In the world of financial markets, trading strategies play a crucial role in determining success. One such strategy that gained significant popularity is the Turtle Trading Strategy.

Developed by legendary trader Richard Dennis and his partner William Eckhardt in 1983, the Turtle Trading Strategy is a trend-following system that aims to capture substantial profits by riding long-term market trends.

Dennis was widely recognized in the trading world as an overwhelming success. He had turned an initial stake of less than $5,000 into more than $100 million.

This article explores the principles behind the Turtle Trading Strategy and how it can be applied in today’s dynamic financial landscape.

Introduction: The Turtle Trading Strategy

The Turtle Trading Strategy is a systematic approach to trading that aims to capitalize on long-term trends in financial markets. It was developed in the 1980s and gained widespread recognition due to its impressive track record.

The strategy is based on a set of rules that guide traders on when to enter and exit positions, how to manage risk, and which markets to trade.

By following these principles, traders can potentially achieve consistent profits over time.

Origin and Philosophy of the Turtle Trading Strategy

The Turtle Trading Strategy originated from an experiment conducted by Richard Dennis and William Eckhardt. They sought to prove that successful trading could be taught rather than being an innate skill.

They selected a group of individuals, known as the “Turtles,” and provided them with a set of trading rules which is called the turtle experiment. The experiment’s success demonstrated that with the right methodology and discipline, anyone could become a profitable trader.

The philosophy behind the Turtle Trading Strategy is rooted in the concept of trend following. It recognizes that markets tend to move in trends and aims to ride these trends for maximum profit potential.

The strategy acknowledges that it is impossible to predict market movements with certainty, so it focuses on capitalizing on established trends instead.

Turtle trading rules: Does it still work today?

The Turtle Trading Strategy developed decades ago, remains relevant in today’s markets. While market dynamics have changed, the core principles of trend following and breakout signals still hold significance.

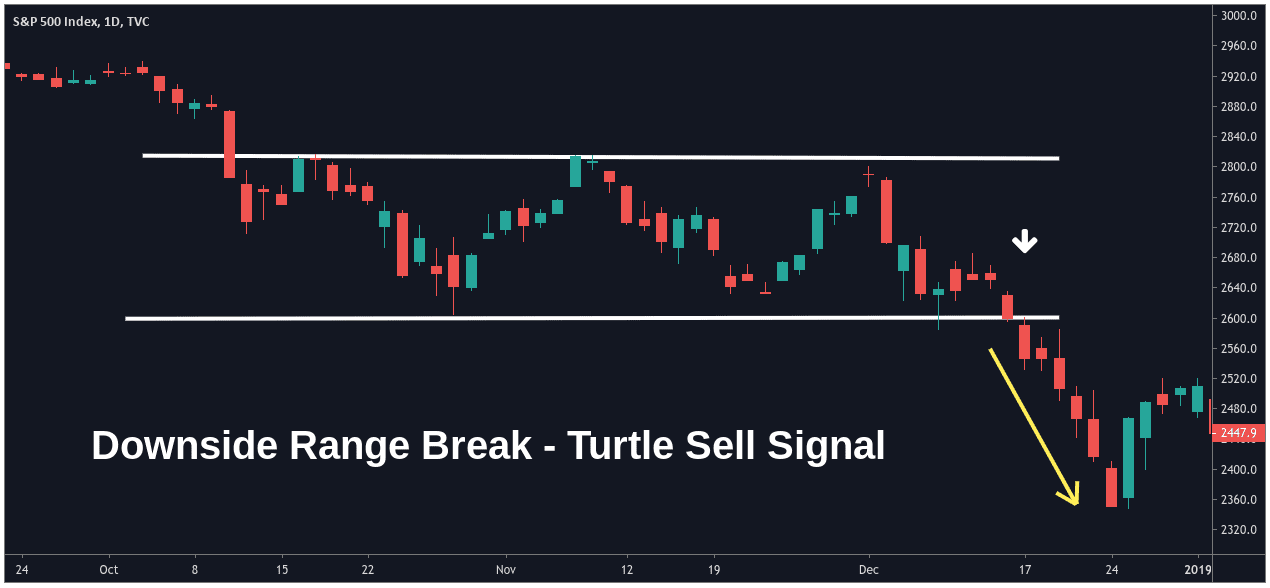

Turtles were taught very specifically how to implement a trend-following strategy. The idea is one should buy assets breaking out to the upside of trading ranges and sell short downside breakouts.

Traders may need to adapt the strategy to modern conditions, incorporating technology and adjusting parameters. Success depends on staying informed, exercising judgment, and implementing effective risk management.

In summary, the Turtle Trading Strategy can still be a valuable tool for capturing profitable trends if applied with diligence and adaptability.

Entry and Exit Signals

The Turtle Trading Strategy employs specific entry and exit signals to determine when to initiate or close a trade. The system utilizes technical indicators, such as moving averages and breakouts, to identify favorable trading opportunities.

For instance, a breakout above a recent high might trigger a buy signal, while a breakout below a recent low could prompt a sell signal.

By using predefined entry and exit rules, the Turtle Trading Strategy eliminates emotional decision-making from the trading process. This helps traders stay disciplined and avoid impulsive actions driven by fear or greed.

Position Sizing and Risk Management

Effective risk management is a fundamental aspect of the Turtle Trading Strategy. The system uses a concept called “position sizing” to determine the appropriate amount of capital to allocate to each trade.

Position sizing is based on a percentage of the trader’s total account equity and takes into account the volatility of the market being traded.

By adjusting position sizes according to market conditions, traders can limit their risk exposure and protect their capital. This systematic approach ensures that no single trade has the potential to significantly impact the overall portfolio.

Trend Following and Breakouts

Trend following is the cornerstone of the Turtle Trading Strategy. The system aims to capture the majority of a trend’s movement by entering trades in the direction of the prevailing trend. The strategy acknowledges that trends can persist for extended periods, allowing traders to profit from substantial price movements.

Breakouts play a crucial role in the Turtle Trading Strategy. A breakout occurs when the price of an asset surpasses a significant level of support or resistance. This signifies a potential shift in market sentiment and presents an opportunity to enter a trade in the direction of the breakout.

By focusing on breakouts, the strategy aims to enter trades at the early stages of a new trend, maximizing profit potential.

Market Selection and Diversification

The Turtle Trading Strategy emphasizes the importance of market selection and diversification. Different markets exhibit varying levels of volatility and trendiness, and it is crucial to identify markets that align with the strategy’s principles.

Traders following the Turtle Trading Strategy typically focus on liquid and highly traded markets, such as commodities, currencies, and equity indices. By diversifying across different markets, traders can spread their risk and potentially benefit from multiple trending opportunities simultaneously.

Emotional Discipline and Psychological Factors

Emotional discipline is a vital component of the Turtle Trading Strategy. It recognizes that emotions, such as fear and greed, can hinder rational decision-making and lead to poor trading outcomes.

To counteract this, the strategy emphasizes the importance of adhering to a set of predefined rules and maintaining discipline during both winning and losing trades.

Traders following the Turtle Trading Strategy strive to remove emotions from their trading decisions. They understand that losses are an inevitable part of trading and focus on following the system’s rules rather than succumbing to impulsive actions driven by emotions.

Implementing the Turtle Trading Strategy

Implementing the Turtle Trading Strategy involves a systematic approach to trading. Traders need to develop a clear set of rules for entry, exit, position sizing, and risk management. These rules should be based on historical market data and thoroughly backtested to ensure their effectiveness.

Once the rules are established, traders can use them consistently when analyzing potential trading opportunities. This requires discipline and the ability to follow the strategy’s guidelines even during challenging market conditions.

Advantages and Disadvantages of the Turtle Trading Strategy

The Turtle Trading Strategy offers several advantages for traders. First, it provides a clear framework for making trading decisions, eliminating ambiguity and subjectivity. Second, it emphasizes risk management, helping traders protect their capital and minimize losses. Third, it can be applied to various markets, allowing for diversification and potential profit opportunities across different asset classes.

However, the strategy also has some limitations. It relies on historical price data and assumes that past market patterns will repeat in the future.

In rapidly changing market conditions or during periods of low volatility, the strategy may generate fewer trading signals.

Additionally, implementing the strategy requires discipline and adherence to predefined rules, which can be challenging for some traders.

Case Studies: Successful Application of the Turtle Trading Strategy

Numerous case studies demonstrate the successful application of the Turtle Trading Strategy. Traders who have followed the strategy’s principles with discipline and patience have achieved significant profits over time.

These success stories highlight the strategy’s ability to capture long-term trends and generate consistent returns when implemented correctly.

It is important to note that while past performance can provide insights, it does not guarantee future results. Each trader’s experience with the Turtle Trading Strategy may vary based on their skills, risk tolerance, and market conditions.

Key Takeaways:

- The Turtle Trading Strategy is a trend-following approach designed to capture long-term market trends and maximize profit potential with proper risk management.

- Breakout signals play a crucial role in the strategy, as traders enter trades when prices surpass significant levels of support or resistance.

- Position sizing based on market volatility helps manage risk, with smaller positions in more volatile markets and larger positions in less volatile markets.

- Pyramiding allows traders to add to winning positions, maximizing gains during favorable trends.

- Following a systematic and rule-based approach helps remove emotions and subjectivity from trading decisions.

- Diversification across different markets spreads risk and provides opportunities across various asset classes.

- Trend following is a key principle, aiming to ride trends until they show signs of weakening or reversing.

- Adapting the strategy to current market dynamics and leveraging technology can enhance its effectiveness in today’s trading environment.

Conclusion

The Turtle Trading Strategy is a powerful trend-following system that aims to capture long-term market trends for profitable trading opportunities. By following a set of predefined rules for entry, exit, position sizing, and risk management, traders can potentially achieve consistent returns. The strategy’s emphasis on discipline, trend following, and risk management sets it apart from other trading approaches.

While past performance is not indicative of future results, the Turtle Trading Strategy has proven to be a robust methodology that has stood the test of time. Traders who approach the strategy with discipline, patience, and a thorough understanding of its principles have the potential to benefit from its advantages.

However, it is essential to remember that no trading strategy is foolproof, and traders should conduct thorough research, backtesting, and adapt the strategy to suit their trading style and risk tolerance.

FAQ

1. Can the Turtle Trading Strategy be applied to all financial markets?

Yes, the Turtle Trading Strategy can be applied to various financial markets, including stocks, commodities, currencies, and indices. However, it is crucial to select markets that exhibit sufficient liquidity and trending characteristics.

2. Is the Turtle Trading Strategy suitable for both beginner and experienced traders?

The Turtle Trading Strategy can be adopted by traders of all experience levels. However, it requires discipline, patience, and adherence to the predefined rules. Beginners should thoroughly understand the strategy and practice in a simulated trading environment before applying it with real capital.

3. Does the Turtle Trading Strategy guarantee profits?

No trading strategy can guarantee profits. The Turtle Trading Strategy provides a framework for identifying potentially profitable trades, but market conditions and individual trading decisions can influence outcomes. Proper risk management and adherence to the strategy’s rules are crucial for long-term success.

4. How can I learn more about implementing the Turtle Trading Strategy?

To learn more about implementing the Turtle Trading Strategy, you can explore books, online resources, and educational courses dedicated to the topic. It is recommended to study the original materials by Richard Dennis and William Eckhardt, as well as seek guidance from experienced traders or mentors.

5. Are there variations of the Turtle Trading Strategy?

Over time, traders have developed variations and adaptations of the Turtle Trading Strategy to suit their preferences and trading styles. It is important to understand the core principles of the strategy and carefully evaluate any modifications to ensure their effectiveness and alignment with your trading goals.