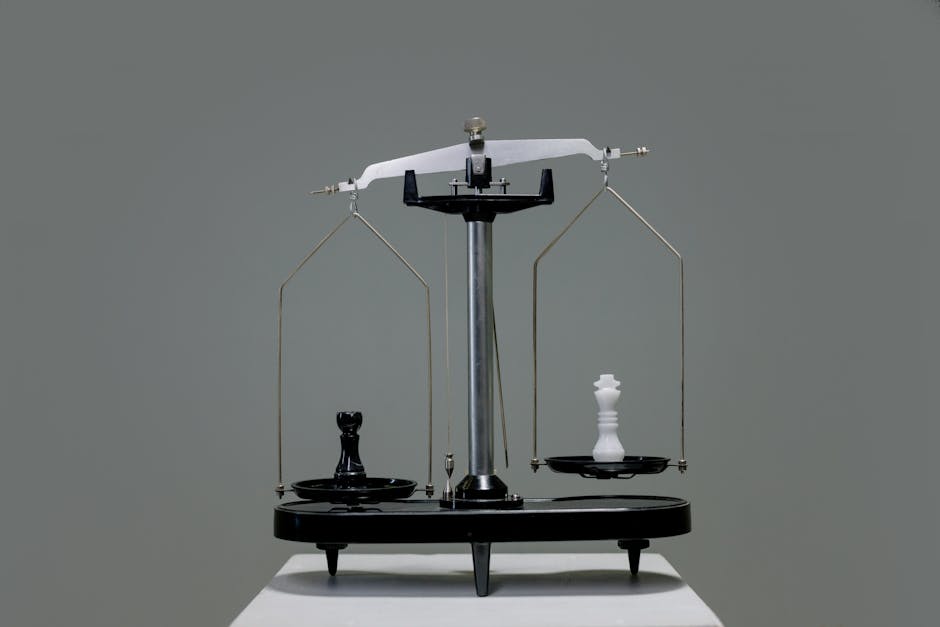

Position sizing is arguably the single most critical component of risk management, determining not just how much you can potentially earn, but more importantly, how much you can afford to lose. In benign, low-volatility environments, the difference between various sizing methodologies might seem negligible. However, when market turbulence spikes—characterized by sudden, large price swings and extended drawdowns—the chosen method becomes the ultimate determinant of survival. The fundamental conflict arises between Fixed Dollar vs. Fixed Fractional Sizing: Which Method Protects Your Capital Better in High-Volatility Environments? Understanding this distinction is essential for any serious trader aiming for sustainable growth, as detailed in our broader guide on Mastering Position Sizing: Advanced Strategies for Scaling, Adding to Winners, and Ultimate Risk Management.

Understanding Fixed Dollar Position Sizing

Fixed Dollar sizing is the simplest method: a trader commits to risking the exact same absolute dollar amount on every trade, regardless of the size of their account. For instance, a trader decides to risk $500 per trade. If their stop loss requires a $50 distance, they buy 10 units; if the stop loss requires a $25 distance, they buy 20 units. The dollar risk remains constant.

The primary advantage of Fixed Dollar sizing is its clarity and predictability in terms of loss magnitude. You always know exactly how much cash you stand to lose on any single setup. However, this method harbors a devastating weakness during high-volatility periods, especially when coupled with a string of losses. Since the dollar risk is static, the percentage risk fluctuates dramatically. If a trader starts with $10,000 and risks $500 (5%), and then suffers a drawdown reducing the account to $5,000, continuing to risk $500 now equates to a 10% risk per trade. This aggressive scaling of percentage risk, often unknowingly, drastically increases the probability of ruin, accelerating the death spiral during sustained market stress.

The Adaptive Power of Fixed Fractional Sizing

Fixed Fractional sizing operates on a fundamentally different and inherently safer premise: the trader risks a fixed percentage of their total trading equity on every single trade. This usually ranges from 0.5% to 2% per trade, depending on the strategy’s edge and correlation. For deep analysis on calculating optimal risk, see The Power of Fixed Fractional Position Sizing: Calculating Optimal Risk per Trade.

In high-volatility environments, Fixed Fractional sizing is the superior capital protector due to its dynamic nature. When the account grows, the dollar risk increases, allowing for compounding. Crucially, when the account shrinks during a drawdown, the dollar risk automatically decreases (e.g., 2% of $10,000 is $200; 2% of $5,000 is $100). This mechanism ensures two critical outcomes:

- It reduces the overall exposure during losing streaks, protecting remaining capital.

- It makes the required percentage gain for recovery smaller relative to the reduced exposure, maximizing survival probability—a key tenet of minimizing ruination, echoing concepts found in Applying the Kelly Criterion to Trading: Maximizing Growth While Minimizing Ruin Probability.

High Volatility: Stress Testing Both Models

High volatility demands wider stop losses. If a trader using Fixed Dollar sizing faces a sudden spike in Average True Range (ATR), they are forced to significantly cut the number of units they buy just to maintain their fixed dollar limit. While this adjustment is necessary, the method itself lacks the inherent self-correction of the fractional model.

Case Study 1: The Drawdown Scenario

Consider two traders starting with $100,000. Both suffer a 20-trade losing streak where they hit their stop loss 15 times, resulting in a 20% drawdown (20 losses * average 1% risk). The difference emerges during the next 10 trades:

- Trader A (Fixed Dollar, $2,000 risk): After the drawdown, their equity is $80,000. If they continue risking $2,000, their percentage risk has risen to 2.5%. If they hit another five losses, they lose $10,000, bringing equity down to $70,000.

- Trader B (Fixed Fractional, 2% risk): After the drawdown, their equity is $80,000. Their risk automatically shrinks to $1,600 (2% of $80,000). If they hit another five losses, they lose $8,000, bringing equity down to $72,000.

Trader B, using the Fixed Fractional method, retains an extra $2,000 and is now risking a smaller dollar amount, requiring less aggressive performance to recover.

Combining Volatility Adjustments with Fractional Sizing

The best practice for navigating high-volatility environments is not simply choosing Fixed Fractional sizing, but combining it with a volatility metric like ATR. This creates a powerful, adaptive position sizing engine. (See: Using ATR to Adjust Position Size: Volatility-Based Risk Management for Dynamic Markets).

The standard calculation for unit size under this combined method is:

$$Units = \frac{(Equity \times Fixed \hspace{0.1cm} Percentage \hspace{0.1cm} Risk)}{(Stop \hspace{0.1cm} Loss \hspace{0.1cm} Distance)}$$

When volatility increases, the Stop Loss Distance (often based on ATR) increases. To keep the dollar risk (the numerator) constant relative to the account size, the Units (the position size) must decrease. This ensures that while the market moves chaotically, the trader’s actual capital exposure remains strictly contained by the predetermined percentage threshold.

This dynamic resizing is crucial for sophisticated methods like scaling into trades or pyramiding Step-by-Step Guide to Scaling Into Trades: Reducing Initial Risk Exposure and Improving Entry Price, ensuring that subsequent additions do not inadvertently push the overall portfolio risk past the safety threshold—a frequent danger when using simpler, static methods like Fixed Dollar.

Conclusion: The Superiority of Adaptive Risk

In the unforgiving environment of high market volatility, capital protection must be paramount. Fixed Dollar sizing, despite its simplicity, is fundamentally brittle; it fails to adapt to the changing health of the trading account, leading to disproportionately large percentage losses during drawdowns. Conversely, Fixed Fractional sizing offers adaptive, self-correcting risk management. By automatically shrinking the dollar risk during losses and expanding it during gains, it maximizes the probability of survival and recovery.

For traders serious about long-term sustainability, adopting a Fixed Fractional model—ideally paired with a volatility adjustment mechanism—is non-negotiable. This discipline helps circumvent The Psychological Pitfalls of Over-Sizing: How Greed and Fear Destroy Capital Allocation Discipline, maintaining capital allocation discipline even when markets incite panic. To explore how this strategy integrates with other advanced techniques like pyramiding and Anti-Martingale approaches, refer to the full guide on Mastering Position Sizing: Advanced Strategies for Scaling, Adding to Winners, and Ultimate Risk Management.

Frequently Asked Questions (FAQs)

What is the key difference between Fixed Dollar and Fixed Fractional sizing in terms of capital protection?

Fixed Dollar sizing risks a constant absolute cash amount, meaning the percentage of capital risked increases drastically as the account suffers losses. Fixed Fractional sizing risks a constant percentage of equity, ensuring the dollar risk automatically shrinks during drawdowns, which dramatically slows the rate of capital erosion and increases recovery probability.

Why does high volatility make Fixed Dollar sizing particularly dangerous?

High volatility requires wider stop losses. If a Fixed Dollar trader keeps their dollar risk constant while stop losses widen, they must drastically reduce unit size, which can be inefficient. More dangerously, if they fail to adjust units, a string of wider losses quickly accelerates the percentage drawdown due to the static dollar risk.

How does Fixed Fractional sizing help minimize the “risk of ruin” during market crashes?

The risk of ruin is minimized because Fixed Fractional sizing employs an anti-Martingale approach: you only bet big when you have a big bankroll. As capital is lost (drawdown), the proportional risk taken decreases, meaning fewer losses are needed to stabilize the account, making the journey back to break-even significantly less demanding.

Should I combine Fixed Fractional sizing with ATR in highly volatile markets?

Absolutely. Combining Fixed Fractional sizing (setting the percentage risk) with ATR (determining the stop distance) creates a robust, adaptive system. This ensures that regardless of how much market volatility increases and widens stop losses, the percentage of capital risked remains consistent, preventing inadvertent overleveraging.

If Fixed Fractional sizing is better, why do some traders use Fixed Dollar sizing?

Fixed Dollar sizing is simple and easy to implement, requiring minimal calculation. It is often used by beginner traders or those managing small, fixed portions of capital where the fluctuation in percentage risk is deemed acceptable for the sake of mechanical simplicity. However, this is generally not recommended for professional, scalable risk management.

Does the Fixed Fractional method still work when scaling into trades?

Yes, Fixed Fractional sizing is essential when scaling into trades or pyramiding. By defining the total risk for the entire position as a fixed percentage (e.g., 2%), traders can ensure that subsequent scaling layers do not push the aggregate risk beyond the set threshold, maintaining overall portfolio safety and discipline.

What is a typical Fixed Fractional percentage used by advanced traders?

Advanced traders typically utilize a conservative Fixed Fractional percentage, often between 0.5% and 1% per trade. This low percentage is chosen to survive extreme losing streaks (as analyzed in backtesting Backtesting Position Sizing Models: Measuring Drawdown and Maximum Adverse Excursion (MAE)) and maintain psychological resilience, especially when managing highly correlated assets or complex pyramiding strategies.