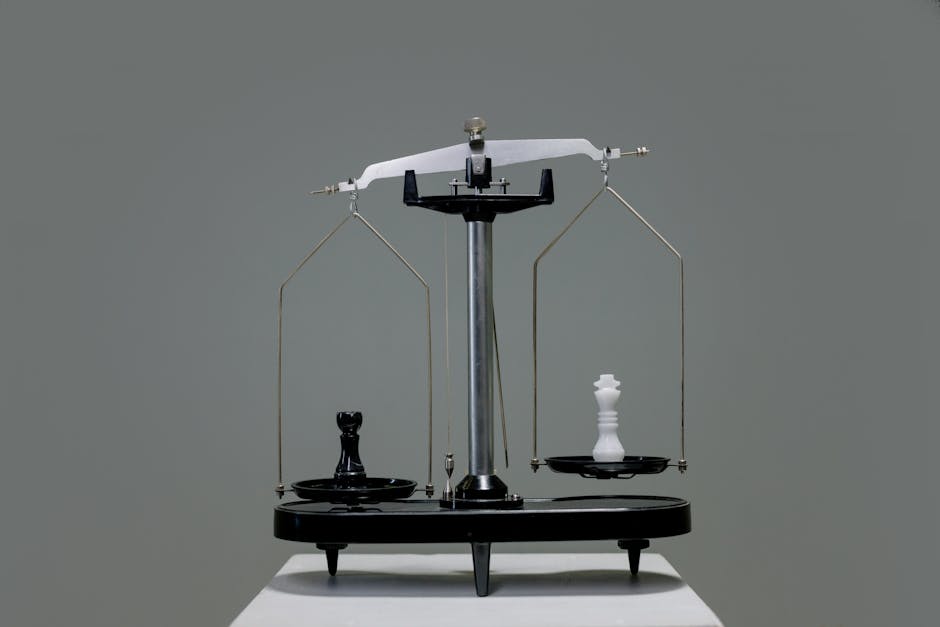

The journey from basic options knowledge to advanced options positioning requires a deep comprehension of the “Greeks”—the mathematical variables that quantify risk sensitivity. While Delta measures directional exposure, its utility is severely limited without its counterparty: Gamma. The core subject of Delta vs. Gamma: Understanding the Dynamic Relationship for Advanced Options Positioning is not about choosing one over the other, but recognizing that they operate in a synergistic dance. Delta tells you where you are, but Gamma tells you how fast you will get to your next P&L point. Mastering this dynamic is paramount for traders seeking control over their portfolio’s sensitivity to underlying price movement, a necessary step detailed in The Options Trader’s Blueprint: Mastering Implied Volatility, Greeks (Delta & Gamma), and Advanced Risk Management.

Defining the Greeks: Delta and Gamma

To employ advanced positioning strategies, we must first firmly establish the roles of these two fundamental measures:

- Delta ($\Delta$): This measures the expected change in the option price for a one-unit change in the underlying asset’s price. A Delta of 0.50 means the option price should increase by $0.50 if the stock price increases by $1.00. Delta is your exposure to directional movement.

- Gamma ($\Gamma$): This is the rate of change of Delta relative to the underlying price. If Delta is velocity, Gamma is acceleration. Positive Gamma means your Delta moves quickly toward 1.00 (or -1.00) as you move In-The-Money (ITM), accelerating profits (or losses) on long positions.

Options traders should view their position’s overall Delta as their immediate risk exposure, but their overall Gamma as their future risk exposure. High Gamma translates to high uncertainty regarding your future Delta exposure, especially during rapid market shifts (see also: Gamma Scalping Strategies: Profiting from the Rate of Change in Delta and Market Movement).

The Synergistic Dance: How Gamma Controls Delta

The relationship between Delta and Gamma defines the convexity of an options position. Convexity refers to the curvature of the P&L graph. Positions with high positive Gamma (e.g., long calls or long puts) exhibit positive convexity; as the underlying moves favorably, profits accelerate because Delta increases rapidly. Positions with negative Gamma (e.g., short strangles or short vertical spreads) exhibit negative convexity; adverse movements accelerate losses because Delta moves rapidly against the trader.

For an advanced trader, Gamma dictates the hedging frequency. If you are aiming for a Delta-neutral portfolio (Delta close to zero), Gamma determines how quickly that neutrality is broken:

- High Positive Gamma: The trader’s Delta will naturally move back toward zero as the underlying price moves. This is auto-hedging, requiring less frequent (and more profitable) adjustments.

- High Negative Gamma: The trader’s Delta will move sharply away from zero with every market movement. This requires constant, often costly, adjustments to maintain neutrality, drastically increasing transaction costs and execution risk.

This dynamic highlights the fundamental trade-off: traders who are long Gamma pay for it via Theta (time decay), while traders who are short Gamma collect Theta but assume higher volatility risk (Vega Risk Management: Hedging Against Sudden Shifts in Implied Volatility).

Advanced Positioning: Balancing Risk Exposure (Delta) and Sensitivity (Gamma)

Advanced options positioning involves selecting strategies that provide the desired Delta exposure while managing the Gamma consequences:

Strategy 1: Positioning for Explosive Moves (Long Gamma, Neutral Delta)

When anticipating a high-magnitude move but unsure of the direction, the ideal setup involves high positive Gamma combined with near-zero Delta. The goal is to maximize Gamma exposure to profit from the resulting Delta changes without taking initial directional risk.

Example: Long Straddle/Strangle. By purchasing both an ATM call and an ATM put, the initial position is Delta-neutral. As the stock moves sharply in either direction, the profitable leg’s Delta accelerates toward 1.00 while the losing leg’s Delta collapses toward zero, resulting in rapid profit accumulation. This is the purest application of buying Gamma to profit from volatility, mitigated by careful IV Rank analysis to ensure the options are not overpriced.

Strategy 2: The Theta Collector (Short Gamma, Defined Delta)

In range-bound markets or when expecting volatility contraction, a trader seeks to sell Gamma and collect Theta. This positioning requires accepting negative convexity, meaning the trader must define their maximum loss early and strictly adhere to risk management rules.

Example: Iron Condor or Calendar Spreads. These strategies are net short Gamma. They profit from the passage of time (Theta) as long as the underlying asset stays within a defined range. However, if the underlying breaks past the short strikes, the position’s Delta quickly accelerates, threatening the small premium collected. Successful short Gamma traders rely heavily on essential position sizing and rapid adjustments to re-center Delta if the market moves against them.

Case Study: Managing Gamma Spike Near Expiration

The most critical interaction between Delta and Gamma occurs as options approach expiration. At-the-Money (ATM) options experience a phenomenon known as the “Gamma Spike.”

Consider a trader holding 10 short ATM call options (negative Gamma) just three days before expiration. The Gamma for that contract is extremely high. If the stock trades $1 above the strike, the option’s Delta instantly shifts from -0.50 toward -1.00. If the trader was attempting to maintain Delta neutrality (a hedge), this spike forces an enormous and urgent adjustment:

- Initial Position: -500 Delta (10 contracts * -0.50 Delta/contract). The trader is long 500 shares to hedge.

- Market moves $1 ITM. Gamma spikes. The option Delta jumps to -0.90.

- New Position Delta: -900 Delta (10 contracts * -0.90 Delta/contract).

- Required Hedge Adjustment: The trader now needs to be long 900 shares, forcing them to buy 400 shares at a higher price, increasing trading costs and accelerating potential losses if the stock reverses.

This demonstrates why short Gamma near expiration is considered highly risky, requiring constant vigilance and advanced technical skills like combining IV with momentum indicators to anticipate necessary adjustments. The closer to expiration, the more intensely Gamma drives Delta, amplifying both reward and risk.

Conclusion

For advanced options positioning, Delta and Gamma must be analyzed as components of position convexity, rather than isolated variables. Delta defines the magnitude of immediate profit or loss from directional movement, while Gamma defines the rate at which that Delta—and therefore your risk profile—changes. Profitable trading hinges on selecting a structure that matches your market outlook: long Gamma for high volatility/explosive moves, and short Gamma for stability/theta collection. Traders who ignore Gamma are merely guessing at their directional exposure; those who master it gain tactical control over their sensitivity profile, a crucial component of The Options Trader’s Blueprint: Mastering Implied Volatility, Greeks (Delta & Gamma), and Advanced Risk Management.

Frequently Asked Questions

What is the key difference between Delta and Gamma risk?

Delta represents the linear, static risk exposure to price movement at a single point in time. Gamma represents the non-linear, dynamic risk—it is the measure of risk that your Delta will dramatically change, accelerating profits or losses based on convexity. Gamma is the hedging risk, while Delta is the directional risk.

How does the Delta/Gamma relationship affect hedging strategies?

A positive Gamma portfolio is “sticky” or self-hedging, meaning its Delta naturally moves back toward zero if the underlying reverses, requiring less frequent adjustment. A negative Gamma portfolio is highly volatile, requiring continuous adjustment (buying high, selling low) to maintain a Delta neutral position, making short Gamma hedging expensive and complex.

Why does Gamma spike near expiration for At-The-Money (ATM) options?

As time value decays rapidly (Theta), an ATM option rapidly transforms into either an ITM option (Delta near 1.00) or an OTM option (Delta near 0.00). This rapid shift in Delta over a tiny price movement causes Gamma (the rate of change of Delta) to surge, making near-expiration ATM options highly sensitive to price fluctuations.

Which option Greeks are inversely related to Gamma?

Gamma and Theta are generally inversely related. Strategies that are long Gamma (positive convexity, like buying options) must pay Theta (time decay), resulting in losses if the market remains flat. Strategies that are short Gamma (negative convexity, like selling options) collect Theta but incur greater Gamma risk if the market moves aggressively.

How do advanced traders use Delta and Gamma to manage risk in volatile markets?

In highly volatile conditions, advanced traders prioritize managing Gamma risk, often favoring strategies that are net long Gamma (buying volatility) to benefit from rapid price acceleration and reduce the need for constant re-hedging. They utilize tools like backtesting options strategies to confirm that their Gamma exposure is appropriately sized relative to their total capital.

Should a beginner trader focus more on Delta or Gamma?

A beginner should focus on understanding Delta first, as it defines immediate directional risk and profit/loss. However, they must immediately incorporate Gamma knowledge, especially when choosing strategies. For instance, beginners should avoid naked short option selling (high negative Gamma) until they master the acceleration risk Gamma introduces.