Trading NVIDIA (NVDA) options presents a unique challenge: the massive implied volatility (IV) yields enormous premium potential for sellers, but the stock’s parabolic moves carry equally massive risk. Mastering High-Volatility Options: Advanced Strategies for NVDA, AI Stocks, and Earnings Season Hedging requires disciplined entry filters. One of the most effective ways to tame this volatility when initiating premium-selling trades, such as the short strangle, is by Using Bollinger Bands as a Strategy Filter for Short Strangle Entry Points on NVDA. This technique shifts the odds in favor of the options seller by ensuring the position is entered only when the stock is statistically overextended, maximizing the potential for mean reversion back toward a stable range, thus facilitating profitable theta decay.

Why NVDA is Ideal for Short Strangles (With Strategic Timing)

NVDA’s defining characteristic is its high IV rank. When IV is elevated, option premiums are inflated, making selling strategies inherently more lucrative. The short strangle involves simultaneously selling an out-of-the-money (OTM) call and an OTM put, capitalizing on the assumption that the stock will remain within a defined range until expiration. While profitable during periods of consolidation, this strategy is highly vulnerable to large directional moves.

The standard challenge when utilizing a strategy like the strangle (discussed in depth in Straddle vs. Strangle: Selecting the Optimal Options Strategy for NVDA Earnings Volatility) on a stock as volatile as NVDA is timing. Entering randomly often exposes the trade to immediate adverse movement. By coupling the strangle with the statistical context provided by Bollinger Bands (BBs), traders gain an objective signal that NVDA is experiencing a temporary deviation from its mean, suggesting high probability of reversal or at least stagnation.

The Bollinger Band Filter: Defining Entry Conditions

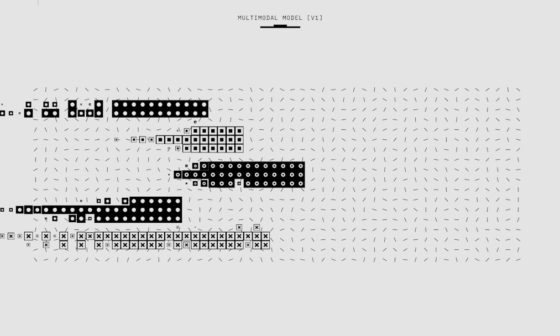

Bollinger Bands are volatility envelopes plotted two standard deviations (SD) above and below a 20-period Simple Moving Average (SMA). Statistically, 95% of price action should occur within the 2 SD bands. When NVDA’s price touches or breaks outside these bands, it signals statistical overextension—a classic mean reversion setup.

For Using Bollinger Bands as a Strategy Filter for Short Strangle Entry Points on NVDA, the entry condition is critical:

- Identify Overextension: Wait for the NVDA share price to touch or close outside the 2.0 SD band (daily chart preferred for swing trading strangles).

- Confirm Bias: If the price touches the upper band, the bias is bearish (expecting reversion downward); if it touches the lower band, the bias is bullish (expecting reversion upward).

- Strike Placement: Once the signal is confirmed, the strike prices for the short strangle should be placed significantly outside the existing outer band boundary to allow for minor overshoot before the reversal takes hold.

The effectiveness of this filter lies in maximizing the theta benefit. By entering when the stock is already stretched, you gain extra cushion while IV is still likely high, allowing you to collect maximum premium before the inevitable IV crush begins.

Practical Application: Setting Up the NVDA Bollinger Strangle

When selling strangles on NVDA, the typical trade duration is 30 to 60 Days to Expiration (DTE). This duration balances the need for rapid theta decay against the higher gamma risk of closer-dated options.

Case Study 1: Post-Rally Consolidation

In Q3 2023, NVDA experienced a rapid 20% surge leading up to a key conference. The stock closed three consecutive days above the upper 2.0 SD Bollinger Band, trading at $480.

- BB Signal: Price decisively breached the upper band (which was situated around $465).

- Entry Timing: On the fourth day, as momentum slowed, a short strangle was initiated.

- Strike Selection: The 2.0 SD band dictated the call side needed protection beyond $465. We targeted the 0.10 Delta call ($530) and the symmetric 0.10 Delta put ($410) for 45 DTE.

- Result: NVDA immediately entered a period of horizontal consolidation between $450 and $475. The IV, which was inflated due to the rally, began to normalize. The trade was closed early at 50% profit within 15 days, adhering to the standard The 50% Rule: Implementing Custom Exit Strategies for Profitable Options Spreads on Volatile Stocks.

Case Study 2: Lower Band Reversion

Following a broad sector correction, NVDA dropped sharply to $390, a level sitting just below the lower 2.0 SD band ($400). This signaled oversold conditions.

- BB Signal: Price closed below the lower band, indicating extreme bearish sentiment likely driven by fear.

- Strike Selection: Using the 2.0 SD band as the anchor, the trade targeted a higher probability of profit. A short put was sold at $340 (0.15 Delta) and a balancing call was sold at $440 (0.15 Delta) for 35 DTE.

- Result: NVDA found support immediately and rallied back toward the 20-day SMA ($420). The high premium collected due to the panic-driven IV was quickly captured as the stock stabilized.

Managing Risk and Adjustments

Even with the statistical edge provided by Bollinger Bands, NVDA is notorious for sustained breakouts (walking the bands). Active risk management is non-negotiable.

When the stock price approaches one of the short strikes, it is crucial to manage the position before it enters the “Gamma Zone,” where directional moves accelerate losses exponentially. Techniques include:

- Delta Threshold Stop: If the Delta of the threatened short strike reaches 0.30, close the entire position or initiate an adjustment.

- Rolling the Untouched Side: If the call is threatened, roll the put (the untouched side) forward in time and closer to the current price to collect more premium and widen the overall profit tent.

- Converting to Iron Condor: To cap maximum loss, buy further OTM options to convert the naked strangle into an The Iron Condor vs. Vertical Spreads: Best NVDA Options Strategies for Range-Bound Trading.

Understanding the sensitivity of the Greeks, particularly Vega (IV exposure) and Gamma (acceleration risk), is essential when trading NVDA’s high-beta options. Traders must avoid Avoiding the Gamma Trap: Psychological Discipline When Trading High-Beta Options Like NVDA by respecting stop-loss levels derived from the Bollinger Band entry strategy.

Conclusion

Using Bollinger Bands as a Strategy Filter for Short Strangle Entry Points on NVDA transforms a high-risk, high-reward strategy into a statistically guided approach. By waiting for NVDA to achieve statistical overextension—a moment identified objectively by the BB outer limits—traders increase their probability of capturing maximum premium just before mean reversion or consolidation begins. This disciplined entry, combined with rigorous risk management tailored to NVDA’s violent price action, is a cornerstone of advanced options trading in the AI sector. For a deeper understanding of combining various technical indicators with options mechanics, continue reading about broader strategies in Mastering High-Volatility Options: Advanced Strategies for NVDA, AI Stocks, and Earnings Season Hedging.

Frequently Asked Questions About Bollinger Band Short Strangles on NVDA

- What time frame should be used for the Bollinger Band indicator when setting up the strangle?

- For swing trading strangles (30-60 DTE), the Daily chart is typically used. This provides a robust signal that filters out intraday noise and focuses on meaningful, sustained statistical overextension that suggests a high probability of mean reversion over the subsequent weeks.

- Should I use the 2.0 SD band or a wider band (e.g., 2.5 SD) for NVDA entry?

- Given NVDA’s extreme volatility, using a wider band (like 2.5 SD) can provide a safer, albeit rarer, entry signal. The 2.0 SD band is standard, but if the stock “walks the bands” frequently, waiting for the 2.5 SD breach minimizes the risk of entering too early into a sustained trend.

- How should Delta be selected when using BBs as an entry filter?

- The Bollinger Band signal informs *when* to enter, but Delta defines the risk profile. When NVDA is outside the bands, strikes are often widened to 0.10 to 0.15 Delta (85-90% probability of profit). This provides sufficient cushion, ensuring the strikes are placed significantly beyond the statistical boundary the price just breached.

- Does the Bollinger Band strategy account for Implied Volatility (IV) changes?

- Yes, indirectly. Bollinger Bands are inherently volatility-adaptive; they widen when volatility increases (higher IV) and narrow when volatility decreases (lower IV). This ensures that the entry signal (touching the band) remains statistically consistent regardless of the current IV environment, maximizing premium collection upon entry.

- If NVDA remains outside the BBs for several days, should the strangle be immediately adjusted?

- If NVDA sustains a trend outside the bands (i.e., “walking the bands”), it indicates a strong momentum shift overriding the mean reversion hypothesis. If the stock pushes the short strike to a 0.30 Delta threshold, immediate adjustment (rolling the untouched side, or converting to an Iron Condor) is necessary, as outlined in strategies like Delta Neutral Trading: Structuring Zero-Risk Options Positions During NVDA’s Post-Earnings Drift.