Cryptocurrency, which was once viewed with skepticism, has since grown into a wildly popular investment among a diverse range of investors. It continues to experience significant growth and evolution, with various metrics and trends showcasing the dynamic nature of this emerging asset class.

Cryptocurrency is a type of digital currency protected by encryption and computer networks. One of the primary reasons it has become important is its decentralized nature, which eliminates the need for intermediaries like banks or financial institutions. Bitcoin was the first cryptocurrency launched in 2009, and dozens of others, known as altcoins, have since emerged.

By leveraging blockchain technology, cryptocurrencies enable peer-to-peer transactions, fostering autonomy, efficiency, and empowerment for users.

In this detailed overview, we present the top cryptocurrency statistics in numbers for 2023, providing insights into market dynamics, innovations, and emerging trends shaping the digital asset landscape.

General Cryptocurrency Statistics

- The statistics in this article are overall about the crypto market, mining, etc. But these are a few general cryptocurrency statistics you need to know before getting started.

- There are 21,000+ cryptocurrencies in the world, though some of them are inactive or discontinued, while the top 20 cryptocurrencies hold 90% of the total cryptocurrency market cap.

- There are more than 420 million crypto users worldwide in 2023.

- Bitcoin accounts for nearly 40 percent of the entire cryptocurrency market value.

- There are 21 million bitcoins in supply from which 19.57M bitcoins have been minted and are already circulated in the market.

- As of 2023, Bitcoin’s high has been recorded as $44,700, while its all-time high is $69,000.

- The highest global cryptocurrency market cap has been recorded as $2.92T, while as of Dec 2023, it marks $1.07T.

- Bitcoin itself holds up 50% total market cap of cryptocurrency.

- There are more than 40,000+ Bitcoin ATMs worldwide.

Crypto Taxes and Economic Statistics

- Cryptocurrency is banned in 51 countries.

- While it is recognized as a global currency, it’s still banned in 51 countries mostly in Africa and Middle Eastern countries.

- In the US, cryptocurrency gains are generally subject to ordinary income tax rates, which can be as high as 37% for the highest income earners.

- Japan taxes cryptocurrency gains at a rate of up to 55%, which is one of the highest tax rates on cryptocurrencies in the world.

- The U.S. government is one of the biggest holders of Bitcoin in the world.

Five Largest Cryptocurrencies by Market Cap

- Bitcoin (BTC) alone holds $856B+ of total market cap ranking number 1.

- Ethereum (ETH) is the second largest cryptocurrency with a $277B+ market cap.

- Tether (USDT) is a stable coin reserve that holds $91B of total market cap.

- Binance coin (BNB) is the world’s biggest exchange wallet Binance’s coin which holds $41B.

- Solana (SOL) is the fifth biggest cryptocurrency with a $39B market cap.

Cryptocurrency Users Statistics by Country

While the USA sees substantially more cryptocurrency activity than almost any other country, more countries around the world are getting into crypto or witnessing current adoption grow. For many developing countries, crypto presents an opportunity to boost financial inclusion and accessibility across unbanked populations.

For citizens in nations that have restricted access to financial services, crypto can be a significant investment and payment tool in the absence of other viable alternatives. Because participants do not require bank accounts, just a crypto wallet, to participate in transactions, cryptocurrency is rapidly being promoted as a tool to allow more individuals access to the financial system.

While widespread acceptance of cryptocurrency in such countries remains in its early stages, as is the setting up of the rules required to enable it, it provides a massive opportunity. Along with combating corrupt financial systems and increasing societal trust with a more transparent system, cryptocurrency allows unbanked populations to store money and make everyday transactions—a fundamental right in terms of monetary safety and inclusion.

- There are over 420M+ cryptocurrency users worldwide.

- Thailand holds the highest number of crypto holders according to most crypto users by country per capita.

- India is ranked Number 1 in the Global crypto adoption index with a staggering number of 100+ Million users, and the United States with 48 Million.

- The United States has the largest number of Bitcoin holders.

- 18% of US college students own cryptocurrency.

- 82% of American crypto owners own Bitcoin.

- As of 2022, around 21% of American adults are crypto owners, according to NBC News.

- The United States has the most cryptocurrency ATMs, with 17,436 functioning crypto ATMs as of 2021.

- In 2022, 60% of Australia’s cryptocurrency owners possess Bitcoin.

- The United Arab Emirates has the greatest percentage of cryptocurrency ownership (27.67%), ahead of Vietnam (26%).

- Nigeria and Turkey have the highest crypto adoption rates in the world.

- China has 84% of the world’s blockchain patents (Statista)

- If Bitcoin were a country, it would rank 23rd overall in energy consumption (Digiconomist)

Bitcoin Statistics

- In 2008, Satoshi Nakamoto released Bitcoin’s white paper.

- Bitcoin was launched in January 2009.

- In May 2020, A guy made Bitcoin’s first transaction of 10,000 BTC, which would’ve been worth $600M.

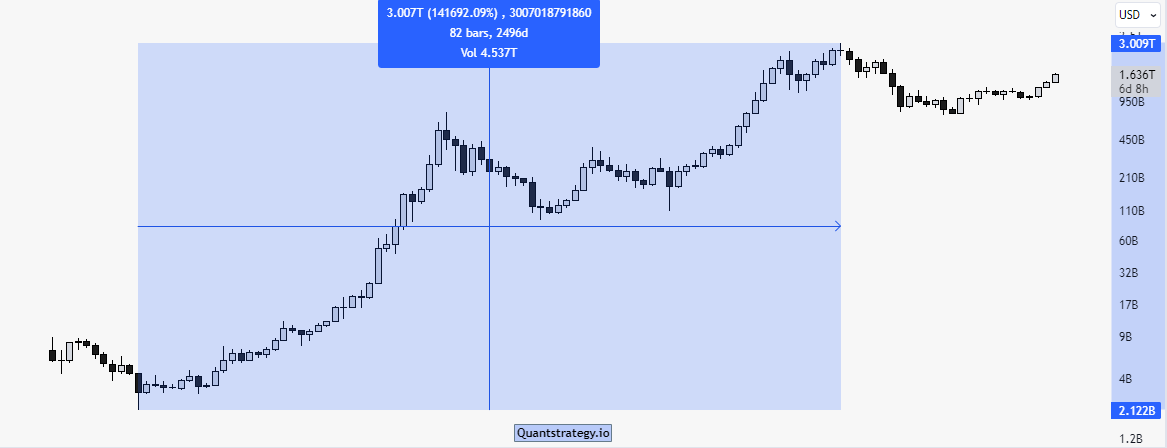

- Bitcoin’s price increased by over 46,49,440%+ since its launch.

- In 2010, Bitcoin’s peak price was $0.09, as of now it is $43,544.

- Bitcoin gave 65% returns in 2023 itself.

- Bitcoin’s price surpassed $1 in 2011.

- In 2021, the value of all cryptocurrencies hit $3 Trillion.

Cryptocurrency statistics 2023

- Until 2013, there only 4 cryptocurrencies existed. Now there are more than 20,000+ cryptocurrencies.

- 30+ Cryptos are created every week.

- A cryptocurrency post surfaces on social media every 2 seconds.

- 72% of the world’s crypto users are under the age of 34.

- Gender statistics suggest that 79% of crypto owners are men.

Top Cryptocurrency Falls

The 2022 Crash

This was the biggest crash in cryptocurrency after the 2021 hype, causing Bitcoin to drop by -75% ($69,400- $17,573).

Terra/Luna Crash ($116- $0.0001)

Without a doubt, the Terra protocol has suffered the most from the 2022 selloff. Terra’s UST token, which was formerly among the largest cryptocurrency stablecoins, was pegged at $1 for several years until everything collapsed in early May 2022.

This caused a $45 Billion wipeout in the course of a few days.

FTX token: ($87- $0.87)

The FTX exchange token, FTT, which made up over a third of Alameda’s balance sheet, was the root of the problem. But the little traded token turned out to be a brittle asset. When the public learned of the token’s significance on the balance sheet, selling pressure mounted for FTT, and the price of the token plummeted to less than $1 from an all-time high of $85.

FTT was trading in the low 20s in the days before the selloff.

In parallel, the FTX exchange witnessed a tremendous influx of withdrawals from uneasy users; billions of dollars worth of withdrawals in a single day were recorded by then-Sam Bankman-Fried, CEO.

Cryptocurrency Environmental Impact Statistics

The technology that enables crypto needs a significant amount of electricity; hence, cryptocurrency’s fast expansion has resulted in an expanding environmental footprint.

Crypto mining consumes nearly all cryptocurrency electricity. This is fundamental to how digital currencies are made—the blockchain depends upon users to confirm transactions and update the blockchain with fresh blocks of data.

The greater the number of blocks of verified transactions analyzed or “hashed,” the more Bitcoin is mined. The term “hash” or hashrate refers to the total processing power used per second for mining and analyzing blockchains. These blockchains are designed to be difficult and costly to verify to prevent unscrupulous actors from distorting this information.

While lower-energy blockchain validation techniques are being investigated, extensive solutions to the environmental concerns of cryptocurrency remain mostly absent.

- Over 90% of Bitcoin’s supply has been mined, experts say the last bitcoins will be mined by 2140.

- 38% of bitcoin mining takes place in the United States.

- China used to be at the top spot, 75% of global capacity.

- If Bitcoin were a country, it would rank 23rd in total energy consumption.

- Bitcoin mining produces greater carbon emissions than gold mining.

- The USA’s share of the world’s Bitcoin mining increased from 3.5% (2020) to 38% (2022).

- The United States has the world’s largest Bitcoin mining company, responsible for nearly 38% of the worldwide Bitcoin network hashrate in 2022. (Cambridge Bitcoin Electricity Consumption Index)

- Bitcoin makes an annual carbon footprint of 72.00 Mt CO2, which is equivalent to Greece’s footprint. (Bitcoin Energy Consumption x Digiconomist).

- Bitcoin mining consumes enough energy to power over 10 million homes for a year. Additionally, it utilizes more energy than Argentina.

Best Countries for Crypto Taxes

Singapore

Singapore does not currently impose a capital gains tax. Thus, the cryptocurrency is tax-free.

Cryptocurrency is typically exempt from income tax. But if you make cryptocurrency as a business or get it in exchange for goods and services, you might have to pay income tax.

Additionally, if you use your Bitcoin to purchase things, you might be required to pay goods and services tax, or GST.

El Salvador

The fact that El Salvador was the first nation to adopt Bitcoin as legal cash is well-known.

All taxes, including income, capital gains, and property taxes, associated with “technological innovation” were eliminated in El Salvador in 2023. Consequently, cryptocurrency income and capital gains are free from taxes!

Businesses nationwide must accept Bitcoin as payment for products and services, which is a bonus for Bitcoin investors.

United Arab Emirates

Individual investors are not currently subject to income or capital gains taxes in the United Arab Emirates.

It’s crucial to remember that all products and services, including those acquired with cryptocurrency, are subject to 5% VAT. Furthermore, living expenses in the United Arab Emirates are quite high.

Cryptocurrency Price Statistics

Bitcoin started 2022 almost twice as lucrative as it had been in 2021, following a year of unprecedented mainstream interest in cryptocurrencies. However, those gains were brief; by July 2022, the price of a Bitcoin had fallen from $47,780 to around $20,000.

Even if Bitcoin’s price hasn’t managed to get above $20,000 since late June, public interest in the crypto markets remains high – 51% of American crypto owners purchased it within the last year. As widespread usage of crypto grows, more ordinary people are wondering how it can fit into their portfolio.

If you’re unsure because of the price swings of the past year, remember that price volatility is a defining feature of cryptocurrency. It is common for prices to plummet by 15% or more in one day. That is why some consultants propose that you allocate 5% or less of your portfolio to crypto.

If you’re thinking about crypto investing, be sure it matches your long-term investment strategy. That means maintaining a balanced portfolio that consists of traditional assets such as ETFs or index funds, and never investing more in cryptocurrency than you can afford to lose. Overall, avoid worrying about short-term fluctuations and instead use a “set it and forget it” technique—the greatest way to any long-term investing purpose.

- By June 2022, Bitcoin had dropped to $22,123, a 67% decrease from its record-breaking high of $67,510 in November 2021. (Morning Consult).

- In July 2023, Bitcoin was among the most valuable cryptocurrencies. (CoinGecko)

- In September 2022, the average market price for Ethereum (ETH) was $1,614.32. (CoinGecko)

- Ethereum’s value has increased dramatically since its launch in 2015, reaching a peak of $4,800 in late 2021. (NextAdvisor x Time).

- In September 2022, Bitcoin transactions cost an average of $79.78. (YCharts)

- The daily price of Bitcoin in September 2022 is close to $20,700, a considerable decrease from November 2021. (CoinGecko)

Crypto Trends & Projections

- The worldwide cryptocurrency industry is expected to increase at a 56.4% CAGR between 2019 and 2025.

- The global blockchain technology market is projected to increase at 68.4% CAGR by 2026.

- Since 2016, the global number of cryptocurrency wallets has increased by 1,271.97%.

- In January 2016, there were just 5.78 million crypto wallets globally. By August 2022, there were 84.02 million.

Advantages & Disadvantages of Cryptocurrencies

Advantages

- Digital currencies offer decentralization, which means no single entity has power over the currency. Even money and transaction control are handed to users, making it more efficient.

- Advanced encryption strategies prevent fraud and provide secure transactions.

- Other benefits include anonymity, which allows for anonymous transactions. Cryptocurrencies can be used by anybody with a reliable internet connection. Lower transaction fees are the last advantage as it demands no other intermediaries.

Disadvantages

- Digital currencies, such as Bitcoin, are less enticing due to volatility.

- Lack of regulation renders it impractical for users to obtain legal advice and address security problems as they are more susceptible to various hackers and threats.

- Another disadvantage is low acceptance among businesses and a preference for traditional payment systems among the rest. Environmental effect is also a concern, as biotin mining needs energy comparable to an entire nation.

Conclusion

In 2023, cryptocurrency’s growth in popularity is impossible to ignore. Despite environmental concerns, market volatility, and growing legislative monitoring, users all over the world are unquestionably devoted to cryptocurrency, and any worries about the industry’s relevance and maturity are dispelled. However, the business is still in its infancy, and you aren’t alone if you are hesitant to invest in it.

Crypto is infamously volatile, but it may be a profitable investment if addressed with a long-term mindset. While there are no promises of returns, keeping your investments for the foreseeable future is one of the greatest methods to protect them. If you wish to invest in cryptocurrency, confirm your financial situation and ensure your portfolio is suitably diversified.