The altcoin market, encompassing every cryptocurrency other than Bitcoin, represents the frontier of digital asset innovation and, critically, volatility. While Bitcoin (BTC) is often viewed as the store-of-value anchor, altcoins offer parabolic growth potential driven by technological advancements, niche use cases (like DeFi, AI, or gaming), and market euphoria. Navigating this landscape requires a sophisticated blend of fundamental analysis, technical acumen, psychological discipline, and a deep understanding of market cycles—specifically, the phenomenon known as “Altcoin Season.” This comprehensive guide serves as your central resource, linking you to eleven detailed cluster posts that break down the critical components of successful altcoin investing, providing the strategies necessary to potentially capture significant returns during the projected 2025 bull market while mitigating inherent risks.

The Foundation of Altcoin Investment: Risk, Returns, and Diversification

Before diving into specific altcoin picks or trading charts, every investor must establish a foundational understanding of the asset class itself. Altcoins generally offer much higher potential returns than Bitcoin, but this upside is directly correlated with significantly increased volatility and risk of capital loss. The volatility of smaller market capitalization coins means prices can drop 50-70% in short order, demanding stringent risk management and portfolio construction.

When constructing a resilient crypto portfolio, diversification is not merely recommended—it is essential. Allocation strategies must account for differing risk profiles, often utilizing Bitcoin as the low-beta anchor while allocating smaller percentages to mid- and low-cap altcoins for growth potential. Diving deeper into the specifics, a crucial resource for portfolio building is examining the core concepts behind Altcoin vs. Bitcoin: Analyzing Risk, Returns, and Portfolio Diversification in Crypto to ensure your allocation matches your risk tolerance and long-term financial goals.

Mastering the Altcoin Season Cycle

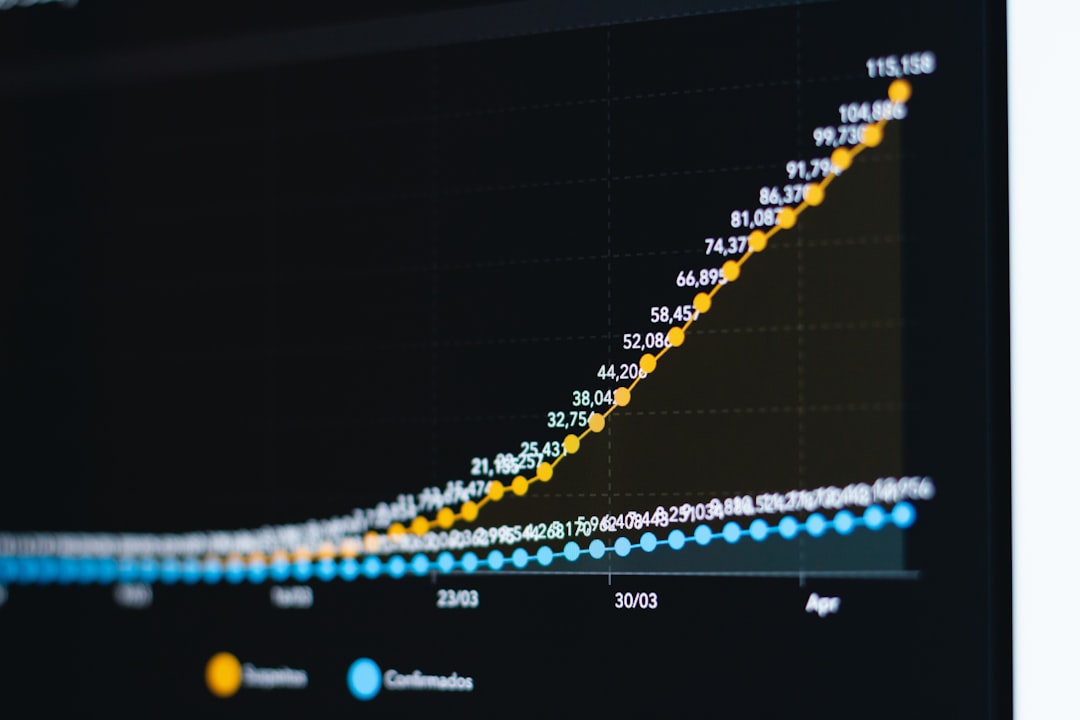

Altcoin Season is a widely recognized, cyclical phase in the cryptocurrency market where capital rotates out of Bitcoin and into altcoins, leading to rapid, coordinated price pumps across various sectors. This phenomenon is typically triggered after Bitcoin has experienced significant gains and plateaus, causing investors to seek higher-yield opportunities.

Success in this market is often less about which altcoin you pick and more about when you enter and exit the market cycle. Monitoring Bitcoin dominance (BTC.D) and the movement of stablecoin reserves are critical tools for timing this rotation. A dropping BTC.D often signals the start of the season. To truly master these cycles and understand market momentum, traders should consult guides on Decoding Altcoin Season: Key Indicators and Timing Your Entry and Exit Points, which detail the technical and psychological shifts that mark the beginning and end of major pumps.

Metrics for Predicting Altcoin Success: Market Cap and Dominance

Understanding market structure is paramount to predicting which assets have the most potential for growth. Altcoin Market Cap (TOTAL2) and Total Crypto Market Cap (TOTAL) provide a macro view of capital inflows and overall market health. Altcoin dominance, specifically, measures the percentage of the total crypto market capitalization held by altcoins versus Bitcoin.

These metrics are the foundation for technical analysis; if the overall market cap isn’t growing, individual altcoins face severe headwinds. A rising Altcoin Market Cap signals broad investor confidence and liquidity for smaller assets. Therefore, grasping the nuances of Understanding Altcoin Market Cap and Dominance: Metrics That Predict Future Growth is crucial, as overall market structure often precedes individual price action, offering early warning signs or confirmations of sector rotation.

Identifying High-Potential Altcoins for 2025

Project selection moves beyond hype and requires diligent fundamental analysis. Investors should look for altcoins with strong development teams, verifiable real-world utility, robust community backing, and clear scaling solutions. Key areas of focus for 2025 include Layer 2 scaling solutions, interoperability protocols, and real-world asset tokenization platforms, as these narratives align with growing institutional interest and mainstream adoption.

While general strategy is vital, the practical application often requires identifying tangible, high-quality projects. A project’s tokenomics—how its supply is distributed, vested, and used—is a non-negotiable factor. Poor tokenomics, such as excessive inflation or large unlocked supplies, can stifle price growth regardless of technological prowess. For those looking for specific research-backed ideas and forecasts, dedicated analysis covering The 5 Altcoins Poised for Explosive Growth in 2025: Deep Dive Research and Analysis offers excellent starting points based on fundamental metrics and development pipelines.

Strategies for High-Risk, High-Reward Low-Cap Hunting

Low-cap altcoins—projects with market caps typically under $100 million—offer the highest potential for massive percentage gains (often 10x to 100x), but they also carry the highest systemic risks, including low liquidity, potential rug pulls, and project failure. Successful low-cap hunting requires a specialized approach focused on early identification and rigorous due diligence.

Diversification across a basket of low-cap assets is essential to offset the probability that most will fail. Vetting involves deep dives into team structure, audit results, community engagement, and the basic viability of the concept. New investors must recognize that the potential 100x gains come with a high risk of total loss, making specialized guides on Low-Cap Altcoin Hunting: High-Risk, High-Reward Strategies for Early Investors indispensable for managing expectations and performing thorough vetting before committing capital.

Leveraging Technical Analysis for Breakouts

Technical analysis (TA) provides the timing mechanism necessary to enter strong altcoin trades at optimal prices. While fundamental analysis dictates what to buy, TA determines when to buy. Key indicators for altcoins include the Relative Strength Index (RSI), which measures momentum and identifies overbought/oversold conditions, and volume analysis, which validates the strength of price movements.

Traders often use TA to identify consolidation patterns, like triangles or flags, which frequently precede major altcoin breakouts. Mastery of volume analysis, momentum oscillators, and trend lines, as outlined in strategies related to Using Technical Indicators to Spot Altcoin Breakouts Before the Crowd, allows traders to refine their entry points for maximum efficiency and reduce the risk of buying the top.

Developing and Testing Robust Strategies

Reliance on intuition or fleeting trends is a fast track to capital destruction. A robust investment strategy must be quantitative, rules-based, and historically verified. This is where backtesting comes into play—simulating your investment or trading strategy on historical data to evaluate its performance metrics, such as profitability, win rate, and maximum drawdown.

Backtesting allows investors to refine parameters and validate hypotheses before risking real funds. It removes guesswork and instills confidence in a strategy’s long-term viability. Before deploying real capital, sophisticated traders always ensure their models are validated, learning How to Backtest Altcoin Investment Strategies for Maximum Profit and Minimal Drawdown is crucial for minimizing risks associated with unverified trading assumptions and ensuring the strategy can withstand varied market conditions.

Deep Dive into Sector-Specific Opportunities: AI and DeFi

The cryptocurrency market often moves in waves, driven by prevailing narratives. Currently, technological narratives dominate the market, with decentralized finance (DeFi) and artificial intelligence (AI) being key drivers of the 2024/2025 cycle. DeFi altcoins aim to replicate traditional financial services (lending, trading, insurance) without intermediaries, creating highly complex but profitable ecosystems.

AI altcoins, which focus on decentralized computing, data verification, and machine learning models, are rising rapidly due to external technological advancements. However, these sectors carry unique risks, including smart contract vulnerabilities in DeFi and regulatory uncertainty in the evolving AI space. Investors must understand the unique opportunities and inherent security risks associated with The Rise of AI and DeFi Altcoins: Sector-Specific Investment Opportunities and Risks to navigate these complex ecosystems effectively and separate legitimate projects from mere marketing hype.

Essential Trading Psychology and Risk Management

In the highly volatile altcoin market, psychological discipline is often the deciding factor between success and failure. The rapid price swings inherent in altcoins frequently trigger debilitating emotions like Fear of Missing Out (FOMO) and Fear, Uncertainty, and Doubt (FUD). FOMO leads traders to chase pumps and buy at the peak, while FUD causes panic selling at the bottom.

Preventing destructive behavior often means following rigid rules designed to protect capital, focusing on the critical skill set detailed in guides for Avoiding FOMO and FUD in the Volatile Altcoin Market: Trading Psychology Essentials. This involves setting strict stop-loss orders, defining position sizes based on risk tolerance (never risking more than 1-2% of total capital on a single trade), and adhering strictly to a predefined trading plan, regardless of media noise or social sentiment.

Learning from Past Bull Runs

The cyclical nature of crypto provides invaluable historical data. Every previous bull run, notably those in 2017 and 2021, contained crucial lessons about market euphoria, capital concentration, and the ultimate distribution phase. One common mistake is riding promising projects to massive gains only to fail to take profits, watching those gains evaporate as the market turns. Another common pitfall is backing projects based solely on hype, which quickly become “dead coins” once the market cycle peaks.

By analyzing the successes and failures of past market leaders and prominent investors, we gain perspective on timing and distribution, insights readily available when reviewing Lessons from the Last Altcoin Bull Run: What Famous Traders Did Right (and Wrong). These lessons underscore the necessity of having a predefined exit strategy and recognizing that no asset goes up forever.

Critical Exit Strategies for Profit Maximization

Entry is easy; exit is hard. The difference between a paper gain and realized profit hinges entirely on a disciplined selling strategy. Without a clear exit plan, emotional factors will inevitably lead investors to hold too long or sell too early. Successful altcoin trading necessitates scaling out—selling portions of your position incrementally as the price reaches predefined targets—rather than trying to liquidate the entire position at the absolute peak.

Developing concrete price targets based on Fibonacci extensions, psychological resistance levels, or market cap milestones ensures profits are locked in consistently. Many sophisticated investors spend more time perfecting their sales triggers than their buying triggers, highlighting the importance of Developing a Robust Exit Strategy for Altcoins: When to Take Profits During a Bull Market to ensure long-term capital preservation and realizing true gains.

Conclusion

Navigating the altcoin market is a high-stakes endeavor that promises extraordinary rewards for those who combine analytical rigor with emotional control. By mastering market cycle timing (Altcoin Season), employing deep fundamental and technical analysis, rigorously backtesting your strategies, and most importantly, maintaining a disciplined approach to risk management and profit-taking, you position yourself for success in the dynamic environment leading up to 2025. Treat the market with respect, focus on verifiable data rather than rumor, and remember that consistent execution of a rules-based strategy outperforms emotion-driven trading every time.

Frequently Asked Questions (FAQ)

- What is the most critical indicator for predicting Altcoin Season?

The Bitcoin Dominance Index (BTC.D) is generally considered the most critical macro indicator. When BTC.D starts falling significantly after a prolonged period of growth, it signals that capital is rotating from Bitcoin into altcoins.

- How much of my crypto portfolio should I allocate to altcoins?

This depends entirely on your risk tolerance. Aggressive investors might allocate 50-70% to altcoins, while conservative investors might stick to 20-30%. The percentage should decrease as you move into lower-cap, higher-risk assets.

- What is ‘backtesting’ and why is it essential for altcoins?

Backtesting is the process of applying an investment strategy to historical market data to see how it would have performed. It is essential for altcoins because their extreme volatility makes strategies untested on historical data highly unreliable under real market pressure.

- What are the primary risks associated with low-cap altcoin hunting?

The primary risks include illiquidity (difficulty selling large positions), project abandonment, technical failures, and “rug pulls” (malicious developers draining liquidity). Thorough due diligence and spreading small bets across multiple projects are mandatory risk mitigation techniques.