter time frames, as most forex scalpers do.

-

Can I use scalping in the cryptocurrency market?

Yes, scalping can be applied to the cryptocurrency market or any other financial asset. However, due to its inherent volatility, traders must exercise caution and adapt their strategies accordingly.

-

How much capital do I need for scalping trading?

The capital required for scalping trading depends on various factors, including the instruments traded and the trader’s risk tolerance. It is crucial to only risk a small percentage of capital on each trade.

-

What is the most important aspect of successful scalping?

Discipline is arguably the most critical aspect of successful scalping trading. Traders must stick to their trading plans, manage risk effectively, and avoid emotional decision-making.