In the fiercely competitive domain of High-Frequency Trading (HFT), success is measured in microseconds. The ability to react faster than competitors, often by merely tens of nanoseconds, determines profitability. Central to this superior speed are sophisticated Quote Matching Algorithms: How HFT Firms Achieve Sub-Millisecond Trade Execution. These systems are not merely software scripts; they are highly optimized, often hardware-accelerated pipelines designed to consume massive streams of market data, identify actionable trading opportunities (i.e., discrepancies or impending order book events), and generate routing instructions before the rest of the market can react. This technological edge is fundamental to the HFT market making model, detailed further in The Definitive Guide to HFT Market Making: Order Book Dynamics and Microstructure Strategies.

The Core Challenge: Latency and Data Integrity

The primary function of a quote matching algorithm is to process incoming market data—specifically, quotes and trades—and compare them against the firm’s internal positions, risk limits, and quoting intentions. The sheer volume of data, especially during volatile periods, demands extreme efficiency. HFT firms must contend with four critical forms of latency: network transmission, hardware processing (decoding/deserialization), operating system overhead, and finally, application latency (the execution logic itself).

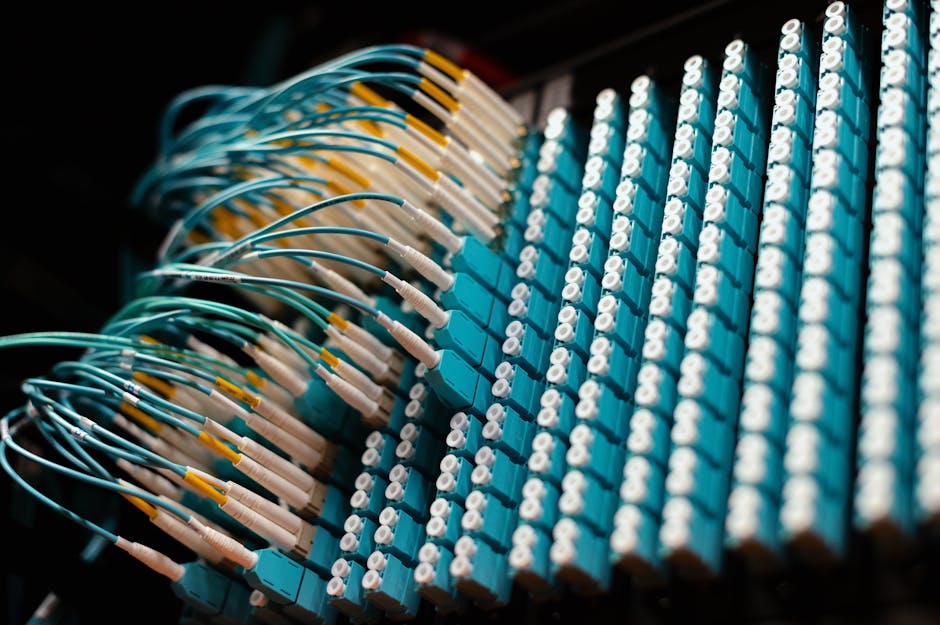

A crucial component is ensuring data integrity. Exchanges often transmit data across multiple feeds, and maintaining a perfectly synchronized, canonical view of the Limit Order Book requires meticulous feed handling. Out-of-order packets or delayed updates can lead to stale quotes, triggering catastrophic adverse selection events. This challenge necessitates specialized hardware and low-level programming techniques to manage the complexity inherent in Order Flow Analysis.

Architecture of High-Speed Quote Matching Systems

Achieving sub-millisecond execution requires moving beyond traditional software stacks. The most advanced HFT operations rely heavily on Field-Programmable Gate Arrays (FPGAs) to execute the most critical path computations directly in hardware. FPGAs provide highly parallel processing capabilities, drastically reducing the clock cycles required for decoding market data and executing simple matching rules.

Example 1: Hardware Accelerated Matching Logic. Instead of receiving a quote message in software, decoding the TCP/IP stack, and then parsing the message fields, an FPGA can be programmed to perform network stack bypass, strip the headers, and directly compare the incoming quote price and volume against pre-loaded internal quoting thresholds. If a match occurs (e.g., a counter-party quote crosses the firm’s optimal inventory-adjusted bid/ask spread), the FPGA can initiate the execution signal directly to the network interface card (NIC), bypassing the kernel entirely. This process cuts application latency from potential milliseconds down to nanoseconds.

Furthermore, because HFT strategies often span multiple exchanges (market fragmentation being a key component of Key Components of Market Microstructure), data normalization is essential. Quote matching algorithms must operate on a unified data structure, regardless of the proprietary format (e.g., FIX, ITCH, or specialized binary protocols) used by various venues. This normalization must occur at the wire level to minimize processing delay.

The Algorithm in Action: Execution Logic and Adverse Selection Mitigation

A quote matching algorithm determines if a trade should occur immediately upon receiving a market message. The core logic involves evaluating the profitability and risk associated with executing against the newly published Best Bid and Offer (BBO). The decision matrix is complex, integrating dynamic factors:

- Price Discrepancy: Does the new market quote allow for profitable execution (e.g., arbitrage between two venues, or fulfilling an internal crossing order)?

- Inventory Risk: How does the potential trade impact the firm’s current inventory delta? A match might be profitable but detrimental if it pushes the firm’s inventory into an undesirable direction, requiring careful calibration outlined in Advanced HFT Market Making Strategies.

- Signal Certainty: Is the incoming quote likely to be fleeting (e.g., a massive block order momentarily hitting the book) or is it a genuine signal of price movement? Quote matching algorithms often use proprietary micro-indicators derived from order flow data, such as volume imbalance or immediate price acceleration, discussed in Developing Custom Indicators from Order Flow Data.

Case Study 2: Detecting Impending Price Moves (Adverse Selection Avoidance). Mitigating adverse selection is perhaps the most critical task for these algorithms. Imagine a scenario where a quote matching algorithm detects a large sweep of liquidity on one side of the book (say, 50,000 shares are lifted at the bid across multiple venues). The algorithm must immediately calculate the velocity and impact of this event. If this liquidation event strongly predicts that the mid-price will drop within the next 100 microseconds, the algorithm must instantaneously cancel any resting bid quotes the firm has and potentially issue a highly aggressive, marketable sell order to minimize adverse selection—a process detailed in strategies for Mitigating Adverse Selection Risk. Speed here ensures the firm avoids being filled on stale bids and prevents significant losses.

Optimizing the Execution Path

Achieving true sub-millisecond execution is impossible without physical proximity to the exchange matching engines. HFT firms invest heavily in co-location services, ensuring their servers are physically closest to the exchange infrastructure. This minimizes network transmission latency (the speed of light constraint).

However, location is only part of the solution. The remaining latency is tackled by optimizing the operating system and network interface layers. Techniques include:

- Kernel Bypass: Utilizing user-space network drivers (like DPDK or specialized proprietary solutions) to move network processing out of the Linux kernel, drastically reducing context switching overhead.

- Precision Timestamps: Using hardware timestamping (PTP or specialized NICs) to ensure the precise measurement and calibration of every step in the processing pipeline, crucial for microsecond-level debugging and performance analysis, which is essential when Backtesting HFT Strategies.

- Deterministic Scheduling: Employing real-time operating system kernels or dedicated hardware schedulers to ensure the quote matching thread receives priority and predictable execution timing, minimizing jitter.

The ultimate goal is to reduce the “wire-to-wire” latency—the time from when an exchange sends a market data packet to the time the HFT firm’s order acknowledgment is received by the exchange—to below 250 microseconds, a competitive requirement in modern equity and futures markets.

Conclusion

Quote matching algorithms represent the zenith of low-latency trading technology. They are complex systems, integrating specialized hardware (FPGAs) with finely tuned, highly concurrent software logic to make mission-critical decisions faster than the blink of an eye. The ability of HFT firms to achieve sub-millisecond trade execution hinges on eliminating processing bottlenecks, leveraging co-location, and implementing robust risk checks against adverse selection. This unparalleled speed is crucial for maintaining tight spreads and profitable operations, forming a critical component of the comprehensive strategies outlined in The Definitive Guide to HFT Market Making: Order Book Dynamics and Microstructure Strategies.

FAQ: Quote Matching Algorithms and Sub-Millisecond Execution

What defines a ‘Quote Matching Algorithm’ in HFT?

A quote matching algorithm is a low-latency system designed to receive market data (quotes, trades, and order modifications), rapidly compare that data against internal risk parameters, inventory targets, and pricing models, and issue an order or cancellation instruction within microsecond constraints.

Why is FPGA technology critical for quote matching algorithms?

FPGAs (Field-Programmable Gate Arrays) are critical because they allow the core data processing and decision logic to be executed directly in hardware, parallelizing tasks like data deserialization and rule-based checks. This bypasses the slower CPU instruction cycles and operating system overhead, reducing latency from microseconds to nanoseconds.

How do HFT firms minimize network latency in their quote matching pipeline?

HFT firms primarily minimize network latency through physical co-location—placing their servers directly inside or immediately adjacent to the exchange’s data center. They further reduce latency by using specialized, high-speed fiber optics and employing kernel bypass techniques to accelerate packet handling at the network interface card (NIC).

What is adverse selection mitigation in the context of these algorithms?

Adverse selection mitigation means the algorithm identifies market events (like sudden, large order imbalances or sweeps of liquidity) that signal an imminent shift in price. By detecting these events faster than competitors, the algorithm can instantaneously cancel outstanding passive quotes, preventing the firm from being filled at a price that is about to become unfavorable.

How does market fragmentation impact quote matching strategy?

Market fragmentation—where the same security trades on multiple exchanges—requires the algorithm to aggregate and normalize multiple incoming data feeds simultaneously. The quote matching logic must determine the best execution venue and price across all locations instantly, ensuring the firm doesn’t miss an opportunity or execute against a stale quote on a slower exchange.

What role do proprietary micro-indicators play in the matching decision?

Micro-indicators, often derived from sophisticated order flow analysis, provide predictive power beyond simple BBO observation. These indicators (e.g., measuring message traffic velocity or short-term volume imbalance) help the quote matching algorithm assess the quality and durability of an incoming quote before deciding whether to execute against it.