Ever since the cryptocurrency was introduced, it brought a huge revolution in the financial market. Experts are comparing fiat currency with cryptocurrencies to know which is better and how they can make the most of it. While both hold some uniqueness, their performance entirely depends upon which businesses are using them.

Their comparison has also risen many arguments because of mixed reviews from people. Some are in favor of converting to cryptocurrencies based on their future and usability. Whereas, others prefer to stick with fiat money/nation’s currency, particularly the US dollar because of its reliability and stability.

To make this selection process easier, below are all the details that a person or a business has to know about both options:

What is Meant by Cryptocurrency?

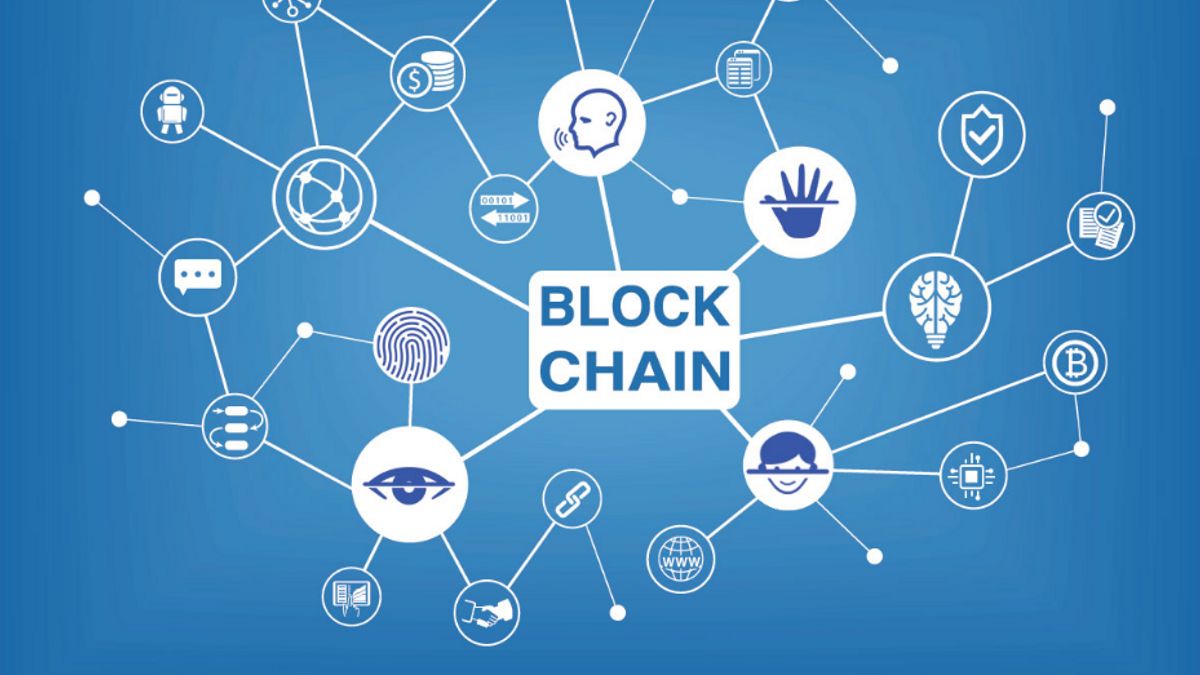

Referred to as a virtual or digital currency, cryptocurrency works on blockchain technology to make transactions safe and secure. It is a decentralized form of currency that has nothing to do with a financial institution or government control.

Bitcoin, introduced in 2009, was the first and most widely used cryptocurrency that gave a boom to the entire crypto industry. It encouraged creators to introduce more digital assets like Bitcoin Cash, Ethereum and Litecoin.

These digital currencies (Bitcoin, Ethereum, Bitcoin Cash, etc.) are regulated under a decentralized system that converts them into a usable payment method for all types of transactions- be it the purchase of a physical commodity, exchange, or services.

For instance, users can transact a Bitcoin against any commodity, be it a cup of coffee, book a hotel room, and even, crypto mortgages are possible today!

What is Meant by Fiat Money?

Every currency that comes under the term ‘legal tender’ is called fiat currency. It works on a centralized system and is liable to follow all government rules and regulations to maintain a federal reserve.

US dollars get maximum attention from businesses and individuals out of all fiat currencies, consisting of the British Pound, Euro, Japanese Yen, etc. The U.S. dollar is the fundamental fiat/commodity money for central authorities, which is why fiat money is also used in international trade.

Major Differences

Value

Since fiat money is legal and regulated by the government/central authority, its intrinsic value depends upon economic conditions, particularly financial stability, and regulations designed for its regulation. If a country suffers from severe economic problems, its fiat currency faces hyperinflation that brings down its value immediately.

On the other hand, cryptocurrency works under a blockchain network and its intrinsic value depends upon multiple factors, consisting of:

-

Technology

-

Utility

-

Crypto market trends

-

Market position/popularity

Market position/popularity may not sound like an important element to evaluate an intrinsic value of a cryptocurrency but it does make a difference in reality. One such examples is Dogecoin (DOGE) which got a boost in price due to its fame, irrespective of not having any competitive advantage over other cryptos.

Governance

A central bank, known as the monetary authority of a nation, works to maintain the federal reserve of a country. They are responsible to work under the monetary policy to determine how much money is circulating in modern economies and when is the right time to increase or decrease its money supply.

On the contrary, while working on a decentralized system, cryptocurrency has no central authority for governance. Their credit supply and amount in the crypto market depends upon their type because every crypto has its own rules and regulations.

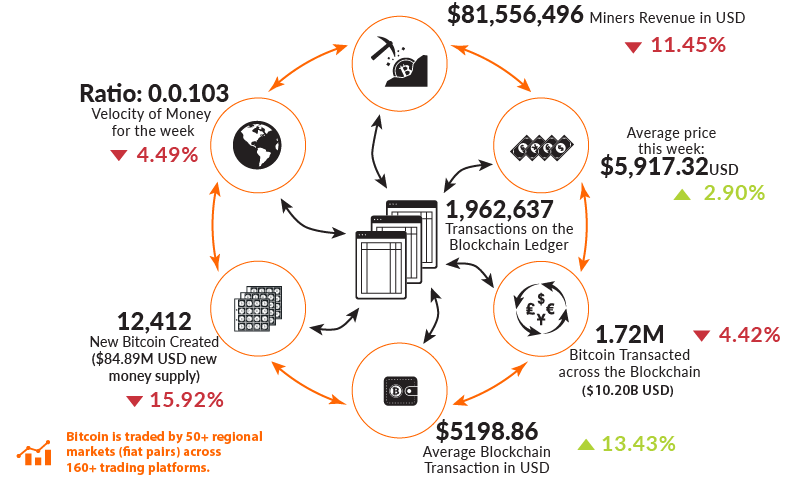

For instance, Bitcoin users have to proceed with the Bitcoin mining process to mint new coins and validate transactions. The minting process makes 1 coin at a 10-minute interval and continues until 21 million Bitcoins are circulating in the market.

Likewise, every cryptocurrency has its system that takes care of its supply and demand in the crypto exchanges. Some coin owners give unlimited supply initially and start to reduce their circulation over time.

Exchanges/Platforms

Fiat money is available for traders across the world. They can use any currency to trade anywhere they want. Fiat currency is ideal for travelers to get local cash from the respective country and investors involved in international trade.

When it comes to crypto, their medium of exchange has emerged as one of the best platforms to trade cryptos from all over the world. Many crypto platforms facilitate traders to use fiat currency, via payment cards, bank transfers, and wire transfers, in exchange for cryptocurrencies. However, if someone doesn’t want to trade that way, some exchanges only deal in cryptocurrency trading.

Advantages and Disadvantages

With their unique features and positions in the financial industry, fiat cryptocurrencies have some advantages and disadvantages that would help traders to choose the right payment method and medium of exchange they should go for.

Let’s have a look at them:

Advantages

Fiat Money

-

In terms of stability, fiat money gets an edge. The top/major currencies, namely the U.S. dollar and Euro, don’t face as much fluctuations as cryptocurrencies do.

-

Fiat currency is commonly used to buy goods and services. Most businesses still prefer to transact in fiat money than to handle cryptos.

-

Financial protections are available for financial institutions, dealing in fiat money. For instance, the US has FDIC insurance of $250,000/depositor, which is not available in the crypto industry.

Cryptocurrency

-

Cryptocurrencies are more profitable but risky at the same time. They have a high potential to see an increase in value than how fiat currency value rises.

-

Most of the transactions take lesser than a minute at the expense of $0.01 or lesser.

-

Traders can send cryptos to any part of the world without asking for permission from financial institutions.

-

Due to irreversible transactions, there are no chances of chargebacks.

Disadvantages

Fiat Money

-

Fiat money transfers, particularly cross-borders, take a few days and charge a limited amount as fees.

-

Some most developed countries or parts of the world are unable to facilitate customers with quality banking services to transact in fiat money.

-

Fiat money merchants always have to process payments through different payment processors and bear transaction fees against their approval.

Cryptocurrency

-

Since cryptocurrencies are highly volatile, they can easily lose their value within weeks or months- irrespective of how big the coin would be.

-

The crypto industry is prone to scams. There are multiple forms of scam schemes, particularly pump-and-dump-scheme, phishing, emails and text that target traders’ accounts.

-

If lost access, there is no way a trader can re-access the blockchain wallet. Cryptocurrency exchange accounts are not protected in terms of security or to ask for compensation against transfer to a wrong address.

Impact of Crypto on Money Printing

Cryptocurrency received a boom during the COVID-19 pandemic when governments started to convert their fiat currencies into bonds. As the result, investors got their hands on cryptocurrencies, especially Bitcoin, as a way to keep themselves safe from upcoming inflation.

The best part about investing in crypto is its non-traditional system that works independently. Unlike fiat money that are regulated by the central bank, cryptos have their regulations that keep changing over time.

That being said, the future of cryptos is much brighter than what experts have predicted. Speculations say that they will be hurting printing money and the related decisions.

Future of Crypto and Fiat Money

As discussed above, crypto has a huge potential to expand its usage over time. Though, this doesn’t mean that fiat money will vanish from the financial market/economy.

It’s safe to say that fiat currency will remain the ideal payment type for spending and saving, just like people used to invest in gold coins and precious metals. The reason behind this is its security, ease of use, and specifically, availability across the world.

On the other hand, crypto has turned out to be the perfect investment opportunity and can be used as an alternative to fiat money for transfers. Due to its volatility, the crypto market is quite unpredictable.