Does psychology play a role in trading? Yes, it does!

We unconsciously carry out thousands of actions each day. That is typically a good thing since if we had to actively think about each breath, each step, or even moving our facial muscles to grin, we’d never get anything done.

However, when it comes to trading, the same auto-pilot algorithms that make it easier for us to traverse the outside world can work against us. Although we can’t change these programs, we can become more conscious of our attitudes and take action to re-program any negative habits.

One such behavioral characteristic that can result in a long-term detrimental effect on a trader’s financial situation is loss aversion. It is the propensity to find it difficult to accept losses after entering a trade, resulting in decisions that stray from the trading strategy and produce greater losses than anticipated.

A trader must conquer this psychological aspect to succeed in the cutthroat environment of the financial markets.

In this article, we will learn about overcoming loss aversion in trading along with strategies for success.

What is Loss Aversion?

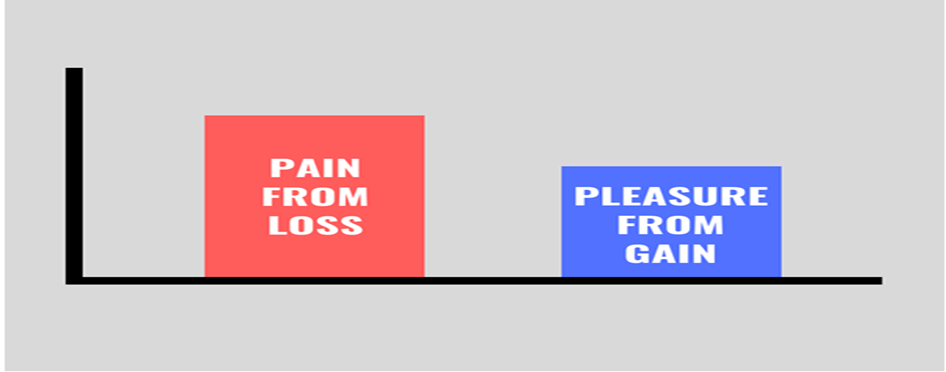

The tendency of people to feel more negative emotions and psychological pain when they lose something as opposed to the pleasant emotions they experience when they gain something is known as loss aversion. It is a type of cognitive bias.

In trading, loss aversion bias is a preference for avoiding losses than seeking to make equivalent gains.

Empirical evidence (Kahneman and Tversky – 1979) on loss aversion recommends that the pain of losing is felt twice as strongly as what is felt with the enjoyment of gains. For example, when faced with a choice to avoid a loss of 100$ or make a profit of 100$, traders with loss aversion will opt for not making a loss than making an equivalent gain.

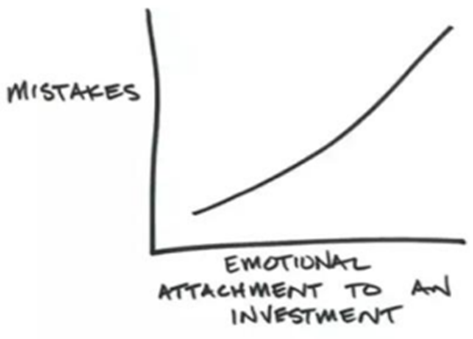

Traders with loss aversion bias often make suboptimal investment decisions. One’s susceptibility to loss averse increases with the number of losses one experiences.

This propensity is a part of behavioral economics, which studies how emotions and other outside factors affect economic choices. Understanding loss aversion and how it influences decision-making can help investors become more aware of their tendencies and make decisions, which are in line with their aims and objectives.

Origin of Loss Aversion – Prospect Theory

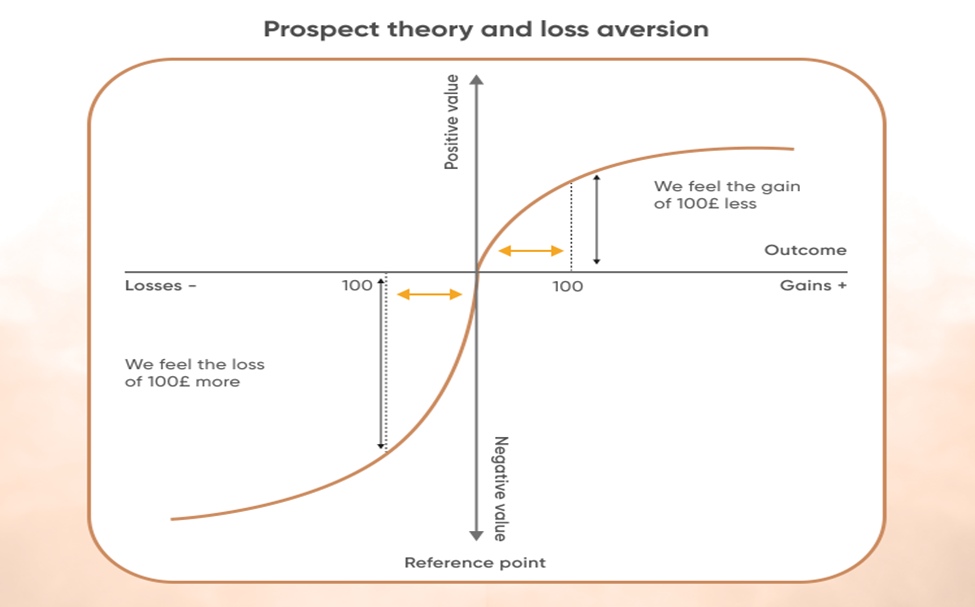

The term loss aversion was developed by Israeli cognitive psychologists Daniel Kahneman and Amos Tversky in 1979 as a component of their prospect theory. Kahneman even won the Nobel Prize in behavioral economics for this.

The prospect theory has significant effects on trading and investing and gave rise to a brand-new area of research called loss aversion behavioral finance.

While the conventional economic theory holds that we make rational judgments based on self-interest, Kahneman and Tversky found that other considerations, including fairness, past experiences, and loss aversion, are also significant in behavioral decision-making.

Researchers revealed in the prospect theory that people are more likely to take risks to prevent a loss than to achieve a gain since the pain of losing is psychologically around two times more powerful than the pleasure of acquiring equivalent gains. This problematic psychology can result in poor financial decision-making.

The opposite is true in terms of gain since people become risk-averse. Instead of taking the chance of winning more but potentially risking obtaining nothing, they would prefer to receive a certain, smaller win.

An excellent illustration of prospect theory in action is purchasing insurance policies. The majority of consumers would rather accept a smaller, guaranteed loss in the form of monthly insurance payments than take a chance at an unexpectedly high cost.

Recognizing Loss Aversion

Nobody enjoys experiencing a loss, but loss averse might make you lose more money or earn less than what you anticipated. Here is a list of loss aversion biases that investors frequently fall into:

- Selling investments in a gain position sooner than fundamental analysis would indicate out of concern that the profits would erode and hold onto losses in the hopes of breaking even someday. Choosing low-risk, assured investments over more lucrative ones that involve greater risk. Refusing to sell despite the availability of higher alternative investment opportunities. When an investor sells a fund or stock ultimately, the return on investment is quite poor because a lot of time may have passed.

- Real estate and property investments frequently exhibit loss aversion. Investors hang onto their property rather than sell it at a loss in the hopes that their investment may become profitable one day. They pay interest on their loans for the duration of keeping the investment, which could have been avoided if they had sold it sooner.

- Selling a stock that has barely increased in price only to make a profit of any size when trading analysis suggests holding the stock longer to make a much greater profit.

- Consciously telling oneself that an investment isn’t a loss till it is realized (that is – until the investment is sold)

- You are refraining from selling a stock you own even if your present rational analysis suggests that it should be given up as an investment.

- Selling to prevent future losses when the price of the stock declines as opposed to buying more and waiting for the price increase. This is referred to as “averaging down”.

Trading Psychology – Overcoming Loss Aversion: Strategies for Success

While there is no immediate cure for loss aversion, it can be efficiently managed with self-control, awareness, and a well-organized trading strategy. To overcome loss aversion and enhance trading performance, traders can use the following main strategies:

-

A Well-Defined Trading Plan

Having a well-defined trading plan, which includes losses is the first step in minimizing loss aversion. Based on the trader’s approach and risk tolerance, this plan should include precise entry and exit spots, stop-loss orders, and profit goals. Additionally, traders should plan how they will respond to certain circumstances, such as trades going in their support, against them, or remaining neutral. A well-thought-out plan reduces irrational emotional judgments and gives an outline for focused trading.

-

Stick to the Plan No Matter What

Once a trading plan is established, it is essential to adhere to it under all circumstances. This entails acting rationally and sticking to the established entry and exit positions, stop-loss orders, and profit targets. It’s crucial to have the self-control to accept losses as a necessary element of trading and refrain from deviating from the strategy out of fear, greed, or irrational impulses.

-

Have Realistic Expectations

Professional traders must have reasonable expectations regarding the dangers and potential gains associated with trading. It’s critical to realize that not every trade will be successful and that losses are an inherent part of trading. Managing loss aversion and avoiding irrational investment decisions can be done by having realistic expectations and realizing that losses are a necessary part of trading.

-

Manage Risk Correctly

Risk management is essential for controlling loss aversion. Never put more money at risk on a single trade than you can afford to lose. Stop-loss orders are advised to avoid losses and safeguard capital. Additionally, traders should refrain from using excessive leverage and placing too much risk in a single trade, as these actions can exacerbate losses and cause loss aversion.

-

Practice Mindfulness & Emotional Regulation

Managing emotions is essential to overcoming loss aversion because they play a significant role in trading. Instead of reacting irrationally to losses, traders who practice mindfulness and emotional regulation techniques can become aware of their emotions, manage them, and make reasonable judgments based on their trading strategy.

-

Evaluate and Learn from Losses

Rather than worrying about losses, traders should see them as chances to learn and grow. Reviewing unsuccessful deals and figuring out what went wrong can yield insightful information for subsequent trades. It’s crucial to spot any patterns or faults in trading and take corrective actions to prevent repeating them.

-

Ask for Mentor or Coach Support

Having a mentor or coach might help you manage your loss aversion. A coach or mentor can offer direction, criticism, and help in controlling emotions, building a trading strategy, and making disciplined trading judgments. Additionally, they can assist traders in overcoming psychological obstacles and keep them responsible for adhering to their plans.

Conclusion

Loss aversion in trading is a cognitive bias, which can cause investors to emphasize more on avoiding losses than making gains. This frequently results in suboptimal financial decisions.

Loss aversion bias is usually a result of anxiety, regret, and fear. Driven by this behavioral bias, an investor may opt to hang onto losing positions for an extended time in the hope that it’ll ultimately turn around, even when the fundament analysis suggests otherwise, or sell a winning work position too early in order to prevent a potential loss.

Overcoming loss aversion is important for successful trading psychology. Traders should understand the causes behind loss aversion and the problems created by it and implement effective trading strategies.

The ability to be flexible and objective, as well as to be able to assess market conditions and make judgments regardless of your current position, can be crucial for overcoming loss aversion. Traders could make better decisions and possibly enhance their overall performance if they recognized and dealt with this bias.