Pairs trading is a well-known trading strategy used in several markets, including ETFs, currencies, equities, and futures markets. It involves opening one long position and one short position for two financial securities in order to lower your market risk. These financial securities can come from the same or separate markets as long as they are positively correlated.

Both long-term traders and short-term investors can use pair trading to their advantage. It’s a market-neutral strategy built primarily to produce possible market-neutral returns using both statistical and technical analysis. It aims to profit from the price convergence between two financial instruments. The direction that the market is moving doesn’t change this strategy.

What is Pairs Trading?

Pairs trading is one way of hedging risk in financial markets. Midway through the 1980s, a team of technical analyst researchers working for Morgan Stanley developed pairs trading for the first time.

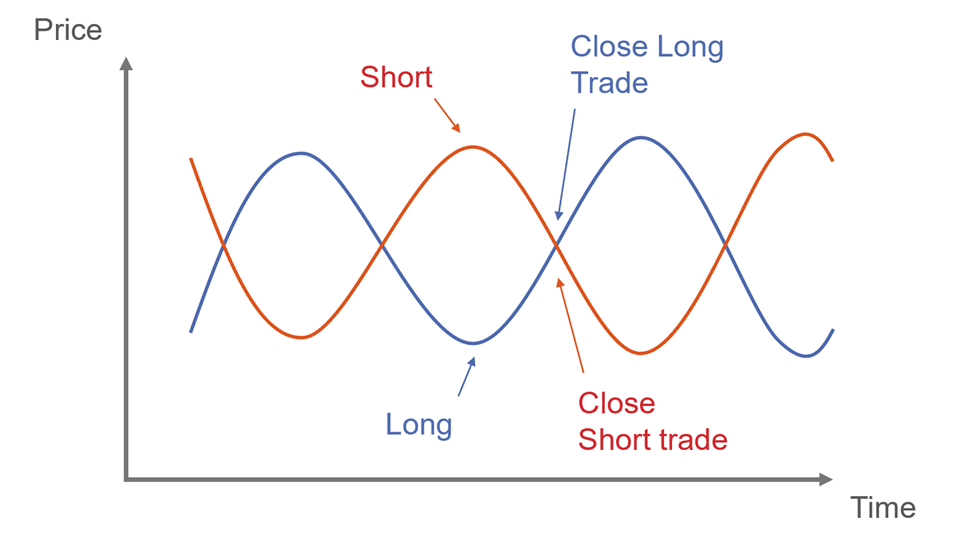

Pairs trading strategy involves opening 2 positions, one short and one long, on two different financial instruments that have a high positive correlation.

The goal of pairs trade is to bet that, even if two assets’ prices initially diverge, they will eventually converge.

When the prices of two assets tend to move in the same direction, there is a positive correlation between them. When the value of one asset increases, the value of the other follows in a roughly proportional manner. The same holds true when prices drop.

You are now hedged or protected against any market-wide fluctuations by holding one “long” and one “short” position. The loss from your long position would be nearly compensated by the gain from your short position if both instruments declined by an amount that was roughly equal.

A pairs trading strategy can therefore be referred to as a “market neutral” strategy that enables a trader to possibly earn from any market circumstance.

How does Pairs Trading Work?

Pairs trading strategies operates under the presumption of market neutrality. This means that if two financial instruments, such as options, futures, currencies, or stocks, have historically exhibited a positive correlation, they will do so going forward.

These securities may belong to a single industry and occasionally even to direct competitors. The price movements of these highly connected assets may begin to diverge, and this can happen over the course of a few minutes, weeks, or even months.

Pairs trade works best when the price of two positively correlated instruments diverges, with the underlying premise being that past performance will cause the prices to converge again after the divergence to restore their historical correlation. In other words, traders participating in this trading approach will look for highly correlated strategies. A pairs trader in a market neutrality concept can expect a price rise of their underperforming assets as well as the price of their overperforming assets to decline soon.

A concrete example is the best way to illustrate this.

Pairs Trading Example

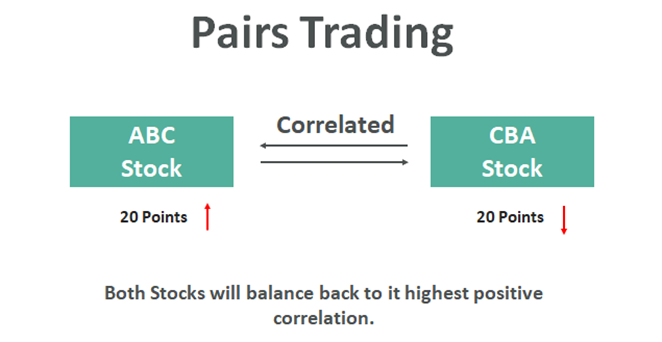

Let us say there is a high positive correlation between ABC stock and CBA stock.

Despite the historically high correlation between the two stocks, ABC stock is 20 points up, and CBA stock is 20 points down.

Since the idea of pairs trade shows that two historically correlated securities that are not well correlated at the moment eventually trade to restore their historical trends, it can be assumed that both these stocks will bounce back.

Pairs Trading and Statistical Arbitrage

Pairs trading is also sometimes called statistical arbitrage trading strategy. Although these two concepts are frequently used synonymously, pairs trading is a subset of statistical arbitrage, thus, we may say that while all statistical arbitrage is pairs trading, not all pairs trading is statistical arbitrage.

Statistical arbitrage strategies are quantitatively driven techniques. The ultimate goal of each strategy is to increase the profit margins for the trading firms.

Statistical arbitrage is not a high-frequency technique but rather a medium-frequency one. The majority of statistical arbitrage’s applications are in the financial markets, and hedge funds and investment banks now use it often.

The mean-reverting portfolios of pairs trade and factor investing are the two main categories of statistical arbitrage. In its most basic form, pairs trade just refers to trading two different assets, but statistical arbitrage can be expanded to include an n-dimensional mean reverting portfolio. Large, diverse portfolios that are traded only for a brief time are used in statistical arbitrage.

Pairs Trading Strategy

Historically, most traders have evaluated their trades and investments with regard to absolute returns. In essence, if you buy something and its value rises, there is a chance of potential benefits from it, or if its value falls, there is a chance to lose money. Pair trades, however, drastically alter this. It entails taking a long position in one and a short position in the other.

Your gains from pairs trade depend on relative returns, which means that one position is performing better than the other. It isn’t important how the two parts of the pair perform compared to one another; rather, it matters how they perform relative to the whole market. Both sides can go up, both can go down, or the outcomes can split. Many people consider pairs trade to be a form of financial hedging.

Correlations are Significant in Pair Trading Strategy

A pairs strategy is built on the historical correlation of both stocks. The main inspiration for this strategy might be that the stocks included in it should inevitably have a higher rate of positive correlation.

The correlation is positive when the two stocks move in the same direction with the same magnitude, whereas the correlation is negative or inverse when the two stocks move in opposite directions with the same magnitude.

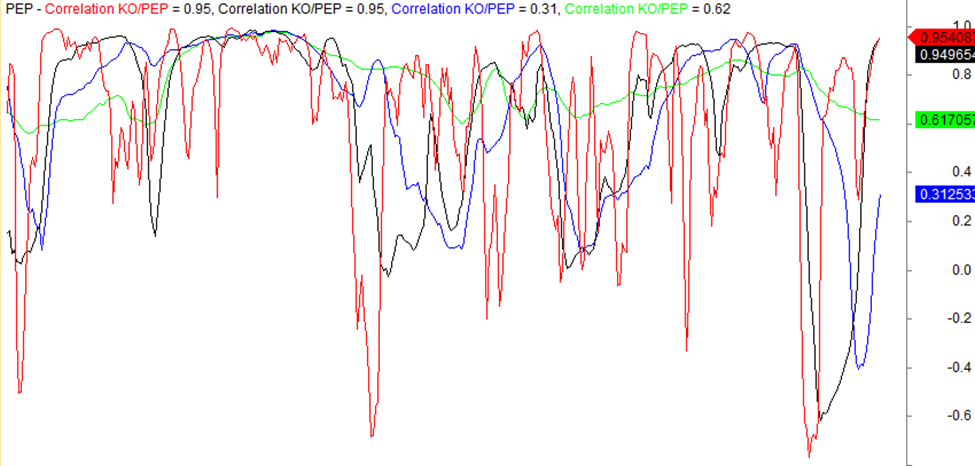

The below chart illustrates four distinct correlations for PEP/KO.

The graph displays the PEP/KO correlations for 10 days (red), 30 days (black), 50 days (blue), and 100 days (green). The numbers change based on how many days there are. The 100-day period, which spans the last 1.5 years, has a range between 0.6 and 0.95, indicating that PEP and KO are fairly correlated.

Traders might select the pair for pairs trade if the correlation is high. This large number illustrates the strong relationship between the two securities. Therefore, the likelihood of the second stock increasing is relatively high if the first one increases.

However, if you only look at correlation, you could get false results. The prices of the two stocks may continue to rise without ever mean-reverting, for example, if your pairs trade is predicated on the spread between the prices of two stocks.

Cointegration in Pairs Trading

Although helpful, a correlation may not be an accurate indicator of a pair’s quality. Wide changes in the spread ratio are possible even when there is a positive correlation. The quality of a pair is frequently better assessed using cointegration.

What is Cointegration?

Cointegration is a statistical concept that refers to the long-term equilibrium relationship between two or more time series variables. It is a concept used to identify stable and predictable patterns in data that include trends, randomness, and other variables.

In other words, cointegration occurs when two or more non-stationary time series have a stable long-run relationship despite exhibiting some degree of short-term differences.

Using Cointegration for Pair Trading

The idea is to find two stocks whose prices are cointegrated, meaning they tend to move together over the long run, but may diverge in the short-term.

By buying one stock and simultaneously selling the other, a trader can profit from the price difference if and when the stocks converge back to their long-term relationship.

To use cointegration for pair trading, a trader would typically follow these steps:

1.

Identify potential pairs: Use statistical models like the Johansen cointegration test to identify pairs of stocks that are cointegrated. These pairs should have a high degree of correlation and a low likelihood of diverging in the long run.

2.

Determine the appropriate spread: Once a pair is identified, a trader would determine the appropriate spread (the price difference between the two stocks) that would generate profits when the stocks converge back to their long-term relationship.

3.

Trade the pair: When the spread widens beyond the predetermined threshold, the trader would buy the underperforming stock and sell the overperforming stock. When the spread narrows back to their long-term relationship, the trader would sell the underperforming stock and buy the overperforming stock, thereby capturing the difference in price.

However, it’s important to note that cointegration is not a guarantee of profitability, and there may be other factors that affect the price movements of the stocks.

Advantages of Pairs Trading

- Aids in risk mitigation – It deals in the trading of two assets, so even if one underperforms, the other can compensate for the losses. This can aid in risk mitigation. It assists in reducing trading risks brought on by movements in the market’s direction.

- Proven gains – The trader makes money no matter how the market is doing. In simple terms, regardless of whether the market is moving up, down, or sideways, gaining or losing, pair traders will be able to profit from their trades.

- Hedging benefits – The trader is entirely hedged, which is the finest benefit of pairs trading. Hedging is accomplished in this trading strategy when the trader sells the overvalued security and buys the undervalued security to reduce the likelihood of loss.

Disadvantages of Pairs Trading

- Price Filling – Since transactions must be completed in big volumes and profits in pairs trade depend on very tight margins, there is a considerable likelihood that stock orders won’t be filled at the anticipated price.

- Commissions – Due to the higher commission rate required by pairs trade, some traders strongly discourage it. The commission for a single trading pair may occasionally be double what it is for an ordinary trade. The difference in commission would determine earnings and losses for traders using small profit margins.

- Using data with high statistical correlation only – Pairs trade depends on a high statistical correlation between the securities. A correlation of at least 0.80 is required by the majority of traders, which is exceedingly difficult to identify.

Conclusion

Pairs trading is a highly effective trading strategy because it can be used irrespective of the state of the market. According to pairs trading, the correlated securities will continue to move in the same way they were already moving, regardless of how the market may change. The price of an underperforming correlated asset will increase in a long trade, whereas the price of an overperforming correlated security will decrease in a short trade.

However, relying on mean reversion in pars trade can be risky because markets are dynamic and change frequently. The expectation of a trader that their pair’s trading correlation will return to its initial value after buying and selling the position can sometimes prove incorrect. Therefore, you must have a sound risk management strategy in place in case your pair’s trade methods do not produce the profit that you had anticipated.