Price movement is necessary to make a profit in the financial markets. Fortunately, price movements are a constant in the markets. What matters most is how quickly prices are moving. Volatility refers to the rate or magnitude of price movement.

When a stock or other security is volatile, a significant price swing is probable, though it might be challenging to determine in which direction. Regardless of which way an underlying security swings in price, it is possible to conduct trades employing volatile options trading strategies where you can profit from the movement of the price.

The good news is that there is a higher chance of making more profit quickly as volatility increases. The bad news is that increased volatility entails greater risk. When volatility surges, you may have the chance to make an above-average profit, but you also face the risk of losing a significant amount of money in a relatively short time.

There are usually plenty of opportunities to make profits while minimizing risks through deploying volatility trading strategies. In this article, we’ll look at the concept of volatility in detail, along with some trading strategies that will help you trade in a volatile market.

What is Volatility and Why is it Important?

Volatility reflects price change during a particular amount of time. Market volatility is characterized by rapid price changes over a brief period of time. On the other hand, non-volatile markets are those where prices either vary very slowly or don’t change at all.

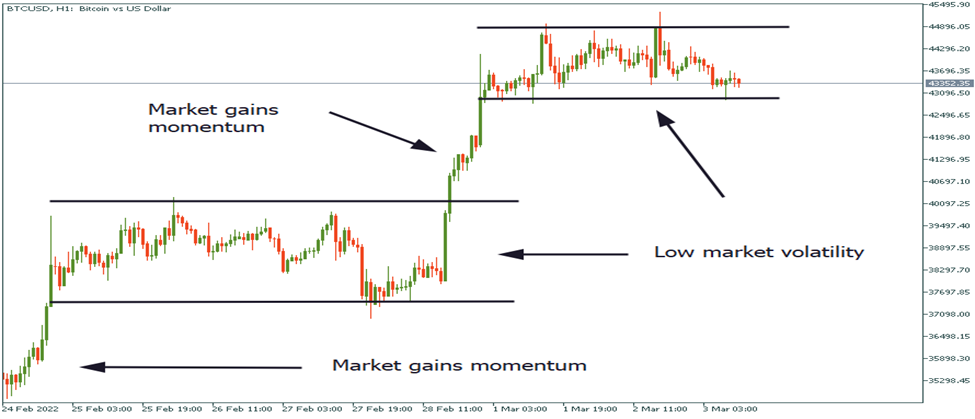

Any instrument which experiences a change in price shows volatility. Every market experiences volatility to varied degrees. For example, the chart below shows how the price behaves differently at various times. It sometimes moves in a significant way. Other times, the price trades in a narrow range as volatility declines. By looking at any chart, traders can find when an asset goes through high and low volatility periods.

The concept of volatility is crucial in the financial market. It can be quite volatile with significant price changes on a monthly, or even daily basis. Everyone who engages in trading has traded volatility in some manner through stock price. The markets wouldn’t have any profit potential without volatility. Volatility is what traders and investors thrive on.

Although volatility raises the risks involved in trading, it can also produce big returns if traded properly.

Measuring the Volatility

The standard deviation, which indicates how far the current price trades from its mean or moving average, is the usual unit of measurement for volatility. The volatility of financial markets can be influenced by a variety of variables. Macroeconomic data, news reports, earning reports, and national and political-economic factors – all can have a huge influence on volatility.

Consider the scenario where the earnings report of an established multinational corporation is lower than anticipated and misses market expectations. This typically results in a significant price change and greater volatility for the corporation’s stock.

Monetary policy meetings of central banks may also significantly affect volatility. For example, if a central bank reduced interest rates, a market could react violently, with the domestic currency typically depreciating and the stock market rising on expectations of increased business profitability.

The Volatility Index (VIX) of the CBOE (Chicago Board Options Exchange) is a popular tool for gauging market volatility and investment risk. The Volatility Index is frequently referred to as the “fear index” since higher values indicate that market players are becoming more fearful.

The VIX index determines the implied volatility (IV) of a basket of put and call options on the S&P 500 index over the following 12 months. A high value of the VIX index denotes higher volatility over one year, whereas a low value denotes lower implied volatility in the S&P 500.

The S&P 500 often declines when the VIX index increases. Investors frequently purchase equities when the VIX has a high reading.

Volatility Trading – Explained

Volatility trading refers to trading a financial instrument’s volatility rather than its price. Investors who trade volatility are not concerned with the direction of price moves. They are merely trading volatility, or how much an instrument’s stock price will fluctuate in the future, regardless of price action.

Options are a popular technique for volatility trading. In simple terms, the predicted future volatility of an option’s underlying instrument has a significant impact on the value of the option. Options on securities with higher predicted future volatility tend to be more valued than those options on securities with lower predicted future volatility.

The options pricing model includes volatility as a crucial factor. There is a total of 6 factors that affect option pricing:

- Strike price

- Interest rates

- Time until expiration

- Dividends

- Underlying price

- Volatility

How to Trade Volatility?

You must think of options as an insurance policy to comprehend how to use volatility in trading. In essence, insurance of any kind—property, auto, life, etc.— serves as a safeguard against the danger of potential monetary losses. Options are particularly helpful during volatile markets, as they have been in 2020 so far.

This idea may be applied to stock options, which indicates that traders will purchase more options contracts in uncertain market situations. The price of the option rises as additional demand enters the market.

And the effects of volatility are as follows:

- Implied volatility (IV expansion) increases as option prices rise.

- Implied volatility falls (IV contractions) when option prices decline.

Note* – We can utilize implied volatility to determine when it would be a good idea to buy or sell options.

It might be time for a change if your strategy essentially amounts to a market prediction and you still struggle with it. The most common rookie error is to keep trading prices even though you have trouble predicting future price movements.

You will need to trade volatility rather than price to get past this obstacle.

Volatility Trading Strategies

A trader who trades volatility isn’t interested in the market direction of the price fluctuation. Whether the price increases or decreases, they profit from high volatility.

Trading volatile stocks is quite safe by using volatility trading strategies via options. Below are some strategies investors can use to profit from volatile markets.

Historical Volatility vs. Implied Volatility

Volatility is represented in annualized percentage terms and can be either historical or implied. Historical volatility (HV) is the actual volatility that the underlying asset has displayed over a period of time, such as the previous month or year. The implied volatility is the level of underlying volatility implied by the current option price.

Because it anticipates future events, implied volatility is more relevant to option pricing than historical volatility. Although historical and implied volatility differs for a particular stock or asset, historical volatility can be used to predict implied volatility.

A higher option price will result from increased implied volatility, while a lower option price will result from decreased implied volatility. Volatility often increases around the time a firm releases its profit. Because of this, implied volatility for this company’s options factored in by traders around “earnings season” will typically be much greater than volatility estimates during quieter times.

Straddle Strategy

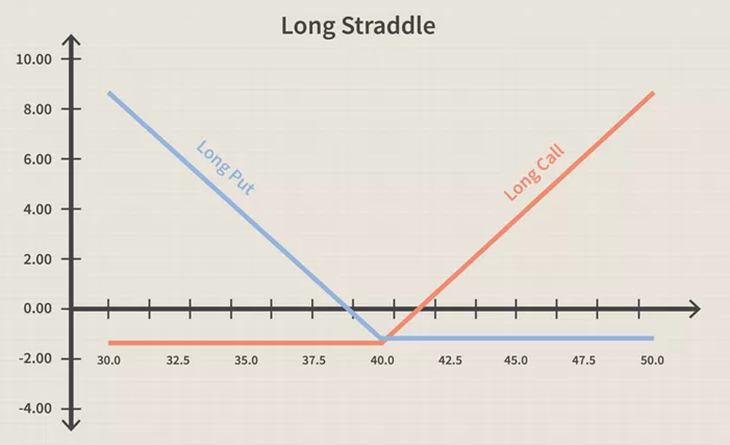

The straddle strategy is one of the most common strategies that aim to profit from increased volatility in any price direction. This strategy makes money when the price goes decisively in one direction—either up or down. Because of this, this strategy performs best when applied during times when a significant rise in volatility is anticipated, such as before significant market reports.

In a straddle strategy, a trader buys a call and put option with the same maturity and same strike price. The trader anticipates increased volatility because the technique allows them to profit when the underlying price changes direction.

For example, a trader purchases a call and put option on a stock with a $40 strike price and a three-month maturity period. Assume that the underlying’s stock price is at $40 as well. So, both options are trading at a profit. Consider a scenario where the underlying price fluctuation has an annual standard deviation of 20 percent and the risk-free rate is 2 percent. Using the Black-Scholes model, we may determine that the call and put prices are $1.69 and $1.49, respectively. (Put-call parity also forecasts that the call and put prices will be around $0.2.)

The strategy costs $3.18, which is the total of the call and put prices. Whether the underlying price rises or falls, it enables a long position to profit from any price shift. Here is how the strategy capitalizes on volatility in both price increase and reduction scenarios:

- At maturity, the underlying price exceeds $40. In this instance, the trader executes the call option to obtain the value, and the put option expires meaningless.

- At maturity, the underlying price is less than $40. In this instance, the trader executes the put option to obtain the value as the call option expires meaningless.

The amount of the premiums paid for the call-and-put options is the cost of the approach. Volatility must be high enough to cover this cost for traders to make a profit using the method. A price that is either higher than $43.18 or lower than $36.82 must be achieved by the trader through volatility. Imagine if the cost rises to $45. Here, the put option expires meaningless, and the call option is profitable: 45-40=5. A net profit of 1.82 is obtained after deducting the position’s cost.

Strangle Strategy

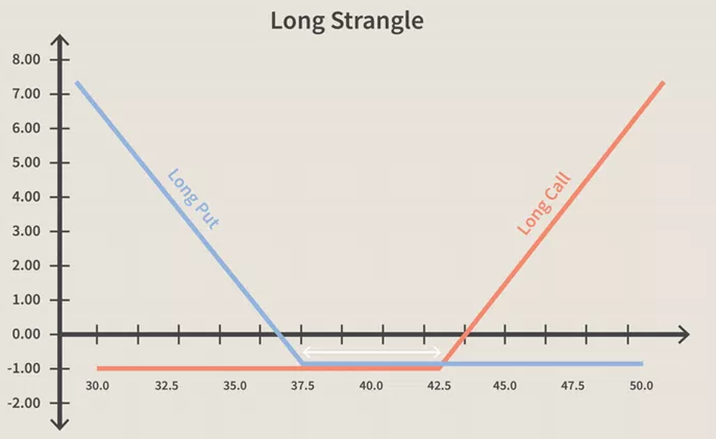

The employment of two at-the-money options makes a long straddle a pricey position. The cost of the position can be reduced by creating straddle-like option positions, but this time utilizing out-of-the-money options. An out-of-the-money call and an out-of-the-money put make up this position, which is known as a “strangle.” This technique won’t cost as much as the previously shown straddle because the options are out-of-the-money.

Using the prior illustration as a guide, suppose a second trader purchases a call and put option with strike prices of $42 and $38, respectively. The call option will cost $0.82, while the put option will cost $0.75, with everything else remaining the same. Thus, the position’s cost is just $1.57, which is roughly 49% less than the cost of the straddle position.

Even though this technique doesn’t require as much investment as the straddle, it does require more volatility to be profitable. This is demonstrated by the length of the black arrow in the chart below. For this strategy to be profitable, volatility must be significantly high for the price to move above $43.57 or below $36.43.

Conclusion

To sum up, volatility trading strategies can give traders an arsenal of strategies to help them get around the complicated and quickly evolving world of options trading. Investors can make wise judgments that may result in positive outcomes by continuously assessing market conditions and applying a profound awareness of the role played by volatility.

Using volatility indicators such as the VIX index, investors can learn how the market expects prices to change in the future. Additionally, employing advanced trading strategies like historical versus implied volatility, straddles, and strangles enables traders to benefit from different market circumstances and develop a well-rounded and flexible trading approach.