For traders seeking a systematic way to protect profits, the Chandelier Exit strategy is an essential volatility-based indicator.

Created by expert Chuck LeBeau, it places a dynamic trailing stop that “hangs” from price highs (like a chandelier) to identify optimal exit points during strong trends.

By preventing early exits and locking in gains, the Chandelier Exit has become a cornerstone of modern risk management for stocks, forex, and crypto trading.

The aim of the Chandelier Exit indicator is to notify investors when they should take an exit or get an entry into the financial market within a certain time period. It highlights the chances of definite trend reversal and prevents most traders from taking an early exit, thereby maximizing returns on the trade.

Principle and Elements of Chandelier Exit Strategy (CE)

Even though Chuck Le Beau was behind the creation of the Chandelier Exit, there is another name that gave life to the entire concept. Alexander Elder, another expert in exit strategies, introduced the trading system and CE to investors and traders through his amazing book ‘Come Into My Trading Room.’

It works on the following principle:

The probability of trend reversal depends upon price action against the prevailing trend. When an asset’s price crosses at a distance equal to thrice the average true range, there will be a higher probability of trend reversal.

Chandelier Exit is used to analyze the price action, depict a potential trend reversal, and send signals to the traders during a certain trend. In low volatile trading conditions, small stop losses are ideal, which enable traders to take an exit at a higher position to enjoy maximum returns.

Highly volatile trading sessions are more likely to face trend reversal. Traders may choose smaller trading sessions to execute their trades within a specific time period successfully.

A Trailing Stop-Loss: Chandelier Exit Strategy

Volatility and stop-loss have a strong relationship that arises the need to use the trailing stop-loss order technique so that traders can make better decisions to earn more returns.

This is where Chandelier Exit Strategy comes in with the promise to bring the best out of its features. In fact, it keeps them safe from potential losses against trend reversals. Many traders suggest going for Chandelier Exit because of its stop-loss analysis feature.

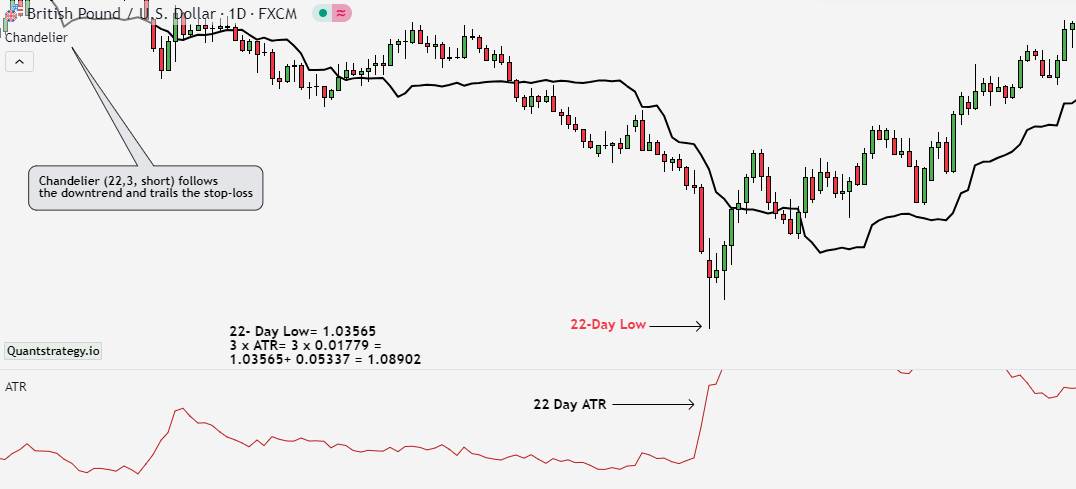

According to Charles Le Beau, setting up a period of 22 plus the multiple of thrice the Average True Range can give satisfactory answers to the questions. The reason behind using an exact number of 22 is the presence of 22 trading days within a month. Moreover, the 22-day long period shows short-term fluctuations in the price. Though, a trader can create a daily chart to analyze the situation or opt for other settings according to the trading style, price fluctuation, and risk tolerance.

Formula and Calculation of Chandelier Exit Indicator

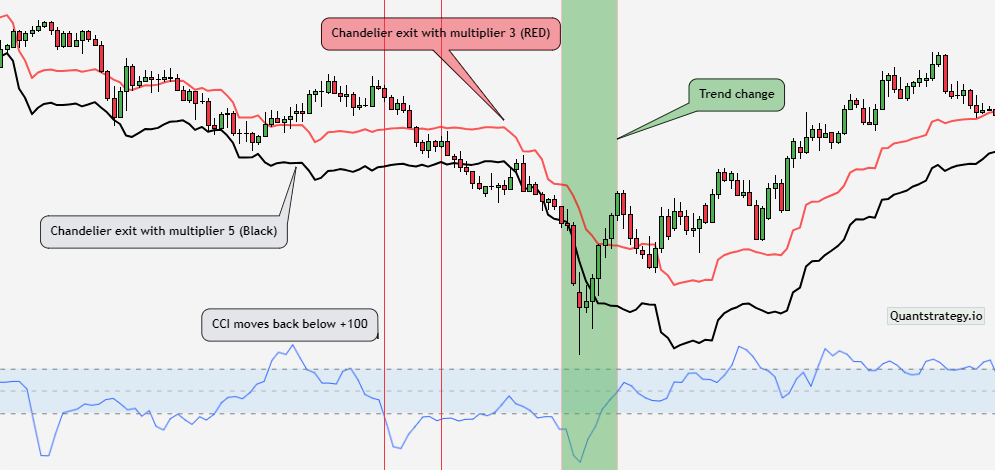

There are two lines showing data of the Chandelier Exit indicator – the chandelier exit short and the chandelier exit long. The latter is used to close long positions while the exit short is needed to close shorter ones. Here, the aim of this technical indicator is to close long positions as soon as an asset’s price crosses from below the exit long and vice versa.

To evaluate the values for the two lines are as follows:

- Chandelier Exit Long: n-day Highest High – ATR (n) x Multiplier

- Chandelier Exit Short: n-day Lowest Low + ATR (n) x Multiplier

Showing:

· ‘n’ as the number chosen by the trader or the default setting period i.e. 22

· ‘multiplier’ is the default Average True Range i.e. 3.0

Chandelier Uptrend

As the name suggests, the Chandelier up trend happens when a security’s price moves upward over time and every successive peak and trough tends to be at the highest high as compared to the previous one.

With that being said, it’s quite evident that it enables traders to earn more returns before the trend starts to show reversal effects. Since the Chandelier Exit highlights an up trend in a trade, it’s quite easy to set trailing stop lows. Moreover, as soon as the trend line flows in the reverse direction, traders can take assistance from other technical indicators to spot trigger points for buying within the same period.

Chandelier Downtrend

The core idea of the Chandelier downtrend revolves around the decline of security within a certain time period. It focuses on low peaks and troughs, where traders have to keep an eye on asset moves and show a proactive approach to avoid possible losses.

When the trend continuously touches the lowest low, it starts to leave negative impacts on security, thereby bringing them on the verge of facing significant financial losses. This is where the exit indicators such as Chandelier Exit turn out to be useful. They are responsible to identify downtrends in a particular time period so that traders can take prompt decisions.

To authenticate the sideways scenarios, traders may combine the signals from Chandelier Exits with that of the Relative Strength Index or RSI. Together, they can estimate a downtrend’s strength and allow investors to figure out whether they should enter short positions.

Implementation of the Chandelier Exit in Forex Trading

The indicator works in the following manner for investors who are interested to invest in the FX market:

Long Position

-

Wait until a candle closes above the CE.

-

Make a long position entry as soon as a new candle opens for the currency pair.

-

Examine the currency pair’s average volatility and initiate a stop-loss order below the Chandelier Exits.

-

Move the stop-loss as the security’s price crosses and creates new highs.

-

At one point, the trend will start to reverse and force the investors to take an exit.

Short Position

-

Wait until a candle closes below the Chandelier Exits.

-

Make a short position entry as soon as a new candle opens for the currency pair.

-

Upon considering the currency pair’s volatility, select a spot above the CE for a stop-loss order.

-

Shift it down as per new lows by the currency pair’s price.

-

That point will disappear as soon as the trend reverses and shows significant variation in the price. The position will close at the same time.

Pros and Cons of the Chandelier Exit

Pros

- Allows investors to make the most of every trade having negligible risk.

-

Combined results with any other technical analysis indicator help to create advanced strategies.

Cons

-

Expert skills are required to make changes in the Chandelier Exit values. It would be difficult for beginners to understand where and how they are supposed to do it.

Conclusion

Referred to as a volatility-based indicator, the Chandelier Exits are useful to create a trailing stop-loss for a trend in the financial market. The best part of this indicator is, it allows traders to stay in the trend a bit longer if the trend extends more than the extent it was expected.

Apart from this, the Chandelier Exit is also a reliable trend indicator that shows a strong trading signal in a long position, when the Chandelier Exit lies below the break and vice versa.

As soon as the existing trend ends and a new trend starts, investors can shift focus on it and let the Chandelier Exits analyze it.

Instant Backtests

Forget guessing how an indicator might perform; our instant backtesting data gives you the answers.

We’ve done the heavy computational lifting so you can focus on making informed decisions.