The landscape of high-volatility options trading, especially concerning stocks like NVIDIA (NVDA), demands precision far beyond standard pricing models. As part of a sophisticated approach to Mastering High-Volatility Options: Advanced Strategies for NVDA, AI Stocks, and Earnings Season Hedging, quantitative traders are increasingly focused on Developing ML Models to Predict Implied Volatility Skew for NVDA Options Pricing. The implied volatility (IV) skew—the phenomenon where options with different strike prices but the same expiration date have varying implied volatilities—is the heartbeat of options pricing. For high-growth, high-beta stocks like NVDA, this skew is highly dynamic, often exhibiting extreme convexity or concavity around major events like earnings, presenting both massive risk and significant arbitrage opportunities for those who can predict its evolution.

The Mechanics of Implied Volatility Skew in NVDA Options

The implied volatility skew reflects market participants’ perception of tail risk. For NVDA, the skew typically exhibits a distinct “smirk,” where out-of-the-money (OTM) put options (lower strikes) have significantly higher implied volatility than OTM call options (higher strikes) or at-the-money (ATM) options. This asymmetry arises because traders generally fear sharp downside moves more than they anticipate equally sharp upside moves, leading to intense demand for protective puts. Before major events, such as NVDA earnings, this skew often steepens dramatically as traders position themselves, anticipating a massive price swing. Predicting the magnitude and direction of this skew change is paramount for advanced strategies like adjusting strikes on a The Iron Condor vs. Vertical Spreads: Best NVDA Options Strategies for Range-Bound Trading or determining the optimal ratio for a straddle versus a strangle (Straddle vs. Strangle: Selecting the Optimal Options Strategy for NVDA Earnings Volatility).

Feature Engineering: The Fuel for Skew Prediction Models

Developing effective Machine Learning models requires robust feature engineering that captures not just historical prices, but complex market microstructure. For predicting the NVDA Implied Volatility Skew, the input features must extend beyond the standard Black-Scholes inputs.

Key feature categories include:

- IV Surface Data: The IV values for a matrix of strikes and expirations (e.g., 90%, 95%, 100%, 105%, 110% moneyness, across 7, 30, and 60 days to expiration).

- Market Microstructure: Real-time and cumulative options order flow, bid/ask spread widths, and open interest distribution. Analyzing aggressive options flow provides leading indicators of where speculative pressure is building (Combining Chart Patterns and Options Flow: Predicting NVDA’s Next Major Move).

- Greek Sensitivity: Aggregated Vega profiles across the IV surface. Since Vega measures sensitivity to volatility changes, a high Vega concentration at a specific strike can amplify skew movement.

- Macroeconomic and Sector Indicators: The VIX index (to gauge broad market fear, linking to Trading the VIX Spike), interest rates, and the performance of peer AI stocks.

- Technical Signals: Standard indicators like RSI, volume profile, and proximity to crucial support/resistance levels.

The target variable for the model is typically not the raw IV level, but the shape metric—for instance, the difference between the IV of the 25 Delta put and the 25 Delta call, normalized by the ATM IV. This measures the steepness of the skew.

Selecting and Training the ML Model for Skew Dynamics

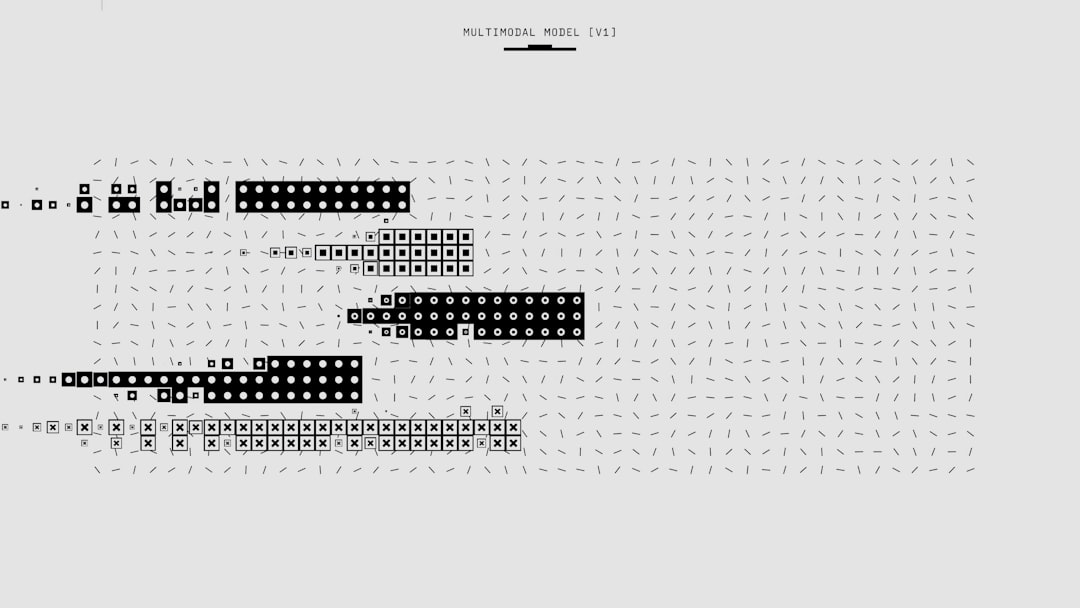

Predicting the evolution of the IV skew is a time-series problem requiring models adept at handling sequential data and complex non-linear relationships. Two primary model architectures are favored:

- Gradient Boosting Machines (GBM): Models like XGBoost or LightGBM excel at handling highly structured data with numerous interacting features. They are robust for predicting the skew shape 1-5 days ahead based on static inputs (e.g., current Greeks and options flow signals).

- Recurrent Neural Networks (RNNs) / LSTMs: Given the time-dependent nature of volatility dynamics, LSTMs (Long Short-Term Memory networks) are powerful for modeling the sequence of skew changes. They can learn how the skew reacts incrementally to news catalysts or sustained order flow pressure, making them ideal for predicting the precise timing of skew flattening or steepening.

Training typically involves segmenting data into pre-earnings periods, post-earnings drift periods (Delta Neutral Trading: Structuring Zero-Risk Options Positions During NVDA’s Post-Earnings Drift), and routine periods, as the underlying dynamics differ drastically.

Case Studies in Predictive Skew Trading

Case Study 1: Anticipating Earnings Skew Collapse

NVDA options frequently exhibit extreme volatility risk premium built into the skew just before earnings. For example, three days before an earnings announcement, the 10-day expiration IV for the 5% OTM put might be 15 points higher than the ATM IV. An ML model, trained on historical NVDA earnings cycles, can predict the precise magnitude of the “volatility crush” and the subsequent skew flattening post-event. If the model predicts a severe flattening (return to a typical smirk) due to the low likelihood of extreme downside after a guidance beat, a quant could execute a short-term trade selling the expensive OTM puts relative to the ATM options. This is a crucial element for those running short volatility strategies like the short strangle (Using Bollinger Bands as a Strategy Filter for Short Strangle Entry Points on NVDA).

Case Study 2: Exploiting Skew Inefficiencies for Put Hedging

A portfolio manager holding a large long position in NVDA seeks cost-effective downside protection. Standard hedging involves buying puts (Portfolio Protection: Using Put Options to Hedge AI Stock Exposure During Market Downturns). However, if the ML model identifies that the IV skew for short-dated options is historically overpriced relative to medium-dated options (e.g., 30 DTE vs. 60 DTE), the manager can adjust the hedge structure. By selling the extremely expensive short-term puts and using those proceeds to buy more medium-term protection, the manager reduces the Theta decay drag while maintaining sufficient downside coverage, leveraging the model’s insight into time-specific skew inefficiency.

Conclusion

Predicting the Implied Volatility Skew is the next frontier in advanced options trading, particularly for high-velocity assets like NVDA. By meticulously engineering features that capture market microstructure, Greek sensitivities, and historical patterns, sophisticated ML models can provide a significant edge. These models allow traders to move beyond simple directional bets and profit from the dynamics of the options curve itself. Mastery of these techniques is essential for those seeking to maximize returns and manage risk effectively in the most volatile market segments. For deeper exploration into advanced high-volatility options strategies, consult our main resource: Mastering High-Volatility Options: Advanced Strategies for NVDA, AI Stocks, and Earnings Season Hedging.

FAQ: Developing ML Models to Predict Implied Volatility Skew for NVDA Options Pricing

- What is the primary difference between modeling IV level and IV skew?

- Modeling the IV level predicts the average expected volatility (often ATM IV), which is important for overall pricing. Modeling the IV skew predicts the shape of the volatility curve across different strikes, reflecting relative pricing differences. For high-volatility NVDA, predicting the skew shape is crucial for spread trading and hedging inefficiencies.

- Why is order flow data so critical when training an ML model for NVDA skew prediction?

- Order flow provides insight into immediate institutional demand for specific strikes, which directly impacts the skew. Large block trades in OTM puts, for instance, are a leading indicator that the downside skew will steepen significantly, often before the pricing fully reflects the magnitude of the demand.

- Which ML model types are best suited for predicting NVDA’s dynamic volatility skew?

- Gradient Boosting Machines (like XGBoost) are effective for static feature sets predicting skew magnitude. However, LSTMs (Long Short-Term Memory networks) are often preferred for modeling the sequential, time-series nature of skew evolution, as they can track how the skew changes day-to-day leading up to an event like earnings.

- How does predicting the skew shape help a trader implement delta-neutral strategies?

- Delta-neutral trading requires constant monitoring of the skew. If the model predicts a severe skew flattening (meaning OTM options become relatively cheaper), the model signals that the Delta of existing positions will change rapidly as the stock moves, necessitating proactive gamma and Vega adjustments to maintain neutrality.

- What is a common feature engineering technique used to quantify the skew for model input?

- A highly effective technique is calculating the “Skew Slope” or “Vol Spread.” This involves taking the difference between the IV of a deep OTM option (e.g., 10 Delta Put) and the IV of a near OTM option (e.g., 30 Delta Put). This numerical value effectively measures the local curvature of the IV surface.