The financial markets can be intense and complex for beginners. Charts, technical indicators, and trading strategies can feel overwhelming. But within this vast world, there are valuable tools that can help you identify potential trading opportunities. This blog explores a powerful combination for new investors: the Aroon Oscillator paired with Moving Averages (MAs).

Deep Dive into the Aroon Oscillator

In 1995, this individual Tushar Chande came up with the Aroon Oscillator, a valuable bearish bias

It functions as a Trend-Changes down indicator, helping traders identify potential downtrends by analyzing the time elapsed since the most recent highs and lows.

The entire technical indicator Aroon consists of 2 lines and an oscillator that displays the interaction of these up and down indicators.

There are 2 baselines>> upper Aroon and lower Aroon.

There is also an oscillator that displays the difference between two lines.

The formula for calculating the upper aroon indicator:

A c = [(NH)/N]·100

Where; N — indicator period

H is the number of days after the absolute maximum in this period

This line also fluctuates between 0 and 100, and we can use it as follows:

If Aroon-Up:

- more than 70% – a powerful bullish trend;

- 50-70% – a bullish trend gaining strength;

- 30-50% – fading trend;

- below 30% – buyers are no longer interested in increasing prices (Bearish Bias).

If Aroon-Down:

- above 70% – bearish sentiment prevails in the market;

- 50–70% – the bearish trend is gaining strength;

- 30–50% – the bearish trend is weakening, but buyers have not yet seized the initiative;

- below 30% – the downward trend has completely exhausted its strength.

Advantages and disadvantages of the Aroon indicator

The Aroon indicator, like other technical analysis tools, has advantages and disadvantages.

Advantages:

- easily identifies major trend-markets;

- does not redraw;

- Universal in use for various trading instruments and platforms;

- applicable on both small and large timeframes;

- With the right settings, it gives good accurate signals.

Flaws:

- signals sometimes arrive a little late;

- during sideways movement, false signals often appear;

- It is recommended to additionally check the received signals using other indicators.

Unveiling Moving Averages

You understand how prices can go up and down a lot? Mas makes things simpler by figuring out the normal price over a certain amount of time, actually, in essence over 50 or 200 days; this is extremely helpful for traders who want to see where things are headed overall and where the prices might either bump up against a limit or find a floor: one clearly can imagine how handy this is, basically smoothing things out so you can catch the bigger picture.

However, there are several types of MA:

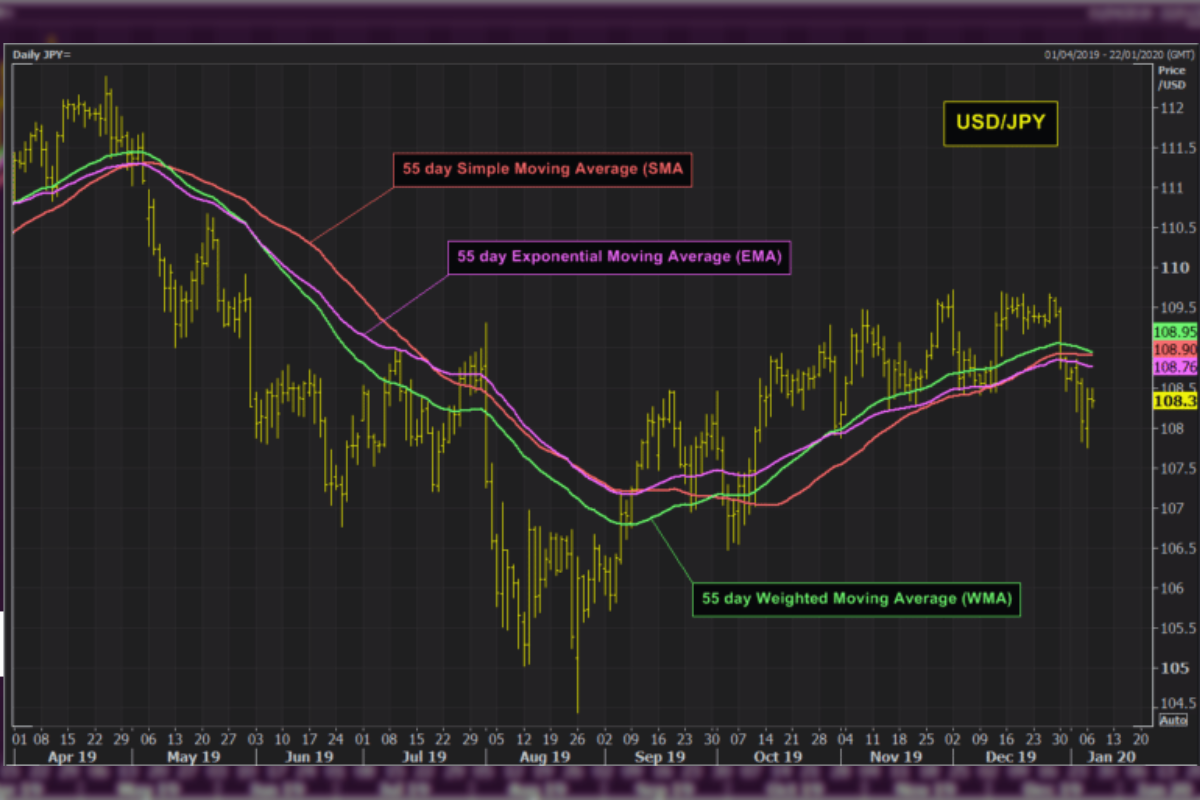

Simple Moving Average (SMA):

The maximum primary type is calculated by summing the ultimate prices over a delegated period and dividing with the aid of a wide variety of periods.

Exponential Moving Average (EMA)

Assigns extra weight to current costs, giving extra significance to more recent data factors. This makes the EMA greater reactive to recent price modifications as compared to the SMA.

MA can also help in identifying trends. By establishing a position of the price relative to the MA, it is possible to determine the current trend. Specifically, if the Price is above MA, there is a successful uptrend.

On the other hand, the Price below MA symbolizes that there is a downtrend. Moreover, when the Price moves and crosses above MA upward, it is called an upward Crossover, and this indicator signals a potential buyout as the Price has turned from a downtrend to an uptrend. In contrast, when Price crosses beneath forward; it is called a downward Crossover signal.

Popular MA’s for Trend Following

Many traders rely on specific MA’s for trend-following strategies:

- 50-day EMA: Often used to identify short-term.

- 200-day EMA: Often used to identify long-term.

Spotting Trends with the Aroon Indicator and MA’s

Ever wondered how to catch winning trends in the market? Here’s a cool trick combining the Aroon Oscillator and Moving Average.

This is a great strategy, especially for beginners, because it combines two powerful tools to give you a clear signal.

Confirmation of Trend Direction

Evidence gets very much stronger about a trend heading upwards if the AroonUp line hits above 70, especially when the MA curve is already going up: the Aroon Oscillator acts inherently, in substance a double-check, making sure you’re right about which the market’s moving: one clearly can imagine using this tool to confirm if the direction shown by the Moving Average is actually the truth.

Identifying Trend Strength

When you mix the tenor from the Aroon Oscillator inherently, in substance the AroonUp and Down Aroon with what the Moving Average is doing, it honestly points out the best times to join in or hop out of a trend.

One clearly can imagine that seeing where things are headed can make a difference. And one mustn’t deny that picking up on how strong or weak a trend is today, thanks to those Aroon tenors, can guide you.

Core Principles of the Aroon Oscillator and Moving Avg Trading Strategy:

Entry Signals

- Long Entry:

- A price that is trading above the specific MA chosen, such as a 50-day EMA;

- AroonUp line above zero line or persistently above 30;

- It indicates the price might have a possibility of being on an UpTrend whilst having created some highs in recent times.

- Short Entry:

- Find the price that is trading below the chosen MA.

- Find the AroonDown line crossing above the zero line or consistently above 30.

- This indicates a possible DownTrend and the price has the new lows recently.

Additional Considerations and Limitations

Although the Aroon Oscillator facilitates its use in trading, in conjunction with MA, it has certain drawbacks. No trading strategy can show 100% efficiency.

Here are a few characteristics for advancement as well:

Market Conditions

The effectiveness of this strategy may be impacted by using numerous market situations. For example, all through intervals of high volatility, the Aroon Oscillator might generate extra common alerts, a number of which can be fake positives.

False Signals

Like any technical indicator, the Aroon Oscillator and MA can generate fake indicators at times.

Backtesting and Paper Trading

Before deploying real capital, it is extraordinarily encouraged to backtest this strategy on historic statistics to evaluate its overall performance in unique market scenarios.

Conclusion

If you’re getting into the field, combining the Aroon Indicator with MA’s can seriously hone your trading approach: one mustn’t deny that this mix is at its most basic level, essentially a cheat code for newbies: by comprehending why both tools shine on their own and where they somewhat fall short, you can use their powers together to spot when trends are about to happen, nail the perfect times to get in or out, and make smarter choices with your trades.