The landscape of modern finance is increasingly defined by extreme volatility, driven primarily by technological leaps in sectors like Artificial Intelligence. Stocks such as NVDA have become bellwethers for this dynamic environment, offering immense profit potential alongside significant risk. For the advanced options trader, mastering high-volatility environments is not about avoiding risk, but precisely quantifying and strategically deploying capital to capture premium decay and directional moves. This comprehensive guide serves as the definitive resource for navigating these choppy waters, aggregating advanced strategies ranging from specialized hedge construction for AI portfolios to optimizing entries and exits around high-stakes earnings events. By leveraging sophisticated techniques—from quantitative backtesting to psychological discipline—traders can transition from speculating to systematically capitalizing on the market’s fear and greed. Below, we delve into the core components of mastering high-volatility options, each section linking to a deep-dive analysis for immediate practical application.

Advanced Volatility Spreads: Range-Bound NVDA Trading

High-volatility stocks like NVDA often exhibit periods of consolidation, especially after massive directional moves. During these range-bound periods, the goal is to profit from high implied volatility (IV) decaying without a significant move in the underlying price. Two popular non-directional strategies are the Iron Condor and various vertical spreads. The Iron Condor profits when the stock stays within a predefined range, capitalizing on the simultaneous shorting of out-of-the-money (OTM) calls and puts. However, vertical spreads (like credit spreads) are generally simpler and carry less complexity in execution, though they cap profit potential more rigidly.

Choosing the right structure depends heavily on the trader’s conviction regarding the range width and risk tolerance. For instance, a trader anticipating a tight consolidation might prefer the Iron Condor to maximize premium capture, while a trader prioritizing defined maximum loss might lean towards credit spreads. A detailed exploration of the trade-offs, particularly when dealing with the high premiums associated with tech leaders, is critical. Understanding when to deploy these structures and the nuances of selecting strike prices is foundational, particularly when comparing The Iron Condor vs. Vertical Spreads: Best NVDA Options Strategies for Range-Bound Trading for optimal outcomes in the often-exaggerated options chains of NVDA.

Portfolio Hedging: Protecting AI Sector Exposure

The aggressive growth trajectory of AI stocks means portfolios holding these assets often carry substantial systematic and unsystematic risk. When market sentiment shifts, these high-beta stocks can suffer steep declines. Effective portfolio management necessitates establishing robust defenses. The most straightforward and liquid method for mitigating exposure is the strategic purchase of put options. These options provide insurance, offsetting losses in the underlying stock value should a market downturn materialize.

Successful hedging involves more than just buying protective puts; it requires careful calibration of delta exposure, expiration dates, and strike selection relative to the overall portfolio value. Traders must decide whether to hedge individual positions (like NVDA or specific AI innovators) or use broader index products like QQQ or SPY for systemic risk. For those invested heavily in the AI revolution, understanding how to utilize options effectively is non-negotiable, especially when implementing Portfolio Protection: Using Put Options to Hedge AI Stock Exposure During Market Downturns to safeguard substantial capital gains against sudden reversals.

Earnings Volatility Capture: Straddle vs. Strangle

Earnings reports are the quintessential high-volatility event, characterized by a massive spike in implied volatility (IV) leading into the announcement, followed by a dramatic collapse (IV crush) afterward. Strategies designed to profit from this volatility—or its subsequent decay—are essential tools. The Straddle and the Strangle are primary examples, both non-directional bets on the magnitude of the post-earnings price movement.

The Straddle involves buying both an At-the-Money (ATM) call and an ATM put, requiring a significant move but benefiting from the highest sensitivity to the underlying price change. Conversely, the Strangle uses Out-of-the-Money (OTM) strikes, making it cheaper but demanding an even larger move to break even. Selecting the right approach hinges on estimating the market’s expected move versus your own analysis of the potential surprise. For traders anticipating a massive swing, the Straddle might be appropriate, but when analyzing the cost-efficiency of capturing the move in expensive stocks, a close examination of the Straddle vs. Strangle: Selecting the Optimal Options Strategy for NVDA Earnings Volatility is crucial for maximizing return on capital.

Managing Extreme Market Fear: The VIX Spike

The CBOE Volatility Index (VIX) acts as the market’s fear gauge. When the VIX spikes—often correlating with swift, sharp market sell-offs—it signals extreme fear and a corresponding inflation of Implied Volatility (IV) across all equity options. For options traders, a VIX spike fundamentally alters the risk profile of existing positions and dramatically changes the pricing of new trades.

Adjusting to these spikes requires a deep understanding of the Greeks, particularly Vega (sensitivity to IV changes) and Theta (time decay). When IV skyrockets, the value of long options positions (high Vega) increases sharply, while short premium positions can face immediate stress. Traders must be prepared to dynamically manage their risk by scaling back short positions or, conversely, exploiting the premium richness by initiating new short volatility trades strategically. Successfully navigating a sharp VIX increase demands precision in Trading the VIX Spike: Adjusting Options Greeks (Vega and Theta) During Extreme Market Fear, ensuring that portfolio sensitivity to IV is correctly calibrated during periods of high stress.

Yield Maximization: Covered Calls and Assignment Risk

For long-term holders of high-growth stocks like NVDA, generating consistent income while retaining equity exposure is a primary objective. The Covered Call strategy is the most established method for achieving this, involving selling call options against shares already owned. This generates premium income, effectively lowering the cost basis of the stock.

While straightforward, executing covered calls on hyper-volatile stocks requires meticulous management of assignment risk. If the stock rallies strongly past the strike price, the trader is obligated to sell their shares at the strike price, capping potential profit. Sophisticated traders manage this by selecting strikes far enough out-of-the-money (OTM) and constantly monitoring delta. Furthermore, proving the efficacy of specific strike and expiration selection demands rigorous data analysis. Systematic quantitative review is essential for Backtesting Covered Call Strategies on NVDA: Maximizing Yield While Managing Assignment Risk to identify parameters that generate maximum yield without excessively sacrificing upside participation.

Predictive Analytics: Combining Flow and Technicals

High-volatility environments are inherently complex, making simple directional bets less reliable. Advanced traders integrate multiple data sources to form a high-conviction thesis. This involves merging traditional technical analysis (chart patterns, support/resistance levels) with the cutting-edge information provided by options order flow.

Options flow—the real-time record of large, often institutional, options trades—can reveal deep-pocket sentiment not yet reflected in the stock price. When massive, unconventional block trades appear, and they align with specific technical indicators (like a breakout from a consolidation pattern), the confluence of signals provides a powerful directional edge. This fusion of market structure analysis and institutional movement is key to Combining Chart Patterns and Options Flow: Predicting NVDA’s Next Major Move and other large-cap technology stocks where options market activity is immense.

Quantitative Pricing Models: Predicting Implied Volatility Skew

The relationship between Implied Volatility (IV) and strike price—known as the volatility skew—is a crucial element in options pricing, especially for stocks like NVDA, which exhibit sharp asymmetric movements. Typically, OTM puts carry higher IV than OTM calls due to demand for downside protection. However, market anomalies and large expected events can distort this skew.

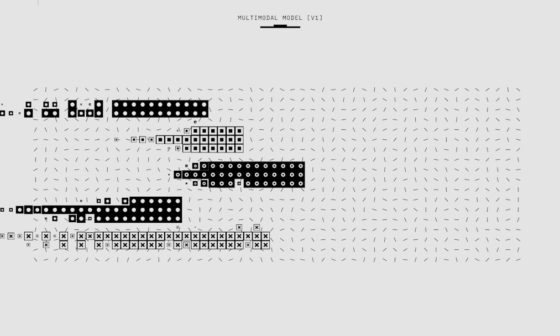

Modern quantitative finance is increasingly utilizing Machine Learning (ML) models to predict changes in this skew. By inputting factors like historical returns, options flow, and macroeconomic indicators, ML models can identify when the current skew is mispriced relative to the predicted future reality. This edge allows traders to capitalize on relative value opportunities. Developing Developing ML Models to Predict Implied Volatility Skew for NVDA Options Pricing is an advanced pursuit that transitions trading from art to rigorous scientific discipline, providing a genuine structural edge in high-premium environments.

Psychological Discipline: Avoiding the Gamma Trap

The “Gamma Trap” is a psychological hazard endemic to trading high-beta, high-volatility options like those on NVDA. Gamma measures the rate of change of an option’s Delta (directional exposure). As a stock moves favorably toward an option’s strike, gamma increases exponentially, leading to rapid, substantial delta changes. This can tempt traders to over-leverage or deviate from their original trade plan based on instantaneous, exhilarating gains.

Emotional reactions—such as chasing a quick rally or doubling down on a losing position due to high gamma sensitivity—can lead to catastrophic outcomes. Maintaining strict psychological discipline, adhering rigorously to position sizing, and predefining entry and exit rules are mandatory safeguards. Successfully Avoiding the Gamma Trap: Psychological Discipline When Trading High-Beta Options Like NVDA ensures longevity in a trading career where emotional decisions are severely penalized by the market’s leverage.

Technical Filtering: Bollinger Bands for Strangles

While quantitative models are powerful, classic technical indicators remain essential for filtering trade entries in volatile markets. Bollinger Bands, which measure market volatility relative to a simple moving average, are particularly useful for defining price extremes and potential inflection points.

When deploying short volatility strategies, such as the Short Strangle, timing the entry is paramount. The ideal entry occurs when implied volatility is high, but the underlying stock is showing temporary signs of price exhaustion near its statistical boundaries. Using the upper and lower bands of the Bollinger Bands as signals for where price extremes might reverse offers a systematic, objective method for selecting high-probability strike prices for short options. Implementing the Using Bollinger Bands as a Strategy Filter for Short Strangle Entry Points on NVDA helps ensure that premium selling is executed at statistically favorable moments, maximizing the probability of the options expiring worthless.

Long-Term AI Investment: Synthetic Stock vs. LEAPS

Investing for the long term in the AI sector demands strategies that offer leveraged exposure to growth while managing capital efficiency. Two advanced methods for achieving this are creating synthetic long stock positions and purchasing Long-term Equity Anticipation Securities (LEAPS).

Synthetic long stock (buying an ATM call and selling an ATM put with the same expiration) perfectly replicates the risk/reward of owning the underlying stock without the large capital outlay, offering superior capital efficiency, though it requires management of margin. LEAPS, on the other hand, are simply options with expiration dates far in the future (typically 1+ year). LEAPS offer leverage with defined risk (the premium paid) and significantly reduce theta decay compared to short-dated options. The choice between Synthetic Long Stock vs. LEAPS: Long-Term Options Strategies for AI Sector Investment revolves around the trader’s preference for margin utilization, capital outlay, and desired risk profile over a multi-year investment horizon.

Risk Management: Delta Neutral Trading

Delta neutral trading aims to construct a position that is insensitive to small directional movements in the underlying asset. This is especially useful during periods of high uncertainty or following major events like NVDA earnings, where the direction is unclear but volatility decay (Theta) is high. A truly delta neutral portfolio is constructed by balancing long and short options exposures such that the total portfolio delta is near zero.

The challenge lies in maintaining this neutrality, as market fluctuations constantly change the delta of individual options. Advanced traders utilize dynamic hedging, frequently adjusting positions (often using the underlying stock or futures) to keep the total delta near zero, allowing them to capture the steady decay of implied volatility. Understanding the mechanics of Delta Neutral Trading: Structuring Zero-Risk Options Positions During NVDA’s Post-Earnings Drift is vital for systematically profiting from the inevitable IV crush following major news events without making a directional bet.

Systematic Exits: The 50% Rule

In options trading, particularly with premium-selling strategies, the exit point is often more critical than the entry point. Allowing a profitable spread to run until expiration exposes the position to unnecessary overnight risk and reduces capital efficiency. The 50% Rule provides a systematic, quantifiable guideline for exiting successful trades.

This rule dictates that when a short options spread has achieved 50% of its maximum potential profit, the position should be closed. For example, if a credit spread collects $1.00 in premium, the trader closes the position when the spread can be bought back for $0.50. This strategy prioritizes risk management and capital velocity over capturing the final, often risky, portion of the premium. Implementing The 50% Rule: Implementing Custom Exit Strategies for Profitable Options Spreads on Volatile Stocks prevents small winners from turning into large losers due to late market reversals or sudden volatility spikes.

Conclusion

Mastering high-volatility options trading in the age of AI and high-growth stocks like NVDA requires a structured, multi-faceted approach. Success is found not in relying on a single tactic, but in strategically deploying a suite of advanced quantitative and psychological tools. By understanding the intricate mechanics of volatility products, utilizing systematic backtesting to validate strategies, integrating predictive analytics like options flow, and maintaining strict risk management principles through techniques like the 50% rule and delta neutral adjustments, traders can transform high volatility from a source of fear into a consistent opportunity for profitable execution. This guide and its linked resources provide the pathway toward achieving systematic success in the most dynamic segments of the modern market.

Frequently Asked Questions (FAQ)

- What is Implied Volatility (IV) Skew and why is it important for NVDA options?

- Implied Volatility Skew refers to the difference in implied volatility across options of the same expiration but different strike prices. For NVDA, the skew is crucial because it often reflects institutional demand for downside protection (high IV on OTM puts). Predicting changes in this skew, potentially using machine learning models, allows traders to identify mispriced options and execute relative value trades, as discussed in the detailed analysis on Developing ML Models to Predict Implied Volatility Skew for NVDA Options Pricing.

- How do I prevent the risk of assignment when selling covered calls on highly volatile stocks?

- Assignment risk is minimized by selecting strike prices far enough Out-of-the-Money (OTM) that the stock is unlikely to reach them before expiration, or by rolling the option to a later date/higher strike if the stock approaches the sold strike. Traders should rigorously backtest their strike selection criteria to maximize premium capture while maintaining safety, a process fully detailed in the guide on Backtesting Covered Call Strategies on NVDA: Maximizing Yield While Managing Assignment Risk.

- What is the primary difference in risk between buying a Straddle and a Strangle for earnings?

- The Straddle (using ATM strikes) is significantly more expensive than the Strangle (using OTM strikes) and therefore requires a smaller price movement to break even. However, the Strangle has lower premium cost but needs a larger price movement to become profitable. The choice depends on the trader’s estimate of the magnitude of the post-earnings move relative to the IV expectation, an important consideration when selecting Straddle vs. Strangle: Selecting the Optimal Options Strategy for NVDA Earnings Volatility.

- When VIX spikes, how should an options trader adjust their Vega exposure?

- When the VIX spikes, implied volatility increases across the board. If the trader has a net short Vega position (e.g., selling credit spreads or strangles), they should consider reducing or hedging these positions to mitigate losses from IV expansion. Conversely, long option positions (net long Vega) benefit from the spike. The article on Trading the VIX Spike: Adjusting Options Greeks (Vega and Theta) During Extreme Market Fear provides comprehensive adjustment techniques.